What Is Cryptocurrency Algorithmic Trading and How Is It Changing the Way We Trade?

What is algorithmic cryptocurrency trading?

Let’s begin with a clear definition of algorithmic trading, which is also sometimes referred to as autotrading. Basically, it is an automated system that uses pre-coded instructions to execute trades, based on a number of market variables ranging from asset price to trading volume.

Cryptocurrency algorithmic trading is popular with traders at every level, from novices to professionals, primarily because the software is able to analyze and respond to the market with a speed and efficiency that a human could never match.

This type of software is having a huge influence on the cryptocurrency markets, increasing the liquidity and volatility of various coins and impacting their market rates. So, it is definitely worth taking a closer look.

What are the different types of cryptocurrency algorithmic trading software?

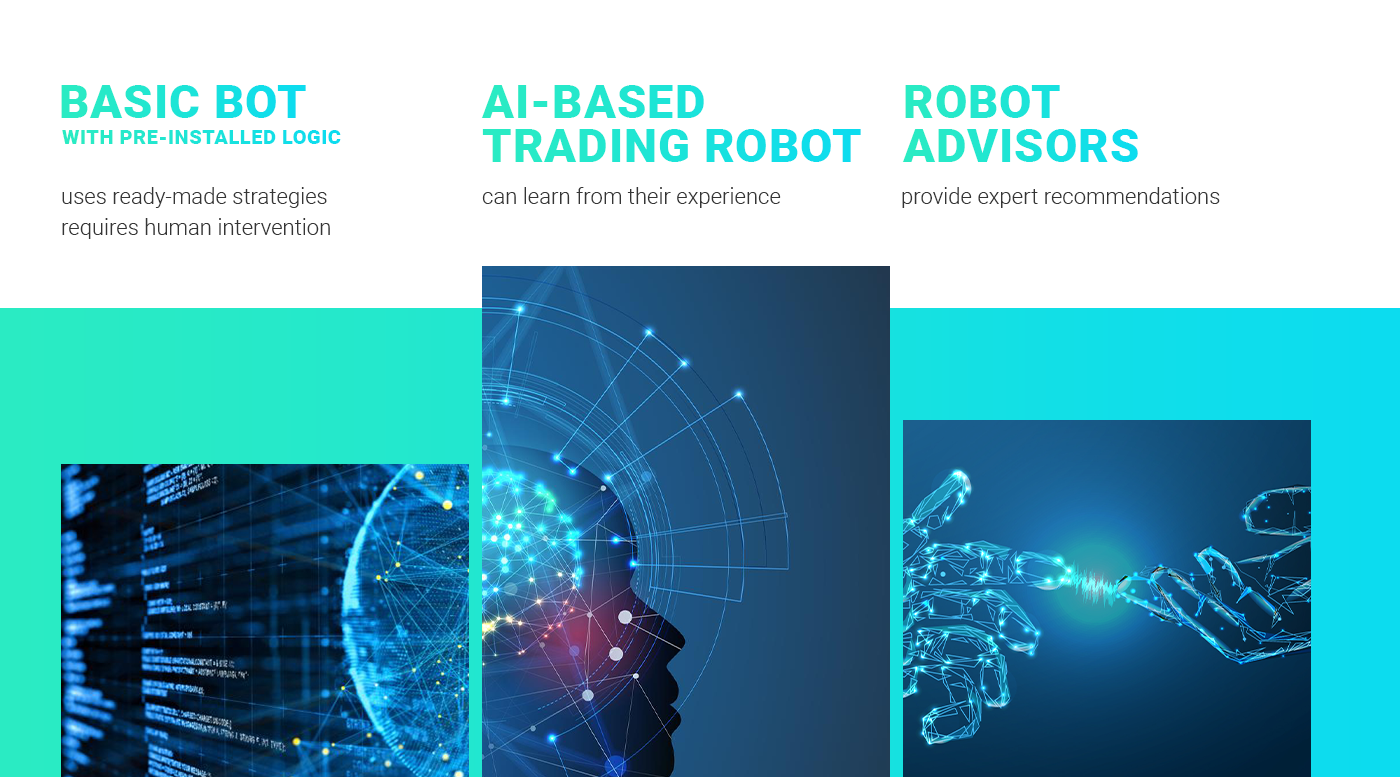

There are various types of automated trading systems that are accessible to cryptocurrency traders.

The first kind of autotrading software we should look at is a basic bot, with pre-installed logic. This type of trading bot algorithm uses ready-made strategies that are automatically implemented when certain market conditions are met. You can test the viability of a trading strategy at zero risk before using it on the market, but to alter the bot’s behavioral response to specific market scenarios you would need to change the actual code. So, it will continue responding the same way based on the coded triggers and their combinations, without accounting for long term shifts that require a new approach. This means that a basic bot is not the answer if you want an ongoing passive income from a system that requires no human intervention.

A more sophisticated algorithmic trading solution is an AI-based trading robot that use machine learning and neural networking technology. These smart algorithms can learn from their experience providing more in-depth and precise analysis of the cryptocurrency markets.

One more type of cryptocurrency algorithmic trading software is robot advisors. These do not do your trading for you, but rather provide expert recommendations.

Why use a cryptocurrency algorithmic trading system?

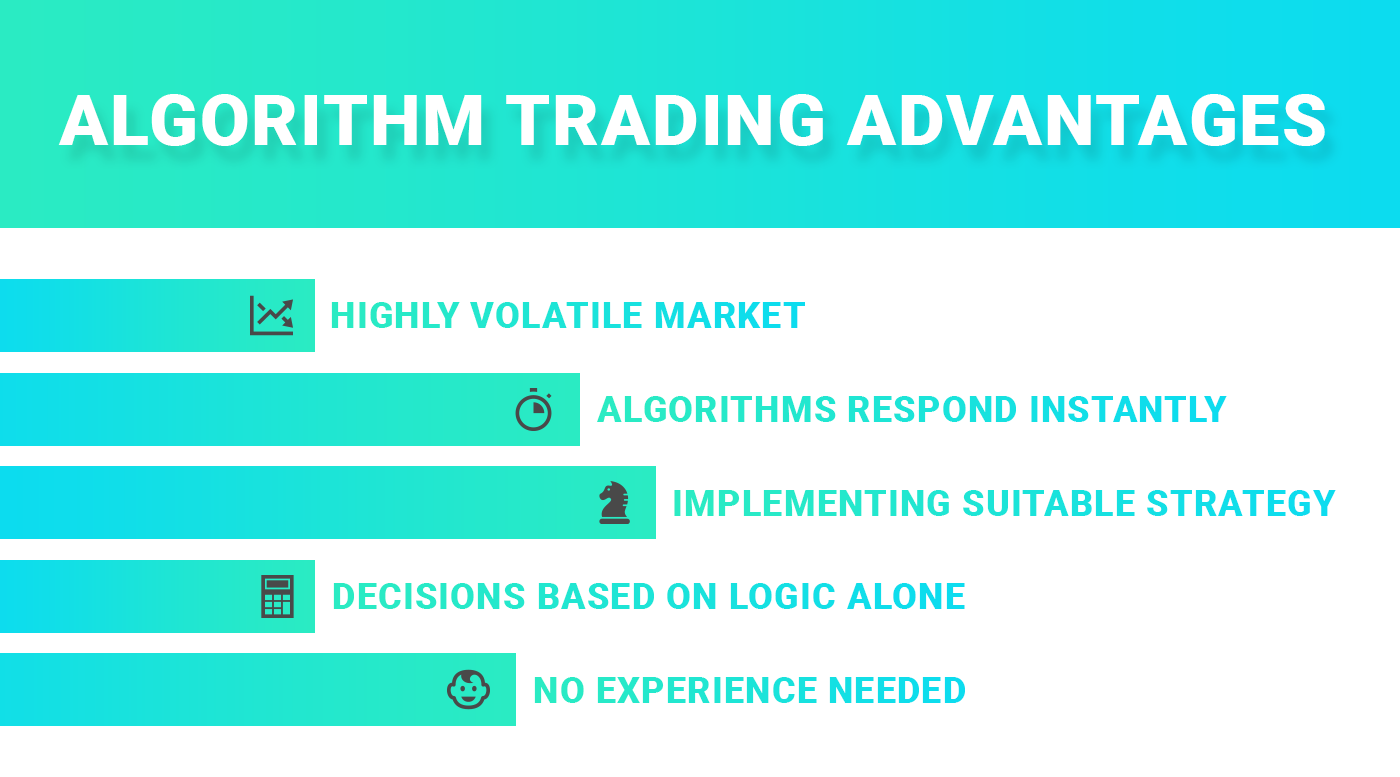

The digital currency markets are highly volatile, experiencing dramatic peaks and troughs, so market participants wishing to effectively exploit emerging opportunities on these rapidly moving markets can benefit from using a fully automated, cryptocurrency algorithmic trading system.

High frequency trading tools account for the vast majority of global market transactions. They are incredibly useful as they can seek out revenue generating trading opportunities around the clock, and respond to the market instantly.

A smart trading robot algorithm can identify active cycles and emerging trends, adjusting strategy with every trend reversal. Using lightning-fast signal technology and dynamic market entry to execute a wide array of order types it will implement the most suitable strategy in response to current market conditions.

These systems have become incredibly sophisticated and have broad capabilities that can limit your exposure. By using the full spectrum of data points they can reduce portfolio volatility and potentially increase your revenue potential.

One of the main ways this is achieved is by preventing you from getting in your own way. By taking emotions such as fear, self-doubt and greed out of the equation, cryptocurrency algorithmic trading software is able to make market decisions based on logic alone.

Moreover, for traders without the necessary experience, or time to dedicate to their investments each day, an automated system is ideal. It can scan numerous exchanges simultaneously, 24 hours a day, to identify crypto market opportunities. Absorbing and instantly analyzing a mass of data it can then execute multiple trades on a large selection of cryptocurrency pairs all at once.

It comes as no surprise that the crypto community, which is driving the digitization of the global economy, has embraced this technology and is utilizing trading bot algorithms to enhance the efficiency and reliability of their cryptocurrency transactions.

So, the benefits are clear, but is cryptocurrency algorithmic trading safe?

Designed to maximize efficiency and profitability, algorithmic trading software solutions offer a host of advantages, particularly for those who are new to the world of trading. Even so, they are not free of risk.

In fact, the main danger in using autotrading software is that a novice trader might be led to believe that they will always profit from their trades because a sophisticated machine is doing all the work for them and will always know exactly how to respond to the market. No human error, right?

A number of pitfalls still exist even when using an automated system. With many types of algorithmic trading software, analysis is only carried our retroactively. Conclusions are frequently drawn based only on positive results, due to a logical fallacy known as the “survivorship bias, while the software also fails to take the broader market context into consideration.

One way to mitigate risk is through your choice of cryptocurrency algorithmic trading platform. Choosing a fully regulated platform is a must if you want a safe, fair and transparent trading experience. A licensed system provider will put rigorous technological security protocols in place and implement strict identification verification practices to safeguard against fraud, secure the privacy of your data and ensure the safety of your funds.

Another way to mitigate exposure is to choose a low-risk avenue for your digital currency investment. One such example is cryptocurrency arbitrage. The way it works is that a crypto arbitrage algorithm automatically buys a coin at the lowest available price on one exchange and then sells it for the highest possible price on another, taking advantage of the temporary price difference to create a profit for the trader. One of the better known EU regulated platforms with a crypto arbitrage algorithm is ArbiSmart.com. Their AI-based automated system is one example of a trend that is taking over the crypto market and changing the way we evaluate and react to its risks and opportunities.

The potential for the average trader is boundless. Essentially, when using a smart robot, a novice trader without a professional, financial background or cryptocurrency market experience can sit just back and watch it do all the work. Hours can be saved that would otherwise need to be spent analyzing the market, evaluating asset histories and waiting for the perfect moment to act. An automated crypto arbitrage algorithm can open and close countless positions across multiple exchanges at once, seizing on market opportunities the second they arise offering unmatched efficiency and speed as well as significantly reducing the trader’s exposure in the volatile digital currency arena.

However, some things are not going to change with the advent of cryptocurrency algorithmic trading. This is still a dynamic market that is far from predictable. While traders can gain a greater measure of security and take advantage of opportunities relating to hundreds of different cryptocurrency pairs, an automated trading platform is not a crystal ball. All investment involves risk and the digital currency market is no different to any other.

As the crypto world gains legitimacy, with more and more individuals, businesses and institutions joining the digital cash revolution, trading technology is evolving to meet those needs and cryptocurrency algorithmic trading systems are emerging to help lead the charge.