Understanding DeFi Oracles

In this guide to defi oracles we will look at what they are, the types available and how they are being used in the decentralized financial arena. We will also look at the limitations and advantages of the top defi oracles and defi oracle projects.

What DeFi Oracles Are

DeFi oracles are a 3rd party service enabling blockchain smart contracts to access external, real-world data.

The oracle gives the smart contract the capacity to access a live feed of information that is not on the blockchain, such as real-time asset prices. DeFi oracles are layers verifying and then relaying critical on-chain data to the smart contract.

How DeFi Oracles Work

Blockchains have no on-chain data saved in their ecosystems. This makes DeFi oracles essential as they can perform queries through crypto exchange application programming interfaces and source the real-time data.

When it comes to the question of how to use DeFi oracles, it should be understood that they are simply intermediaries that provide a service. They have been created to integrate with a smart contract and deliver a wealth of real-time information, which more often than not relates to pricing. Blockchain oracles have had a huge impact on the rapid growth of DeFi as they are resolve issues of data reliability in trading.

DeFi oracle data can either be inbound or outbound. While inbound data is transmitted to the smart contract from an external source, outbound data is sent to the external sources from the smart contract.

Another distinction that needs to be made is the difference between hardware and software data sources. Hardware oracles, such as sensors and bar code scanners convert real-world data into a digital format that can be transmitted to a smart contract. In contrast, software oracles are purely virtual, collecting real-time online data, such as the crypto exchange price information and feeding it to the smart contract.

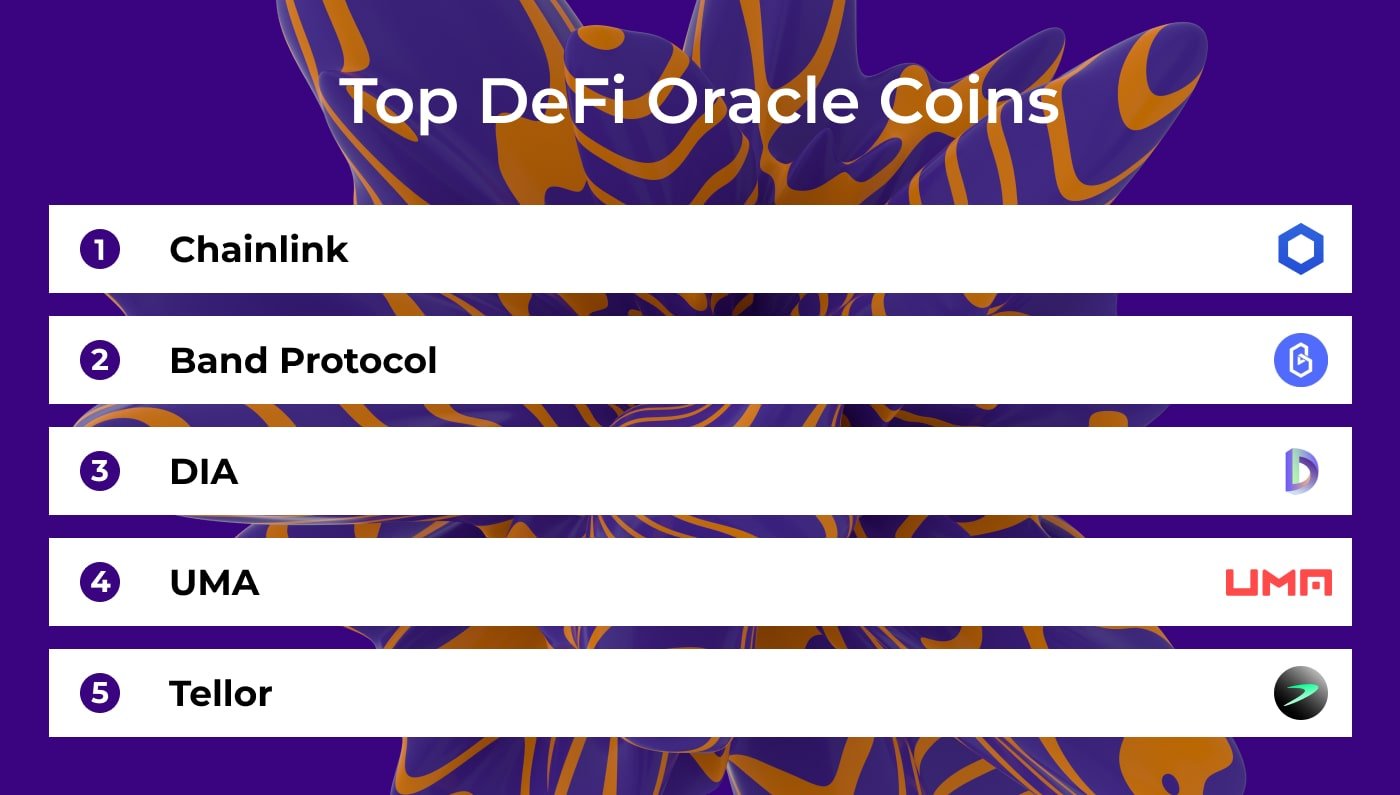

Top DeFi Oracle Coins

Any thorough DeFi oracles list has to include big names like Band Protocol, ChainLink, Nest and DIA, which were among the best performers in 2020. When we look at the tokens of these top defi oracles, the unmatched growth they have experienced in the last 12 months alone has been exceptional.

One of the leading DeFi oracle coins, Link, comes from ChainLink, with the open-source API, with on and off chain design, made to help developers build multi-functional applications. Then there is Band, from the decentralized oracle framework, Band Protocol, which is community driven and feeds off-chain real-time data to dapps. Another big player is DIA, from the Swiss open-source information platform that uses crypto-economic incentives in return for data validation. Then you also have UMA, TRB and a number of additional up and coming oracle coins. Their growing success is unsurprising, considering how critical oracles are, feeding data to smart contracts, as primary components to the main functionality of any stablecoin.

The Risks of DeFi Oracles

Even the top DeFi oracles involve a degree of danger and some of the risk relates to the type of oracle being used – centralized or decentralized.

Firstly, decentralized oracles use the Schelling points game theory. Data is pulled from multiple sources that have no communication between them and a consensus is reached. The oracle utilizes an array of external sources to send data to the smart contract to boost the reliability and credibility of the information being provided. There is a vulnerability to this type of oracle, as it can be undermined by signaling, bribing and other forms of collusion between parties. Possibly the biggest danger is a “man-in-the-middle attack”, whereby a hacker attacks the feed.

In contrast, a centralized oracle uses a single node to send data from an external source to the smart contract.The counterparty risk can weaken dapp security, since centralized systems have a single point of failure, making them more vulnerable to effective breaches from hackers looking to exploit price anomalies.

While decentralized oracles are usually fast but less secure, with low latency rates, centralized, or semi-centralized oracles tend to be safer but slower and are preferred by many DeFi applications as a means of combatting their vulnerability to external attack. They frequently use game theory dispute resolution methodologies to create a tough defense against attacks that attempt to manipulate their data. However, one downside of centralized oracles is that these protections can lead to extensive wait times, often lasting weeks. Another is the problematic issue of centralized 3rd party systems integrating with decentralized blockchain systems, creating a conflict. The reliability and relevance of the information sent through the oracle is critical to the efficient functioning of the smart contract that receives the data. If a dapp or protocol gets latent, or invalid data the results can be catastrophic.

Finally, we need to consider the fact that since all oracles are 3rd party services, these intermediaries are not part of the blockchain and so are more vulnerable to hacks since they are outside the consensus mechanism and can’t benefit from its security apparatus.

For this reason, here at ArbiSmart, we have a hybrid system that takes the best of DeFi and CeFi to create a secure and lucrative home for your crypto. ArbiSmart’s FIU licensed and regulated crypto arbitrage system is a secure alternative to DeFi applications often used by yield farmers, while offering the huge returns these investors expect. It has the transparency, speed and cost effectiveness of DeFi and the security of a centralized ecosystem, with profits reaching up to 45% a year. In addition, the platform token, RBIS, is well-established and has experienced steady, proven growth. In fact in the last two years alone, RBIS has risen by over 120% and is set to go up in value by 3,000% by the end of 2021.

Crypto arbitrage one of the lowest risk investment strategies, which creates a profit by taking advantage of price inefficiencies across exchanges and isn’t impacted by digital currency market volatility. There is also human oversight from a risk management team that tracks the markets 24/7 and is able to instantly intervene in the case of unexpected market tumult, as well as a team monitoring the platform for suspicious activity.

If you have found the information we have provided on DeFi oracles valuable and would like to learn more about different aspects of blockchain technology and cryptocurrency investing, please feel free to check out the other articles on the ArbiSmart blog. Alternatively, you can check out the Arbitrage page of our website to find out more about crypto arbitrage strategy and whether it might meet your crypto investing needs.