What Factors Decide the Price of Bitcoin and Other Cryptocurrencies?

Crypto is the world’s most volatile asset class, and Bitcoin’s value frequently undergoes dramatic shifts. It is therefore critical to understand the various factors determining the price of Bitcoin and other cryptos if you want to successfully anticipate their future trajectory.

In this blog post, we will examine the fundamentals impacting the price of Bitcoin and altcoins and how they differ from the factors impacting the price of traditional assets.

How Is Bitcoin’s Value Established?

For any asset, much of its value correlates to usability as a medium of exchange. Bitcoin is a virtual currency that is divisible, fungible, and portable, has a limited supply, and is gaining rapidly in global legitimacy. However, it hasn’t reached mass-adoption yet. While PayPal, among other financial service providers, is supporting Bitcoin payments, and more institutional investors than ever have boarded the Bitcoin train, the value of crypto will reach its full potential only once there is a much wider consensus to accept it as currency.

So, who decides the price of Bitcoin?

Since cryptocurrencies are decentralized financial assets, control is in the hands of the entire network of users and decisions are made by the community. There is no central authority and there are no intermediaries like banks, as payment processing is performed by anonymous nodes on the network. As a result, the Bitcoin price is decided by the community of miners, network operators and users.

What Are the Main Indicators and Variables that Determine Bitcoin’s Price?

There are all kinds of drivers, impacting the price of bitcoin and other cryptos. Some of the primary indicators and variables include:

Production Costs

Mining Bitcoin requires a lot of electricity. This makes it extremely costly as it demands a huge amount energy, and this has driven up the price. However growing concerns about the environmental impact may also have the opposite effect.

Market Competition

While Bitcoin was the first ever cryptocurrency, hundreds of altcoins of all types, from stablecoins to meme coins have entered the market since then and this more competitive landscape could impact the price of “digital gold.”

Supply and Demand

The Bitcoin supply is finite. New coins can only be created at a fixed rate, through mining until the supply cap of 21 million is reached. So, the price will rise as supply outpaces demand.

Market Sentiment

Sentiment has a huge influence on crypto prices. Market participants tend to get greedy when the price of Bitcoin is rising, buying as much as they canso they don’t miss out and they get fearful if prices plummet, selling their coins as fast as possible. The Crypto Fear and Greed Index tracks social media and news sites to create a scale that measures digital currency market sentiment in real time.

Legislation

The crypto arena has been known as the “Wild West”, although regulatory bodies are gradually legislating and catching up with developments in decentralized finance. Rather than slowing growth, as regulation tends to do in other markets, this is actually good for crypto prices. It lends confidence and legitimacy, by providing an answer to open questions about tax, insurance, privacy, and accountability, and this clarity could push up crypto prices. Yet, there is always the risk that over-regulation could have the opposite effect.

How Valuable is Bitcoin, When Compared to Other Currencies?

As with any form of currency, Bitcoin’s value depends on the number of products or services each unit of the currency can purchase.

So, how valuable is Bitcoin?

On the downside, unlike with fiat currencies, there are all kinds of products and services that generally cannot be bought with Bitcoin, from basic groceries to clothes and shoes. You also can’t pay your taxes with it and probably not your phone bill either and all of this is likely to reduce its value.

On the other hand, Bitcoin serves as a great hedge against inflation and a source of huge returns with bull runs that result in price jumps of hundreds of percent.

Since, in a decentralized system, value is determined by coin users, market forces should create the necessary conditions to support the growing use of Bitcoin. Increased adoption is likely to boost the value, as demand will lead to major online retailers supporting crypto payments, central banks adding it to their balance sheets and global corporate giants conducting trade in digital currency.

How Can You Ensure Your Crypto Maintains Its Value?

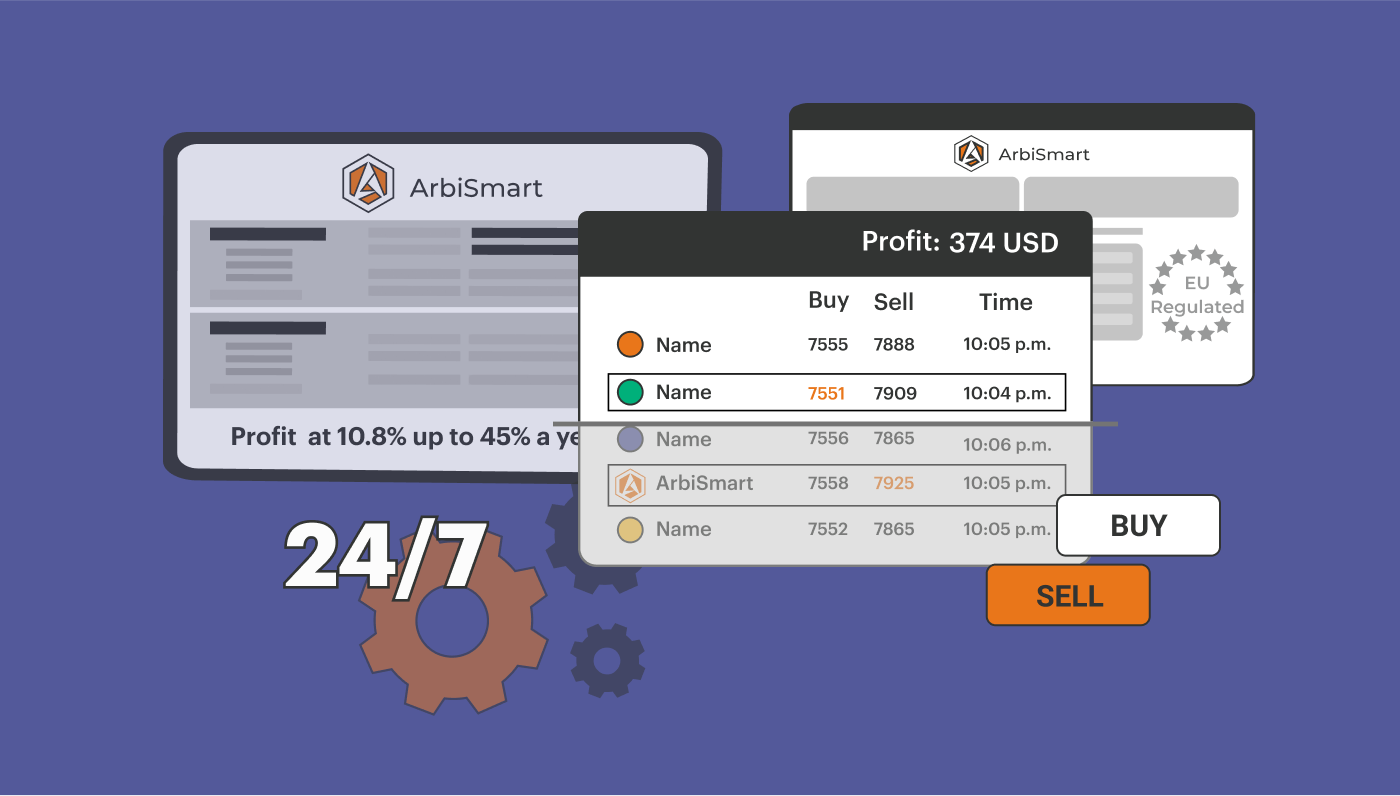

The volatility of the crypto markets means that the Bitcoin and Ethereum that you hold can rise or fall in value in the space of a heartbeat. However, here at ArbiSmart, our EU licensed platform offers automated crypto arbitrage. This means that your crypto will retain its value in a bear or bull market. Here’s how:

Crypto arbitrage involves exploiting brief windows in which a coin is available at different prices at the same time. These temporary price differences across crypto exchanges occur regularly for all types of reasons. For example, a price disparity can arise when there are differences in liquidity or trading volume between bigger and smaller exchanges.

The platform user deposits fiat or crypto and then the algorithm converts the funds into RBIS, our native token, and uses them to trade crypto arbitrage.

24/7, the algorithm tracks hundreds of coins across 35 exchanges looking for price differences. It buys the coin on the exchange with the lowest available price, and then instantly sells wherever it is highest, , for profits that start at 10.8% and reach as high as 45% a year, depending on the size of the deposit.

The major plus here is the fact that even if the market crashes, price differences across exchanges will continue to occur just as consistently as ever. So, you continue to make a steady profit and your crypto retains its value, making ArbiSmart a great hedge against falling prices.

The value of RBIS has already gone up by over 800% and it is set to skyrocket in the months ahead with the introduction of a series of new RBIS utilities and with the listing of the token on global exchanges at the end of 2021.

As we can see, a wide variety of factors can impact the value of a cryptocurrency, but of equal importance is the strategy you implement for buying and selling your chosen coin.

Find out more about crypto arbitrage, or check out the ArbiSmart blog exploring posts about various digital assets, blockchain, DeFi and a range of related topics.