Crypto Derivatives Trading Explained

Bitcoin has had an incredible year, with the huge growth in the popularity of this exciting asset and the increasing legitimacy of cryptocurrencies in general having led to a surge in crypto derivatives trades.

In this short guide to crypto derivatives trading, we will be examining what derivatives are, the forms they take, and the advantages and disadvantages they offer to financial market traders.

What Is Crypto Derivatives Trading?

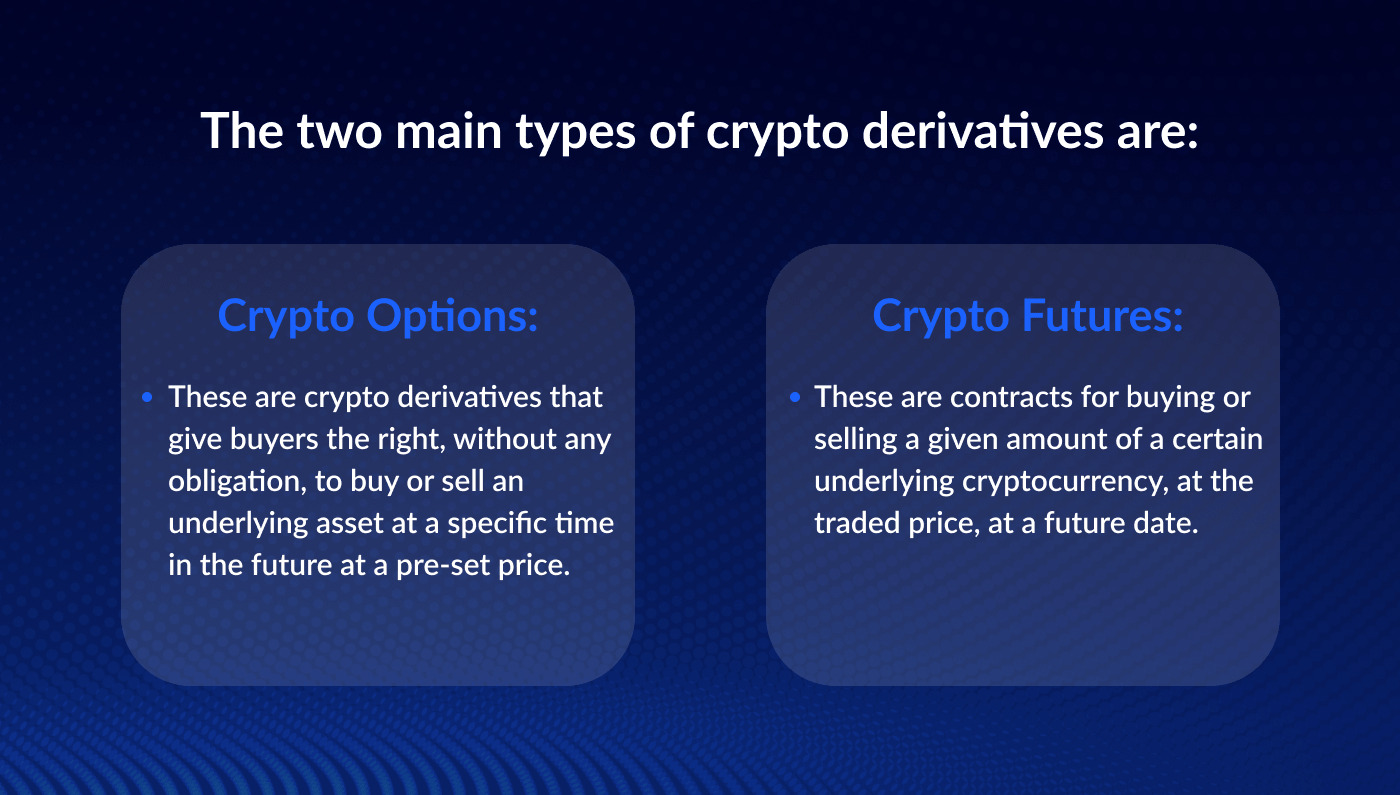

Crypto derivatives are financial products whose value is derived from an underlying cryptocurrency asset. When you trade crypto derivatives, you are entering a contract to buy or sell the underlying asset on a specific future date, at a pre-determined price. You make a profit by correctly anticipating the price trajectory of the cryptocurrency over the duration of the contract. The two main types of crypto derivatives are cryptocurrency options and futures:

Crypto Options: These are crypto derivatives that give buyers the right, without any obligation, to buy or sell an underlying asset at a specific time in the future at a pre-set price. However, if the buyer chooses to exercise their right to purchase the asset then the seller must deliver the asset for the pre-agreed price.

Crypto Futures: These are contracts for buying or selling a given amount of a certain underlying cryptocurrency, at the traded price, at a future date. The contract expiry date for bitcoin derivatives futures determines when the contract will be settled by the buyer and seller. A variant of this is perpetual swap trading, where there is no settlement expiry date.

The Upside to Crypto Derivatives Trading

Highly liquid, providing a great hedging tool and a fantastic way to diversify a portfolio, derivatives in crypto trading let you gain access to the digital currency markets without having to hold any actual cryptocurrency.

An additional benefit of derivatives crypto trading is that it can protect against the short-term market volatility of the underlying asset. No matter what is suddenly happens now to the price of your chosen cryptocurrency, it will not impact your profits as the derivative contract is settled at a pre-determined price.

Another major factor is that it allows for the easy use of leverage. So, what is leverage and how does it work?

Leverage is a means of increasing your trading power, controlling a larger position on the market, as much as a hundred times the size of your investment. Trading derivatives in crypto with leverage is very straightforward, and when you are trading perpetual swap products there isn’t even the need to take out a margin loan as collateral, making for a completely hassle-free experience.

The Downside to Crypto Derivatives Trading

The crypto markets are characterized by dramatic price fluctuations, making them a risky option and this exposure is heightened when leverage enters the picture.

While leverage can offer a great way to maximize your profit potential, there is serious risk involved in the overleveraging of derivatives in crypto trading. The extreme volatility of the crypto markets means that liquidation could occur very easily. In fact, with 100X leverage, the market only needs to shift 1% in the wrong direction, and you could hit your bankruptcy price, with your position being liquidated and all your collateral going to cover your losses.

A Safer Way to Trade Crypto

There is one way to trade cryptocurrencies that is far less risky, without requiring you to compromise on profits and that is crypto arbitrage.

Crypto arbitrage allows you to generate returns without being vulnerable to crypto market volatility and is widely acknowledged to be among the lowest-risk forms of investing. It involves exploiting temporary price inefficiencies across exchanges, which are instances where for just a few minutes, a coin will be available at different prices at the same time.

Here at ArbiSmart, our fully automated, EU licensed crypto arbitrage platform is connected to 35 exchanges, which it tracks 24/7, monitoring hundreds of cryptocurrencies at once, to identify crypto arbitrage opportunities. It buys the coin on the exchange where the price is lowest then instantly sells it on the exchange where the price is highest, to make a profit, before the market adjusts and the price inefficiency is resolved. You simply register, deposit funds, and the ArbiSmart platform takes over, executing trades at lightning-speed, to generate returns reaching as high as 45% a year.

The world of cryptocurrencies offers countless lucrative opportunities, and crypto derivatives in particular are extremely attractive to investors because they provide a great hedging tool, allow for fast and simple use of leverage, provide high liquidity and the ability to short with ease. However, the intense volatility of the crypto exchanges make them a high-risk home for your capital, which is why crypto arbitrage offers the best of all worlds, combining high profit potential with minimal exposure. To learn more about cryptocurrency in general, check out the rest of the ArbiSmart blog and to learn about arbitrage specifically, click here.