An Examination of the Future of Digital Currency

Established coins like Bitcoin and Ethereum, as well as new breakouts like Cardano and Solana are making daily headlines, due to their incredible volatility and the rapid pace of new crypto legislation in various global jurisdictions. More and more newcomers are dipping a toe into the crypto water each day. However, while a great deal of progress has been made there is still a way to go before we see mass adoption of digital currencies.

The Current Crypto Landscape

Cryptocurrencies are gaining legitimacy and popularity, as new regulations are introduced globally and major financial institutions and corporations are supporting crypto payments, creating their own coins or adding digital assets to their portfolios.

Digital currencies are most frequently used for investment, through HODLing, which involves purchasing coins and holding on to them in anticipation of a rise in value over the long term, or swing trading, to exploit the high volatility of the crypto markets by taking advantage of short-term price shifts.

With increasing popularity, digital currencies are being used for remittance, where direct payments are made across the world through a peer-to-peer network, providing a low-cost, rapid and secure means of transferring funds.

Currently, digital currencies are only infrequently used for the purchase and sale of goods and services as the systems are still not in place to make this a standard payment method for shoppers.

The Future of Digital Currency

The current transition to a cashless economy, accelerated by COVID, looks set to continue, with mobile phone technology potentially replacing the use of credit cards altogether.

Mobile wallets could enable users to seamlessly execute transactions using all types of cryptocurrencies including established digital assets like Bitcoin and Ethereum, stablecoins, and central bank digital currencies (CBDCs).

We are also likely to see cash-based bank accounts for use with online retailers expand to provide extensive crypto options.

An Increase in Central Bank Digital Currencies (CBDCs)

The future of digital currency will most certainly entail the growth CBDCs, the digital version of a national currency. CBDCs will enable individuals and corporations to execute paperless electronic payments securely, using a digital currency that has been issued and backed by the country’s central bank.

Expanded Payment Options

Another of the major developments we are likely to see is the increased availability of crypto payment choices for goods and services, with more digital payment options becoming available.

Today, using a credit card, you can expect to pay between 1.5% and 3.5% in fees and that’s before taking any potential conversion fees into account. All this means that digital currency payment methods are going to continue gaining ground, offering an attractive alternative that is secure, convenient and cost effective.

Smarter Contract Management

When considering the future of digital currency, we must also look at the technology that facilitates their secure creation and transfer. Smart contracts are blockchain-stored programs that enable the recording and enforcement of a legal document. They are designed for the automation of legal agreements with no intermediaries or delays, and they are triggered as soon as specific pre-set conditions are met. This means far lower costs with no third parties, an indelible record on the blockchain and a faster, more efficient contract management experience.

Faster, More Cost-Effective Remittance

Fiat remittance services are often used by workers sending money back to families in their country of origin and they can have huge fees, as high as 12%. In contrast, crypto remittance services are far less expensive, much faster, and more accessible, and in future, they will very likely become the standard.

More Crypto Investment Options

The future of digital currency will involve a wider range of reliable crypto investment options. At this point traditional stocks and bonds are far more popular with investors. However, the tide is turning as more people are exploiting the 24/7 lucrative revenue opportunities presented by the high volatility of the crypto markets and taking advantage of the fact that crypto investing offers a great hedge against inflation.

New modes of investing are being added all the time and now crypto exchange traded funds (ETFs) are available as well as crypto retirement funds, among others.

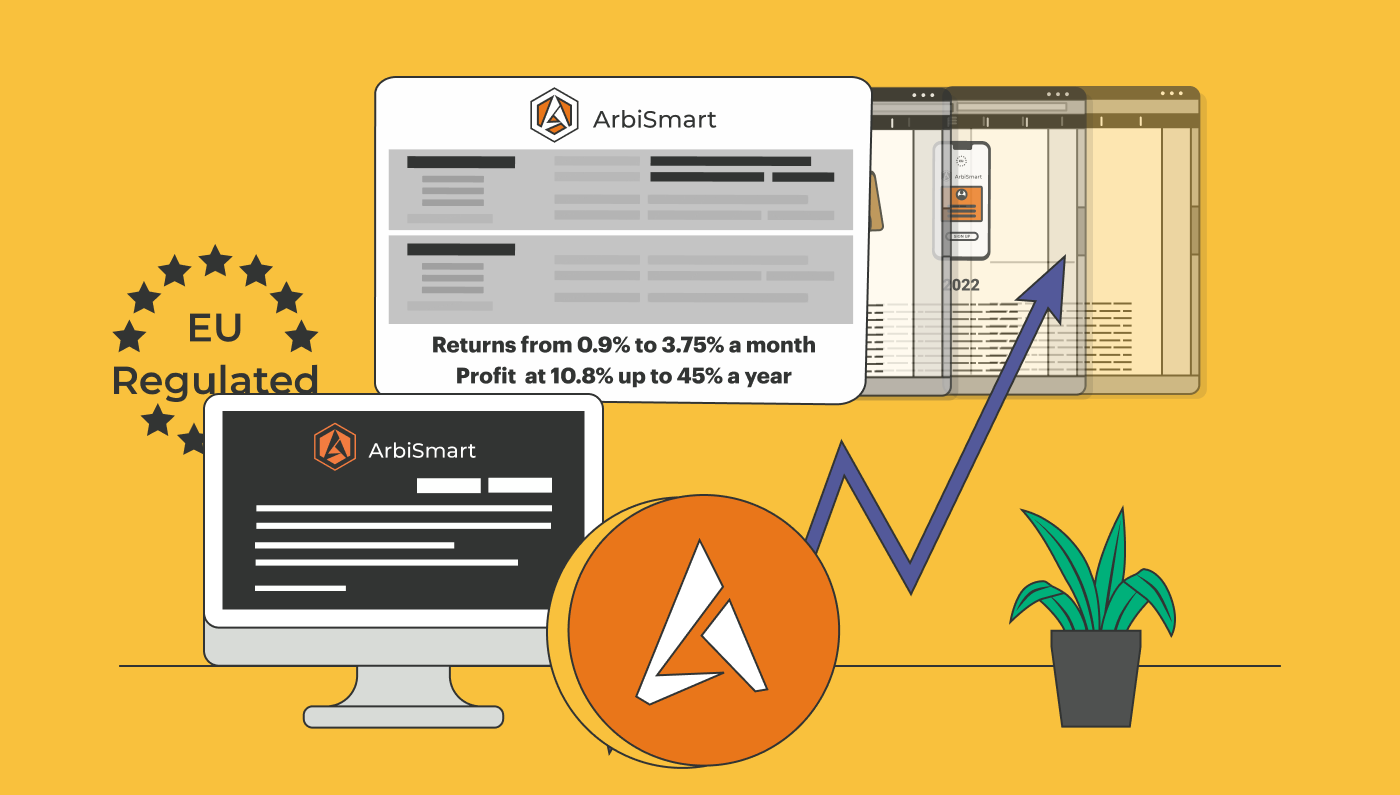

Here at ArbiSmart, our fully automated crypto arbitrage, platform offers a secure, EU regulated investment option that generates guaranteed returns, which can be calculated in advance. The platform also provides a great hedge against crypto market volatility while delivering unmatched crypto profits that start at 10.8% and reach up to 45% a year (0.9% to 3.75% a month). You will also earn capital gains on the rising value of RBIS, ArbiSmart’s native token, which has already gone up by over 850%. The price is set to soar even higher in the next quarter, following the listing on global exchanges later this month and the launch of a series of new RBIS utilities in Q1 of 2022.

In many respects, the future of digital currency is still uncertain, but one thing is clear. Crypto investment and payment options are on track to expand. The range of available financial services in the crypto arena will increase as well as opportunities for managing agreements through smart, as adoption of cryptocurrencies rises. To learn more about decentralized finance, crypto investment strategies, like crypto arbitrage, blockchain based technologies and types of digital assets, check out the ArbiSmart blog.