How to Store Cryptocurrency: The Pros and Cons of Hot and Cold Crypto Wallets

Cryptocurrency is stored in an electronic wallet. Let’s start by defining what a crypto wallet is and how it functions.

A crypto wallet provides the operational capability to interact with a blockchain network. They provide the connectivity tools to enable blockchain transactions. The critical data they generate includes public and private keys and the alphanumeric “address” based on these keys that serves as a location where crypto can be transferred. The wallet doesn’t actually remove your funds from the blockchain, it just transfers it between addresses.

Keep in mind, your address is shared with anyone you want to allow to send you funds, yet your private key, which provides access to your crypto must remain confidential to ensure the security of your capital.

Crypto storage wallet options fall into two primary categories- hot and cold.

What is a hot wallet?

Hot storage crypto wallets are connected to the internet. On the plus side, with hot storage crypto is instantly accessible. They are easy to set up and if you are considering how to store cryptocurrency for maximum convenience, nothing beats bitcoin hot wallets for getting your hands on your BTC quickly. Most of them are accessible via your phone these days and as a result, hot storage crypto wallets are great for traders or others who need to frequently access their capital. Hot wallets also tend to provide support for a wider range of cryptocurrencies than cold wallets. However, their primary drawback is that as a web-based storage system, they cannot be made completely resistant to hacks. In addition, wallets and exchanges are starting to be regulated, so accountability is increasing as are customer protections, but there is also uncertainty with regard to taxation and governmental interference.

What is a cold wallet?

A cold storage crypto wallet is not connected to the internet. As a result it is by far the most secure option, since there is no way it can be hacked, even if the transfer of funds is not as seamless and rapid as with hot storage. This makes it an attractive option for long term investors wishing to HODL, as they wait for their crypto to appreciate over a period of months or years. With a cold storage crypto wallet, popular examples being Trezor and Ledger, your crypto is stored offline, using a physical piece of hardware to store your private key. For this reason, while a web-based, hot wallet is free to set up, you will be paying in the range of $100 for cold wallet storage to purchase the device.

While safer than hot wallets, even the best cold storage wallet has one major security challenge- the human element. You are in charge of your own funds, so you need to ensure you don’t lose track of your wallet, and many experts advise keeping it in a safety deposit box. Since there is a substantial fee for purchasing a cold wallet and it offers tighter security many investors choose this option for larger sums and simply keep smaller sums in a hot wallet, just as you would keep your primary capital in the bank, but a few notes in your back pocket.

When deciding how to store cryptocurrency savings, another huge factor to take into account is interest. With a cold storage wallet, you are in charge of your own funds so you can never earn any interest on your capital. It is just sitting idle. However, a new phenomenon is emerging. While up to now, most hot wallets have only offered a safe mode of storage for your funds a new hot wallet option is taking the crypto world by storm- the interest-bearing wallet.

Interest-bearing wallets

An interest bearing wallet allows you to earn a passive income, while you get on with your day. Instead of just being concerned with how to store cryptocurrency safely, a major question you now have to ask before choosing a wallet is where you can do it most profitably.

In most cases, all you need to do is open an account and make a deposit. Then, your funds will be transferred to a closed savings account, for a set period, to earn a passive income. The amount of interest you can make, will depend on the size of your deposit and the time frame you choose for the lock on your savings account. The wallet will then use your funds for providing loans to other clients, trading or a variety of other purposes.

In many respects this is very similar to how a traditional bank offers interest, using your funds to purchase assets or provide loans. However the primary difference is that an interest-bearing wallet offers interest multiple times higher than the 1% average offered by a bank and there is never a danger of negative rates.

When deciding how to store cryptocurrency, there are a number of factors to consider including the safety, transparency and profitability of your chosen wallet.

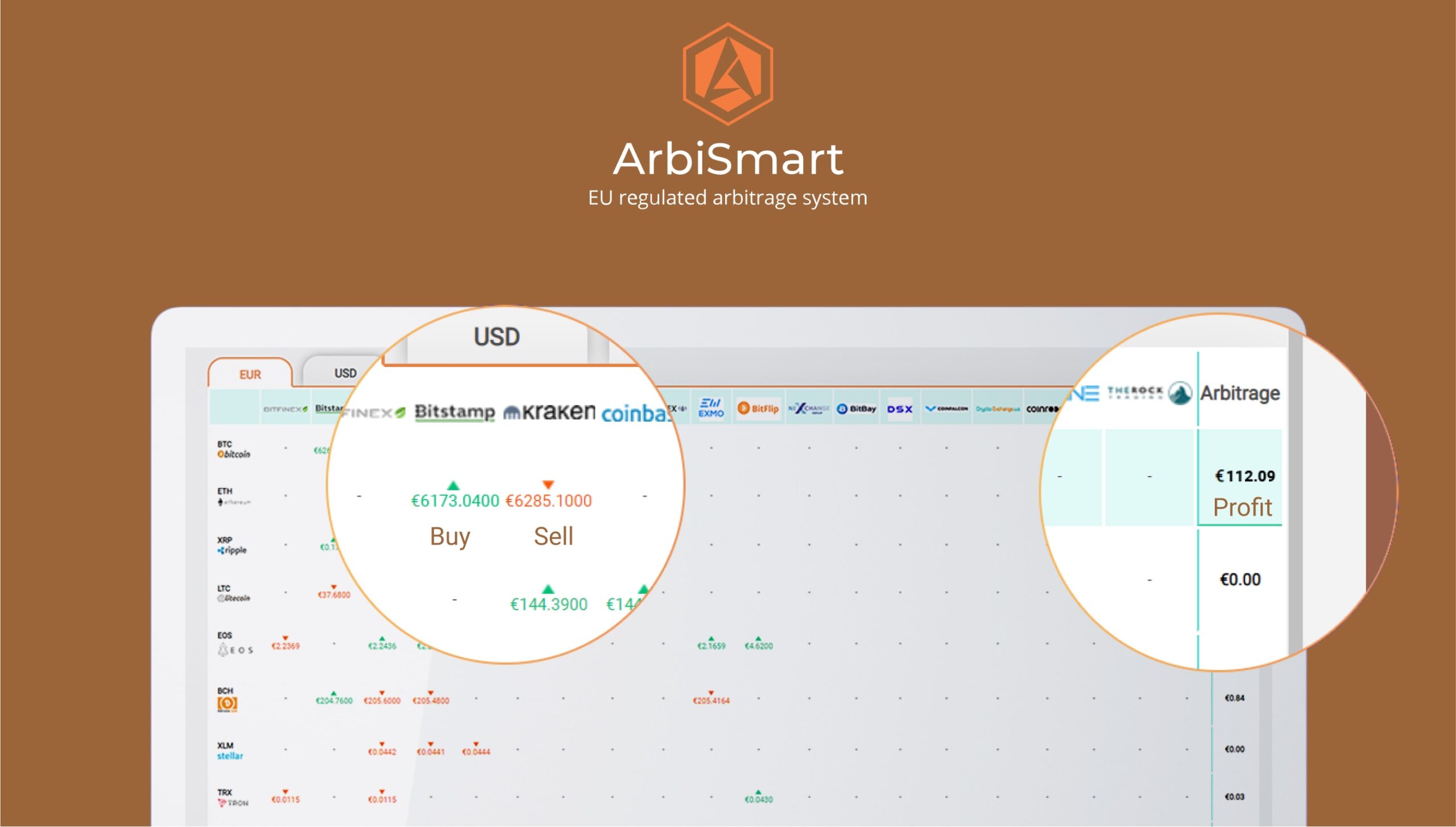

At ArbiSmart, in addition to our popular, highly liquid automated crypto arbitrage platform, we also offer an interest bearing wallet. The way it works is you fund your account with either fiat or cryptocurrency, the platform uses your capital to perform automated crypto arbitrage trading and a share in the profits is paid to you for the use of your funds. All funds not in current use for crypto arbitrage are kept securely in cold storage.

Crypto arbitrage is widely acknowledged to be one of the lowest risk types of fiat or crypto investment yet it is also highly lucrative. When choosing how to store cryptocurrency, for most of us it comes down to where you can find the highest possible interest rates and at ArbiSmart, you can make anywhere from 10.8% up to 45% a year. The amount you make will depend on a number of factors, such as the size of your deposit, your account currency and account type. You can choose a flexible account, withdrawing your funds at any time in ETH, BTC or EUR, or place them in a closed account for a set period, where the longer the lock, the higher your interest rate.

Unlike many wallets with no regulatory oversight at ArbiSmart, we are EU licensed meaning that we are externally audited, implement bank grade data security measures, are compliant with KYC and AML protocols and have established an insurance fund that covers your account balance if a system breach were ever to occur. There is also an expert support team offering personal assistance the minute it is needed, via multiple channels.

When it comes choosing how to store cryptocurrency there are all types of wallets and the type you choose will be determined by your plans for your capital. For large sums that are to be held for long-term investment cold storage is safest, though in this case your money will be sitting idle, earning nothing, and you need to be incredibly careful with your device so as not to lose all your money. In contrast, small sums that are constantly being moved around for the purpose of purchases or trading, a hot wallet is preferable. Then of course, if you wish to earn a passive income and make your money work for you every minute of the day, an interest bearing wallet is by far the best and most lucrative option.