DeFi vs. CeFi: Pros and Cons

To effectively compare and contrast decentralized finance (DeFi), and centralized finance (CeFi), we need to start with a definition of terms.

What Are DeFi and CeFi?

DeFi utilizes emerging blockchain technologies to enable cross-border, permissionless transactions involving digital assets. In contrast, CeFi utilizes intermediaries to provide centralized financial products and services, examples being payment service providers and banks.

CeFi Benefits

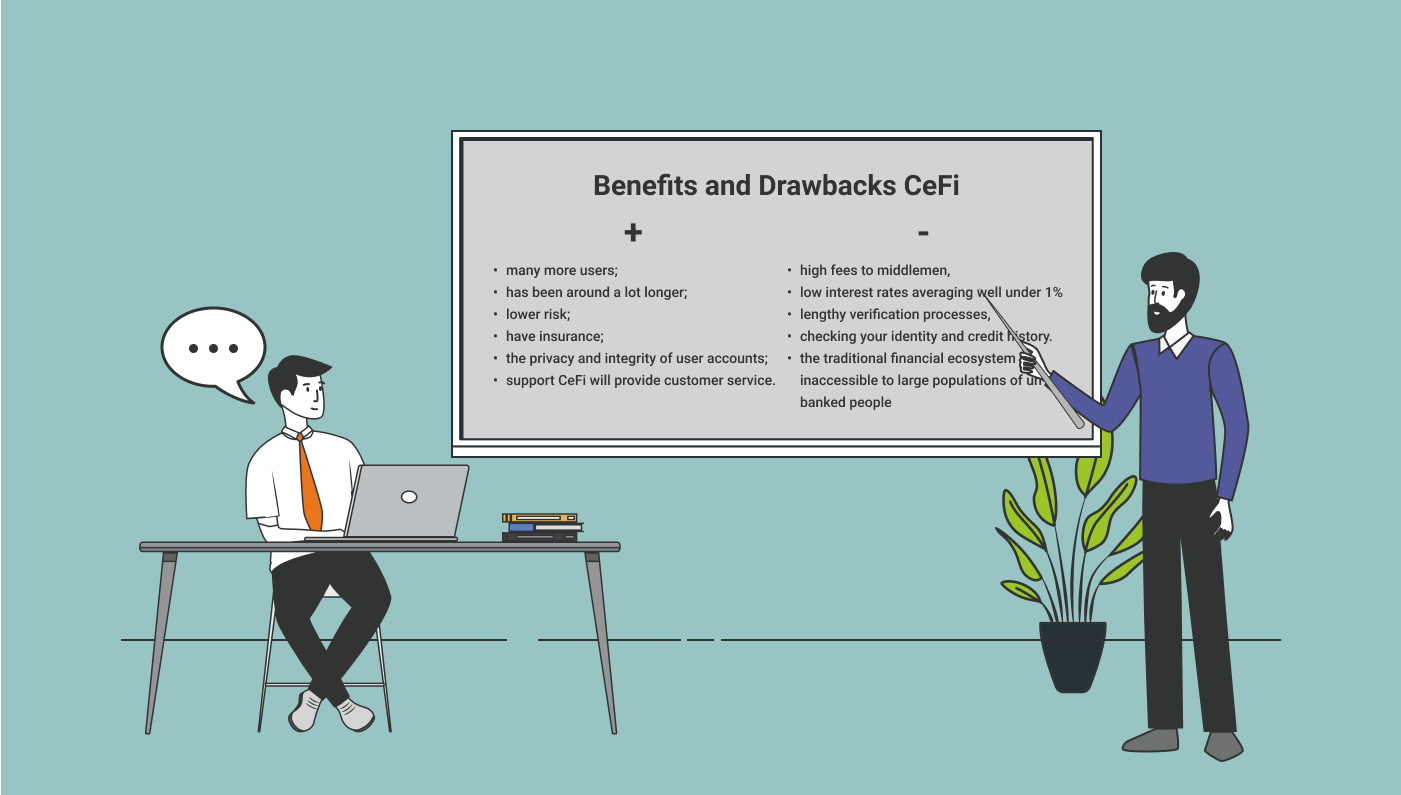

First and foremost, when it comes to CeFi vs DeFi, centralized finance has many, many more users and has been around a lot longer. Centralized platforms are significantly lower risk than those that are decentralized and have insurance as well as rigorous, well-established regulatory and technological safeguards in place to ensure the privacy and integrity of user accounts.

Also, CeFi means simplicity, as there is no specialized knowledge required to log into your bank account of visit the Paypal app. Also, if you ever need support, CeFi will provide customer service, whereas a DeFi platform will not.

CeFi Drawbacks

On the downside, CeFi means high fees to middlemen, low interest rates averaging well under 1% and lengthy verification processes, checking your identity and credit history. In addition, the traditional financial ecosystem is also inaccessible to large populations of un-banked people, who do not meet the necessary criteria.

DeFi Benefits

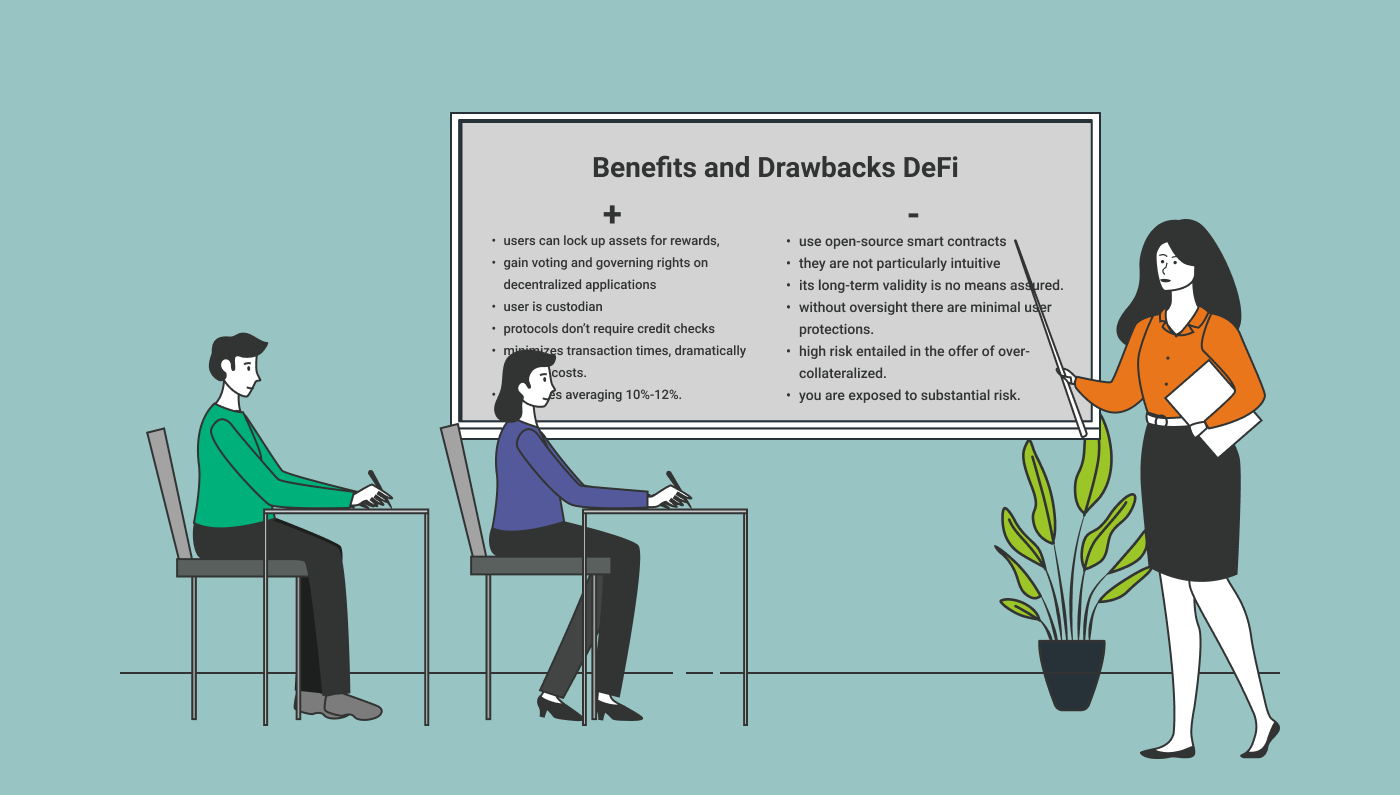

DeFi users can lock up assets for rewards, or gain voting and governing rights on decentralized applications, known as Dapps, using Ethereum blockchain-based smart contracts. Instead of a bank acting as custodian the user is custodian and in complete control, holding onto their own private keys.

Crypto-based protocols for lending and borrowing also don’t require credit checks and by cutting out the middlemen, DeFi minimizes transaction times, and dramatically slashes costs. In addition, when it comes to DeFi vs CeFi interest rates there is no comparison, with DeFi rates averaging 10%-12% and sometimes reaching much higher.

DeFi Drawbacks

DeFi protocols use open-source smart contracts so they can be vulnerable to hacks and liquidity issues. They are also not particularly intuitive and for those who are new to crypto there can be a steep learning curve, with various technical challenges. If you don’t know what you are doing your losses can be substantial.

It is also important to acknowledge that DeFi is an emerging financial ecosystem, and while this lends itself to greater innovation, its long-term validity is by no means assured. It can be exceptionally high risk and the entire crypto space is minimally regulated, meaning that without oversight there are minimal user protections.

Finally, there is the high risk entailed in the offer of over-collateralized loans for an asset class characterized by high volatility. With DeFi you are exposed to substantial risk from market fluctuations and in the case of a sudden price shift you could lose all your funds in the blink of an eye.

DeFi vs CeFi – The Main Differences

CeFi and DeFi have certain things in common. For example, both provide a means of accessing financial services like loans and interest-bearing accounts and they both earn revenues from user fees. However, there are substantial differences between them, which need to be explored thoroughly before deciding which to invest in.

The first factor to consider, when looking at DeFi vs CeFi is accessibility. CeFi is not open to everyone. Yet, with DeFi, permissionless protocols provide access to financial services via the blockchain to people in regions without strong economies that do not have good credit or enough stored wealth.

Another issue when exploring DeFi vs CeFi is liquidity provisioning. In DeFi you can generate generous profits by locking up funds in a smart contract, so that they can bring liquidity, and be utilized by other platform users. Since there are no intermediaries, fees charged by the platform go towards variable APY rewards. In contrast, on a CeFi platform, fees go directly to the company.

Then of course there is the matter of trust and security. On a CeFi exchange there is a single, central authority that if it becomes compromised leaves all your personal information and funds vulnerable. However, it is also not exposed to the holes that can be found in open-source smart contract security.

Another difference between DeFi and CeFi is the issue of personal control and responsibility. With DeFi, you are in charge of what happens with your money, and there are no 3rd parties involved so your funds are accessible at any time, without being limited to business hours. However, with a centralized system you have no control over your access to services, your fees, or how your savings account funds are being used.

What Comes Next for DeFi and CeFi?

In ever-increasing numbers, major CeFi systems and global corporate giants are boarding the blockchain train, and as regulation catches up with advances in digital finance. more institutions and individuals are adopting and incorporating crypto assets into their portfolios. However, for DeFi to overtake traditional CeFi, issues of security and reliability need to be resolved, and so at this stage a hybrid approach is ideal.

Here at AbiSmart, we give you the best of both worlds. You benefit from CeFi’s strict regulation, human oversight, and support that minimize risk and enhance security as well as the cost efficiency, speed, accessibility, and exceptionally high yields of decentralized financial ecosystems.

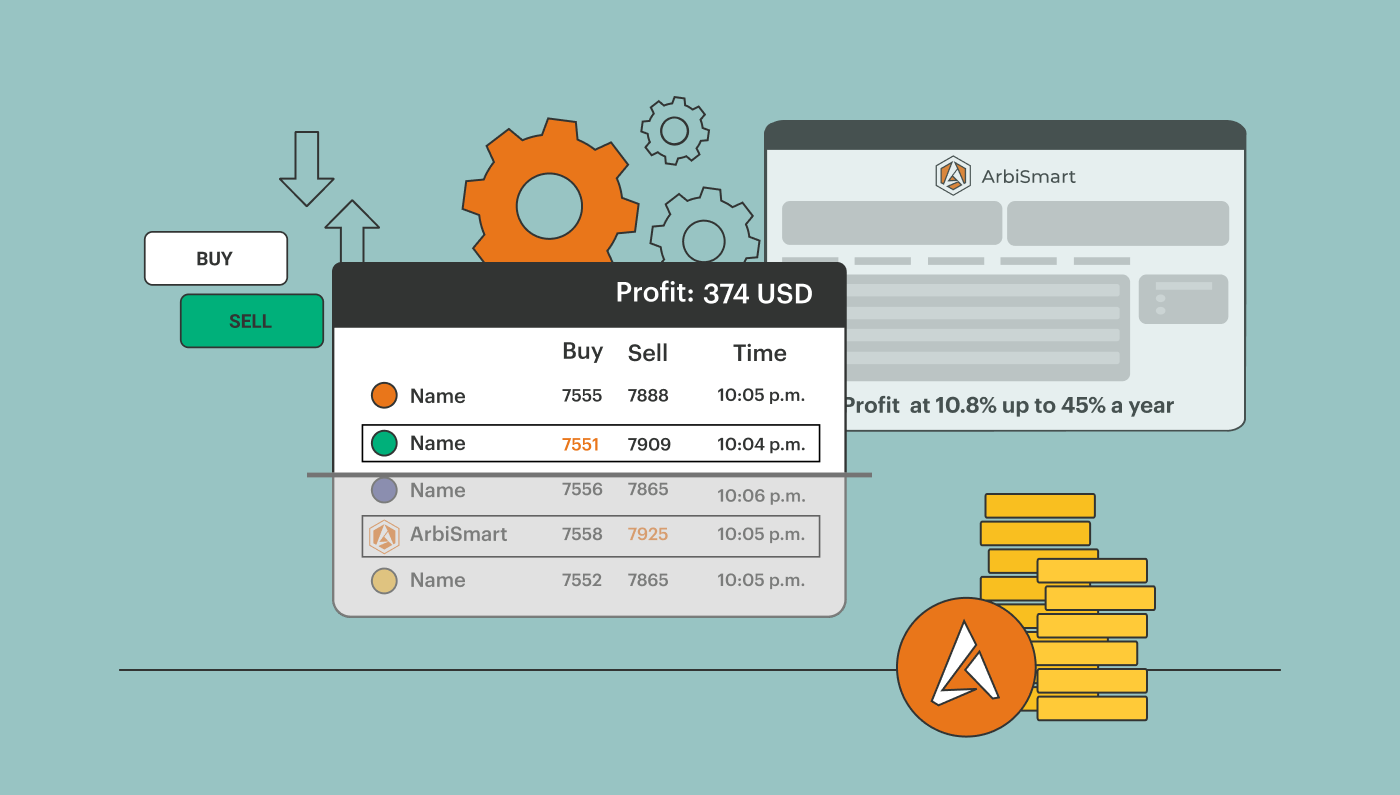

Our platform, powered by our native token RBIS, performs automated crypto arbitrage – a low risk investment strategy that exploits temporary price differences across exchanges. ArbiSmart delivers profits that start at 10.8% and reach as high as 45% a year, depending on the amount deposited. These passive profits are far higher than the average yield from both CeFi and DeFi protocols, while risk is minimal. One reason for this is that price discrepancies between exchanges will continue to occur, even if the market suddenly crashes, making it the perfect hedge against a sudden, unanticipated shift in market trajectory.

In addition to passive profits from crypto arbitrage, and capital gains from the rising value of the RBIS token, (which has already gone up by 650% in just two years), you can also provide liquidity for a profit, but with a much better APY than any fully DeFi platform. By locking up your funds for a pre-set period, you can make as much as 1% a day in interest depending on the size of your investment.

A major advantage of CeFi that ArbiSmart offers is regulatory oversight. The platform is fully EU licensed and regulated with all the protections that this entails from external auditing, separation of client and company funds and account fund coverage to KYC procedures and strict technological security requirements. In addition, unlike its DeFi counterparts, ArbiSmart provides expert 24-hour service and support. Moreover, there are no keys to be lost and the team can always assist you in re-accessing your account.

ArbiSmart excels in combining the benefits of both DeFi and CeFi to deliver unparalleled security and profitability. The future of global financial services is likely to favor a middle ground rather than a scenario where either decentralized or centralized systems dominate completely.

To find out about a wide variety of additional crypto-related trends and topics from yield farming to trading non-fungible tokens, check out the ArbiSmart blog.