The Ultimate DeFi Yield Farming Guide

In this guide to yield farming, we will look at some of the main features and characteristics of this type of investing. We will also examine yield farming strategies as well as the advantages and disadvantages of putting your funds at the disposal of a Decentralized Finance (DeFi) application.

What Is DeFi Yield Farming and How Does It Work?

Decentralized finance applications, often abbreviated to dapps, are open source, blockchain-based environments where you can loan, borrow, buy and sell crypto assets and perform a range of other activities. A DeFi yield farmer is a crypto owner who provides a dapp with liquidity in return for a reward.

To make money with DeFi yield farming, you need to place your crypto capital in the hands of a dapp, where it will be locked up for a given period, and used by the company to earn a profit. They may loan your funds to other users of the application, trade with your capital or use it for some other purpose. In return for the liquidity you provide, you can be rewarded with project tokens and can receive an exceptionally high interest rate on your deposit.

What Characterizes DeFi Yield Farming Strategies?

DeFi yield farming, sometimes referred to as liquidity mining, is becoming more complex by the day, as yield farmers find new ways to optimize their profit potential with a variety of sophisticated strategies. Many of these require the yield farmer to stake tokens in an intricate chain of protocols to maximize their earnings, borrowing and lending at rapid speeds to receive a greater number of tokens. It is therefore essential to have a thorough understanding of the strategy you are using, as it can be risky entering such a complicated investment sphere.

It should be noted that when performing DeFi yield farming coins like USDT, USDC, Dai, and Tether are commonly preferred. This is because these are stablecoins, which can offer the simplest means of monitoring the success of your investments.

Why Choose Yield Farming?

If we look at bank interest, which averages just 1% and bonds that tend to average returns of 5-6%, a defi yield farming comparison is impressive and very convincing.

DeFi yield farming offers sky-high returns and the bold investor can win big, with triple-digit profits on their cryptocurrency, from tokens they receive from the companies borrowing their funds as well as from the interest on the loan.

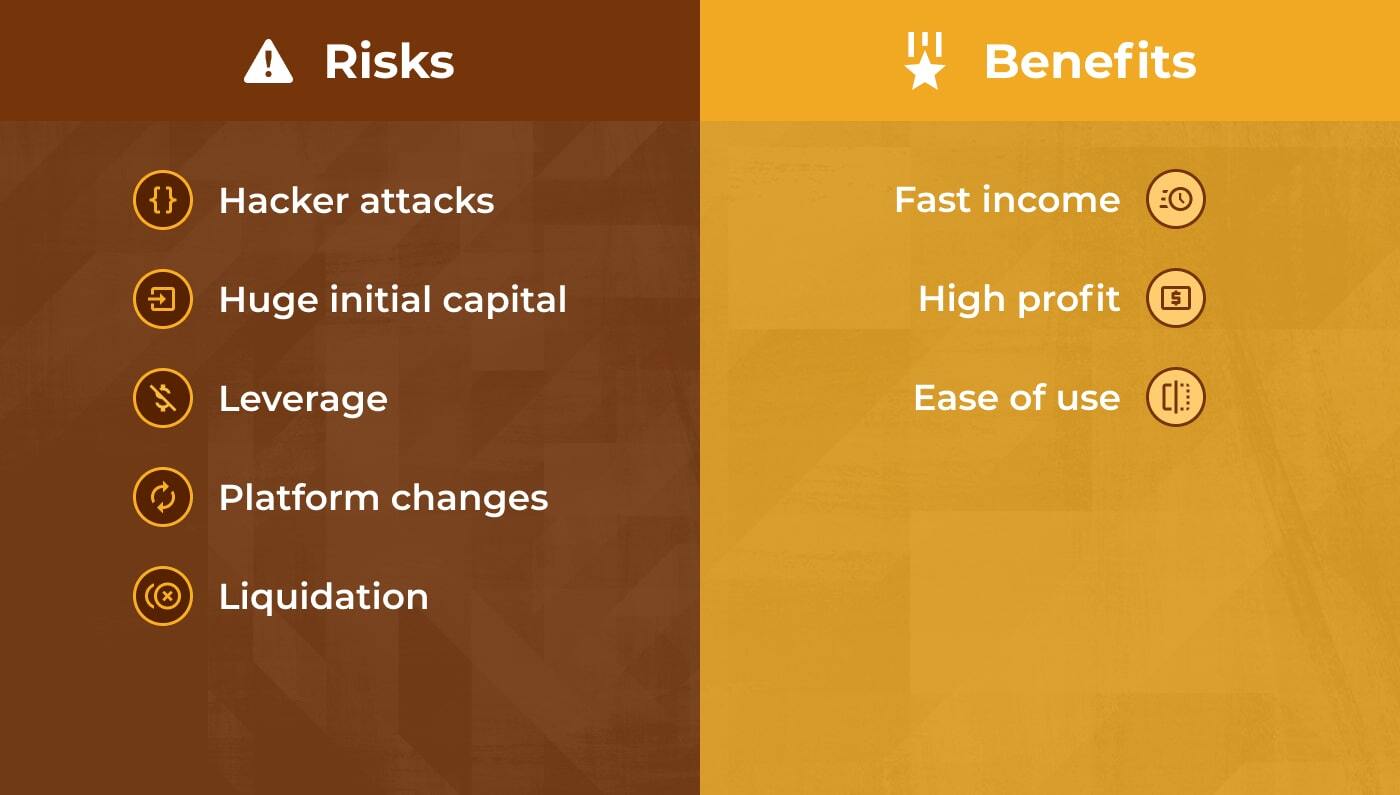

What Are the Dangers?

DeFi yield farming involves significant risk, one of the biggest of which is the huge amount of initial capital that it can require to make the big returns. Since the crypto markets and DeFi tokens in particular are so incredibly volatile, there is the danger of liquidation, which happens when the value of the coin being used as collateral drops, triggering a loss of the yield farmer’s entire balance.

DeFi yield farming coins are often unproven and can lose value as quickly as they gain it, causing the dapp behind the token to completely collapse. With the common strategy of rapidly borrowing and lending to earn the greatest reward for the liquidity you are providing the dapp, liquidation is a real and present danger.

Another major issue is data security. Since dapps are open-source applications they are particularly vulnerable to hacks. This is compounded by the fact that in the rush to market, many developers are using unaudited code that may have bugs that make it easier for hackers to breach. This can lead to substantial losses as we saw time and again, throughout 2020.

What Is the Safest, Smartest Approach?

Automated yield farming offers an attractive option for those looking for a quick, large return on their capital. But, as we have seen, one of the primary features of DeFi yield farming is that it is a high-risk, high-return investment opportunity.

Your best option is to find a way to exploit the high profit potential of automated yield farming, while significantly mitigating your exposure. Here at ArbiSmart, we achieve this with our EU licensed, fully automated crypto arbitrage platform.

Crypto arbitrage is generally considered to be one of the lowest risk forms of investing, this is even more stark when we are making a Defi yield farming comparison. One of the reasons is that it crypto arbitrage generates profits from price inefficiencies across exchanges and is not vulnerable to crypto market volatility.

The ArbiSmart platform is a DeFi and Centralized Finance (CeFi) hybrid. It provides the best of both worlds, offering all the cost-effectiveness, easy access, transparency and rapidity of DeFi yield farming, in addition to offering the security associated with a centralized financial ecosystem.

As an FIU licensed platform, ArbiSmart complies with strict data security protocols and client capital protections. Moreover, it is not simply an automated blockchain-based platform but also has human oversight from a risk-management team that tracks crypto market activity around the clock and can intervene in the case of extreme market upheaval.

At ArbiSmart, you can also enjoy the huge returns that are characteristic of yield farming. In fact while the return on a yield farming dapp is, on average, 10%, per annum, at ArbiSmart, you can make up to 45% a year.

Another factor to consider is the fact that many yield farming tokens are very young, unstable, unreliable and easily manipulated by token holders who borrow and lend it in quick succession, driving up the value. In contrast, RBIS, the ArbiSmart native token is well established, having steadily risen in value by over 120% in just the last two years, based on the development and growth of the platform. ArbiSmart clients are earning generous capital gains, which are projected to grow substantially, since the token value is expected to reach 3,000% by the end of 2021.

Yield farming has gained ground quickly becoming a primary investment channel in the crypto space, due to its huge profit potential. However, the risks cannot and should not be dismissed lightly. For this reason, choosing a route like crypto arbitrage, with a licensed platform like ArbiSmart, is the smart option. It offers sky-rocketing returns, while simultaneously providing a low-risk investment strategy, regulatory safeguards, such as external auditing and rigorous data security measures as well as a native token that is steadily and consistently growing in value.

To learn more about all types of crypto investing, check out the rest of the ArbiSmart blog, or click here, if you’re ready to give crypto arbitrage a go.