Stablecoins, Yield Farmers and the Ongoing Search for Crypto Security

The world of Decentralized Finance (DeFi) applications and the high yield crypto investing opportunities they offer have taken center stage within the crypto community in the last year. Crypto investors looking for a fresh source of passive income have turned in large numbers to yield farming, which involves depositing funds with a DeFi application (dapp) or smart contract. Those funds provide liquidity which is used to fuel the operation, or to provide loans to other dapp users. In return, the yield farmer then earns a passive profit of approximately 10% and in addition, they benefit from reward tokens, incentives for locking up their cryptocurrency in the dapp.

Why is there so much hype over yield farming?

Yield farming harnesses the advantages presented by DeFi – full transparency, no middle men or bureaucracy, exceptional cost efficiency, speed and of course the fact that as a decentralized, blockchain-based ecosystem, there is no central authority and no background or credit checks. But, primarily, yield farming offers returns ten times higher than those offered by a bank.

What are the best coins in yield farming?

To achieve the highest possible cryptocurrency investment yield token choice is critical. The best coins in yield farming are commonly believed to be stablecoins, such as USDC, BUSD, DAI, or tether (USDT), which offer a means of protection from fluctuations in the price of the underlying asset.

A stablecoin is a digital currency that is used for the purpose of minimizing the volatility of crypto prices. A stablecoin can be pegged to another asset, such as a cryptocurrency, exchange traded commodity, or fiat money.

Powered by the stability they offer to tokenholders, stablecoins are gaining ground, benefiting from the demand created by the growing popularity of yield farming and their prices are spiking. In fact USDT has one of the highest daily transaction volumes and it is expected to out-perform Bitcoin at any time now. When using stablecoins, yield farmers benefit from greater stability, but on the other hand, the costs are also higher. In trying to determine the best coins in yield farming, we need to consider that particularly in times of market uncertainty a coin with the promise of stability will be in high demand, making stablecoins an attractive proposition. However, it should not be forgotten that a stablecoin is only as strong as the underlying asset to which it is pegged.

In the opinion of many, the best coins in yield farming are new up and comers like BAT and XRX, which have shot up in yields and are earning more reward tokens. The supply on apps like Compound has increased dramatically, with a large market cap percentage locked in. The yield farmer is exposed to greater volatility but the returns are also higher. The main danger of the boom in these coins is that if they move against one another the yield farmer’s collateral can be totally liquidated.

How secure is yield farming?

There are some major security issues with yield farming, the most significant being the weaknesses in smart contract security that continue to be exploited on a frequent basis. In fact, there have been at least five major DeFi attacks, costing millions in the last six months alone. Then there is the fact that with regulation one step behind DeFi advancements there are few protection for investors in place and the possibility of costly tax implications, which are yet to be codified.

Another danger is with the way in which token incentives are structured for yield farmers and how they are used to earn the highest possible return. One of the more popular dapps is Compound, where yield farmers can earn around 10-12% interest on their deposit and also earn COMP tokens for lending and borrowing.

A yield farmer seeking higher returns can move their assets around, chasing the pool offering the best percentage yield that week. By borrowing against their own deposits in a loop they can earn a higher yield but are also increasing their risks. Demand becomes inflated, with whales manipulating the market and there is no guarantee the boom will last. In addition, if the currency used for collateral drops in value to a specific threshold, then all the yield farmer’s funds can be liquidated and they can lose all their capital.

It is hard to escape the conclusion that yield farming has been dangerously overhyped. It involves an exceptionally high degree of risk and the long-term viability of the Ethereum network and its security vulnerabilities are yet to be discovered.

For those looking for high yield crypto investments. There are a number of alternatives, from high risk- high-return options like day trading to the far less time intensive and far low risk option of HODLing, where coins are safe but can take a long time to appreciate. There is also another route to consider if you want a passive crypto income. Crypto hedge funds yield excellent returns but there are frequently sky high minimum investment requirements making them inaccessible to the majority of investors. There are also commonly long wait periods until funds can be accessed and of course, depending on their strategies, they are vulnerable to the often wild swings of the crypto markets.

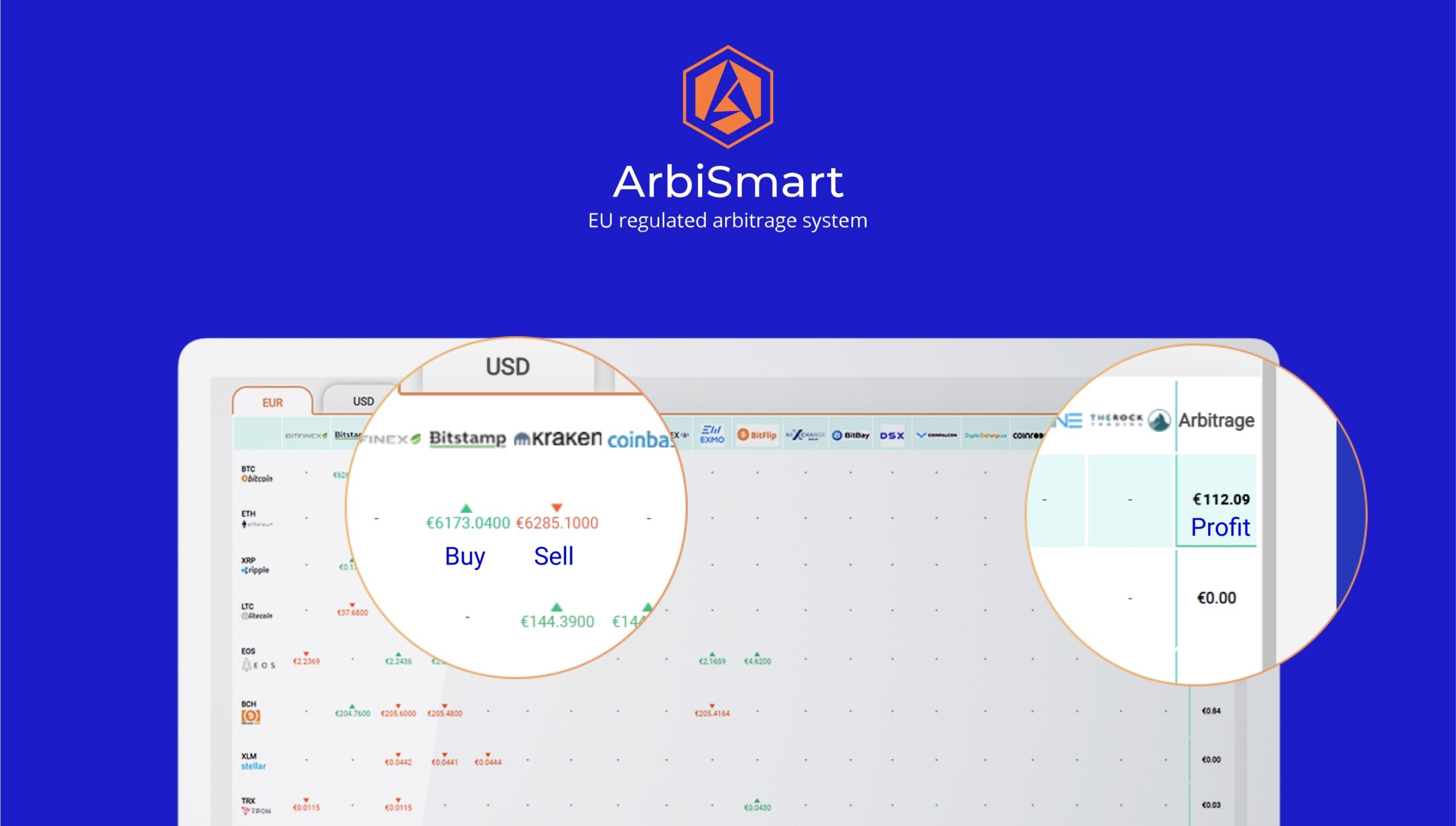

This is where crypto arbitrage really shines. It involves almost zero risk, and is not vulnerable to crypto market volatility.

At ArbiSmart, our AI-based algorithm is able to identify price discrepancies across multiple exchanges instantly, taking advantage of the fact that prices can differ for a coin for a brief period. The system will automatically buy at the lowest price, then sell at the highest price to earn a profit on the spread before the price disparity is resolved. There is no borrowing involved, or collateral required, and the longer term value of the coin being bought and sold has no impact on the profitability of the arbitrage trade.

In contrast to yield farming, our system offers a perfect synthesis of traditional and blockchain-based security protocols. Since ArbiSmart is fully EU licensed and regulated, you are fully protected by means of external auditing, rigorous Anti-money Laundering (AML) and Know Your Client (KYC) procedures, incredibly tough data security measures and an insurance fund to provide coverage if a hack ever were to succeed. We provide an additional shield in the event of a market crash with a risk management team that monitors the crypto exchanges 24/7. We also have a team tracking the ArbiSmart system around the clock that can step in and prevent a technical glitch from causing significant disruption, while our support staff is available to provide assistance at any hour.

Most importantly though,if you take the DeFi route, even if you have chosen the best coins in yield farming for generating returns, you can’t expect interest much beyond 10%. However, at ArbiSmart, you can earn interest that starts at 10.8% and reaches as high as 45%, depending on the amount of your initial deposit.

You can also benefit from a secondary revenue stream from our interest bearing wallet. It offers up to 45% interest per year and you can withdraw your profits at any time in fiat or crypto. If your funds are converted into RBIS, the company’s native token, the returns can be even higher. The RBIS token has already gone up by 120% since its introduction 18 months ago offering great capital gains and it is projected to reach a 3,000% rise by the end of 2021, simply on the basis of the utility and popularity of the financial products that it powers.

If you are currently looking into the most lucrative and secure way to enter the crypto investment arena, the buzz around yield farming can be hard to ignore. However the dangers are very real and as this is still an emerging investment field, many of the risks are still unclear. At this stage, a hybrid approach with a platform that takes the best of both decentralized and more traditional legacy financial systems appears to be the safest and most profitable path for today’s crypto investor.