Global Crypto Adoption – What Country Uses Crypto the Most?

In this post we are going to explore the various approaches to cryptocurrency around the world. We will look at how the incorporation of digital assets into some national economies, and not others is impacting the future of crypto as a global financial force.

Powerful, Industrialized Countries and Crypto

The global crypto market is worth over two trillion US dollars but the majority of citizens in wealthy industrialized countries actually have very little, if any, actual experience with it. For example, in 2020, in the US, according to Statista, only 6% of people reported that they owned or used crypto.

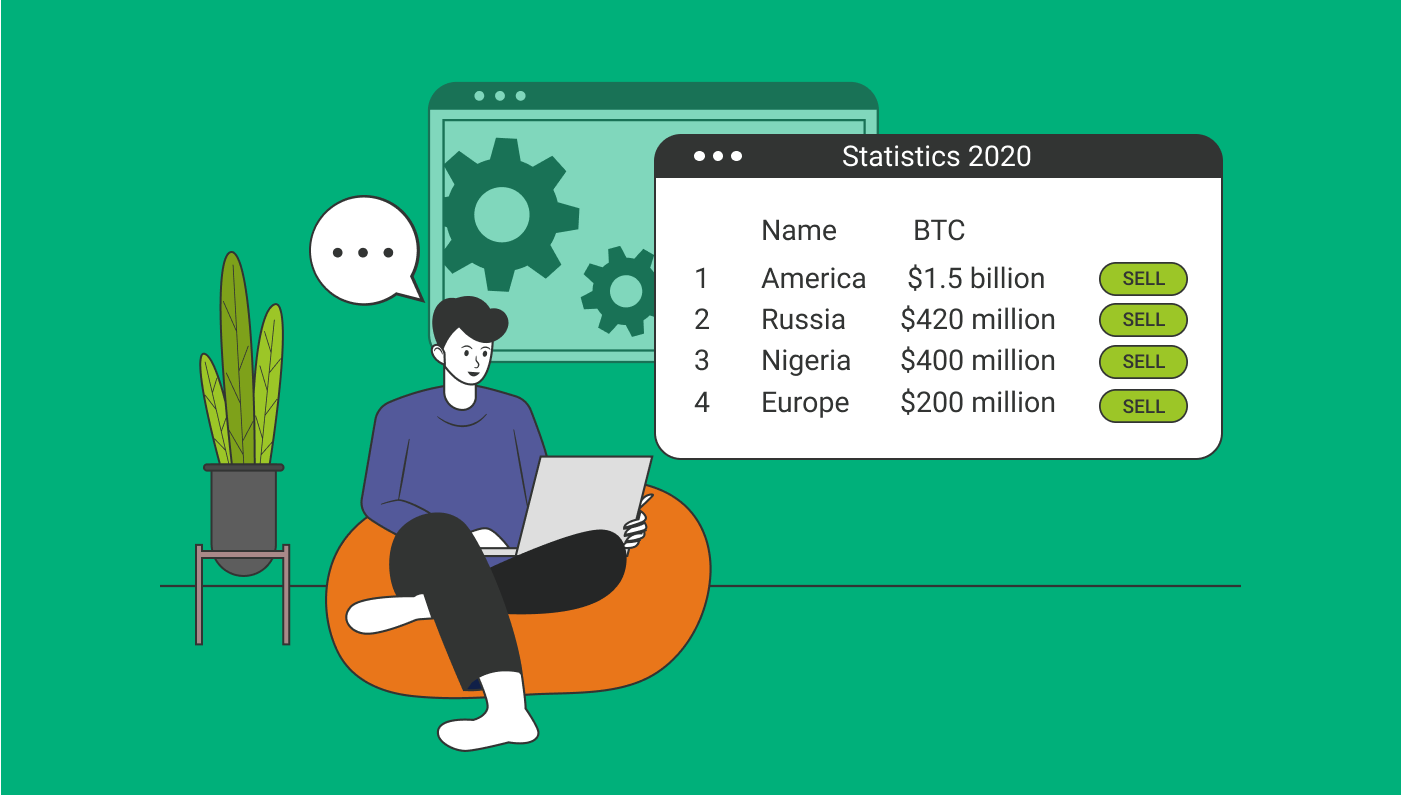

However, 2020 also saw more than $1.5 billion worth of Bitcoin traded on American exchanges, which is three times the trading volume of Russia, which was equal to just over $420 million. Close on its heels in third place was Nigeria with around $400 million, with Europe trailing far behind at $200 million.

Top Crypto Countries

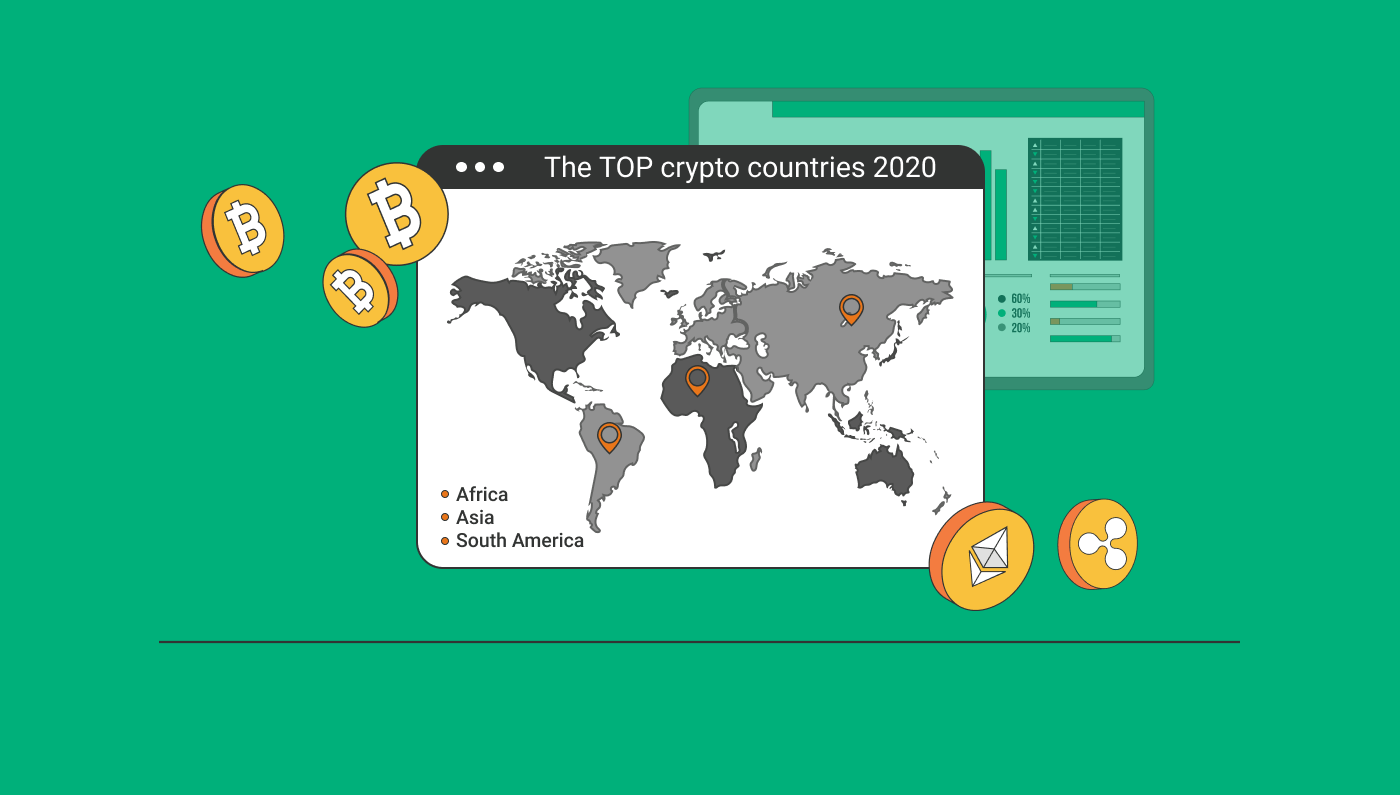

Some countries’ populations are adopting crypto at a dizzying pace, while others are less enthusiastic. Equally national governments are taking divergent regulatory paths with some supporting the growth of digital assets, while others are legislating against crypto usage at every turn.

Interestingly, the largest and most powerful economies fall into the bottom half of the list of countries ranked by crypto usage and ownership. The top crypto countries are primarily in the continents of Africa, Asia and South America. In these regions there is a far higher likelihood of cryptocurrency ownership than in North America, Europe or Australia.

The World’s Crypto Leaders

So, if you are wondering what country uses crypto the most, the answer is Nigeria, where 32% of those surveyed, approximately a third of the country, reported ownership or use of digital assets in 2020. There are a variety of factors behind this trend, with one of the most significant being the fact that over 40% of Nigerians live in poverty. Crypto transactions are low cost, making them an affordable option. These transactions don’t require you to have a bank account and can be made via cellphone which is how a vast proportion of local payments are made.

Also, with inflation frequently in double figures, cryptocurrencies like Bitcoin with a cap on the number of coins that can ever be created, provide an excellent hedge against inflation.

It seems that in terms of digital asset use, the top crypto countries are not necessarily those with the strongest economies but those most in need of a fast, low cost, decentralized financial ecosystem.

While Nigeria leads the world’s top 10 crypto countries, there are multiple appearances on the list from Asia, including Vietnam, coming second with 21% usage of crypto followed by the Philippines with 20%. Turkey and Peru are tied in fourth place, with 16%, and then comes Switzerland with 11% crypto ownership and usage. India and China with their vast populations only have 9% and 7% crypto usage respectively, coming in 6th and 7th place. The world’s top 10 crypto countries are rounded out with the US at 6%, Germany at 5% and Japan at 4%.

The Most Popular Types of Crypto Investment

On average world-over, crypto ownership stands at 3.9%, with the demographic slanting younger, more educated and around 60% male. In addition, almost 20,000 business globally now accept crypto as a form of payment.

So, what are they doing with their crypto?

Well, most are buying established coins like Bitcoin and Ethereum, either for short term trades or for HODLing, though altcoins of all kinds are gaining ground as the legitimacy and popularity of crypto grows worldwide.

Two recent additions to the crypto space may be worth mentioning here for their rapid global rise. The first is non-fungible tokens (NFT’s) and the second is meme coins.

NFTs are one-of-a-kind works of digital art, virtual collectibles or in-game items, where the purchaser gets ownership validated on the blockchain, so the legitimacy and originality of the artwork is publicly verifiable. So far 2021 has seen hundreds of millions in NFT sales, with Beeple famously selling a piece for over $69 million. In total, the market cap of global transactions involving NFT’s currently stands at $338 million.

Then of course there arethe buzzed-about meme coins, the best known being the original, Dogecoin, which was created as a joke. Yet, in Q1 2021, Dogecoin grew by 7,555%. Meme coins have no utility to speak of but since Elon Musk started to tweet about Dogecoin, retail investors started buying in a frenzy. This type of coin is easy to create and as a result there are now over 5,000 currently circulating.

In spite of all the hype, blue chip coins with a high market cap are still leading the field. In general, investors want a solid investment with a project that has a genuinely valuable utility, offering a product or service that can stand the test of time and is not just a passing fad.

However, there is one alternative to investing in a specific coin and it is rapidly gaining ground as an investment strategy because it provides a great hedge against a sudden change in market direction. With crypto arbitrage, if the current bull run suddenly ends in another crash, you will continue to earn a steady generous return on your Bitcoin, Ethereum or fiat.

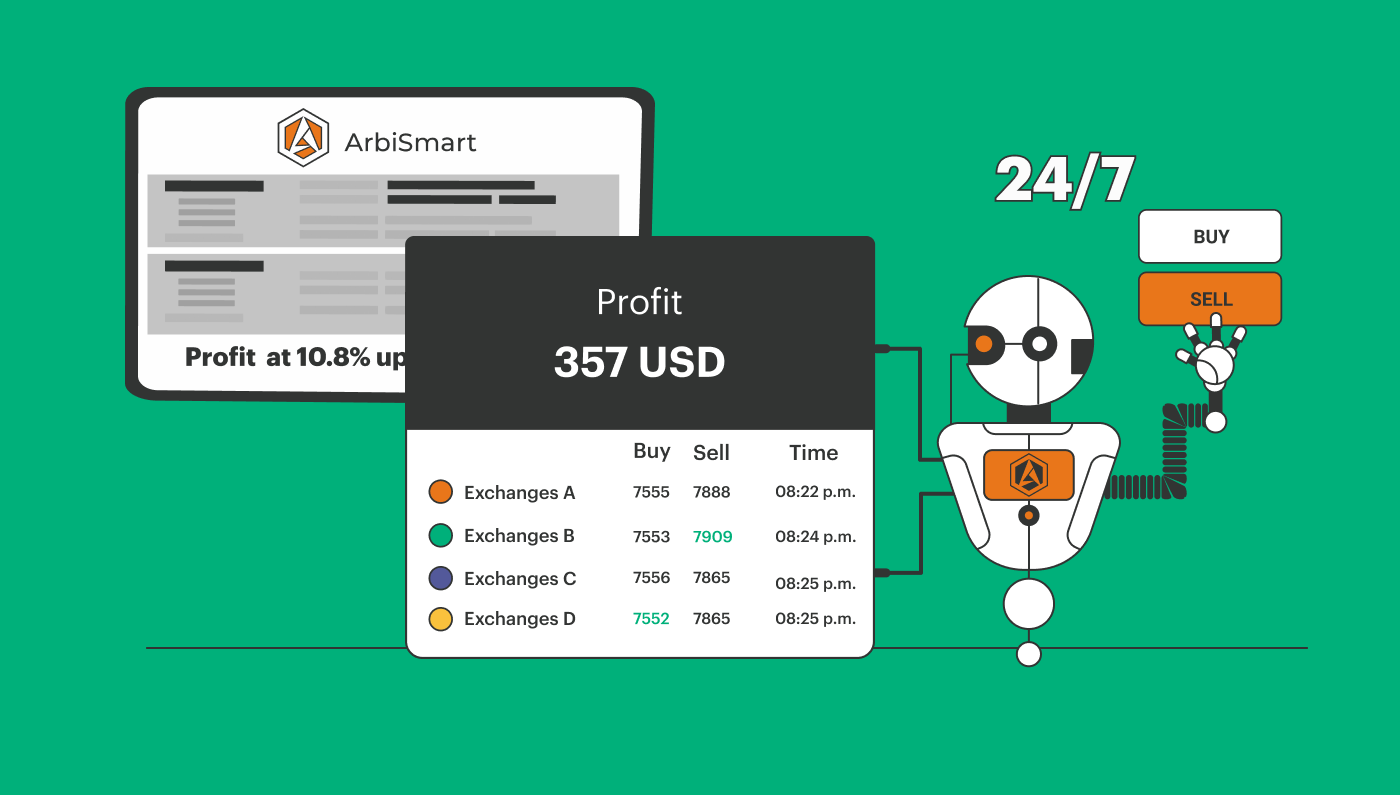

Crypto arbitrage involves exploiting temporary price discrepancies, where a coin can be available on Exchange A at one price but simultaneously available on Exchanges B,C and D at different prices. These brief discrepancies are often the result of a disparity in trading volume or liquidity levels between exchanges of different sizes.

Here, at ArbiSmart, our automated crypto arbitrage platform is connected to 35 exchanges at once. Our algorithm scans hundreds of coins, around the clock and when it finds a price difference it automatically buys at the lowest price then sells on the exchange where the price is highest. Profits range from 10.8% to 45% a year, depending on the size of the deposit.

Globally, crypto has over 300 million users and tens of thousands of businesses supporting payments using digital assets. These numbers are likely to rise further in the future if adoption levels maintain their steady upward trajectory, meaning that the gaps in crypto usage between emerging and wealthier economies will narrow.

Interested in learning more? Explore a wide range of topics related to the world of digital currencies at any time, by visiting the ArbiSmart blog.