A Quick Guide to Crypto Lending Arbitrage: Risks Versus Rewards

Since the explosion of crypto assets in recent years, the financial landscape has changed dramatically. It has created new types of investment opportunity for institutions and individuals, while opening the doors to the financial markets for millions of people to whom they had previously been firmly closed. With incredible year on year growth, and a current total market capitalization of $244 billion, the profitability and accessibility of this game changing new asset class cannot be underestimated.

An increasingly common form of crypto investment is arbitrage. This involves purchasing a cryptocurrency on one exchange where the price is low and then instantly selling it on another exchange at a higher price, making a profit from the temporary price discrepancy. This type of trading is particularly popular due to the fact that the trader incurs only minimal risk to their capital. An offshoot of this type of trading is crypto lending arbitrage.

What is crypto lending arbitrage?

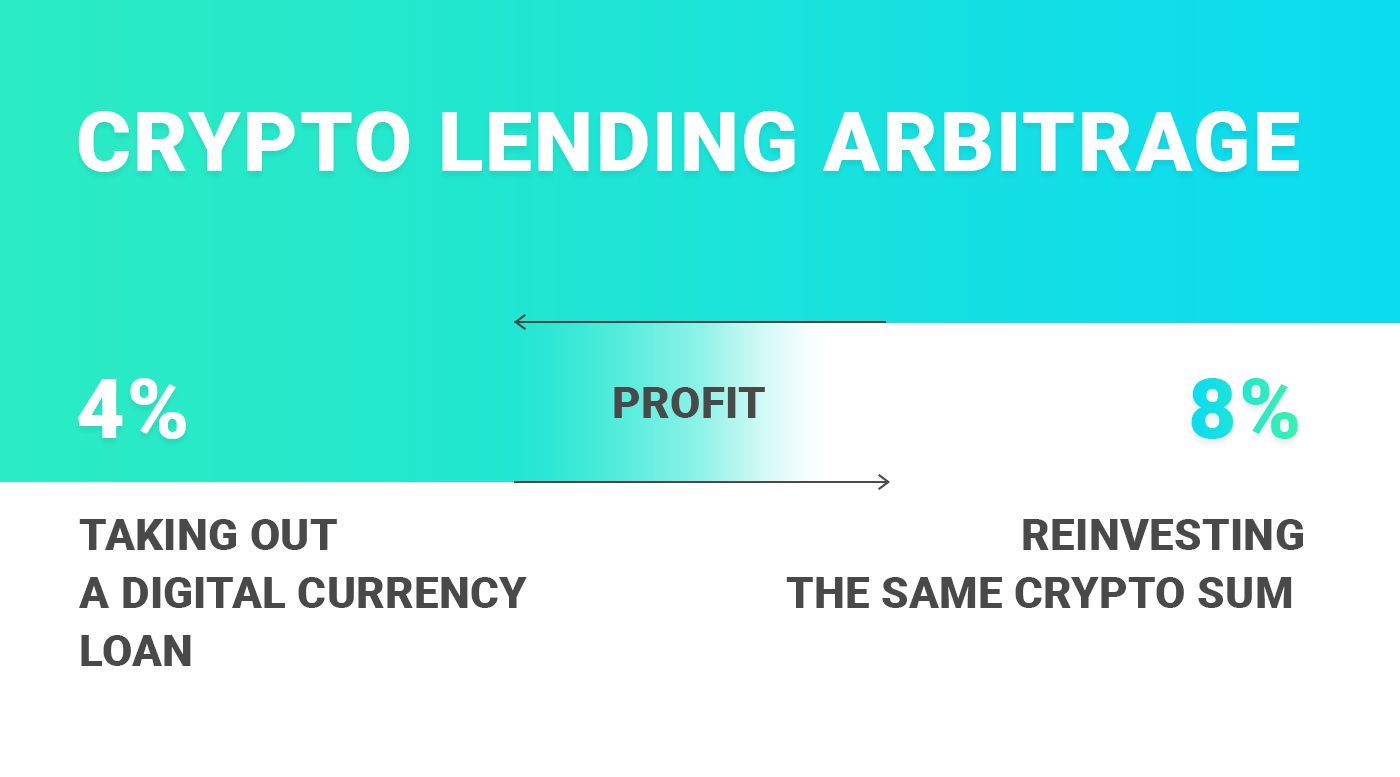

Crypto lending arbitrage is equally straightforward, referring to the process of taking out a digital currency loan from one lending source, which has a low interest rate, and then reinvesting that same crypto sum elsewhere to earn a higher rate of interest.

Since the investor’s profit is derived from the spread between interest rates, when seeking out crypto lending arbitrage opportunities, you are looking for a coin that you can lend at a higher rate than you can borrow it. Just remember, when calculating your earning potential you need to be aware that the size of the loan may well impact your profit margins, due to the fact that when large sums are involved, the lending platform may adapt their rates accordingly.

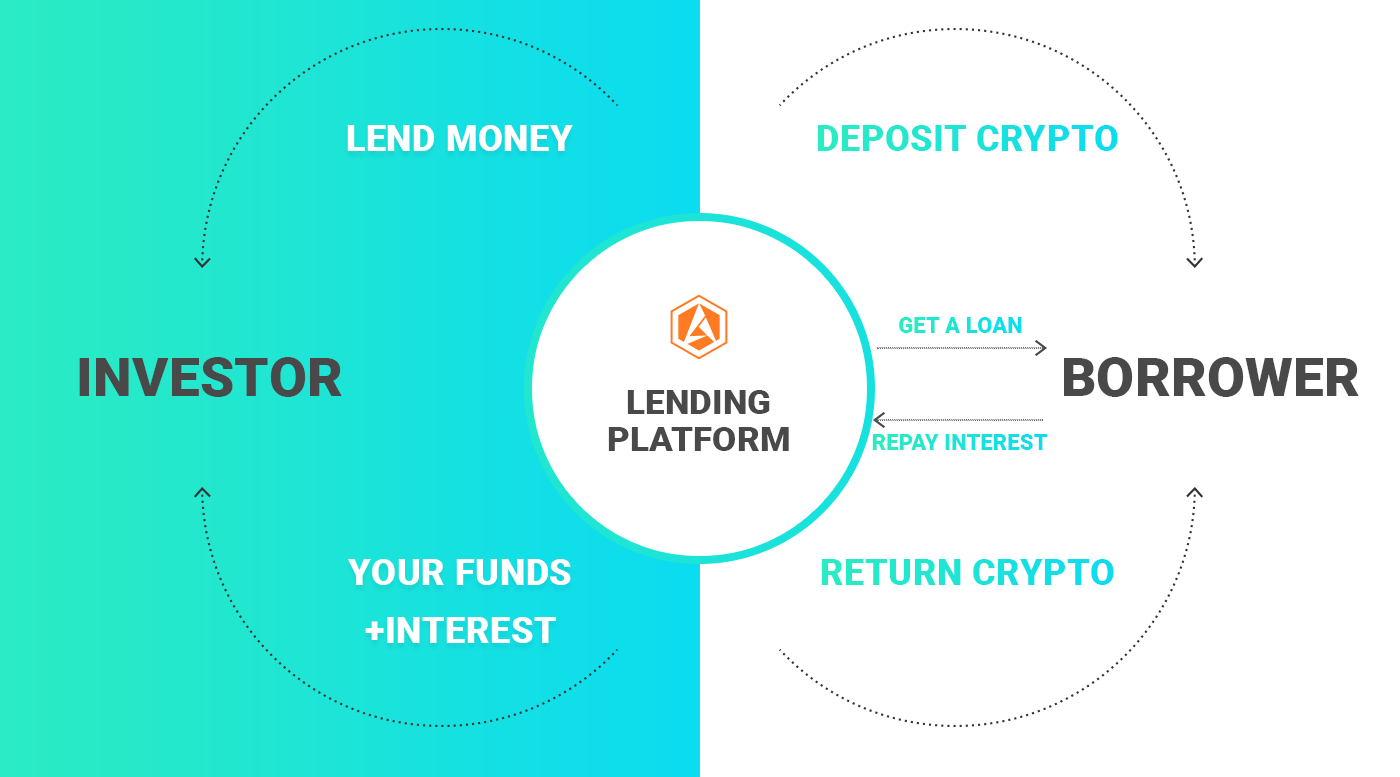

When it comes to all the various aspects of crypto lending arbitrage, from borrowing funds, providing collateral, investing, paying fees and earning from the interest differential, you are entering the emerging world of DeFi. DeFi, also known as Decentralized Finance is the use of blockchain based infrastructure to aid in the democratization of the financial arena. It makes digital assets accessible to everyone, by offering loans without the strict background and credit checks demanded by banks. DeFi platforms, offering interest-bearing crypto accounts are mutually beneficial to the platform and the trader. The platform enjoys greater liquidity and enhanced revenue potential, while the trader gains interest earnings.

What is the best way to stay on top of your market activity?

Crypto lending arbitrage involves the rapid movement of funds with sums often being lent and borrowed at a dizzying pace. Keeping track of what is in each column is essential if you wish to remain in the black and evaluate the efficacy of your current crypto lending arbitrage strategy.

One critical tactic is to maintain an updated record to keep tabs on the sum of digital currency which is clear profit and the amounts you owe from your lending/ borrowing transactions.

To achieve this end and to best exploit the opportunities presented by the crypto loans market, you need to be able to see real time crypto lending rates at a glance on all the major lending platforms and be able to reference the data with ease and instantly access it at any time.

One of the best and simplest ways to keep an updated lending rates record is to pull real time crypto lending rates directly onto a spreadsheet, such as the free web-based program, google sheets. In this way, you’ll be able to instantly track and access up-to-the-minute data on borrowing and lending rates across multiple lending platforms.

What are the risks of crypto loans trading?

Any discussion of risk should be prefaced with an acknowledgement that crypto lending arbitrage involves very little exposure, compared to most other types of digital currency trading. However, to take advantage of any lending opportunity, you will need to deposit some cryptocurrencies to collateralize your loan, leaving you open to the dangers of price fluctuations eating into your collateral. If you are not careful, the reward could be negligible and might not worth the effort involved.

Another risk, common to all forms of lending for profit is that the counter party could default on the loan. In such a circumstance your arbitrage chain would fall apart and you would lose your collateral.

Another major factor to consider is that since there is no single international regulatory standard and many aspects of crypto investment are still outside the purview of market regulators and payment system oversight, entering the crypto loans arena can be a dangerous proposition. These issues are gradually being addressed and governments and international institutions are taking steps to codify investor and consumer protections, but with jurisdictional holes still gaping, you have to be careful where you place your funds. The best way to safeguard your capital is by only investing in a jurisdiction that allows crypto loans trading and by only using a fully licensed and regulated platform that demands Know Your Customer (KYC) and Anti-money Laundering (AML) identification verification.

How can you optimize your revenue potential while minimizing your exposure?

Obviously, there is no magical formula for trading completely risk free, however in choosing the right platform you can set yourself up better for success. There are a variety of arbitrage platforms out there and you need to be smart about the one you choose. Each platform has its own borrowing and lending rates so your profit potential may be more limited on one platform than on another. Reputation is also a major consideration and, as we’ve discussed, selecting a regulated, transparent platform with a clean, trusted record and a name for reliability and accuracy among the crypto community is essential.

The right web-based, peer-to-peer platform, can enable you to benefit from some high interest, crypto loans trading opportunities. In fact, at their most lucrative they can generate above 10% per year from interest rates, which dramatically outdoes more traditional interest-bearing investment opportunities that only tend to earn the investor around 1% per year.

One of the safest ways to do your Bitcoin lending is with an automated, licensed arbitrage platform. Let’s take ArbiSmart.com as an example. As with many crypto lending arbitrage platforms and DeFi service providers, it offers to pay competitive interest rates on your cryptocurrencies. You simply lend the crypto to ArbiSmart and they use the funds to participate in arbitrage trading and lending, via an automated crypto arbitrage system. They will then pay you interest on the funds that you have lent the platform, so you can strengthen your crypto portfolio and earn from your holdings while reducing your risk exposure.

When used in reference to traditional, fiat currency, lending arbitrage is the simple process of borrowing money from the bank at a certain interest rate and then lending that sum to another party for a higher interest rate, making a profit from the difference in price. Fiat can also be loaned for use in a crypto arbitrage lending transaction. For example, you can take a bank loan at a rate of 5% a year and then lend that sum to a platform such as ArbiSmart, at a 10% higher rate, and then make monthly withdrawals of the interest earned.

Whichever crypto lending solution you choose, it is important to minimize your exposure as best you can, taking precautionary measures, including, of course, never investing more than you can afford to lose. However, the primary advantage of an automated crypto lending arbitrage system is that the overall risks are still lower than with almost all other types of crypto investment and by expending very little time and effort you can enjoy lucrative opportunities and see almost instantaneous results.