To Bot or Not to Bot? Crypto Trading Robot Pros and Cons

The digital currency markets are active around the clock. As a result, a cryptocurrency trading bot, which can scan the crypto exchanges twenty four hours a day, is becoming a must-have trading tool. It provides investors with a means of seizing developing opportunities as they arise, without having to sit bleary eyed in front of a laptop into the early hours. Yet, depending on the type of cryptocurrency trading bot you choose, you could be eating into your profits with expensive licenses and no guarantees of market success once you’ve paid the flat fee.

A brief overview of trading robots for cryptocurrency

Look online and you’ll find a large selection of cryptocurrency trading bot options. Basically, a trading robot is a software program that connects to crypto exchanges, frequently via an API, to automatically open market positions on your behalf based on a number of preset conditions.

Today’s sophisticated bots are highly customizable and can take a vast amount of data into account, including trading volume and price fluctuations over given time frames, and the currency’s order history. The bot will track price movements for your chosen crypto assets and respond in strict accordance with pre-programmed rules.

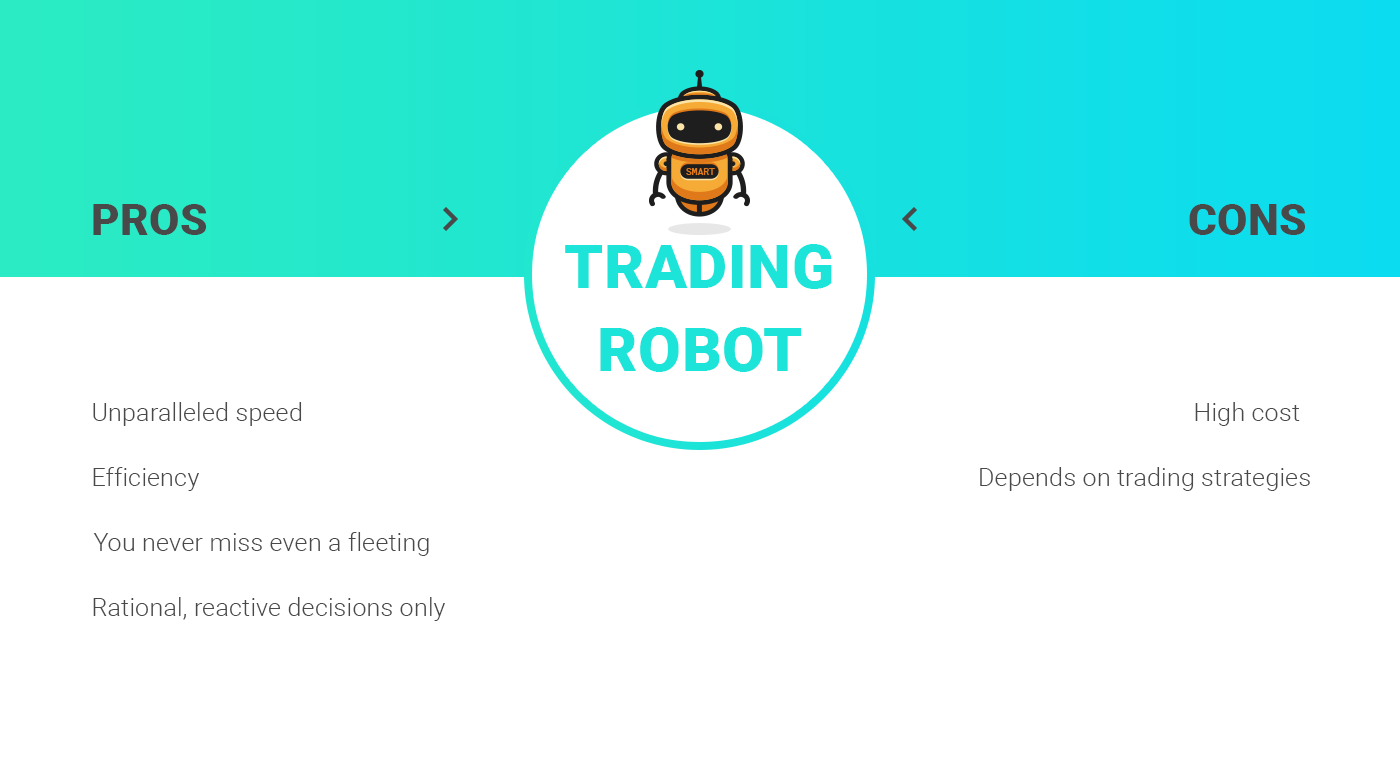

The upside

Whether you are trading bitcoin, ripple or tron trading bot software offers unparalleled speed and efficiency that even the most experienced investment professional is incapable of matching. Through constant interaction with the markets they ensure that you never miss even a fleeting, lucrative opportunity. In addition, trading bots can save you from yourself, removing emotion from the picture and ensuring that you don’t make irrational, reactive decisions based on panic or greed.

The downside

Cost is a major disadvantage here. While prices are dropping, with increased competition, and the growing availability of open source software, for many years price has been a prohibitive factor, with systems at the top end of the scale costing upwards of ten thousand dollars.

Another downside is the fact that many people mistakenly place far too much faith in automated trading systems assuming they will always make the most rational decision based on all the available market data. However, a bot is only as reliable as the trading strategies with which it is programmed and just as they can lead to generous returns, they can equally be flawed, and result in market losses.

What to consider when selecting a bot

When using an automated trading bot cryptocurrency traders need to assess a variety of criteria, from price, to levels of complexity and ease of use. A stellar trading bot will offer integrations with multiple crypto exchanges providing more opportunities for generating profits, while also using AI machine learning algorithms for enhanced automation capabilities.

In evaluating an automated trading bot cryptocurrency traders should also consider how intuitive it is. An easy-to-navigate platform is critical, whether the trader is opting for a pre-programmed bot or coding for themselves. Those doing their own programming will still benefit from a clear, user-friendly configuration wizard and an inviting dashboard that allows for an overview of trading activity at a glance.

Particularly if you are new to the crypto markets, you may wish to choose a cryptocurrency trading bot that does it all for you, so you can sit back, with the aim of earning a completely passive income. Alternatively, you may be looking for a bot that is solely a time-saver, providing you with the tools you need to automate your existing crypto market strategies. In this case, you will need to ask a number of key questions. What kind of tools does the bot offer? Can you benefit from a full range of technical analysis features, such as Bollinger Bands, RSI and MACD? Can you implement a trailing stop loss? Does it provide a wide array of DCA and shorting features?

When selecting automated trading software you should also keep an eye out for features that allow you to back- test crypto strategies as well as those that enable you to piggy-back the top performing strategies of others. Let’s not forget another important issue, which is whether or not the price is competitive and whether they charge trading fees.

Accessibility is also vital. You need to consider whether the bot is cloud based and if it supports all types of device so you can access your trading account at your convenience.

Leading cryptocurrency trading bot strategies

A cryptocurrency trading bot can be an effective option when it comes to implementing a market making strategy, even though there is a great deal of competition with this approach, particularly under low liquidity conditions. Eliminating the middle-men from the equation, the bot will automatically place limit orders for a price outside of the spread with the aim of turning a profit from buying low and selling high. In this way automated software will enable you to boost your trading volume, and save a great deal of time, effort and funds setting prices and earning on the spread.

Another option is a crypto robot arbitrage strategy. It enables you to exploit the revenue opportunities presented by the extreme volatility of the digital currency markets, while also benefiting from the reduced risk of arbitrage trading. The decentralized digital currency markets are still newcomers to the online financial arena and while the gaps are closing the various crypto exchanges still experience pronounced price inefficiencies.

A crypto robot arbitrage strategy minimizes exposure by enabling the trader to profit from these significant price differentials, by buying a cryptocurrency for the lowest possible price on one exchange and then immediately selling the currency on a different exchange at a higher price to earn a profit on the spread.

An intra-exchange cryptocurrency arbitrage bot can achieve this more efficiently and rapidly than a human with a far more extensive reach. Monitoring multiple currencies across numerous exchanges and being able to respond to a market opportunity before the prices change would present a challenge to even the most experienced investor and this is where bots truly shine.

Let’s take one of the more established, crypto arbitrage trading bots, ArbiSmart.com as an example. The system scans over 20 exchanges simultaneously 24/7 to seize emerging arbitrage opportunities the second they arise, finding the lowest available buy price and then instantaneously finding the highest available sell price for the best possible profit margin.

Any discussion of the pros and cons of crypto trading bots needs to take into account that there are countless options on the market today, geared to every type of trader. For example, you can elect for simple software designed to implement basic strategies, or opt for an advanced artificial intelligence based system that can process wealth of complex data and execute multiple trades on numerous markets simultaneously. This will impact the price, which can range from free open-source software to professional grade systems worth thousands of dollars. Without a doubt, trading bots can be costly and are essentially only as good as the market strategies with which they are programmed. However, when used judiciously and with human monitoring, they can be an invaluable tool for instantly exploiting market opportunities rapidly and efficiently to optimize your profits.