Yield Farming: Planting the Seeds for Capital Growth with DeFi

Yield farming provides an effective means of earning a steady, sky-high return on your crypto capital. It involves using Decentralized Finance (DeFi) solutions to earn exceptional profits that far exceed those offered by any bank, or other traditional investment channel.

DeFi is a digital ecosystem covering a vast array of decentralized financial protocols, products and services from crypto assets, margin trading, and crypto exchanges to derivatives, synthetic assets and algorithmic trading, although the greatest demand in DeFi by far is for crypto lending and borrowing.

To give you an idea of the scope of DeFi applications, they have locked in approximately $2 billion in crypto assets to date. Their growing popularity may well be due to the fact that DeFi offers incredible yield generating opportunities to crypto liquidity providers. Yield farming is basically a search for liquidity, where you put your capital into a specific crypto-based application or a smart contract, so the company can use your funds to generate profits and earn you more cryptocurrency. The company may also use your capital to give loans to other platform users that will earn interest of which you will receive a share.

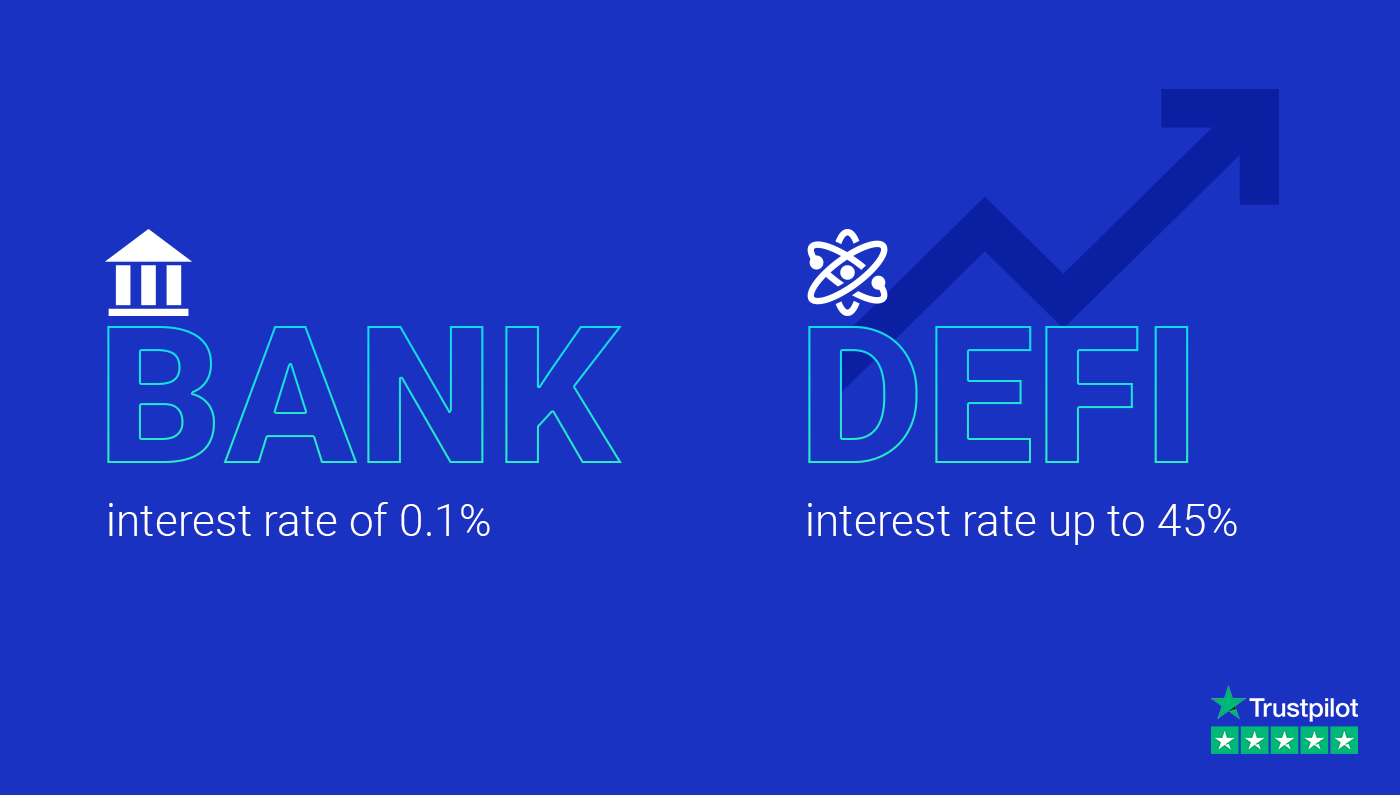

Unlike a bank that will give you, on average, an interest rate of just 0.1%, DeFi products can generate returns many hundreds of times greater. Undoubtedly, these rates will decrease as DeFi gains traction and finds its place in the financial mainstream. However, for now, DeFi yield farming offers an exciting revenue opportunity with unmatched annual returns.

Crypto investing in a DeFi market does not mean investing in a cryptocurrency like Bitcoin. Rather, it entails lending your Bitcoin to a platform that offers yield farming opportunities for an additional return above and beyond BTC price appreciation.

To clarify, let’s take ArbiSmart’s crypto arbitrage platform as an example. Our platform is powered by our native token, called RBIS, an ERC-20 token on the Ethereum blockchain. As soon as you register and deposit fiat or crypto with ArbiSmart, those funds are converted into RBIS and then used by our automated crypto arbitrage system, to trade and earn a profit on your behalf. You can then invest your RBIS to earn compound interest, or simply withdraw your earnings in euro at any time.

At ArbiSmart, your passive profits can reach as high as 45% per year and your risk stays close to zero. This rate of return is almost unheard of and far higher than any legitimate, regulated competitor is offering in the crypto arbitrage space.

We offer equally high returns as reward for liquidity with our interest-bearing wallet. By using the ArbiSmart wallet, instead of just letting your crypto sit idle while you wait for it to appreciate, you can place it in a savings account and generate another stream of passive income anywhere from 10.8% to 45% a year, while also earning huge capital gains from the rising value of the RBIS token, which is projected to go up by 3,000% by the end of 2021. Rates depend on the amount you invest and the type of savings plan you have. If you choose to place your funds into an account that is locked for a set period then your profits will reach even higher than the available maximum for regular accounts.

The advantages for yield farming with ArbiSmart are evident. Our platform is fully EU licensed and one of the most trusted and transparent in the crypto space. Generally, yield farming would not be characterized as low risk, however ArbiSmart is able to mitigate risk dramatically. This is achieved by investing client funds in crypto arbitrage, which is widely considered to be a crypto investment strategy involving minimal exposure. This is because it involves using a fully automated system to profit from price disparities for a given digital currency across exchanges as opposed to speculating on the future fortunes of a coin on the highly volatile crypto markets. No less importantly, ArbiSmart returns are unmatched within the regulated DeFi sphere. While RBIS token supply is capped at 450 million and availability is limited, the demand is growing rapidly. In fact, since the introduction of the token in 2019, it has already risen more than 119% in value and this trajectory looks set to continue as the platform keeps steadily gaining in popularity.

The DeFi arena is packed with yield farming opportunities that offer exceptionally high returns in a short period of time. Whichever route you take, make sure to choose a reliable platform, with minimal exposure and maximum revenue potential. Select platforms with services that offer genuine added value and have tokens with a proven track record. Digital, decentralized financial solutions are the way forward, not just as a complement to traditional investment channels, but as the economic ecosystem defining the future of finance.