Forex Trading Vs Cryptocurrency Trading: Which Is Best for You?

The world of traditional forex and the crypto arena both offer lucrative investment opportunities to both beginner and veteran traders. Before you can decide whether to trade cryptocurrency forex, or another asset entirely, let’s examine the similarities between FX and digital currencies, as well as the differences, exploring the pros and cons of each.

What are the main similarities between forex and cryptocurrency trading?

Both the foreign exchange and digital currency markets enable traders to profit from the rising and falling prices of their chosen currencies, buying and selling over the short or long term, to benefit from high liquidity and volatility.

In both cases, trading is primarily performed online using trading technology that can be accessed from the comfort of home by anyone with an internet connection..

What are the primary differences between forex and cryptocurrency?

The foreign exchange market is a decentralized, global currency market, with an estimated daily turnover of over $5 trillion. Market participants include financial institutions, individual and retail investors, as well as banks and corporations. It is fast, paced, liquid and highly volatile, offering trading opportunities 24 hours a day, 5 days a week.

Forex involves trading on the shifting prices of various national currencies, so fundamental factors such as social or political upheaval and economic indicators like the Consumer Price Index publication and the GDP numbers will impact the value of the currency.

In contrast, cryptocurrency trading deals with coins that have no connection to a specific country. Far younger than the forex market, the newly emergent crypto market has a daily turnover of just $100 billion, though it is growing at an incredibly rapid pace. Cryptocurrency trading can take place 24/7, every single day of the year, with no interruptions for weekends, or holidays.

One of the major features of cryptocurrency market trading is that the level of regulation differs between countries, as governments are responding to the developments in decentralized finance at different speeds and to differing degrees. So, when we are looking at cryptocurrency vs forex in terms of legislation, the foreign exchange markets are more established with more consistent regulatory oversight. For this reason, new regulation, alongside factors such as supply and demand and market sentiment, is a primary factor influencing cryptocurrency prices.

Mention should also be made of the fact that most forex trading is Over the Counter (OTC), whereas most cryptocurrency trading is done on exchanges. OTC trading tends to involve a broker, to whom a fee needs to be paid, which is often taken off the spread. In contrast, exchange trading, while also involving the payment of a fee, in this case to the Bitcoin exchange, will entail lower transaction costs overall. This is due, in part, to the fact that there is usually a fixed fee that applies to all trades and is not dependent on the specific currency pair, market conditions or other factors.

What are the main advantages and disadvantages of the forex market?

A primary characteristic of the forex market is its size and the vast number of participants. This makes for exceptional liquidity, increasing trading opportunities and making it possible to execute large volumes of trades rapidly and reliably.

When looking at forex trading vs cryptocurrency trading you also need to take into account that while both allow even those with only small amounts to invest to participate, forex provides the advantage of leverage. Your forex cryptocurrency broker will offer up to 50 times the trading power of the amount you have placed on your trade. This provides a means of making much larger profits, but also involves significantly higher risks.

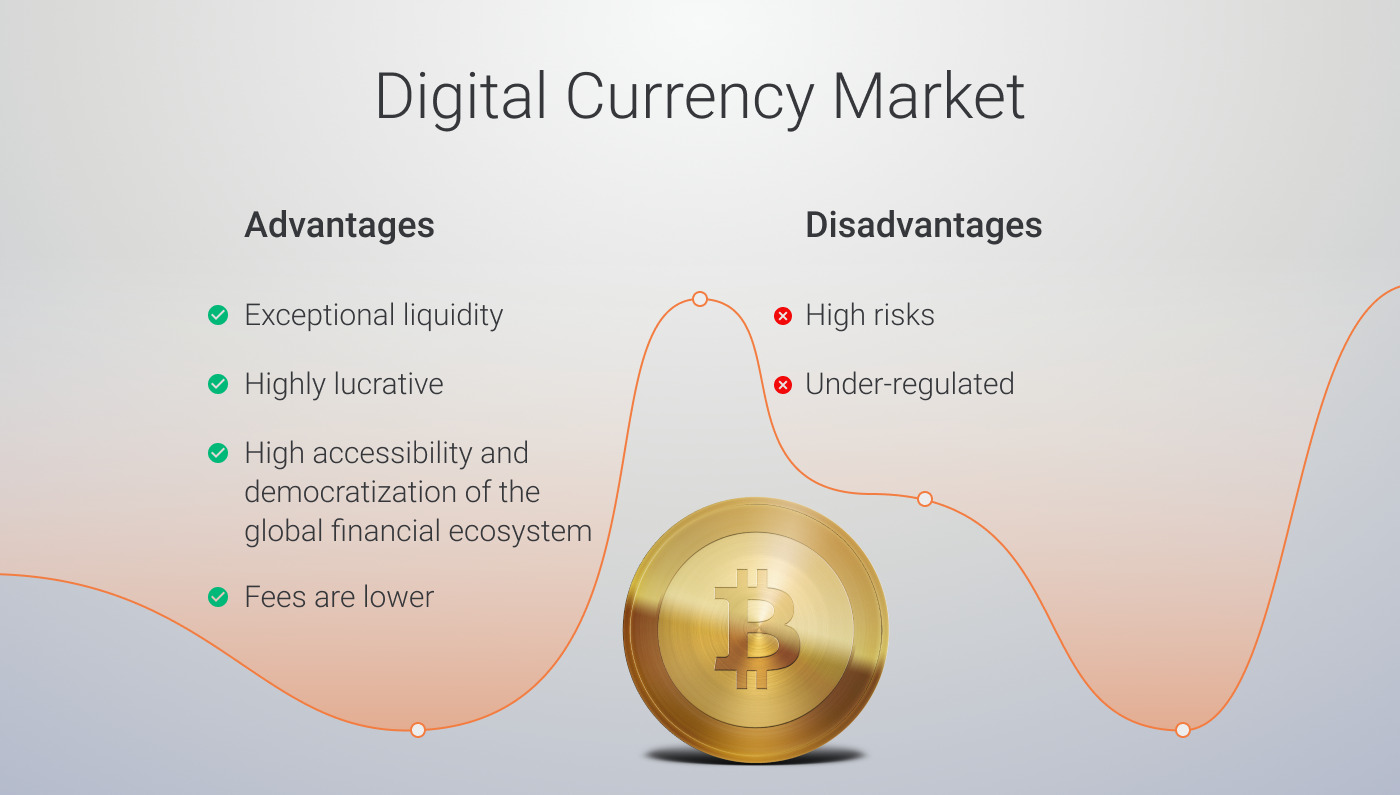

What are the main advantages and disadvantages of the cryptocurrency market?

Whether you trade cryptocurrency or forex, volatility is a central characteristic of both markets. However, this is far more extreme in the case of digital currencies. For example, Bitcoin is renowned for the fact that it has skyrocketed to hundreds of times its price and then gone into freefall within a few short months, before climbing again to new heights. This is great, and one of the top benefits of cryptocurrency trading for short-term traders looking to profit from market shifts, but it also holds inherent risk, making cryptocurrency trading a lucrative but less than reliable short-term investment opportunity. However, the overall trajectory of Bitcoin is upward and long-term traders, who got on board early and have held on to their coins, have made millions.

We have already touched upon the fact that the crypto sphere is under-regulated and in fact has been termed the financial “Wild West.” As a result, crypto traders need to be extremely cautious when choosing an investment platform, or wallet for storing their cryptocurrencies, as criminal elements have been known to exploit the anonymity of the crypto space. Much of this danger can be avoided by using a licensed and regulated crypto services provider. Here at ArbiSmart for example, we are fully FIU licensed to provide crypto exchange services, ensuring that there is external auditing, strict KYC/AML requirements, client fund protections and tough data security protocols. ArbiSmart is also FIU licensed to provide wallet services, which will be available, starting in 2021.

Another of the main benefits of cryptocurrency trading is its accessibility and the way in which it democratizes the global financial ecosystem. For those without bank account access it allows a means of saving, making payments and receiving funds securely, and all at incredibly low cost. Because there are no financial institutions acting as middlemen, payments made through peer-to-peer networks are direct, so fees are lower, and transactions are also far faster.

How do you make the right choice?

When examining the opportunities offered by forex trading vs cryptocurrency trading your choice will very much depend on your temperament. The foreign exchange market offers greater liquidity as well as far greater security from a regulatory perspective. While forex is still a highly volatile market, offering great profit potential, nothing compares to the extreme ups and downs of the crypto exchanges, and the accompanying increased risk and reward.

As we have discussed, if you know how to buy and trade cryptocurrency safely, choosing a regulated crypto investment platform, with an excellent reputation such as ArbiSmart, then you can trade with the same peace of mind as any forex trader.

When it comes down to cryptocurrency vs forex, both offer exceptional revenue opportunities. So, why choose between the two? Your best option is to diversify your portfolio and enjoying the benefits of both types of currency markets, spreading your risk across a wide choice of assets including a range of major, minor and exotic currencies as well as a variety of established cryptocurrencies and emerging altcoins.