A Guide to Using Moving Average Convergence Divergence (MACD) in Crypto Trading

There are a wide variety of technical indicators for crypto traders to choose from and Moving Average Convergence Divergence (MACD) is among the most popular.

Let’s see what it is, how it works and what market advantage it offers crypto traders.

A Definition of MACD

Moving Average Convergence Divergence, or MACD for short, is a trend-following momentum indicator which is designed to help you decide the best time to open a position. It enables you to determine the strength of your chosen asset’s price trajectory and whether it is likely to continue in its current direction.

A moving average is a means of arriving at a constantly updated average price for an asset. This average price calculation mitigates the impact of sudden short-term price movements over a given period. MACD reflects the relationship between two moving averages. Depending on how they cross, you can decide whether to implement a short or long strategy.

At this point, a few technical definitions might be useful:

- Simple Moving Averages (SMAs) – a simple mathematical average of the prices over a chosen timeframe

- Exponential Moving Averages (EMAs) – greater weight is placed on more recent prices than older ones over the chosen timeframe.

- MACD line – The result of calculating the 12-day EMA minus the 26-day EMA.

- Signal line – the 9-day EMA of the MACD

- MACD Histogram – A graph that plots the difference between the MACD line and the Signal line. The histogram can be used to generate buy and sell signals.

How to read an MACD Histogram

An MACD histogram will indicate changes in price direction. Trend momentum is indicated by the convergence and divergence between the MACD line, and the signal line displayed in the histogram. The EMA’s will converge when a trend is losing steam and will converge when the trend is picking up momentum.

Popular MACD Crypto Trading Strategies

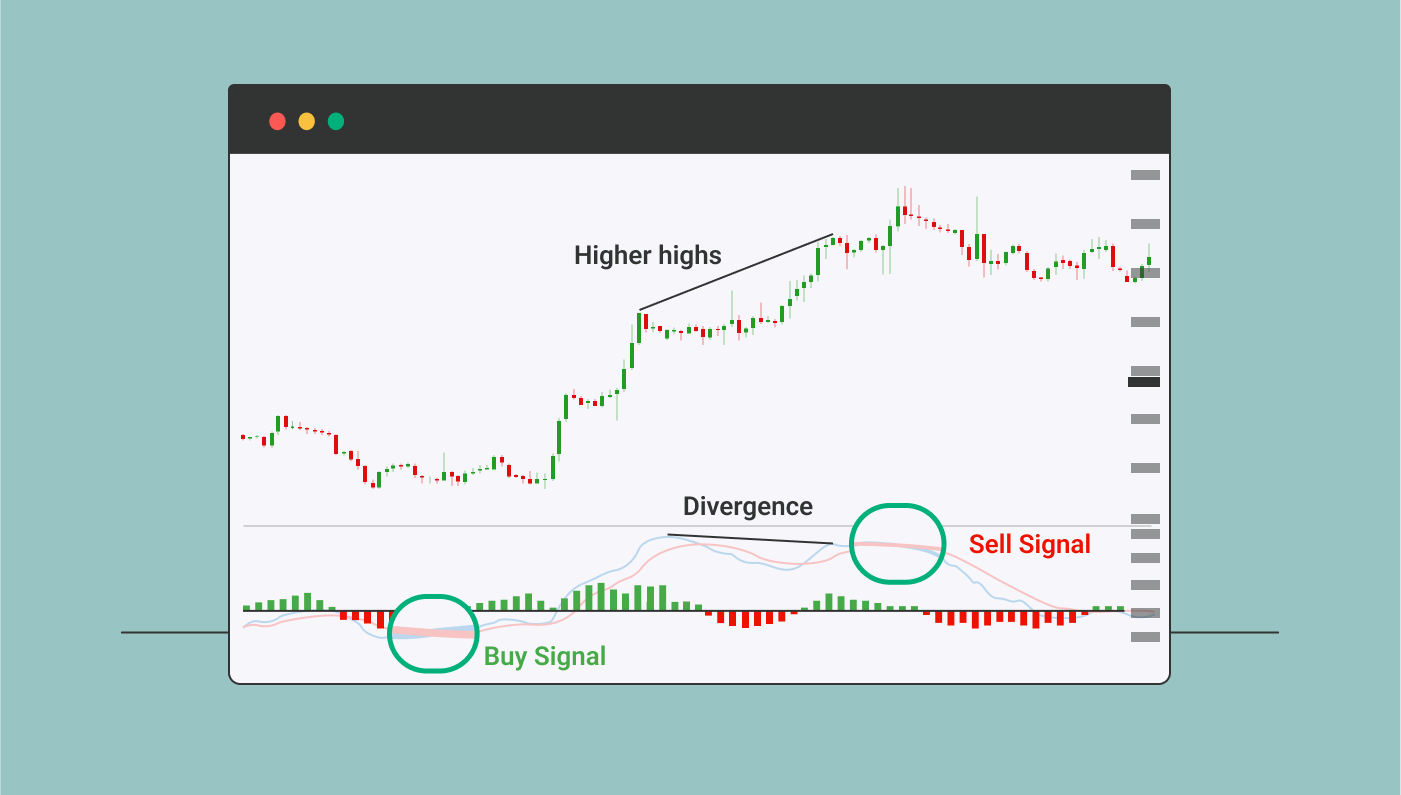

Crossover Strategy

This strategy examines the crossover points between the MACD line and the signal line. By looking at the places where the two connect bullish and bearish signals can be identified. You should buy your chosen digital asset when the MACD line crosses above the signal line. In contrast, you should sell, when the MACD line crosses below its 9-day EMA.

It is worth noting that this strategy is founded on historic price activity, so you are using the signal after the market has already shifted. In other words, it is a lagging strategy based on past data. When the trend is weak, this could mean that you are responding to the market too late and by the time the signal is generated, the trend is already reversing.

Zero Line Cross Strategy.

The signal is considered bearish if the MACD line crosses from above the zero line and in this scenario you would do well to sell to benefit from the downward trend. In contrast, the signal is considered bullish, and you should buy, if the MACD line crosses from below showing upward momentum. Whatever the market trajectory, a longer histogram bar translates to a stronger signal.

The zero cross strategy is best suited for traders who are taking a long-term approach, since it is slower paced, with fewer signals. In the fast-paced, volatile crypto arena, the signal can emerge too late to be of value if the market trend has already reversed.

Histogram Reversal Strategy

In periods of weak market momentum, when the market is moving slowly, the histogram will decrease in height. During times of strong market momentum, the histogram will increase in height.

As the histogram bars displaying the difference between the signal and MACD lines move further from zero, the distance between the two moving average lines expands.

An Effortless Alternative

MACD is a valuable technical indicator that can help traders identify potential trend reversals and price swings. However, as with any attempt to anticipate price movements in the highly volatile crypto market, it involves a certain level of risk, while also requiring ongoing analysis.

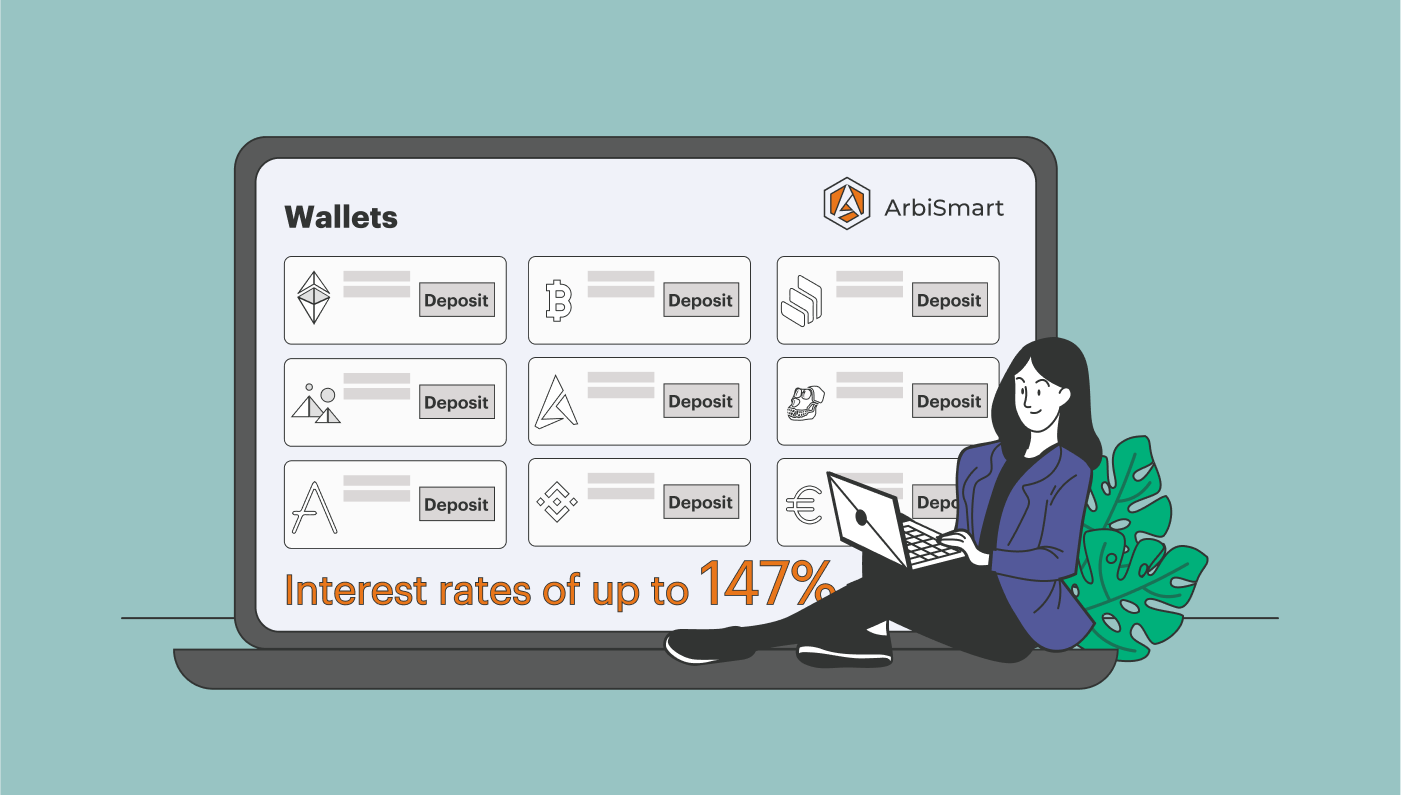

Here, at ArbiSmart, our EU authorized and registered interest-generating wallet exposes you to almost zero risk, while offering passive profits of up to 147% a year, simply for storing your FIAT or crypto in a locked savings plan.

You simply deposit funds, pick a plan, deposit amount and currency and then get on with other things, while your money gets to work on your behalf. No need to sit in front of a screen analyzing market moves, monitoring the market or executing trades.

Whichever direction the market is moving, you will continue to earn the same consistent, reliable passive profit. Interest is paid out daily, and you will earn a higher rate the larger your deposit, the longer the duration of the savings plan contract, which can range from as little as 1 month to as long as 5 years, and the higher your account level.

If you’d like to learn more about a range of crypto topics, relating to DeFi, trading strategies, emerging blockchain technologies and more, browse the ArbiSmart blog. Or, to securely store your funds while also earning an industry-high a passive profit, open an ArbiSmart wallet today!