The Best Way to Earn a Passive Income on Your Bitcoin and Ethereum

When it comes to making a profit from your Bitcoin and Ethereum, your options are limitless. There are a whole range of exciting passive revenue channels to choose from, and of course, as with all investment opportunities, you will need to establish profit targets and carefully consider your level of risk tolerance before taking the leap.

Those who put safety first may want to choose a regular crypto wallet, where they can safely store their crypto, while they wait for it to appreciate over the long term. On the one hand, their money will be sitting idle, but on the other hand, this is a secure option that allows cryptocurrency holders to ride out market volatility. At the other end of the spectrum, is digital currency day trading, a high-risk, high-return investment approach that has huge revenue potential but also exposes the trader to the possibility of devastating losses.

However, in the new era of financial digitization and decentralization, another route has opened up offering greater security and better returns. In this article we’ll discuss some of the most popular options for crypto investment being offered by Decentralized Finance (DeFi) companies that provide yield farming opportunities. So let’s take a closer look at what that means and who some of the biggest players are in this emerging investment arena.

What Opportunities Does DeFi Provide?

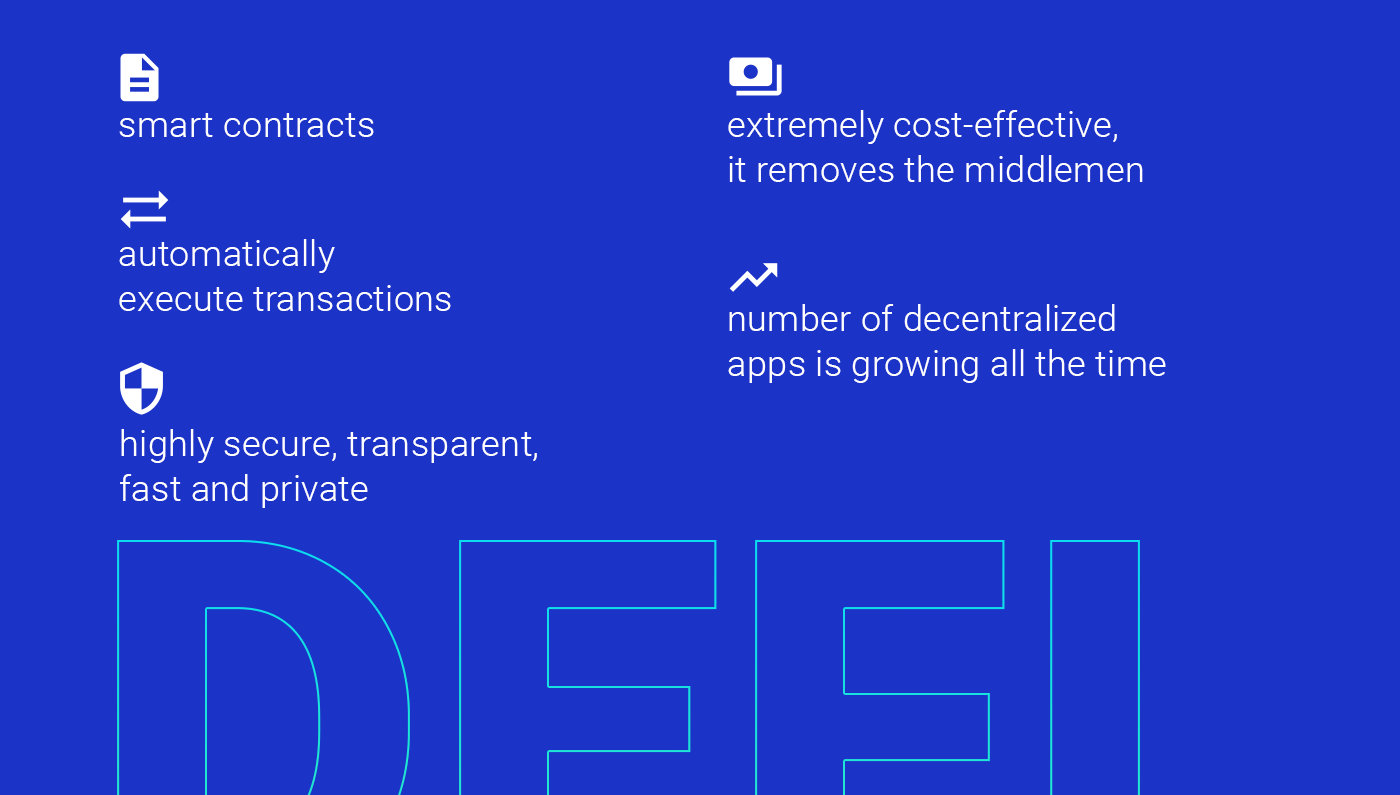

Decentralized Finance, or DeFi for short is a term used to describe a completely new approach to digital banking, using smart contracts to automatically execute transactions when preset conditions are met. Based on blockchain technology, the DeFi ecosystem is highly secure, transparent, fast and private. It has no central governing authority and is extremely cost-effective as it removes the middlemen. The number of decentralized apps, known as dapps is growing all the time and they offer a range of financial services including borrowing, lending, trading and insurance to name a few.

Yield farming is the practice of leveraging the unique characteristics of Defi protocols, products and services to generate exceptionally high profits that are greater than those offered by traditional financial systems and investment channels, such as banks, stock indices and real estate. Rather than simply investing in a specific cryptocurrency, with yield farming you are loaning out your crypto capital to a company that will use it for a variety of purposes such as trading or loaning to its other clients. The company benefits from the liquidity you provide, while you earn extremely high interest on your coins.

To see how it works in practice, let’s check out some of the dapps in the DeFi and crypto farming arena.

Compound

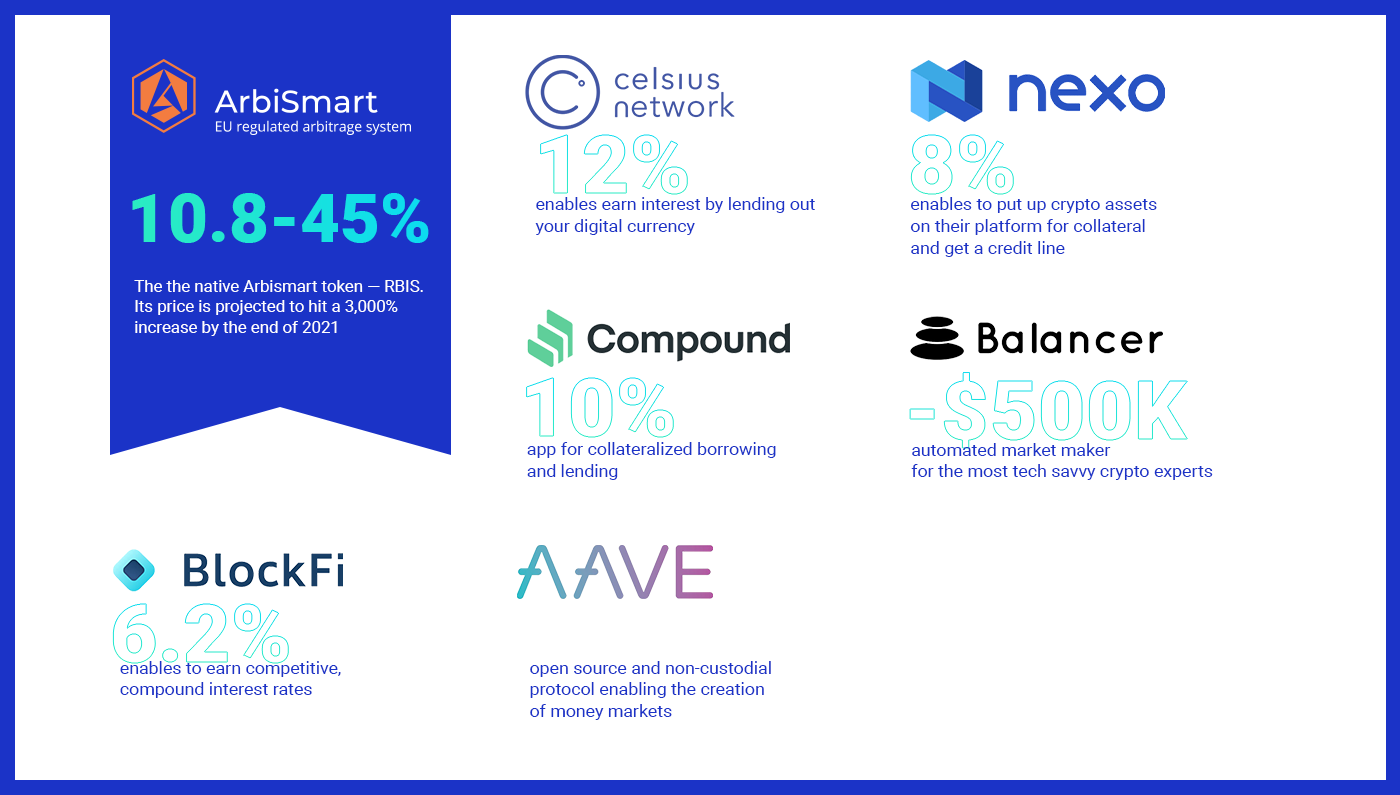

DeFi application for collateralized borrowing and lending is Compound. It uses its native COMP token to power the platform and allows users to borrow funds and lend their crypto assets by locking them into the protocol. Interest rates are determined based on the supply and demand of each asset, averaging around 10% APY.

Celsius Network

Celsius Network is a US company that enables you to take out a cash loan using crypto as collateral to make payments on the blockchain and to earn interest by lending out your digital currency. Powered by the native token, CEL, the platform basically enables users to earn interest on their crypto, while simultaneously using that capital on other applications. Peak interest can reach up to 12% per year.

Nexo

Nexo enables you to put up your crypto assets on their platform for collateral and get a credit line against them. Nexo, with a native token of the same name, takes your crypto, puts it in cold storage hold and you get a loan with no credit check. The platform offers around 8% interest per year.

BlockFi

BlockFi enables users to earn up to 6.2% APY. The company only supports wire withdrawals of $5,000 or more, and smaller amounts must be withdrawn to a wallet in stablecoin or cryptocurrency.

AAVE

Aave, is an open source and non-custodial protocol enabling the creation of money markets. Users can earn interest on deposits and borrow assets and it offers uncollateralized stable, fixed loans. Its native token, LEND provides discounted fees and staking rewards. The support is only offered via chat bot and email, with no direct, person-to-person communication.

Balancer

Only recently launched, in March 2020, Balancer is an automated market maker, designed for the most tech savvy crypto experts. It allows users to create or contribute to liquidity pools that automatically rebalance and then earn fees from other users trading against their portfolio. Its native token is BAL, which users earn for providing liquidity. When it comes to security however, it seems Balancer has fallen at the first hurdle, as it was hacked June 28th 2020 losing $500K when two multi-token pools were drained.

The Balancer hack was the latest of five DeFi attacks since the beginning of the year, where open source platforms have been exploited by hackers. Without question, DeFi offers exciting, fresh revenue opportunities and new ways of doing business yet, it has security issues and holes in its smart contracts that should not be ignored if you are considering investing your hard earned crypto capital.

In contrast, at ArbiSmart, we have created a hybrid that offers the best of both the DeFi and Centralized Finance (CeFi) worlds. Not only does the company offer all the advantages of blockchain technology, from speed to privacy and profitability, but it has round-the-clock human monitoring of its automated systems and an array of additional risk management tools and protocols.

There are also a number of other factors that make ArbiSmart, a safer and more lucrative passive earning opportunity for crypto investors, leaving its DeFi competitors in the dust.

The ArbiSmart Advantage

When it comes to generating a generous passive income, ArbiSmart is not only less vulnerable to hacks, but also is fully EU licensed, meaning that it is externally and internally audited, has an insurance funds to cover all operational capital, implements strict AML/KYC measures as well as high level IT security checks and more. This transparency and commitment to security goes a long way to explaining our exceptional online reputation within the crypto community.

ArbiSmart provides a fully automated crypto arbitrage platform that offers exceptionally low risk and great returns. Arbitrage is a strategy that allows our users to benefit from crypto market volatility without the high exposure, by taking advantage of price discrepancies. Our system scans multiple crypto exchanges at once, identifying the exchange where a cryptocurrency is being offered at the lowest available price and buying it, before immediately finding the exchange where the price is highest and selling to make a profit on the spread. Also, unlike all of our closest competitors, as opposed to providing peak rates of 10-12%, ArbiSmart profits start at 10.8% and can reach as high as 45% a year!

Another factor that puts ArbiSmart head and shoulders above the rest is our native token, RBIS. Once you register your capital is converted into RBIS for use by our automated, AI-based algorithmic trading software. You can choose to reinvest your crypto arbitrage profits to earn compound interest or withdraw your passive income in BTC, ETH, or EUR at any time. The RBIS token is consistently rising in value and in the last 18 months since its introduction it has gone up 119%. In parallel with successful new product advancements and the growing global popularity of the platform, RBIS is able to provide exceptional capital gains and is projected to rise in value by 3000% by the close of 2021.

An additional passive revenue channel that enables users to make their money work for them instead of just sitting idle is our EU licensed interest-bearing wallet, which generates returns of up to 45% a year or more, in return for the liquidity that account holders provide. If account funds are locked for a given time frame then rates reach even higher, with greater profits, the longer the account is closed. When the funds are converted into RBIS, the returns are even better.

If at any point, the client has a question, then they can immediately benefit from personal 24 hour support from their own dedicated account manager. Assistance is available via email, phone, Messenger, Telegram, Whatsapp and more.

As we can see, there are numerous ways that cryptocurrency owners can earn a passive income, maximizing the profit potential on their Ethereum and Bitcoin, using a variety of decentralized applications. However, some are better than others and ArbiSmart is setting the standard in terms of security, oversight, risk reduction, support and critically, the fact that we offer rates far above those offered by any other legitimate player in the field.