Crypto Minting vs Mining Explained

When it comes to minting vs mining in crypto the main difference is the contrasting way in which coins are created. In this guide we’ll provide a clear picture of how coins are minted and mined and what each process involves.

What Is Crypto Mining?

Mining in crypto is an activity that involves recording and confirming the legitimacy of transactions on the blockchain, a digital public ledger. To perform the verification process and receive cryptocurrency as a reward, the crypto miner needs to solve highly complex cryptographic mathematical problems. Starting with the first Bitcoin ever mined in 2009, each newly mined block means the creation of new coins and enables the maintenance of a centralized log of all existing crypto transactions.

Crypto mining can be a perfectly legal activity so long as it is performed in a jurisdiction where it is permitted by law. However, there are illegal instances of cryptojacking, a form of cyberattack, where criminals install malware or Javascript in browsers to hijack other people’s processing power.

How Is Crypto Mined?

The first step in the process of crypto mining requires the nodes in a blockchain to verify the legitimacy of cryptocurrency transactions. Secondly, the list of confirmed transactions is bundled together and added to an unverified data block. Next, once enough transactions are added to the block, additional data is appended. This includes header data from the previous block in the chain and a nonce, which combine to create a hash. The new hash is added to the unverified block for confirmation by a miner node. To guarantee its integrity, other miners will then review the hash, confirming the legitimacy of the block. Lastly, now that the block is verified, it is published on the blockchain, and the Proof of Work (PoW) is complete. Now we have an immutable permanent blockchain record of the transaction.

What Is Minting in Crypto?

The question of crypto minting vs. mining and how they intersect comes down to the fact that minting is part of mining. Once a coin is hashed, this triggers the minting process. This echoes the traditional financial process of mining gold and then minting coins for circulation.

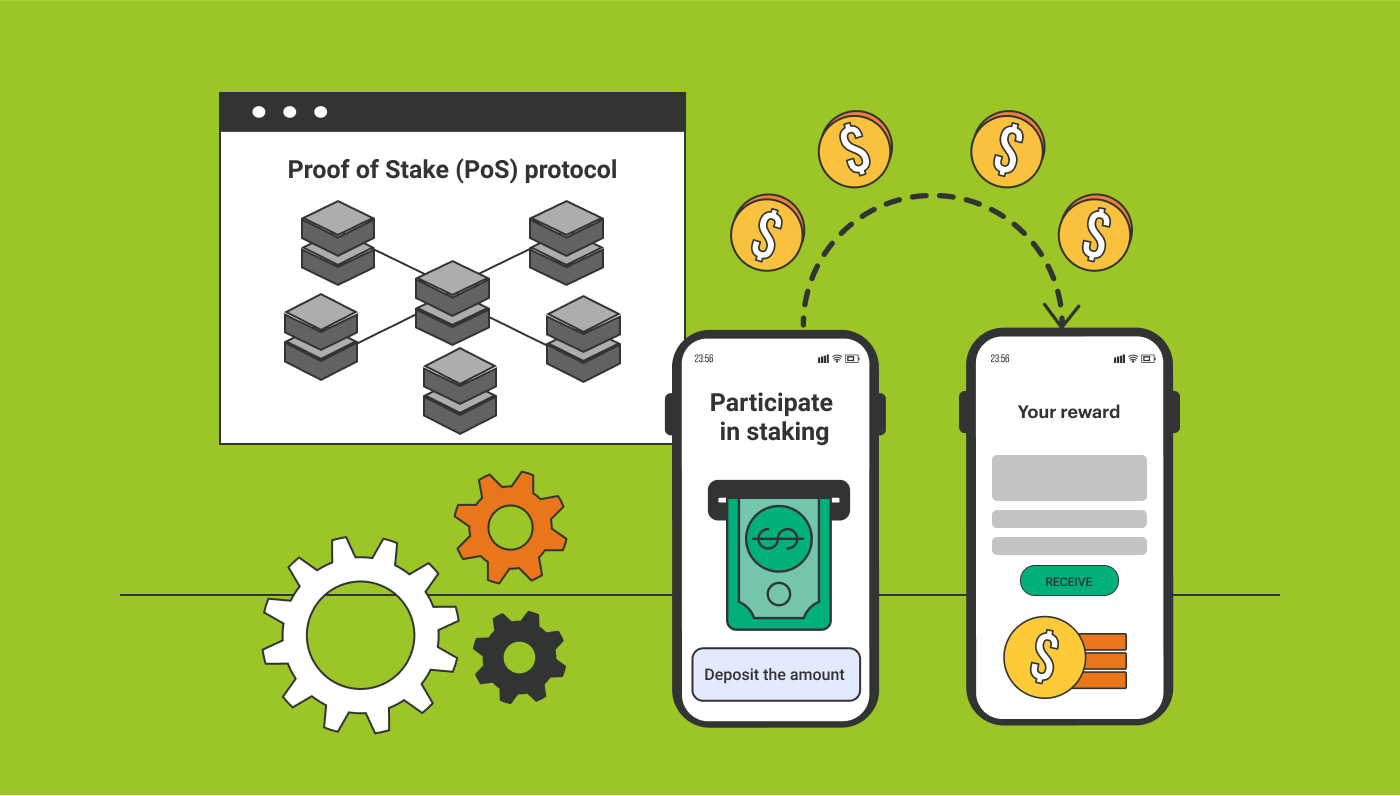

While crypto mining uses a Proof of Work (PoW) protocol, as outlined above, crypto minting uses a Proof of Stake (PoS) protocol. This is a process known as staking whereby new blocks are created through the authentication of information, which is then recorded on the blockchain. Staking requires depositing a substantial sum to participate and it can expose the individual to an exceptionally high level of risk. However, the rewards, which come from transaction fees paid by system users are also potentially very high.

As we can see, both minting and mining involve coin creation. Both generate new tokens in a decentralized fashion, securing the blockchain, but the means to that end differ. To distinguish between PoW and PoS protocols, we need to understand the minting process.

How Is Crypto Minted?

An examination of crypto minting vs. mining shows that the processes are vastly different.

When staking, the first step is to deposit funds in order to be able to participate in a Proof of Stake. Among those who have staked money certain accounts are then randomly chosen to record and validate blockchain data. This ensures that no single individual providing a stake, known as a forger, can take control of the token. However, the larger the amount staked, the greater the chance that the account will be chosen to verify data.

A Greener, Simpler Strategy

Here at ArbiSmart, with our automated crypto arbitrage platform, no time, effort or huge expenditure of electrical power is required, as it is with mining.

Also, in contrast to minting, even though profits are substantial, there is close to zero risk. Additionally, while minting involves a large initial deposit and waiting period before you can earn new coins with ArbiSmart you can start earning straight away, with a minimal investment. There is also no need for a computer to verify transactions or special software, just an internet connection.

You register, deposit funds and then the platform takes over while you get on with your day. Your fiat or crypto is converted into our native token, RBIS, and used for trading crypto arbitrage.

This type of investing involves taking advantage of disparities in the trading volume or liquidity levels between bigger and smaller exchanges, which result in a digital asset becoming temporarily available on various exchanges, at different prices at the same time.

ArbiSmart’s algorithm, which is scanning nearly 40 exchanges simultaneously, 24/7, will find a price disparity, and then buy the digital asset on the exchange with the lowest price before instantly selling it for a profit on the exchange with the highest price.

Because price differences across exchanges will continue to arise, in bull or bear markets, ArbiSmart is an excellent hedge against a crash.

Crypto arbitrage passive profits start at 10.8% and reach up to 45%, depending on the size of your investment and you also receive compound interest. In addition, you will earn capital gains on the rising value of the RBIS token, which has already risen by 730% in just two years.

Finally, there are profits just for storing your funds on the platform. You can make as much as 1% a day for locking up your assets in a closed savings account. This is similar to the act of holding them in a smart contract for a Proof of Stake (PoS) network to be put to work validating transactions but simpler, lower risk and with higher returns.

Want to learn more about crypto arbitrage, or a vast selection of other topics relating to cryptocurrencies, the blockchain and decentralized finance? Visit the ArbiSmart blog.