How to Trade Crypto: An introduction to the Digital Currency Markets

In this quick guide to cryptocurrency trading for beginners we will provide the basic building blocks, showing you how to trade crypto both profitably and responsibly.

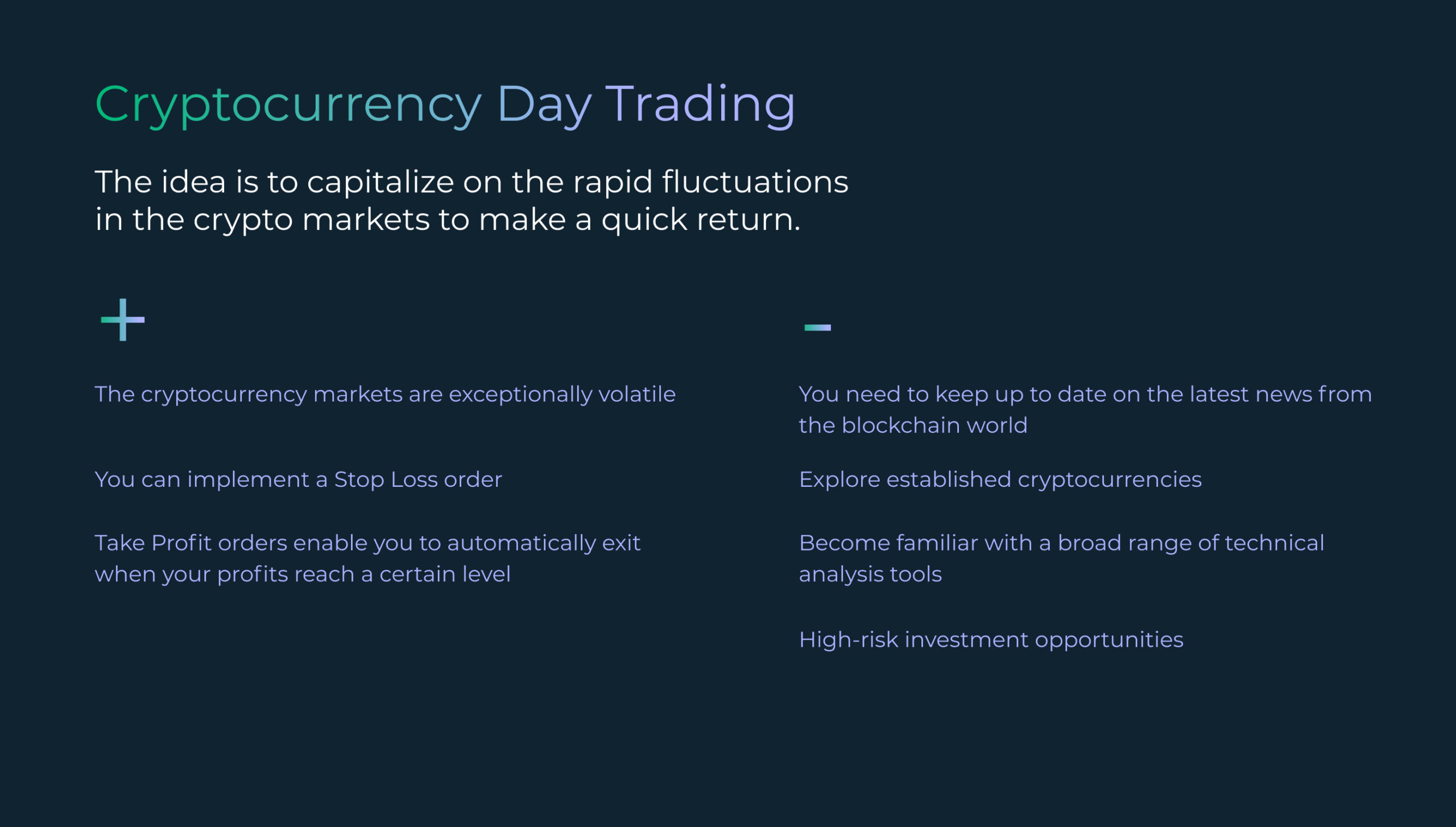

A Guide to Cryptocurrency Day Trading

Cryptocurrency day trading involves short-term market moves, where positions are opened for anywhere from a few seconds to a few hours. The idea is to capitalize on the rapid fluctuations in the crypto markets to make a quick return.

In learning how to trade crypto for profit you need to keep up to date on the latest news from the blockchain world, and explore established cryptocurrencies as well as promising new altcoins. It is also essential that you become familiar with a broad range of technical analysis tools, since to trade successfully, you will need to be able to review asset histories, analyze patterns and monitor emerging trends. The key to a profitable crypto portfolio is up-to-the-minute, accurate market knowledge, which is gained using a range of dynamic live charts and technical indicators, such as moving averages that pinpoint trend directions and determine support and resistance levels.

One of the most frequently quoted rules of crypto trading is to never invest more than you can afford to lose. The cryptocurrency markets are exceptionally volatile, making them high-risk investment opportunities that require you to take whatever steps possible to mitigate your exposure.

If you are day trading, one practical measure you can take to minimize your risk is to take advantage of market orders that allow you to lock in profits and prevent runaway losses. You can implement a Stop Loss order, where if the asset goes in the wrong direction and hits a certain price then the coin is automatically sold, so you don’t have to sit in front of the screen every second monitoring your open positions. Alternatively, Take Profit orders enable you to automatically exit when your profits reach a certain level, so there is no danger of a sudden price reversal wiping out all your gains before you can cash out.

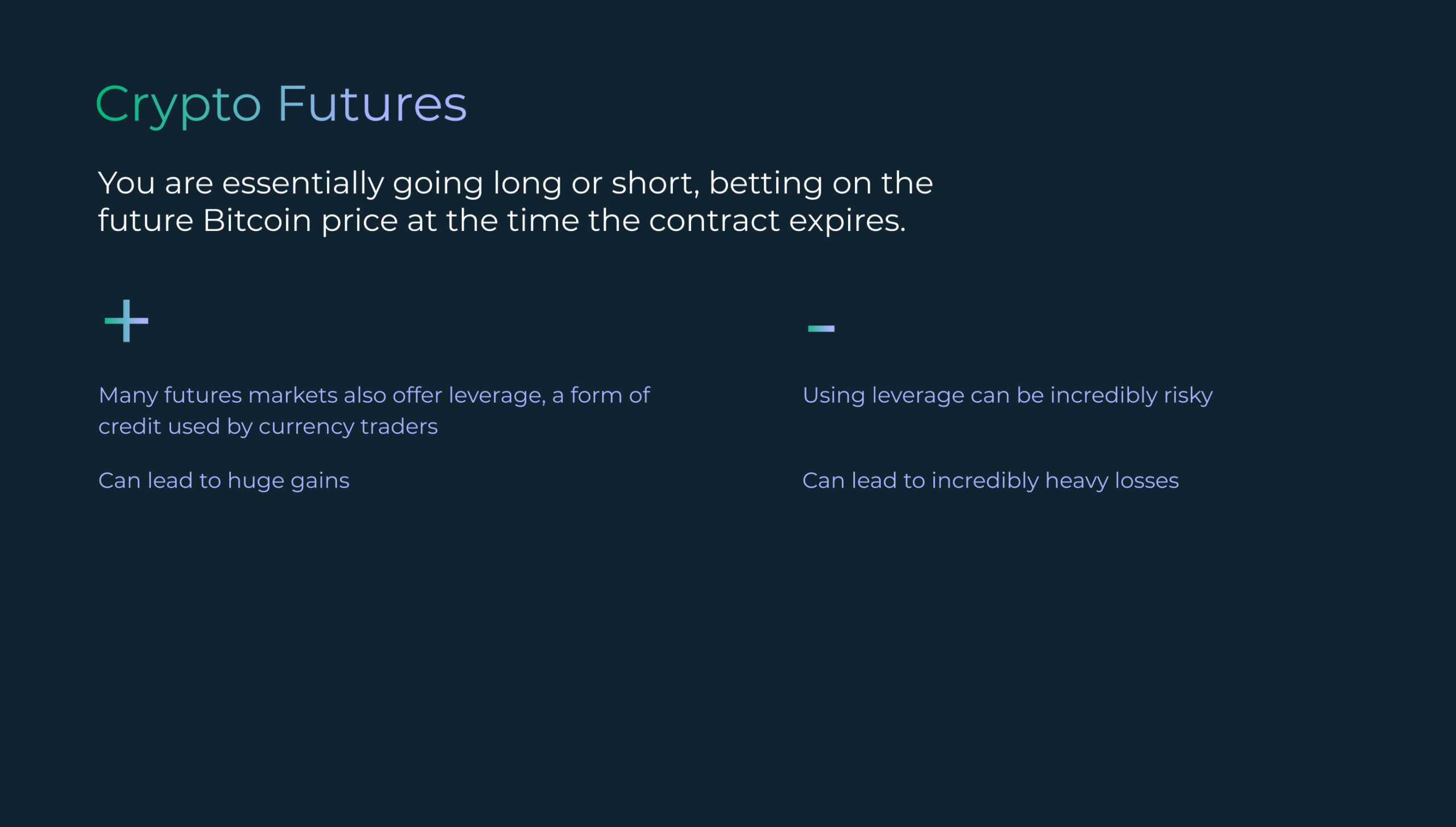

How to Trade Crypto Futures

A crypto future is a derivative. This means that it is a type of contract for purchasing or selling a cryptocurrency, such as Bitcoin on a pre-set date, at a predetermined price. You are essentially going long or short, betting on the future Bitcoin price at the time the contract expires.

Many futures markets also offer leverage, a form of credit used by currency traders. It enables you to increase your trading power substantially, opening a position hundreds of times the size of your actual investment. However, using leverage can be incredibly risky, since while just a small shift in the currency rate can lead to huge gains, it can also lead to incredibly heavy losses.

When it comes to choosing how to trade crypto for profit, whether it is futures or another form of digital currency trading, you need to be very clear on your profit expectations and the degree of risk you are willing to tolerate.

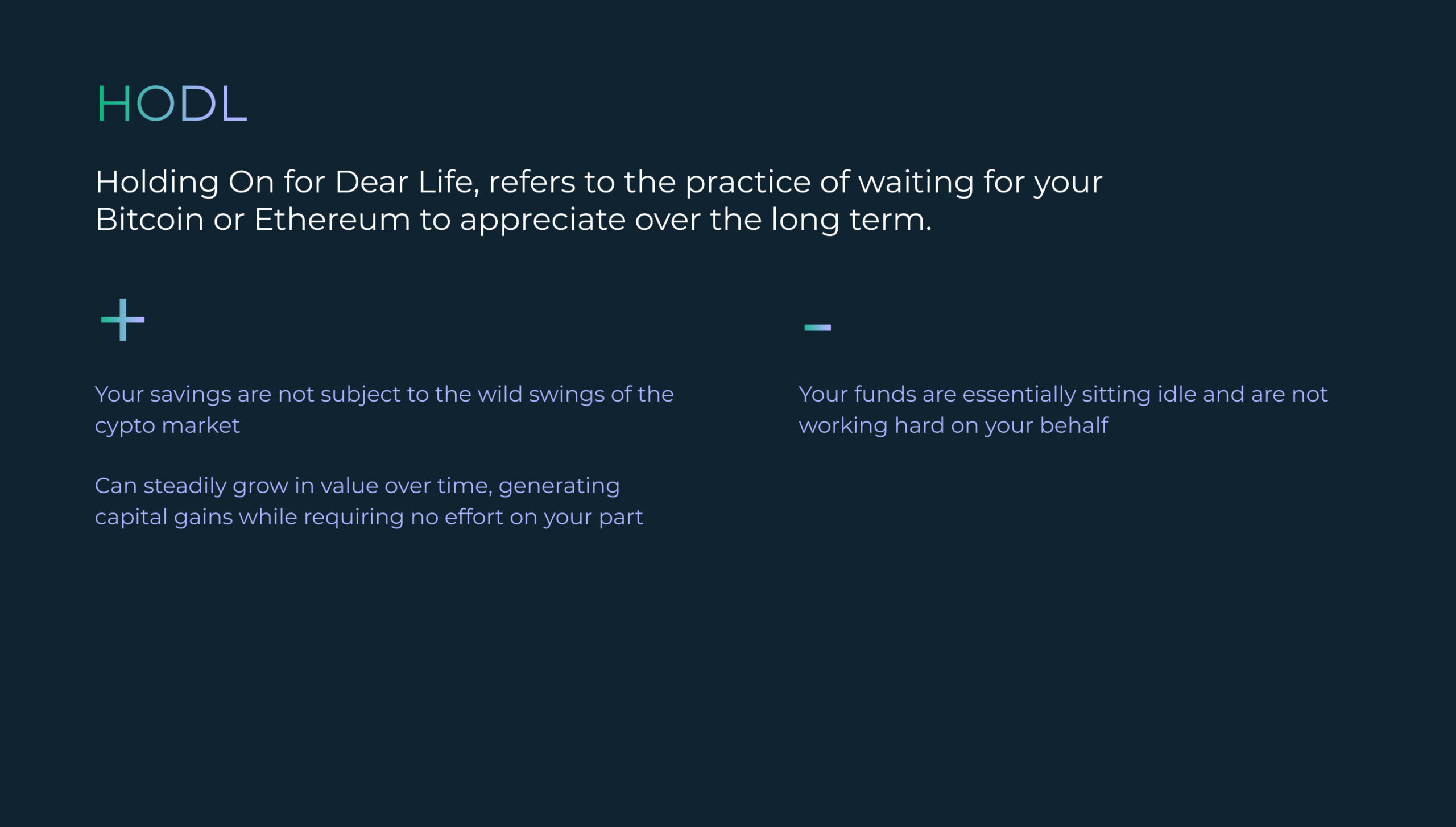

How to HODL

When deciding how to trade crypto, you may end up opting for the slow but steady approach. HODLing, which has been said to stand for Holding On for Dear Life, refers to the practice of waiting for your Bitcoin or Ethereum to appreciate over the long term. The idea is that your savings are not subject to the wild swings of the cypto market but rather, can steadily grow in value over time, generating capital gains while requiring no effort on your part. While this is a solid, comparatively safe investment option, your funds are essentially sitting idle and unlike active trading, are not working hard on your behalf.

How to Trade Crypto with Minimum Risk

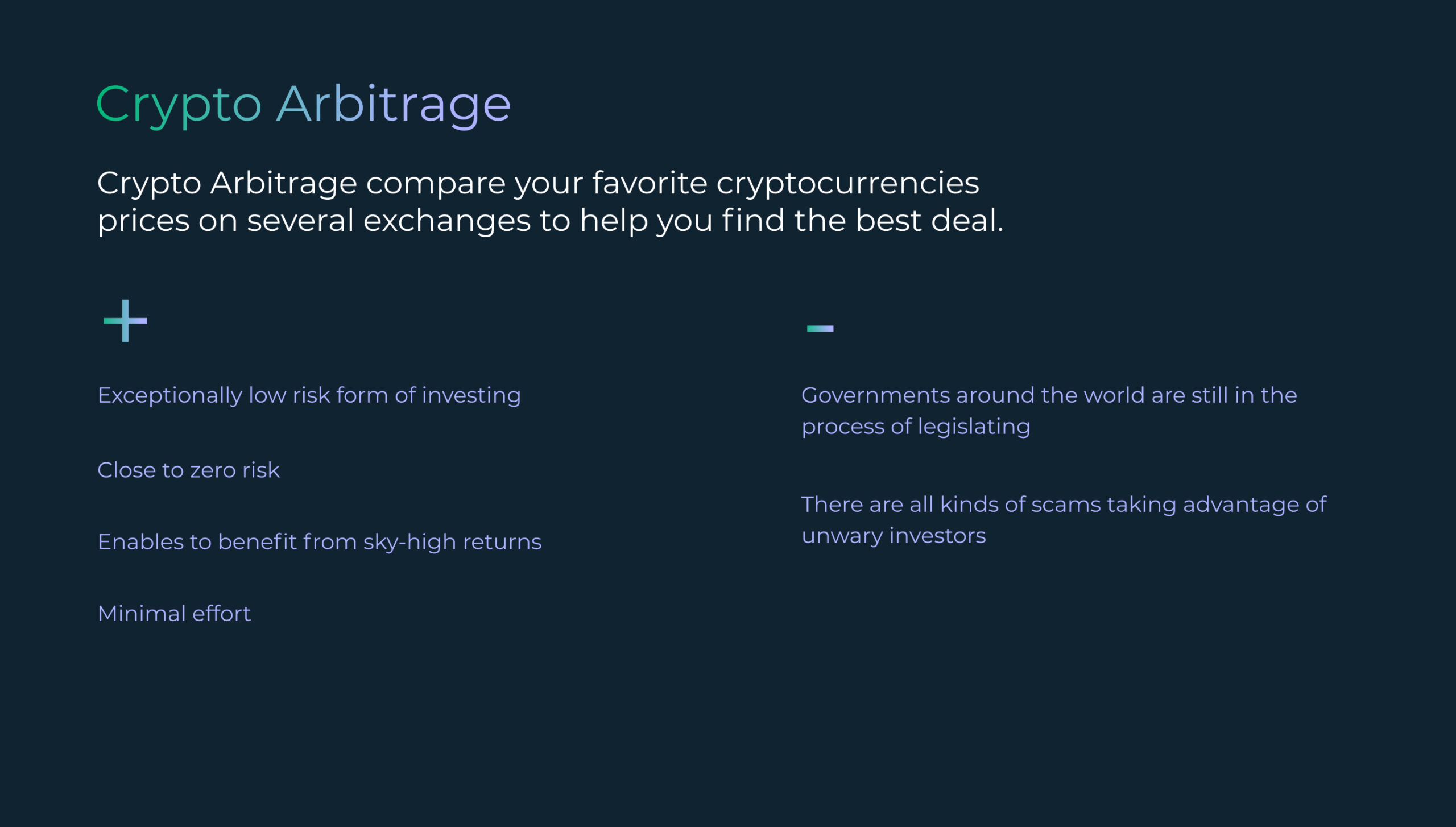

One of the golden rules of cryptocurrency trading is to only trade with a regulated platform to ensure the security of your funds. Regulatory oversight is critical for safeguarding client accounts and providing necessary protection against fraud and hacks. Yet, unfortunately, when it comes to this emerging asset class regulation has been slow to catch up. Governments around the world are still in the process of legislating and crypto traders putting their funds in the hands of online investment platforms cannot always be certain who they can trust. As a result, there are all kinds of scams taking advantage of unwary investors.

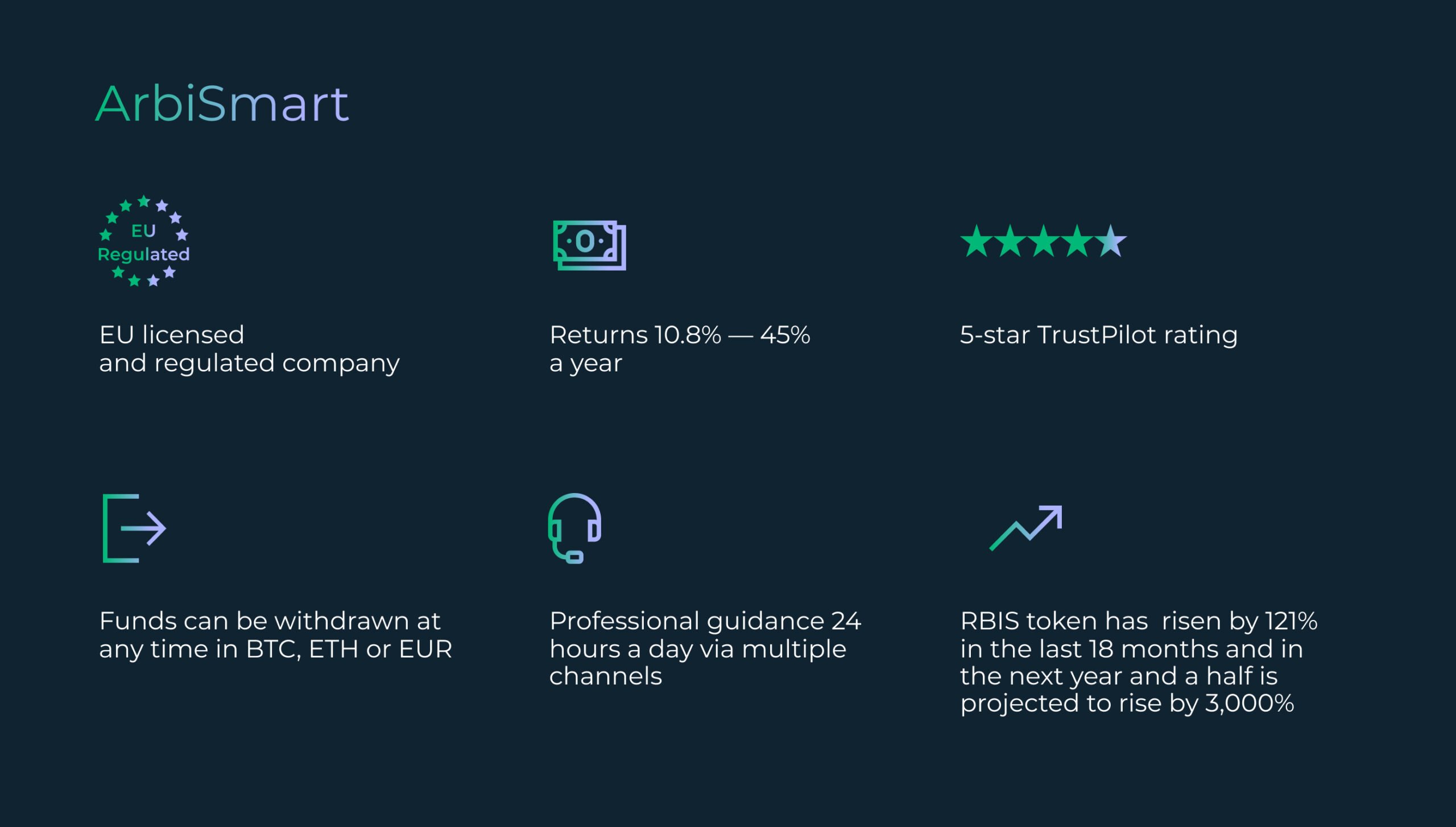

Here at ArbiSmart, our crypto arbitrage platform is fully EU licensed and regulated. This means that we implement rigorous data security protocols, maintain a client insurance fund that covers all operational capital, adhere to strict ID verification requirements and undergo regular external auditing. All this makes for a safe, transparent and trustworthy crypto investing experience.

In addition, crypto arbitrage is an exceptionally low risk form of investing, used by financial institutions, hedge funds and individual investors. When compared with day trading and HODLing, crypto arbitrage is the best of all worlds, as it enables you to benefit from sky-high returns, with minimal effort and close to zero risk.

How to Trade Crypto Arbitrage

Crypto arbitrage involves exploiting the fact that a cryptocurrency can be simultaneously available at different prices across multiple exchanges for a short period of time. An automated system can identify these instances, taking advantage of this small window of opportunity to buy the coin on the exchange where it is offered at the lowest price and then instantly sell it on the exchange where it is being offered at the highest price to make a profit before the temporary price difference resolves itself.

At ArbiSmart, we have a fully automated system, scanning over 20 exchanges at once to identify and exploit crypto arbitrage opportunities, executing a huge volume of trades around the clock. Our system offers returns starting at 10.8% and reaching as high as 45% a year, based on the amount of capital you deposit.

Once you’ve deposited funds in either fiat or crypto, the platform takes it from there. Your capital is converted into RBIS, the platform’s native token and used for trading. However, your funds can be withdrawn at any time in BTC, ETH or EUR. The RBIS token has already risen in value by 121% in the last 18 months and in the next year and a half is projected to rise by 3,000%, creating generous capital gains for clients in addition to crypto arbitrage profits.

When it comes to the issue of how to trade crypto responsibly, accountability is key and at ArbiSmart we have a stellar online reputation, in large part due to the fact that our dedicated support team offers personal, professional guidance 24 hours a day via multiple channels.

We also offer a wallet, where you can store your crypto and fiat profits. Unlike HODLing, where your crypto sits passively, waiting to appreciate over time, with the ArbiSmart wallet, you don’t have to lift a finger while your money earns interest of up to 45% a year. The exact amount you make will depend on the account currency, the sum deposited and the savings account type. An account that is locked for a set period will earn a better interest rate and the longer the lock, the higher the returns.

In this guide, we’ve explored how to trade crypto, using a variety of strategies. Whichever route you choose to take, the crypto markets can offer exciting, lucrative opportunities. Remember to do some basic research about any platform or wallet you trust with your money, taking every possible precaution to minimize risks, while maximizing your crypto profits.