Crypto Trading Tools and Strategies Explained: How to Buy and Sell Cryptocurrency

Before we dig in and look in greater detail at particularly effective crypto trading strategies and tools, let’s take a brief look at how cryptocurrency markets work.

Like other financial markets, cryptocurrency exchanges are environments where assets are bought and sold. Prices will rise and fall based on a variety of factors, such as supply and demand, market sentiment, regulatory developments and more.

There are numerous ways to buy and sell cryptocurrency, from HODLing for those taking the long view to a day trading cryptocurrency strategy for those preferring a short-term investment. There are also a variety of tools that investors can use to facilitate their trading like margin that allows you to increase your market position and risk management features such as stop loss or take profit orders.

Then of course there are all the different ways in which investors can try to anticipate the trajectory of a specific asset. For crypto traders this can include fundamental analysis of the demand for a token, the viability of the company behind it and the utility of the product or service that the company is offering. Investors can also try to predict market movements with technical analysis, using charting tools to analyze trends and patterns, track price movements, provide price averages and measure volatility.

For example, when you buy and sell cryptocurrency and want to project the future direction of your chosen coin, one of the most valuable technical indicators you can use is moving averages.

How Moving Averages Work in Crypto Trading

What is a moving average? In simple terms, it is a technical tool, a line on a chart that identifies an asset’s mean price over a set of time periods, making it a useful indicator of the coin’s general trajectory.

Major spikes or drops, followed by a rapid return to the previous price will not be shown on the moving average as they would on a regular price chart. Instead, a moving average in crypto trading will focus on the mean, enabling you to identify a point of equilibrium, where the price settles at its fair value.

One specific type of moving average that is of value to investors looking to buy and sell cryptocurrency is the ‘exponential moving average (EMA), which gives greater weight to average prices over more recent time periods. EMA’s can illustrate a cryptocurrency price trend, showing support and resistance levels, with greater accuracy by using the most current data points.

While a moving average can provide a great baseline for the price of a cryptocurrency, its value is limited since this is a lagging, or trend following indicator, meaning that it is based on the average price over past periods. It can only provide insight relating to historic price movements and cannot reliably predict future market activity. Therefore, moving averages in crypto trading should be used in conjunction with other tools showing the price action of your chosen digital asset.

How to Evaluate and Manage Your Risk

Moving averages provide just one type of data, within a single category of technical indicators. There are numerous methodologies for anticipating price direction, which can combine to provide a strong indication of a cryptocurrency’s trajectory. However, it should be noted that when it comes to day trading on the digital currency exchanges, any attempt to buy and sell cryptocurrency, exploiting short-term price action on a highly volatile market, will be risky.

There are certain ways that you can mitigate your risk. For example, when it comes to choosing where to invest, the best website to buy and sell cryptocurrency, whatever your strategy, will be one that is fully licensed and regulated. The crypto space suffers from high levels of criminal activity, as a result of the fact that the entire digital currency arena is based on anonymity and is only minimally regulated. While regulatory bodies and government entities are gradually catching up with developments in the crypto sphere, the entire ecosystem is critically under-legislated meaning that there is little oversight and few consumer protections.

If, however, you select a licensed crypto investment platform, you can benefit from a range of regulatory safeguards that include external auditing, insurance coverage for client capital, separate company and client accounts, compliance with KYC/AML procedures, implementation of strict data security protocols and more.

Obviously, you will also want a company with a solid reputation for trust and transparency that will not suddenly charge sky-high hidden costs and will enable you to buy and sell cryptocurrency without fees on each side of every transaction.

One of the main things you can do to reduce your exposure when you enter the crypto world is to choose the safest possible crypto investment strategy, and that is broadly acknowledged to be crypto arbitrage.

How Crypto Arbitrage Works

Crypto arbitrage is rapidly becoming one of the most commonly used trading strategies in crypto. The reason for its increasing popularity is that it is widely considered by both the crypto and traditional financial community to be one of lowest-risk forms of investing.

The reason it is such a low-risk cryptocurrency trading strategy is that it does not involve profiting from crypto market volatility. Rather, it involves taking advantage of price inefficiencies across exchanges. These are instances where a cryptocurrency is temporarily available at different prices at the same time.

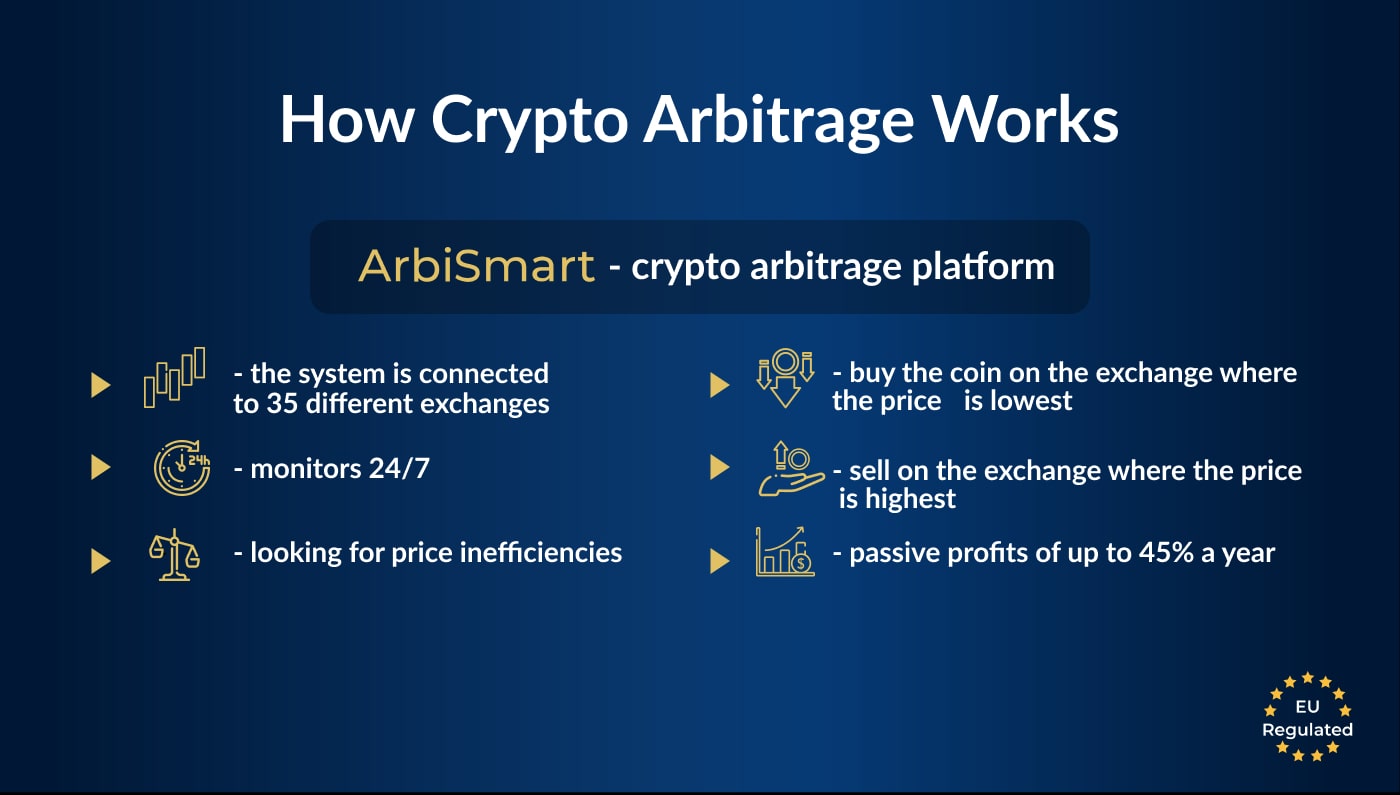

To understand a little better, let’s take a look at ArbiSmart, our EU licensed and regulated, crypto arbitrage platform. The system is connected to 35 different exchanges, which it monitors 24/7, looking for price inefficiencies. It will then buy the coin on the exchange where the price is lowest and then instantly sell it on the exchange where the price is highest to make a profit on the spread before the market has time to adjust to compensate for the price discrepancy. The AI-based system is fully automated and once you sign up and deposit funds, it will take over to buy and sell cryptocurrency on your behalf for guaranteed passive profits of up to 45% a year.

Whenever you choose to buy and sell cryptocurrency, the more in-depth analysis you perform and the more up-to-the-minute insights you can gain, the better your chances of market success. No matter which cryptocurrency trading strategy you implement when day trading on the crypto exchanges, the extreme volatility of the crypto markets mean that you are incurring a great deal of risk with every single trade. For this reason, crypto arbitrage, which enables you to generate generous profits on the purchase and sale of digital currencies, without being vulnerable the rapid price fluctuations of the crypto market, is among the safest and smartest investment strategies.

Check out the Arbitrage page of our website to find out more about crypto arbitrage or learn about crypto trading in general on the ArbiSmart blog.