How to Implement a Crypto Pair Trading Investment Strategy

The increasing popularity of all types of cryptocurrencies over the last year has led this emerging asset class to become an essential part of many retail and institutional investment portfolios. As a result, a variety of strategies are being adopted to enable investors to best exploit the volatile crypto exchanges.

In this post, we will be exploring pair trading, which is expected to be a leading cryptocurrency investment strategy in 2021. We will be asking how does cryptocurrency pair trading work, and what are the best pairs to trade? We will also be examining how a crypto pair trading investment strategy can be used to generate a return in both rising and falling crypto markets and what potential risks are involved.

What is pair trading in crypto?

Often referred to as a market-neutral strategy, since you can make a profit whichever direction the market is moving, cryptocurrency pair trading entails the simultaneous purchase and sale of two closely correlated currencies with the expectation that one will outperform the other. The idea is that you will profit from the purchased currency (long position) rising in value more that the sold currency (short position) falls in value.

This market-neutral strategy is particularly suited to crypto investing due to the high volatility, that causes frequent, fast ups and downs in price.

What are the best cryptocurrency pairs to trade?

When you want to implement a crypto pair trading strategy you need to determine which pairs are most popular across all the various exchanges. In cryptocurrency pair trading of a crypto-fiat pair the most popular option is to trade the coin against USD, while in crypto-crypto pairs Bitcoin is the top choice due to global demand.

Bitcoin pair trading is popular because BTC, as part of a pair, offers countless trading opportunities, it is listed on all exchanges, has high market capitalization, and can be traded for a large choice of different currencies. Almost as popular is Ethereum, with the high usability of the smart contracts available on its platform, as well as USDT, which has gained a great deal of traction as it is a leading stable coin, with an exchange rate linked to the US dollar. Common pairs are BTC/ETH, USDT/BTC, BTC/LTC, and ETH/LTC.

Liquidity is essential, as it means you can find buyers with ease, without delay. So, you need to check the trading volume of your chosen coins, as always being able to sell means that a bear market won’t cause you to lose money, having to accept a low exchange rate.

What are the drawbacks of cryptocurrency pair trading?

A major downside of using a crypto pair trading strategy is that you can be trading crypto but still losing our on the next big Bitcoin bull run. As a market-neutral strategy, crypto pair trading does not financially benefit you if the price of Bitcoin soars.

In addition, it is a form of investing that requires experience, market knowledge and a lot of time in front of a screen, researching bid/ask prices, analyzing price charts, monitoring the markets and executing trades.

What are the risks of crypto pair trading?

When it comes to pair trading in cryptocurrency, there is a certain degree of risk involved:

Correlation breakdowns

The best crypto trading pair has two coins with a high correlation. This means that the two cryptocurrencies rise or drop in price in relation to each other, either moving in the same direction, or opposite directions. This presents a certain predictive value.

However, correlations constantly change, so the breakdown in a correlation is a potential risk, as your pair trade could suddenly lose money if your currencies move in unanticipated directions.

Using exchanges

This Bitcoin investment strategy involves holding your coins on an exchange, and this is not without risk. Exchange wallets are vulnerable to hacks and unfortunately have a history of losing crypto owners’ funds. In fact, up to now, over 2 Billion USD has been hacked from crypto exchanges.

Is there a less risky Bitcoin investment strategy?

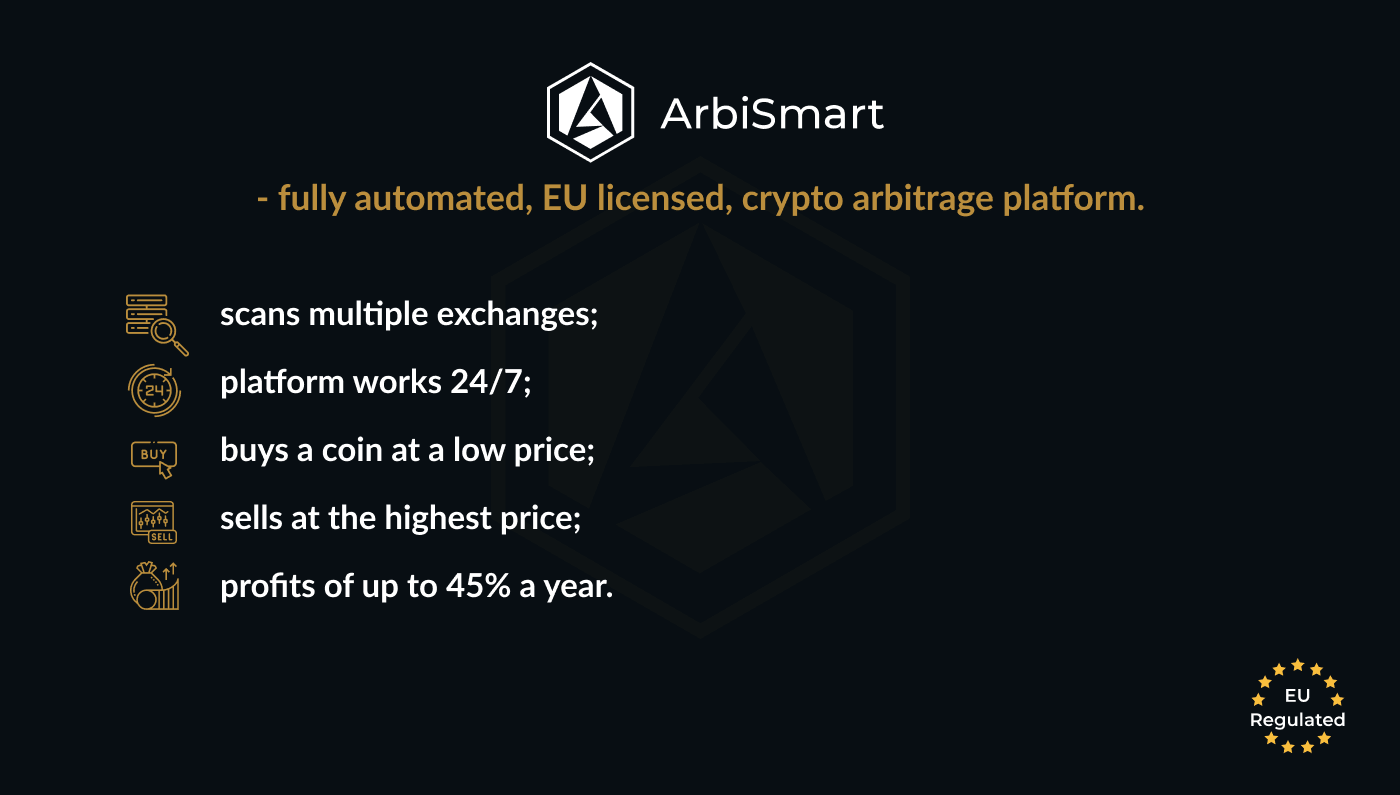

Here at AribSmart, our fully automated, EU licensed, crypto arbitrage platform offers an exceptionally low risk crypto strategy that requires no prior experience and no time in front of a screen managing your trades.

In one way it is similar to a crypto pair trading investment strategy, as you can trade in a rising or falling market. However, since you are not making money from market volatility, but instead, you are taking advantage of price inefficiencies across exchanges, it is a far safer Bitcoin investment strategy . Also, at ArbiSmart, this is done via an EU licensed and regulated platform without any of the security vulnerabilities of an exchange.

The ArbiSmart platform scans multiple exchanges, day and night, looking for crypto arbitrage opportunities, instances where temporarily, a coin is available at different prices at the same time. It automatically buys the coin on the exchange where the price is lowest, then instantly sells it on the exchange where the price is highest, to create profits before the temporary price inefficiency resolves itself. It manages to do this for hundreds of coins, at once, executing a huge number of trades simultaneously, generating profits of up to 45% a year, without requiring you to lift a finger once you’ve signed up and deposited funds.

While a crypto pair trading investment strategy enables you to make potentially large profits, regardless of the overall direction of the crypto market, there is a substantial time commitment and level of market knowledge required as well as a significant degree of risk. In contrast with crypto arbitrage, no effort is required at all, once you’ve signed up and deposited funds and it involves close to zero risk, all while providing unparalleled profits.

Learn more about this strategy in ArbiSmart’s introduction to arbitrage or get to grips with a wide variety of topics related to the crypto market strategies, blockchain, altcoins and decentralized finance on the ArbiSmart blog.