Want to Know Where to Find the Highest Rates for Lending Crypto? We’ve Done Your Research for You

There are numerous ways to earn a profit from your cryptocurrency and these days, with the rise of Decentralized Finance applications (dapps), particularly those focused on borrowing and lending crypto assets, investors have high earning expectations.

How does crypto lending work?

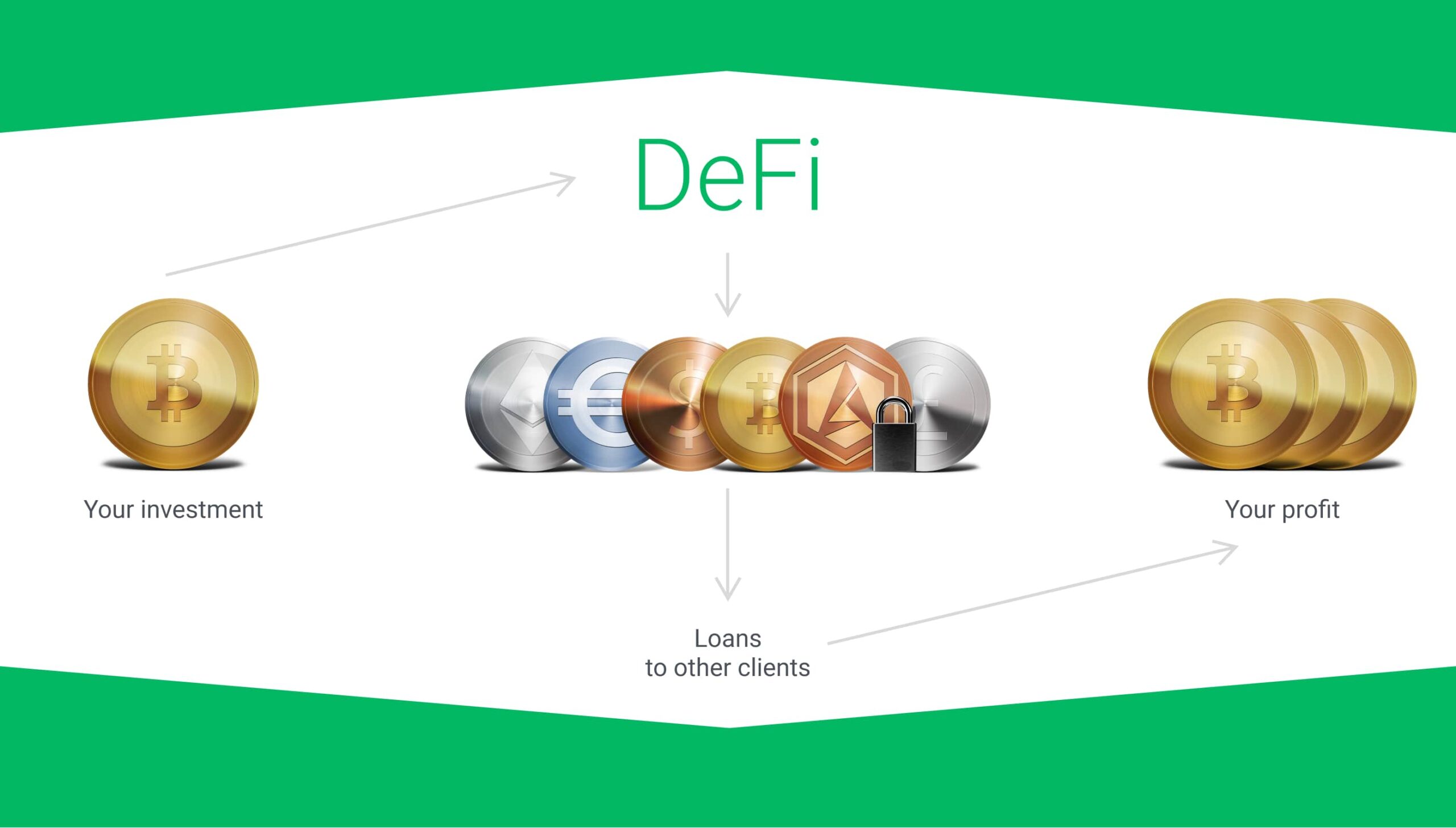

Most crypto lending applications run on smart contracts, using blockchain technology and they allow users to instantly lend and borrow money without identity of credit checks. They are fully automated, instantly executing transactions at lightning speed, cost effectively, without middlemen or bureaucracy, and there is no centralized authority controlling the movement of assets or overseeing transactions.

The process is simple, with the dapp user interacting directly with the smart contract from their e-wallet. The crypto owner loans their funds to the dapp, which then loans the money to another client, or uses it for trading or to otherwise power the dapp’s operations. While the dapp gains liquidity, the crypto owner earns exceptionally generous returns. The highest interest rates for lending crypto currently being offered in the Decentralized Finance (DeFi) space are around 10-12%.

So, who has the highest rates for lending crypto?

Crypto lending rates are far higher than the interest that can be earned with more passive traditional investment channels, like the stock market or real estate and they certainly exceed the returns that can be expected from letting your crypto assets sit idle in a regular wallet. Also it goes without mentioning that your bitcoin or ethereum lending rates are going to be ten times higher than anything offered by the bank.

Let’s briefly examine the crypto lending rates of a few of the better known competitors in the space. BlockFi offers around 6%, while Nexo offers around 8% interest. The Compound dapp for collateralized borrowing and lending offers up to 10% returns, while one of the best interest rates for lending crypto within the DeFi arena is the Celsius Network, offering 12%.

When you are searching for the best interest rates for lending crypto, you will also be taking into account that borrowing and lending dapps also offer token rewards for platform activity. These are basically incentives for locking funds in the dapp. A strong token, means the potential for gains above and beyond the interest they offer. Examples include Nexo’s native token of the same name, Celcius Network’s CEL coin, Aave’s LEND token and COMP, the native token of Compound.finance.

The danger of course occurs when we consider how the crypto lending system is structured for yield farmers, dapp users who borrow and lend funds to dapps to earn high interest rates. To earn the highest rates for lending crypto a yield farmer will move their money around to exploit the best percentage yields available that day or that week. They make a deposit, earning reward tokens, then borrow against it, to earn even more tokens. This generates higher yields but also significantly adds to their exposure, as demand gets inflated and the big investors with the most tokens can then manipulate the market. Keep in mind, there are no guarantees that demand for the token will continue as the bubble could burst at any time. Chasing the best interest rates for lending crypto, by borrowing and lending in quick succession, you need to also consider that to protect themselves, dapps often require overcollateralization. So, if the currency that you used as collateral falls below a certain threshold, then your balance could be liquidated and you could end up losing everything.

Aside from lending rates, what else needs to be considered?

Another serious factor to take into account when weighing up the pros and cons of using a dapp to benefit from high lending rates is account integrity. Before you hand over your EUR, ETH or BTC to a dapp, the holes in smart contract security may make you think twice. Hackers successfully attacked Decentralized Finance applications multiple times in the first half of 2020, with five major hacks hitting the news before the close of the summer and costing millions.

In addition, even if you have found the dapp with the best bitcoin lending rates, there is still the issue of regulatory uncertainty to consider. Decentralized Finance and the entire world of crypto is advancing at a rapid pace and in many countries regulation is one step behind the developments relating to this emerging asset class. This means less consumer protections, a lack of accountability and vulnerability to untrustworthy elements.

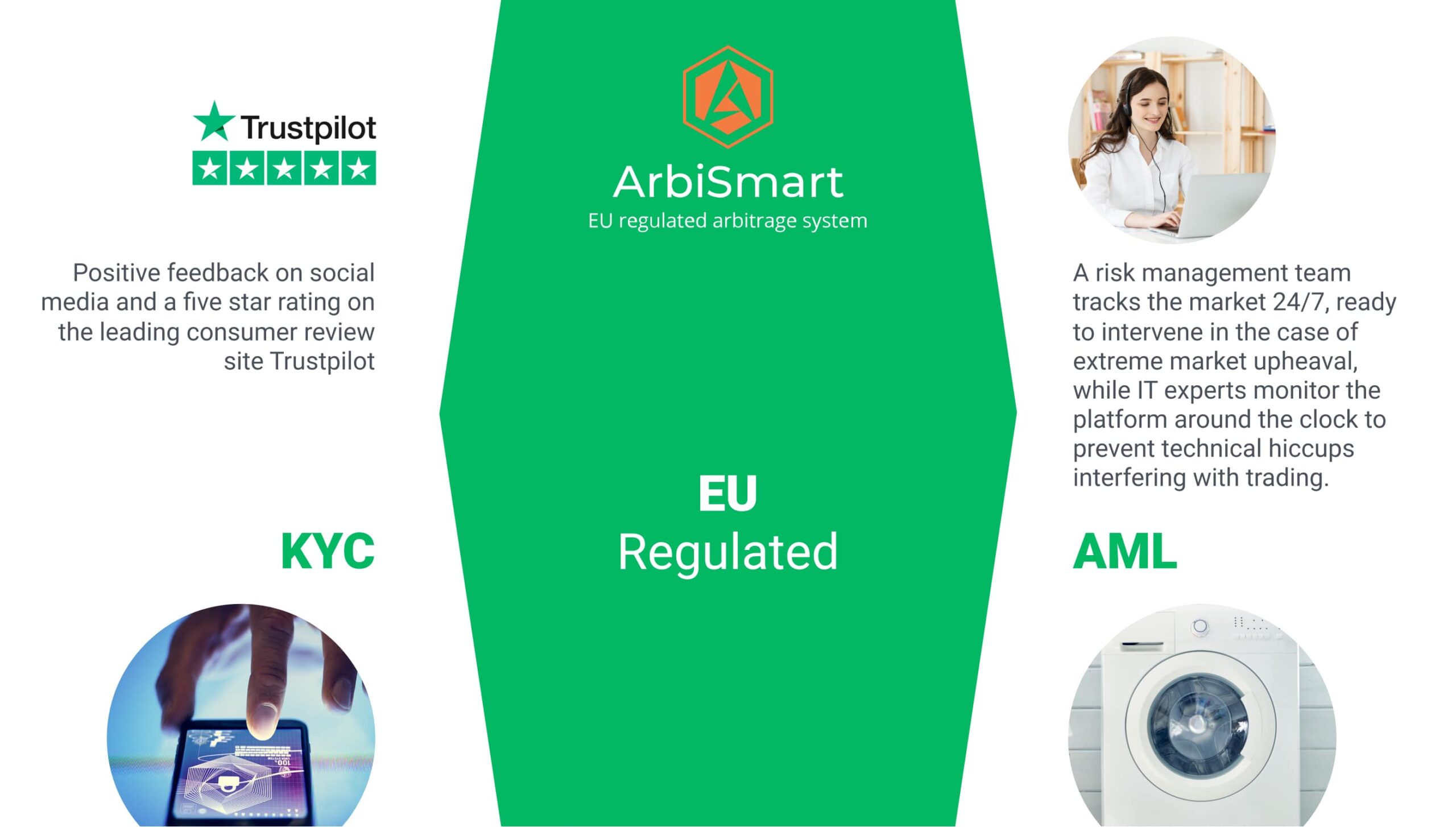

However, at ArbiSmart, we are able to bridge the gap and provide the best of both worlds. Our fully licensed and regulated investment platform utilizes a mix of blockchain and traditional, bank-grade security protocols. Our clients benefit from an investing environment characterized by accountability, reliability and airtight security as well as the speed, efficiency and automation of blockchain.

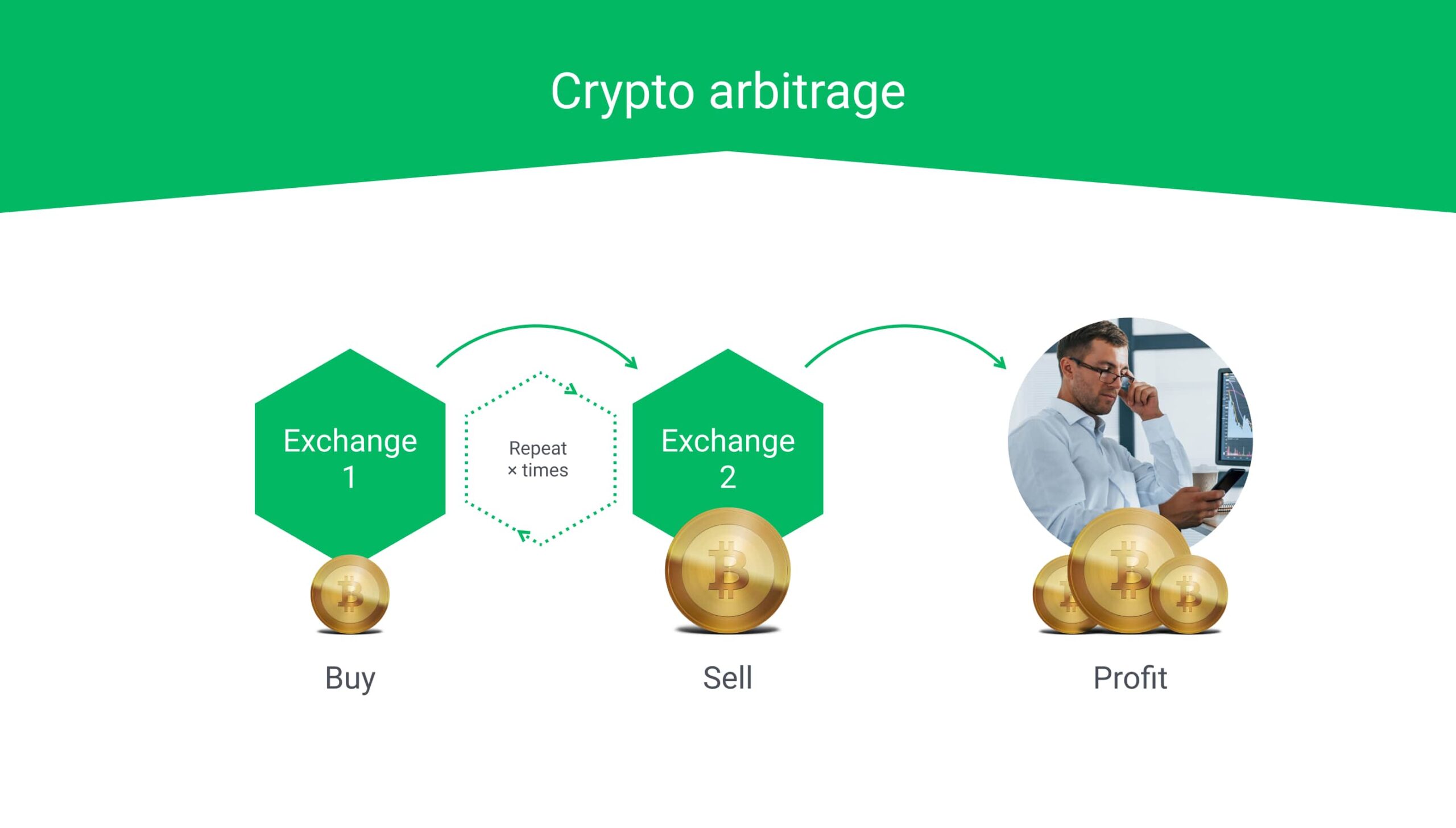

Our automated, EU licensed crypto arbitrage platform offers an exceptionally low risk form of crypto investing that takes advantage of temporary price disparities across exchanges. It automatically finds price differences, buying a coin at the lowest available price and then instantly selling it at the highest available price before the price discrepancy resolves itself, so you can earn a profit on the spread.

You simply make a deposit in crypto or fiat and it is converted into our native token RBIS. Then you can sit back while the algorithm does all the work to earn you interest that starts at 10.8% and reaches up to 45%, depending on the amount you deposit, a profit margin far higher than is offered by any of the major DeFi lending applications.

You can also earn generous capital gains from the rising value of the RBIS token. It has already gone up in value by 120% and if it continues its current rate of growth, the token is projected to rise by an additional 3,000% over the next 18 months. This is in large part due to the increasing global popularity of the platform and ongoing development of licensed financial products that meet a market need.

Another passive revenue stream that ArbiSmart offers, which also generates up to 45% annual interest, is our licensed interest-bearing wallet, with the exact amount of your return depending on the account type, account currency and the amount deposited.

Unlike with DeFi crypto lending applications however, you needn’t lift a finger to earn a profit from the platform token, since there is no need to spend precious time chasing the pool with the highest yields. This also removes the danger of inflated token prices that come with constantly moving your crypto assets to earn reward tokens. Also, since there is no borrowing on the platform, no collateral is required and so there is no danger of liquidation as a result of an over-collateralized loan.

In addition, in contrast to the under-regulated DeFi space, since ArbiSmart is a fully EU licensed platform, you can benefit from all manner of consumer protections, such as external auditing, AML and KYC protocols that protect against criminal activity, exceptionally strict data security measures to prevent hacks and a client insurance fund that covers your capital if ever a hack actually succeeded.

Unlike fully automated dapps, where all interaction with the dapp is directly between smart contracts and crypto wallets, ArbiSmart provides an extra layer of security with the addition of the human element. A risk management team tracks the market 24/7, ready to intervene in the case of extreme market upheaval, while IT experts monitor the platform around the clock to prevent technical hiccups interfering with trading. Then of course there is the support team, which is available day and night to offer personal assistance and guidance via multiple channels, providing another layer of accountability.

So, if you are looking for the highest rates for lending crypto there are clearly plenty of options to choose from. However if you want a passive income with minimal effort, maximum yield and almost no risk whatsoever, crypto arbitrage platforms like ArbiSmart can offer a smarter, safer and far more lucrative solution.