How to Earn Interest on Crypto: Make Your Digital Currency Work for You

The DeFi (Decentralized Finance) arena is booming and creating a world of new opportunities for those with digital currency savings. There are a variety of ways to store your cryptocurrency, and when it comes to choosing a digital wallet, you will need to take a number of different factors into account. Primarily, you will be looking for the lowest transaction fees and the highest security standards.

For the majority of its brief history, there has been no way to earn interest on crypto through your e-wallet. Investors have been taking advantage of the many lucrative opportunities presented by this emerging asset class, as the volatile crypto markets can present exciting profit potential. However, up until very recently, a wallet has simply provided a means of secure storage, without providing any financial incentive whatsoever.

How to earn interest on crypto

To earn interest on crypto, you will be following a process very similar to that of opening a savings account with the bank. By locking your funds in a savings account that is closed for a set period, you are allowing your cryptocurrency to be used for a specific purpose, such as arbitrage trading, day trading, or lending to name a few. Essentially, it is similar in concept to allowing the bank to use your capital for investment and receiving interest in return, except with crypto interest you can earn a reward for the use of your currency in addition to the interest on your funds.

One notable subcategory of crypto interest earning that is gaining in popularity among digital currency holders is known as crypto staking. You can cash in on crypto staking, by keeping your coins in an e-wallet to support a certain blockchain network, and then earning staking rewards for allowing the use of your digital currency to float its operations.

As with opening a bank account, the steps you take to earn interest on crypto are simple. You open an account and deposit your funds, which will then be transferred to an interest-bearing account where they will earn you a passive income, based on the size of your investment, the type of savings account you have chosen, and the time-frame you have selected, if you are locking your account.

Here however is where the similarity to a bank account ends. To take a closer look at the differences between earning interest with a crypto wallet and earning interest through a bank account let’s first see what considerations are front of mind when we choose to invest our savings.

One investment reality you can bank on

The ultimate investment involves low risk, a high return and minimal effort. Unfortunately, this is not an easy find and most of the time we need to prioritize and compromise. Generally, if we want substantial profits, we are opening ourselves up to higher risk and more active hands-on investment. Equally, low risk frequently translates to lower effort and steadier but less generous returns.

For example, taking on the crypto exchanges as a day trader can provide huge returns but as the peaks and troughs of Bitcoin’s price prove, this can be a risky business. Then of course there are stocks that are somewhat high risk, require monitoring but offer, on average, a healthy 10% a year. Alternatively, you can opt to invest in real estate, but keep in mind that even though returns reach approximately 2% per month there are tax and maintenance issues which require time and money as well as complex and time consuming bureaucracy.

At the other end of the spectrum, you have bonds that are low risk and low effort, but, on average, will only offer about 5-6% per annum. Of course there is also a standard bank savings account. With banks, the risk is basically non-existent and no effort is required, but you can only expect returns, on average, of about 1% a year.

However, when you earn interest on cryptocurrency, you are likely to enjoy far higher returns than any of these alternatives. Your money is never sitting idle, but is working for you every second of the day, with no effort required on your part. Your risk is limited, although your level of exposure will depend on the risk management protocols, strategies, security policies and experience of your chosen wallet.

When comparing an interest-bearing e-wallet with a bank account the difference is stark. With the wallet you can boost your account balance, without bank rates of zero, or negative interest eroding your savings. You are also safeguarded against inflation and protected from stock market crashes. In addition, the interest from your wallet offers you a particularly lucrative way to store coins that you want to HODL, while they gain in value over time.

In fact, crypto holders can take advantage of banks, to earn even higher interest returns. The strategy is easy. Firstly, you take a loan from the bank for anywhere from 1% to 10% interest a year. Secondly, you convert the loan sum into cryptocurrency and place that money with an interest-bearing wallet that offers rates that are multiple times higher. In this way, not only is your bank loan monthly interest covered, but you will be making a generous profit. This strategy is called lending arbitrage, loan arbitrage, OPM (Other People’s Money) or investing without capital and is widely used by investment professionals and companies. For example, the bank employs an OPM strategy in order to provide loans, finance mortgages, buy companies and continue generating substantial revenues using the funds of the ordinary people. They make vast profits yet their clients see a return of just 1-2 %. With DeFi and interest bearing accounts you can use an OPM strategy, with one major difference – you are the one taking advantage of the bank’s funds, using the bank’s own methods to your benefit.

What to look for in an interest-bearing wallet

Let’s say, for example, you have Bitcoin sitting idly in a regular wallet. Bitcoin deposit interest rates differ between wallets, so before you open an account you want to be sure that you are getting the best deal possible. You also want to read the fine print, checking there are no hidden fees. When choosing where to earn interest on bitcoin you need to prioritize the security of your funds with a wallet that implements rigorous technological safeguards and protocols. Stability, transparency and reliability are key, so choosing a licensed and regulated provider in compliance with the strictest AML and KYC regulations is essential.

Obviously another major factor to take into account is the size of your profits. You want the highest rates the industry can offer without compromising on the standard of legitimacy.

One more consideration is your control over your capital. If you want to earn interest on crypto, you need to look for a wallet that offers a choice of savings plans that will suit your needs now and later, as they evolve. It should provide both flexible and long-term plans for different time frames, as well as support for a wide array of currency options for deposit and withdrawal.

To understand how it works, let’s take one of the bigger, regulated EU players, ArbiSmart.com as an example. The company services include both interest bearing wallets and an automated crypto-arbitrage platform. The wallet holder places funds in their account and earns interest by allowing ArbiSmart to perform arbitrage trades with their coins. A share in the profits generated by the investment are paid to them for the use of their funds. Wallet holders can earn anywhere from 10.8% to 45% interest, depending on the currency type, the amount deposited, whether or not the account is locked, and if so, for how long. One more notable ArbiSmart feature is that it offers interest on both fiat and cryptocurrencies.

Some final tips

The crypto sphere is finally catching up with the traditional, fiat-based financial ecosystem in the one very important respect, where it previously failed to measure up. Digital currency holders can now earn interest on bitcoin and take control, putting their money to work and ensuring financial security, without exposing themselves to unnecessary market risk.

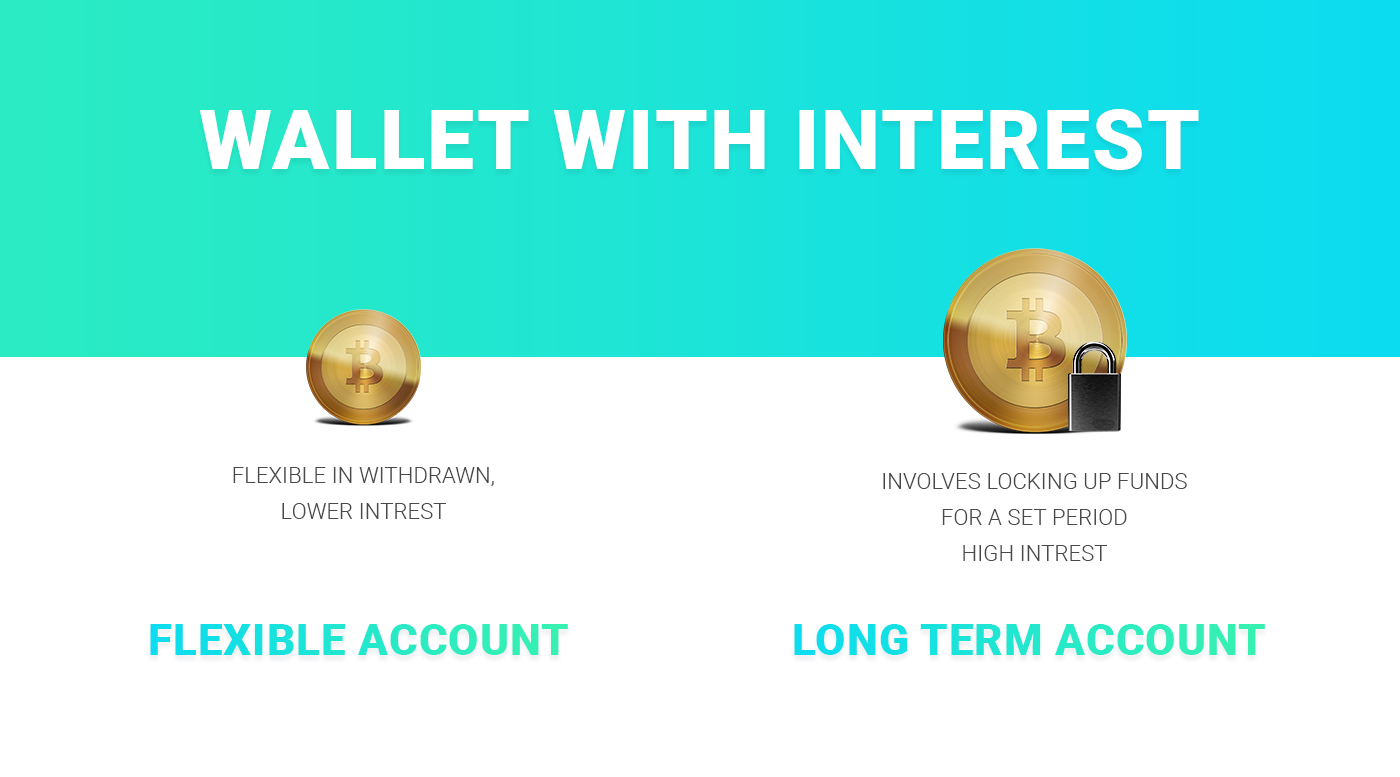

You can earn interest on crypto with both a flexible account or with an account that offers a long-term plan, which involves locking up your funds for a set period. If left to reach maturity these accounts can offer far higher rates, so you need to make sure you are realistic about your overall liquidity, so that you don’t lose out on interest earnings, for withdrawing your funds before the set-period has passed.

While a wallet may offer the highest interest rates that doesn’t necessarily make it your best option. The right wallet will offer you great returns, but also quality human support and it will enable you to make deposits directly into your bank account. Most importantly, it will be fully licensed and regulated. It will be operating under an established company and will have been around for a while – at least a year. It is critical that they are legitimate, with a stellar online reputation. Anything less is playing Russian roulette with your savings.

Of course, you shouldn’t dive into until you’ve done your research. But once you have, the right interest bearing crypto wallet can be a great way to see substantial returns, without requiring you to lift a finger or risk your funds unnecessarily.