A Beginner’s Guide to Trading Cryptocurrency

Cryptocurrencies seem to be everywhere these days and the subject of multiple articles on the best assets for both short and long term investment. However, the crypto world can be a minefield for the inexperienced investor. Rates on the crypto exchanges are known to be exceptionally volatile, but while the risk is high, the rewards can be amazing as the cryptocurrency arena offers incredibly lucrative opportunities. Clearly, before diving in, you would do well to take the time to get a grounding in the basics. So, let’s start at the beginning.

What are digital currencies?

Cryptocurrency, also known as digital currency, is an electronic cash system. Digital currencies are a method of exchange that uses blockchain technology to secure all transactions, as well as verify and record transfers.

A completely decentralized, peer-to-peer network monitors all transfers and this means that there are no middlemen taking a slice of your profits. There is no governmental oversight or interference and no banks or other financial institutions can assert control.

The data encryption and consensus processes are safeguarded by highly complex, advanced cryptography. Transfers are fast and the entire process is characterized by transparency, immediacy and airtight security.

What is the fastest way to trade cryptocurrency?

There are numerous ways to trade cryptocurrencies and take advantage of the exceptionally profitable opportunities they present. One of the most popular and fastest ways to invest in crypto is to trade using an online platform. You can either buy the actual coin, or alternatively, CFD’s on cryptocurrency. This means that you are not buying the coin itself, but are simply speculating on its price direction. Due to the extreme volatility of the crypto markets this can be incredibly risky.

Many of these platforms are unregulated and therefore highly unreliable. Moreover, they offer leveraged trading that can substantially increase your exposure, particularly if you have limited investment capital.

What is leverage in crypto trading?

Leverage is the use of credit, also known as margin, which is offered by brokers. It allows you to trade amounts up to hundreds of times the size of your initial capital. While your trading power grows substantially, enabling you to earn a far higher return on the trade than would otherwise be possible, your risk is also vastly increased. A margin call is the request by the broker for the trader to deposit funds to cover the full amount of borrowed capital.

Is it a good or bad idea to trade on margin in crypto trading?

Since buying on margin is the act of borrowing funds to purchase an asset, it holds the same benefits and risks as any loan. Trading cryptocurrencies on margin amplifies potential profits and losses and if the broker issues a margin call then you will need to put up additional capital or liquidate open positions to keep your investment.

Does cryptocurrency have trading hours?

For most financial markets, peak trading hours, where you will see the highest volume of trading, tend to be between 08:00 and 16.00 local time. In contrast, the crypto exchanges are open around the clock and digital currencies can be traded 24/7.

Probably the most active cryptocurrency regions are the US, Turkey, UK and the EU countries and as a result, European and US trading hours see the most market action and the greatest volatility. However, the Asian exchanges shouldn’t be discounted, as they can experience big price shifts when the European markets are in a low volatility zone. So, major volatility on a Sunday night GMT can have a huge impact for a trader in a European time zone by the time the traders wake up and get into action on Monday morning.

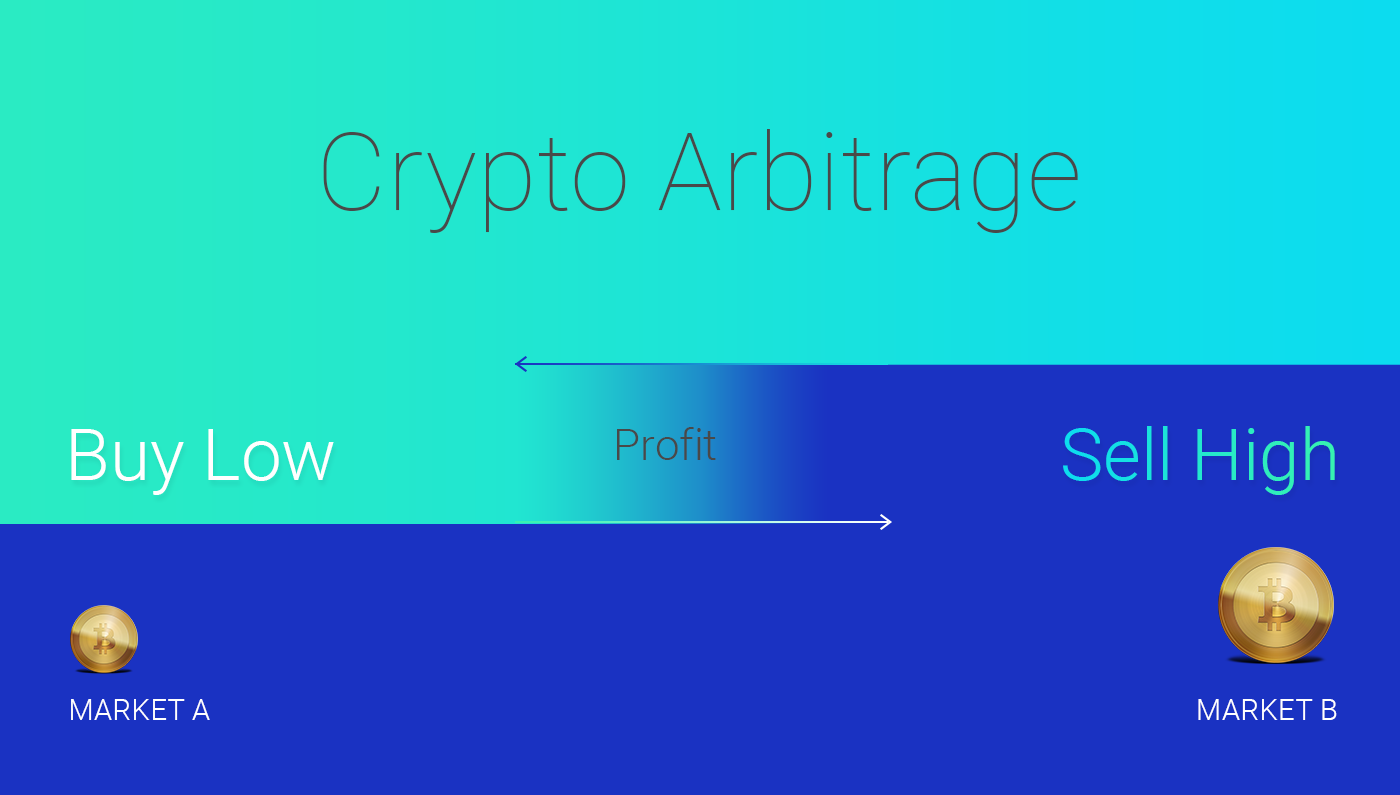

The many crypto exchanges are geographically separated with varying levels of liquidity. This means that it is not uncommon to see large price disparities between the exchanges, particularly after major moves that impact the price of a given coin. So, for example, Bitcoin could be being sold for €400 more on one exchange than on another at exactly the same time.

How can I minimize my risk trading cryptocurrencies?

There are multiple ways to limit your exposure when trading cryptocurrencies. One of the best is to diversify your portfolio spreading your risk across a variety of non-crypto assets as well as trading on a wide range of digital currencies so you can take advantage of overall crypto market growth and the rise in its total market capitalization.

Another way to minimize your risk is with the type of trading strategy you implement. One strategy that is commonly considered to be among the safest, involving almost zero exposure is crypto arbitrage. This is the practice of buying a cryptocurrency on one exchange, where the price is low and then instantly selling it on another, where the price is higher to make a profit on the spread by taking advantage of the short term price disparities that exist across the exchanges.

Here at ArbiSmart.com, as a fully EU licensed crypto arbitrage platform we comply with the strictest regulatory standards maintaining the highest levels of security, transparency and reliability. Our automated platform does all the work for you, scanning over twenty different exchanges simultaneously to find and exploit fresh arbitrage opportunities 24/7. It generates unparalleled returns ranging from 10.8% to 45% per year, based on the size of your investment.

ArbiSmart clients can earn an additional crypto passive income, at equally low risk, with our interest bearing crypto wallet, which offers great returns for zero effort, by ensuring your digital currency doesn’t just sit idle but is working on your behalf. Rates can reach as high as 45%, depending on the amount you deposit, whether or not you choose a savings plan where your funds are locked for a set period and if you do, the time frame you pick for the account maturity. Interest rates will shoot even higher, if you choose to convert your funds into the platform’s native token, RBIS.

What is tokenization in cryptocurrency?

Tokenization refers to the process of converting an asset into a digital token on a blockchain. All types of assets can be tokenized, from stocks to art, real estate and more.

Taking real estate as an example, let’s say, you can’t afford to buy your own luxury condominium. Instead, you find a company that has tokenized one. They created 50 ERC-20 Ethereum blockchain based tokens, each of which represents two percent ownership of a property worth 1M USD. A single token will cost you $20,000.

This is great for you as you can get a piece of the luxury property market without having to find a vast amount of capital. Time and money are also saved, since with blockchain transactions there is no need for lengthy bureaucracy or for the use of expensive intermediaries. Meanwhile the company gains liquidity generally lacking in the real estate market, as well as opening their business up to a larger audience, who would normally be priced out of this market.

Tokenization is not only useful for purchasing part of a product, it is also useful for purchasing services of all types, from payments to investment or data storage. To use the company’s platform and receive its services, you purchase tokens and the more popular it becomes, the more valuable the digital currency, which can then be traded on cryptocurrency exchanges.

For example, the ArbiSmart token, RBIS, is the engine that powers our entire operation. As soon as you make a deposit with our crypto arbitrage platform, your funds are converted into RBIS and then used for trading, although it should be noted that your profits can be withdrawn in euro at any time. Additionally, you can earn profits with the ArbiSmart wallet, by allowing your stored digital currency to be used for crypto arbitrage trading. Only 450M RBIS will ever be generated, with the amount having been capped. While supply may be limited, demand has been steadily increasing. Since the introduction of the token in early 2019, the price of the token has gone up by 119% and its value has been on a steep rise ever since, generating revenue for both the company and its clients.

Is crypto trading taxable?

With the growing popularity of cryptocurrencies such as Bitcoin and Ethereum in recent years, governments have woken up to the revenue potential presented by this new assert class. It’s a good idea to keep on top of the latest regulatory developments in your local jurisdiction as taxation catches up with a new financial reality.

In the United States, for example, the IRS has recently released digital currency tax guidelines, which state that for tax purposes, crypto of all kinds should be treated as property as opposed to currency. As a result, crypto is becoming taxable in the same way as stocks, real estate or gold, meaning that US taxpayers will be required to report cryptocurrency trading losses and gains on their tax return.

Of course, each country has its own taxation laws and these are in the process of being ironed out, with each jurisdiction setting its own rules and fine-tuning its response to the newly emergent electronic cash economy. The most important thing to remember is to keep up to date with tax developments in your region, so as not to be taken by surprise in the event that your earnings suddenly become taxable.

As we can see, there are numerous ways for investors to get a foothold in the crypto arena, some exposing you to greater risk than others and all with varying levels of revenue potential. Your choice of how to trade will depend on a variety of factors including your knowledge level, earning expectations and the amount of time you wish to dedicate to your portfolio. However you choose to trade, it is critical that you do your research, keep up with regulatory developments and choose a reputable, regulated platform that has safeguards in place to protect the integrity of your account while also implementing strategies that minimize your market exposure.

If you wish to learn more about crypto arbitrage, click here, or you can register now and start trading with ArbiSmart right away.