Understanding the Risks of DeFi Investing

The risks involved in cryptocurrency investment of any kind can be significant and one of the most popular recent trends is for Decentralized Finance (DeFi) yield-farming protocols, which involve substantial capital exposure. However, this type of DeFi cryptocurrency investing has seen incredible growth in the last few years due to the fact that the potential yields are exceptional.

Crypto investing in a DeFi protocol is not the same as investing in a cryptocurrency like Bitcoin or Ethereum. Instead, it involves lending your Bitcoin to a platform that offers yield farming opportunities. This means you are putting your funds at the disposal of the application, which gains liquidity, using your capital to earn profits, by trading, or loaning out your funds to other clients, while you earn a high yield on the crypto that they have borrowed, as well as project tokens.

So, how risky is cryptocurrency investing with a DeFi protocol? It is definitely a high-risk endeavor, but for many, it is completely worth it. Benefits include peer-to-peer access to a wide array of crypto financial services from borrowing and lending to insurance and trading. This a borderless environment that is open to everyone. It is cost efficient, with no middlemen or identity checks high liquidity and most importantly, generous profits.

How Risky Is DeFi Investing and What Are the Main Types of Defi Investment Risks?

The risks of DeFi cryptocurrency investment cannot and should not be underestimated and they come from a number of different aspects of decentralized protocols.

When it comes to comparing traditional and DeFi investment risks, decentralized finance involves additional dangers, starting with the fact that the crypto world is the Wild West of online investing. Unlike the world of traditional fiat investing, cryptocurrency risks come from its being severely under-regulated, with virtually no oversight at all and this, combined with the anonymity of DeFi protocols exposes you to a less than trustworthy element. Since crypto is a completely new asset class, legislators are still catching up with rapid developments in the complex world of blockchain technology. It is just beginning to go under a regulatory microscope, so the future tax implications of your investing and the future of crypto as a whole is uncertain.

Putting all this aside, there are also DeFi cryptocurrency investment risks relating to hacks as the smart contract technology that they use has holes that have led to a number of high-profile breaches over the last year. The coding that supports a DeFi protocol has a cryptocurrency systemic risk whereby errors in the code can provide an attack vector, which hackers exploit to steal your capital. Defi investors need to understand that smart contract stacking and composability involve the danger that one unstable protocol can bring down an entire interconnected DeFi system.

Then of course there are the Defi protocol cryptocurrency risks of using centralized oracles that transmit data to the smart contract and are vulnerable to tampering. Centralized systems are used to reduce inefficiencies and the threat of hacks, but they pose serious DeFi investment risks. They tend to feed data to an exchange from a single source, as opposed to many unconnected sources, which opens the door to a criminal party seizing control of the real-world data source to manipulate price feeds to their own ends.

One other factor to consider, is the financial risk incurred when a native token drops in value, impacting the entire ecosystem. The price performance of the token supporting the blockchain can strongly affect the value of the funds locked in the protocol. While a rise can lead to profits, a crash can lead to significant losses. Then of course there are the additional Defi cryptocurrency trading risks of impermanent losses, where tokens are valued lower within the protocol than they are in a wallet.

How to Minimize Risks in DeFi Investing

So, we’ve seen the dangers of DeFi protocols, but how risky is cryptocurrency trading in general? The fact is that it completely depends on the strategy you employ.

Here at ArbiSmart, we offer crypto arbitrage, the lowest-risk form of digital currency investing. It is able to bypass the risks involved by trading on the volatility of the crypto markets, as it generates profits by taking advantage of price inefficiencies across exchanges. Our system scans 35 exchanges simultaneously looking for instances where a coin is temporarily available at different prices at the same time. It then instantly buys the coin on the exchange where the price is lowest and then sells it on the exchange where the price is highest, making a profit before the market adjusts and the brief window of opportunity closes. Unlike with DeFi protocols there is no borrowing and there are no collateral requirements.

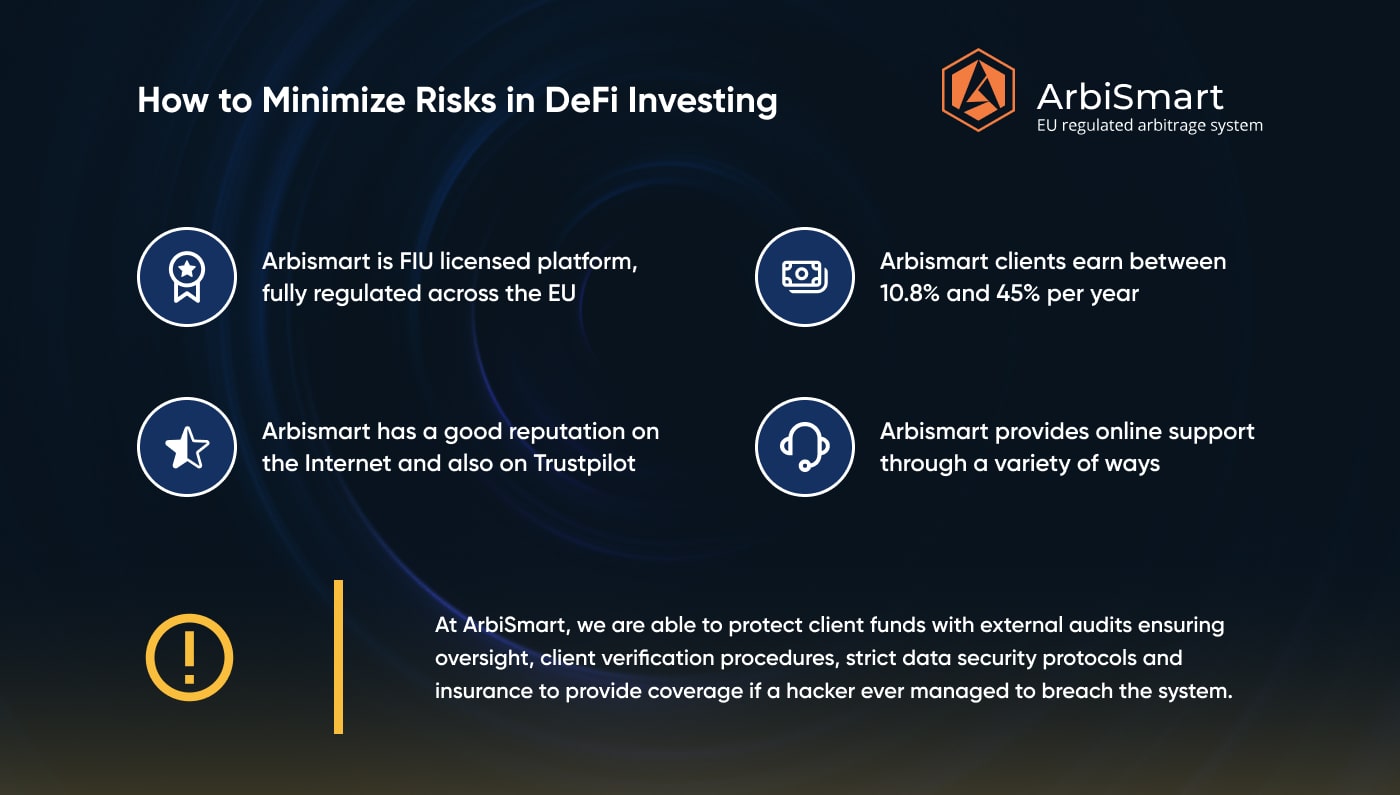

As an FIU licensed platform, fully regulated across the EU, at ArbiSmart, we are able to protect client funds with external audits ensuring oversight, client verification procedures, strict data security protocols and insurance to provide coverage if a hacker ever managed to breach the system. Also unlike these fully automated DeFi applications, our automated system is backed up by a risk management team that tracks the exchanges round the clock and can intervene in cases of extreme market upheaval.

Finally of course, at ArbiSmart, our clients earn between 10.8% and 45% per year, depending on the amount deposited, a sum far exceeding the 10% – 12% average earning per year offered by DeFi protocols.

Having understood what DeFi investing involves, you must decide whether the lucrative opportunities it offers make it worth the risk. A hybrid approach, such as the one offered by ArbiSmart that synthesizes the best aspects of decentralized protocols and traditional legacy systems mitigates risk, while offering an even higher revenue potential.

To learn more about all forms of decentralized finance check out the ArbiSmart blog. More specifically, you can check out our Arbitrage page to get further information about how crypto arbitrage works.