Top Trading Bot Cryptocurrency Strategies for 2020

When it comes to setting yourself up for crypto investing success, you need to make sure you are using the best possible tools for the job. There are a whole range of factors to consider, when choosing an algorithmic trading system, from your experience level and time availability to risk tolerance and strategy preference. However, the best trading bot for cryptocurrency investors always needs to be as low-risk, low-effort and high-return as possible. This has never been truer than in 2020, with the impact of the Coronavirus on the global economy, making securing your future more important than ever.

Is Using an Automated Trading Bot Simpler? Yes!

Is It Smarter? Maybe…

By using an automated trading bot, you are doing yourself a favor for a number of reasons. Not only does it free you up for other things, but a pre-coded bot does not require you to have any market knowledge or prior experience. It will track patterns and price fluctuations for a range of assets and then based on market conditions, will execute trades on your behalf, with no human intervention required.

Instead of sitting glued to a screen for eighteen hours a day, becoming more likely to make mistakes, miss opportunities and stray from your trading plan as a result of tiredness or frustration, you can let an algorithm do the work for you. A bot will implement the strategies with which it has been programmed, 24 hours a day, seven days a week, with no fatigue, and it will seize new market opportunities the second they emerge, without getting distracted by emotion or getting caught up in the moment.

When deciding between trading bots cryptocurrency investors are faced with an increasingly crowded market that offers an overwhelming selection. The choices range from inexpensive no-frills bots for the implementation of only the most basic strategies to sophisticated, AI based, machine learning algorithms designed to process a vast amount of data and execute a huge volume of trades simultaneously. As a result, costs can vary wildly. While there is free, open source software available, at the other end of the spectrum there are professional grade systems that can run to thousands of dollars.

As we can see, the trading bots cryptocurrency investors use can vary massively, in price and quality. They can also differ with regard to bot trading strategies and this is where things get interesting. While clearly a bot won’t ever be panicked, greedy or inattentive, they can be wrong, since they are programmed by people. The better the strategy they’ve been coded with the better the results. A flawed strategy that doesn’t take into account all the different variables for different market conditions will undoubtedly lead to substantial losses.

2020 has been a tough year for the global economy, and as a result of COVID 19, investors are looking to protect their savings, at all costs. If you who want to mitigate your risk but still achieve a high profit margin cryptocurrency trading bot options are limited, but the best strategy to choose is crypto arbitrage.

Crypto arbitrage is widely acknowledged to be one of the world’s lowest risk cryptocurrency strategies and it is therefore no surprise that it is crypto arbitrage bots are seeing a surge in popularity among financial institutions, hedge funds and individual traders in these uncertain times.

Crypto Arbitrage Trading Bots

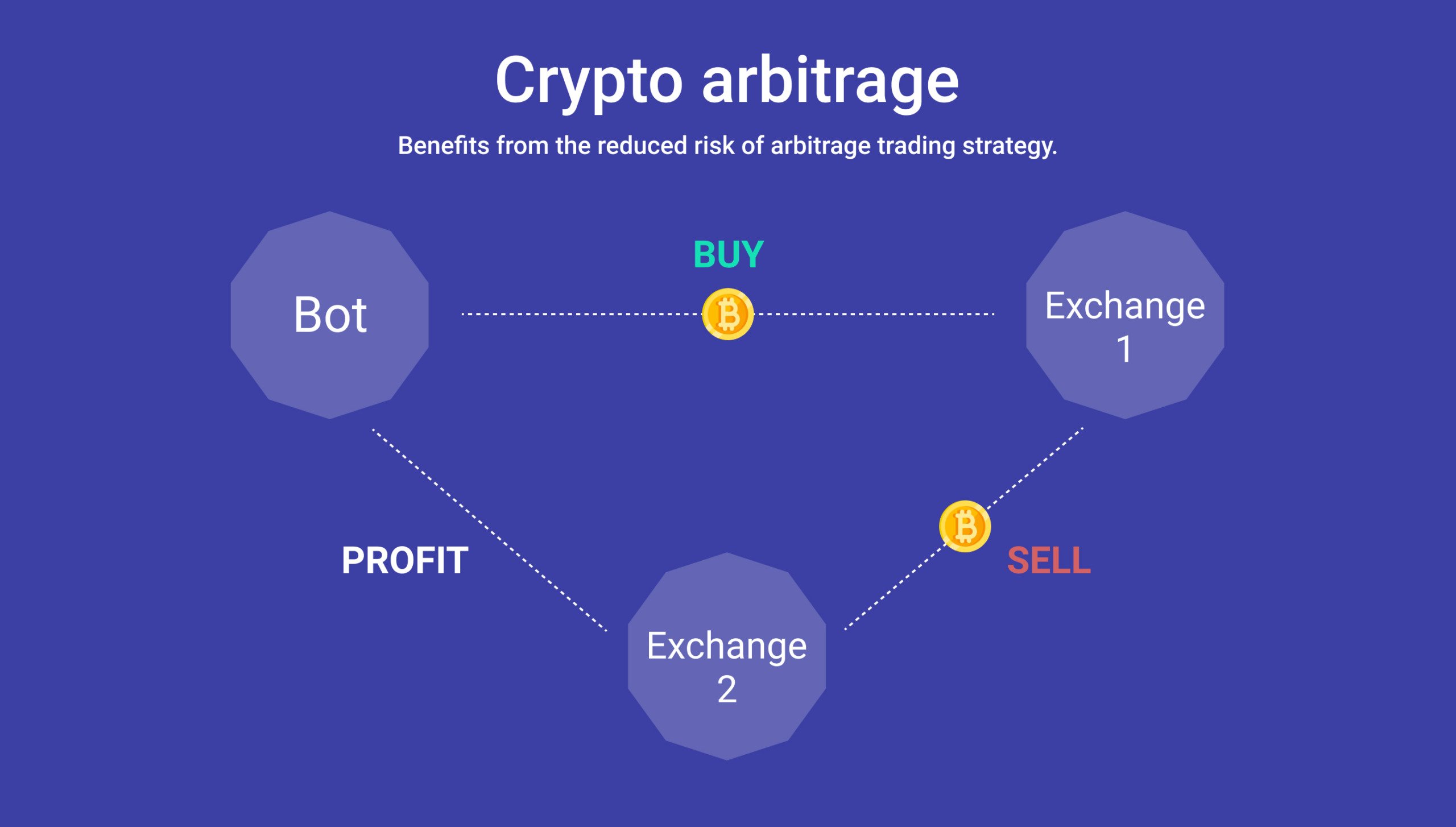

Crypto arbitrage involves profiting from the fact that for a brief time, a digital currency can be available on multiple exchanges at the same time, at different prices. By using a bot for cryptocurrency automated trading, an investor is then able to exploit this temporary price discrepancy. The bot can identify crypto arbitrage opportunities, buying the coin on the exchange wherethe price is lowest and then selling it for a profit on the exchange where the price is highest, before the market adjusts and the temporary price difference is resolved.

Using crypto arbitrage algorithmic trading software is the only way to implement a crypto arbitrage strategy as it demands a speed and multi-tasking capacity that no investor, however experienced could ever achieve manually. It requires the ability to scan multiple exchanges at the same time, 24/7 to identify and take advantage of price inefficiencies as soon as they arise and to respond instantly, executing multiple trades simultaneously to exploit crypto arbitrage opportunities.

Here at ArbiSmart, our EU regulated crypto arbitrage platform offers a great example of how using trading bots cryptocurrency investors can enjoy the best of all worlds – low exposure, minimal effort and high returns.

Our free, fully automated, AI-based, machine learning algorithm is connected to 35 different exchanges. It seeks out crypto arbitrage opportunities around the clock and generates guaranteed returns of up to 45% a year. All you need to do is sign up, fund your account and then let the platform take over from there.

ArbiSmart is one of the best trading bots cryptocurrency investors can choose in such a fragile economy, because risk is close to zero. Yet, this is only one of the factors that you need to consider as your priorities shift towards safety and stability, in these uncertain times.

Critical Considerations in the Current Economy

When choosing trading bots cryptocurrency investors need to be more careful than ever these days. When the future is unclear, you want to put your funds in as secure an environment as possible and one major aspect of this is regulation.

You need a company that is fully licensed. This means that it complies with regulatory requirements that ensure the integrity of your account. A licensed company protects your capital by preventing fraud, with the implementation of AML and KYC procedures, regular auditing, rigorous technological data security measures and insurance coverage for all client capital.

You also want steady guaranteed returns that you can rely on. For example, at ArbiSmart we publish the precise profit range you can expect to earn monthly and annually at every single account level, so you can plan ahead financially, with no surprises.

When it comes to choosing between trading bots cryptocurrency investors have a wide selection to pick from, with varying levels of sophistication, different fee structures and a range of strategies. While the current market reality may lead many to opt for a more cautious approach, a crypto arbitrage trading bot enables you to profit from exceptional crypto market volatility, while also benefiting from the reduced risk of arbitrage trading strategy. So, you don’t have to sacrifice generous profits in the name of protecting your savings. It is the ideal solution for 2020 and also makes sense for those planning for the long term, once the events currently rocking the global economy are in the rear – view mirror.

If you’d like to find out more about automated crypto arbitrage trading, you can check out a detailed explanation on our website or speak to a member of our team. Alternatively, you can just go ahead, and give it a try!