What is crypto arbitrage and is it a smart investment strategy?

Crypto arbitrage is an increasingly popular investment strategy, particularly among the crypto trading community, which is already alert to the profit potential of the crypto markets but is always looking for ways to mitigate its inherent risks.

Before we can get into some quite complex questions regarding the challenges, risks and benefits of crypto arbitrage, we should take a moment to discuss what arbitrage is and how it works.

Arbitrage investing can take many forms, depending on the types of assets involved, but the basic principle is this: the trader makes money by buying an asset on one market and then selling it on another market at a higher price. Arbitrage tends to offer quite generous returns and is thought to be a comparatively low risk form of investment, making it a popular strategy across all types of asset class, from retail to real estate.

Let’s take a closer look, using stock market arbitrage as an example. Your first step, when implementing this strategy is to purchase a stock on a foreign exchange, where the price has not yet adjusted for a fluctuating exchange rate. This enables you to buy it below market value, since the stock will be undervalued when compared to the price of the stock on the local exchange. So, to make our example more concrete, let’s imagine that you have purchased Amazon stock cheaply on the London Stock Exchange. You will then sell it at a higher rate on the local New York Stock Exchange, profiting from the difference in price between the foreign and local exchanges.

What is crypto arbitrage?

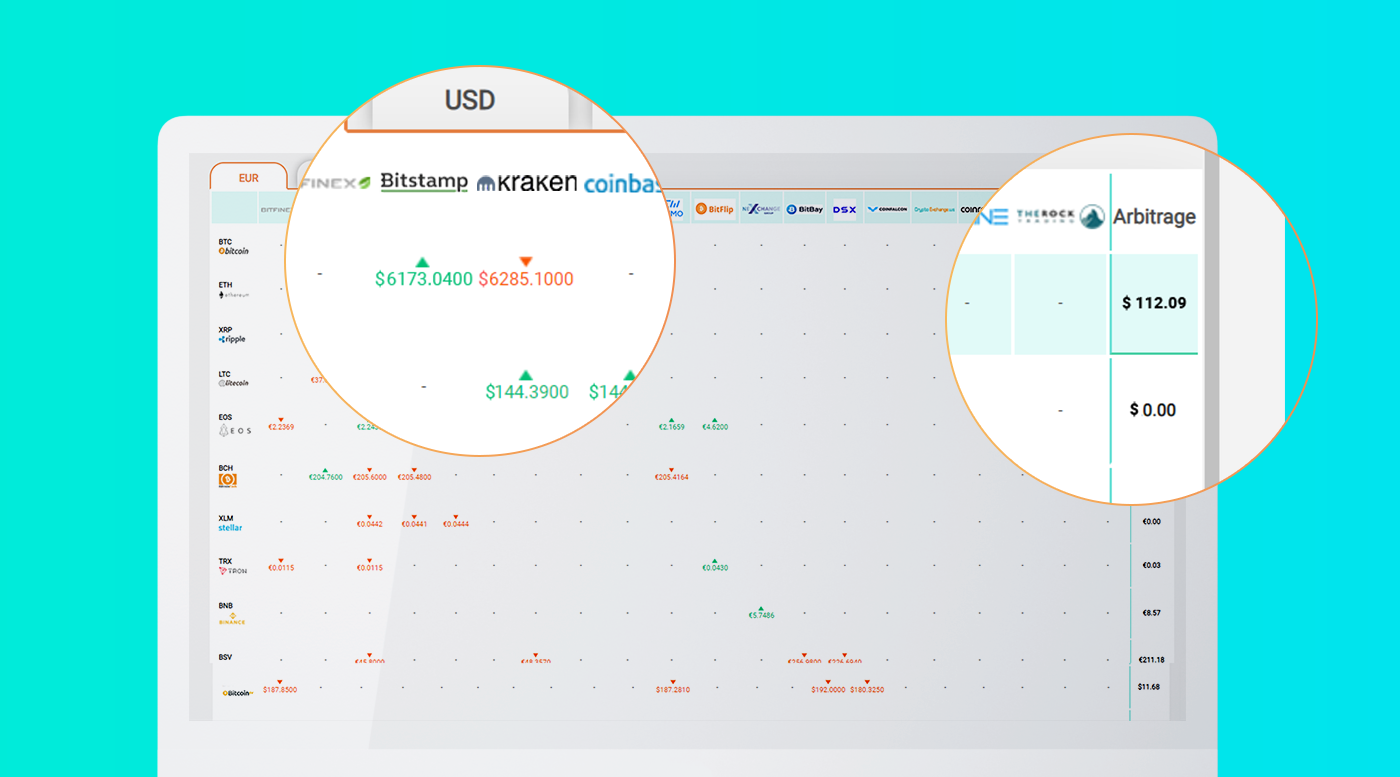

Due to the fact that it exposes the trader to minimal risks, crypto arbitrage is rapidly gaining a following in the digital currency arena. The strategy involves monitoring the difference between the buy and sell prices of a cryptocurrency, known as the spread, across a number of different exchanges. The way you make money with crypto arbitrage is by finding the lowest available price at which to buy your chosen coin and then the highest price at which it can be sold, so you can earn a profit from the spread.

The challenges

One of the greatest challenges when you set out to make money with crypto arbitrage is the sheer complexity of the process. Firstly, you need to be able to access an incredible amount of data, relating to multiple cryptocurrencies and exchanges, so you can identify price differentiations. In order to then exploit this information you will need to be able to respond to the market at lightening speed, instantly executing multiple orders pretty much simultaneously.

In theory, crypto arbitrage should dramatically reduce your risk and ensure a profit, since if you can identify different market prices for a single asset on two exchanges, you will be guaranteed to make money on the trade. Yet, timing is a critical element here. You need to be able to make both the purchase and the sale before the market can adjust to compensate for the price inefficiency. Any delay could result in a substantial capital loss.

To realistically achieve this successfully you need a software program designed to automatically identify and then capitalize on dynamic crypto arbitrage opportunities.

Using an automated crypto arbitrage system

If you want to make money with crypto arbitrage you can choose to pay for your own software, which requires not only a significant capital investment, but also coding experience to pre-program your own strategies, as well as the market knowledge necessary to identify lucrative opportunities.

However, another option is a fully automated system, using AI machine learning based algorithms that can do it all for you, while you sit back and watch it work. One popular example of a free cryptocurrency algo trading software solution is ArbiSmart.com. The user can invest completely passively, as the automated system scans multiple exchanges at once, around the clock, to find the best price at which to buy and sell the user’s preferred coins.

Automated crypto arbitrage software offers a number of advantages, it’s most important being the ability to function with a speed and efficiency that far eclipses a human’s manual capabilities. The trader is able take advantage of market inefficiencies twenty four hours a day, seizing developing opportunities in real time, whenever they occur, for numerous cryptocurrencies on multiple exchanges at once. Algo trading software can handle a huge volume of trades, instantly responding to the market with dynamic market entry and exit.

However, you should not lose sight of the fact that an automated system, for better or worse, takes humans completely out of the equation. On the plus side, they never make an emotion-fuelled irrational move, but this also means that when an unexpected event occurs they will continue to perform in accordance with pre-programmed strategies. So, choose software providers that allow for, or provide human oversight and intervention where necessary.

The risks

When determining whether you would like to try and make money with crypto arbitrage, you need to also consider the potential risks. Firstly, the crypto markets are extremely volatile and while this presents lucrative opportunities for profiting from rapid market shifts, it also creates an unstable trading environment that is in constant flux and difficult to predict, which entails a degree of risk.

Another factor is the lack of regulation in the crypto markets. While the world of cryptocurrency is no longer the Wild West, it is still a developing asset class and legislation is one step behind the market. The blockchain and digital currency sphere, due to its anonymity and decentralization has attracted its fair share of bad actors, scammers and hackers, so you need a trading environment that is fully regulated, offering air-tight, bank-grade security and total transparency. If you want to make money with crypto arbitrage you also need to keep abreast of developing investment and taxation laws relating to cryptocurrency in your local jurisdiction.

The benefits

One advantage of the fact that digital currency is an emerging asset class, is that the crypto market still has price inefficiencies between exchanges that can be exploited. This provides opportunities that are no longer afforded by more traditional markets, presenting profitable avenues for investment.

Crypto arbitrage, as we’ve mentioned is exceptionally low risk. While no form of investment involves zero exposure, crypto arbitrage is one of the safest by far. Crypto arbitrage investment enables you to grow your portfolio, benefiting from cryptocurrency market volatility, without the uncertainty.

What to keep in mind

So, can you make money with crypto arbitrage? Absolutely.

You just need to find the right tools to support your investment goals. Make sure any system you choose is fully licensed and regulated and also that it offers attractive rates for trade execution and fund transfers. You don’t want to be paying for deposits and withdrawals and you want to be earning a passive income from your crypto wallet even when you aren’t actively trading.

While you need to do your homework first, the world of crypto-arbitrage offers exciting opportunities for investors looking to diversify with digital currencies without incurring a high level of risk, and whatever your investment level, it can be a great way to boost your bottom line.