Tips for How to Trade Bitcoin as We Enter 2021

While the current situation on the cryptocurrency market may seem incredibly advantageous to Bitcoin holders, as 2021 arrives, crypto investors need to consider what the year ahead is likely to bring and how to best to mitigate risk, in a time of unparalleled opportunity and uncertainty.

Should I invest in cryptocurrency?

There are those who argue that COVID 19 has been a turning point for the cryptocurrency market, and Bitcoin in particular, with some analysts suggesting the coin will see price peaks as high $50,000 in 2021. They claim that there is increased demand for cryptocurrency and that it is gaining mainstream adoption. Moreover, while Bitcoin demand is rising supply is decreasing as “digital gold” reaches its 21 million limit.

Others take a less optimistic view. They look to recent history for their answer, pointing to the Bitcoin 2017 rally that, within a year, turned into a prolonged slump. Prices fell as fast as they rose, with the investors who had driven the bull market, dropping out of the crypto markets, withdrawing liquidity and crashing prices.

The global markets have been in flux, with fiat currencies frequently taking a hit, experiencing chronic devaluation, as the governments of various nations try and navigate their way through the pandemic, and the series of lockdowns and lay-offs it has caused. COVID 19 and the current market meltdown of traditional currencies has created a window of opportunity. As a direct result of the coronavirus, the cryprocurrency market has seen new interest as investors look to an alternative to the traditional financial ecosystem, where their capital can ride out the storm.

This is a volatile time, which means there are some very lucrative, but high-risk opportunities developing for crypto traders, some safer and more profitable than others. So, if you are asking “should I invest in cryptocurrency?”, the answer is that it depends on the level of risk you are willing to tolerate and the profit targets you have in mind.

If you are wondering how to trade Bitcoin and take advantage of the current trends on the cryptocurrency market, then here are a few actual bitcoin trading tips so you can get a slice of the action more smartly and safely.

5 Tips to Trade Cryptocurrency Safely in the Current Financial Climate

Diversify your portfolio

Of all the tips to trade cryptocurrency at minimal risk, one of the most important is to never put all your eggs in a single basket. This means that you need to have a variety of assets in your portfolio from traditional, currencies, stocks, commodities and indices to cryptocurrencies.

Moreover, your crypto assets should also be varied. While BTC has seen unmatched highs in recent weeks, if the rally ends and you have no other crypto coin investments, a crash could have a seriously detrimental affect on your portfolio. So, pick a range of altcoins, selecting promising new-comers and more established currencies – there are plenty to choose from – and spread your exposure across the crypto markets. It is also a great idea to place some funds in stablecoins like Tether (USDT) or USD Coin (USDC) when you are uncertain which direction the crypto-market winds are blowing. This is not only true in periods of high market volatility but is a piece of valuable advice, even when COVID 19 becomes just a memory.

If you are day trading, use risk management tools

If you want to know how to trade Bitcoin safely, the answer is simple. Use all the tools at your disposal to mitigate risk whether or not the current market is volatile. If you prefer to enter the BTC options market, using crypto derivatives trading platforms, then obviously hedge, putting protective put options in place. If you are trading on a regular exchange then you will need to protect your capital with Stop Loss orders. This means that if the value of BTC suddenly drops then your position is closed out at a certain price and you have protected your downside.

You should also consider use of a trailing stop loss, which adapts to changing market conditions, closing out the trade only when the value hits a specific percentage below the current price. This will limit the damage from a crash, while also enabling you to profit from price spikes.

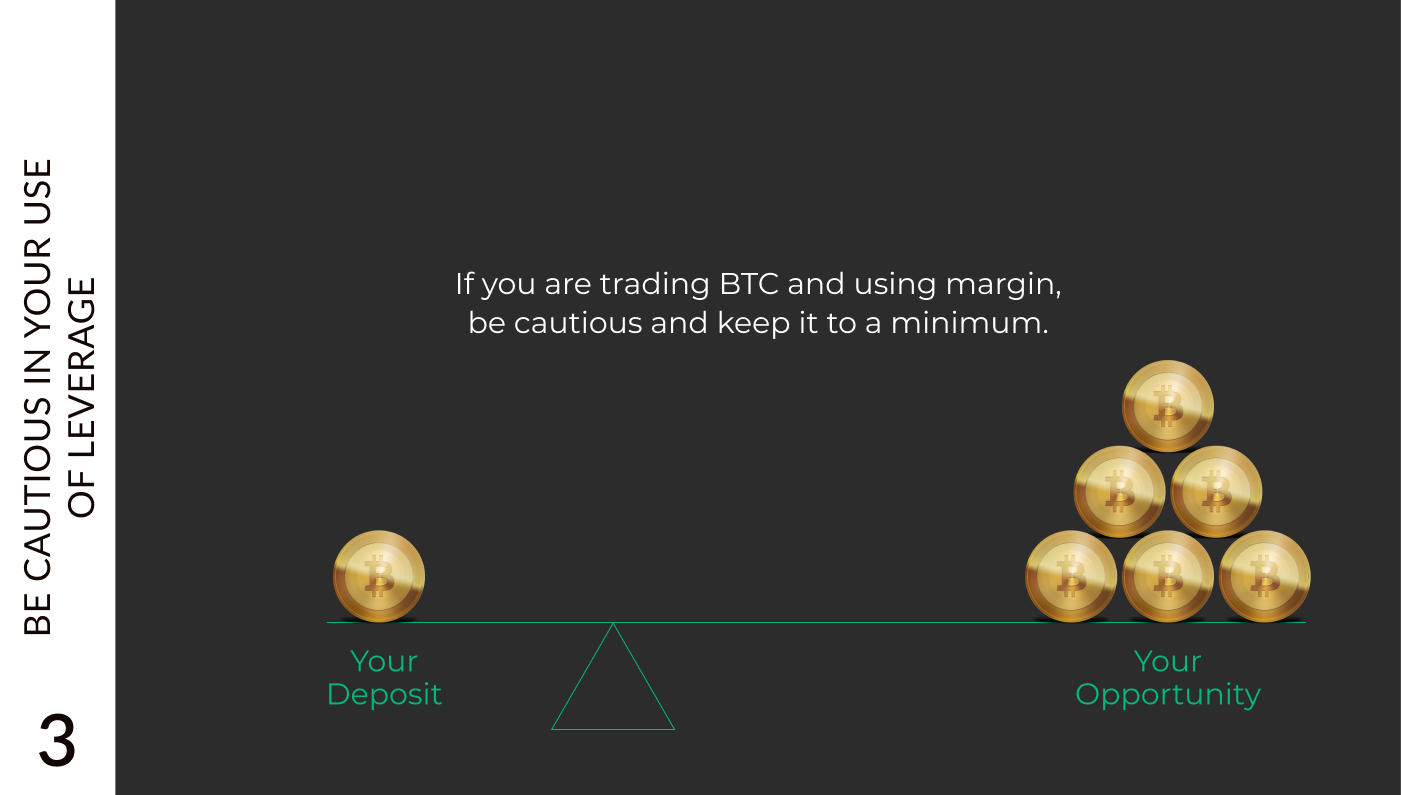

Be cautious in your use of leverage

If you are trading BTC and using margin, be cautious and keep it to a minimum. While it can multiply your trading power, massively growing your profit potential, the reverse is also true. The current crypto market volatility is unmatched and the losses from a crashing market can be compounded by the excessive use of leverage, liquidating your entire balance.

Reallocate funds quickly but cautiously

In deciding how to trade Bitcoin or any other crypto asset safely, in times of market upheaval, a good rule is to not get over-excited, upend your entire crypto portfolio in an instant and switch to completely different cryptocurrencies in an effort to seize the moment. Based on developing market conditions, don’t change your full crypto asset allocation all at once to capitalize on current events. It is certainly important and part of any successful strategy, to assess market conditions and move quickly to exploit emerging opportunities. However, keep something back. You can always add more to your latest investment after you have tested the waters.

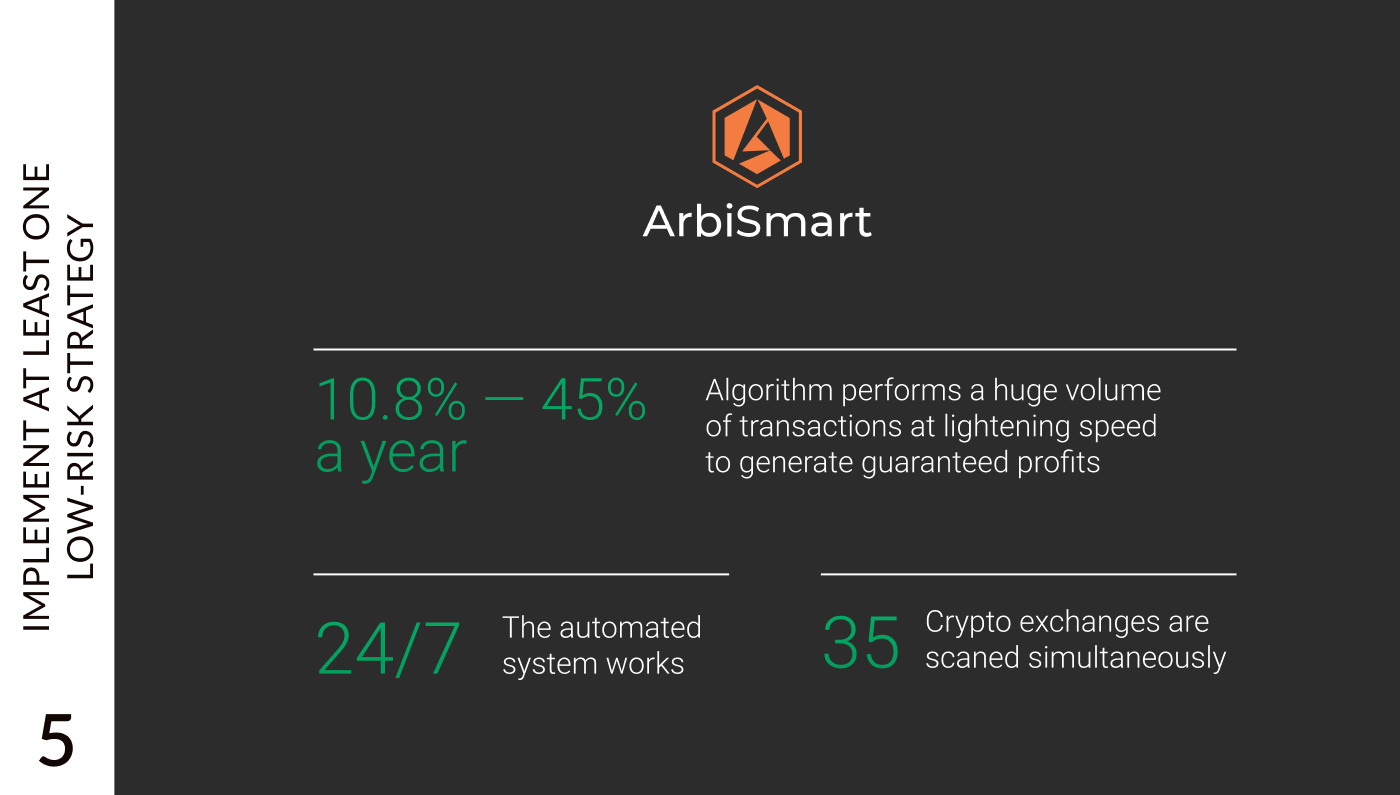

Implement at least one low-risk strategy

If you are wondering how to make money in Bitcoin and profit with minimal exposure, one of the best strategies, widely acknowledged to be exceptionally low risk, is crypto arbitrage. This is because it completely avoids the dangers of market volatility. Instead, it takes advantage of price inefficiencies across exchanges. To understand better, let’s take a look at our own EU regulated, fully automated crypto arbitrage platform.

The ArbiSmart system is connected to 35 different exchanges which it scans around the clock to find price inefficiencies. These are brief windows where a cryptocurrency is available at different prices at the same time. ArbiSmart’s AI-based algorithm will then instantly buy the currency on the exchange where it is cheapest and then sell it on the exchange where it is priced the highest to make a profit on the spread, before the market adjusts and the temporary inefficiency is resolved. This generates a passive income from your Bitcoin ranging from 10.8% to 45% a year, depending on the amount deposited.

Without a doubt, we are living in uncertain times and the full affects of COVID 19 on global centralized and decentralized markets, are yet to be seen. However, if you are trying to decide how to trade Bitcoin effectively under any market conditions then it is advisable to embrace the crypto moment but take plenty of basic precautions to mitigate risk in the new year.

To learn more about crypto investing of all kinds, check out our blog. Alternatively, you can visit ArbiSmart.com to learn more about crypto arbitrage or sign up directly to our investment platform.