China’s e-CNY, the Digital Yuan, Explained

China’s official digital currency, the e-CNY, also referred to as the digital yuan, is a government- backed Chinese central bank digital currency (CBDC), with equal value to the yuan.

What is e-CNY?

The e-CNY’s works the same as cash, and can be used with a card or mobile app. Chinese government official are strongly urging the country’s citizens to adopt the currency though many around the world see the e-CNY main objectives to be a bid to strengthen the government’ surveillance capabilities and gain tighter control over the economy.

How Quickly is e-CNY Being Adopted?

Over a hundred countries are exploring the introduction of their own CBDC but less than 30 have even entered the pilot stage. Leagues ahead of other countries interested in introducing an official digital currency, eCNY is being rapidly rolled out, and pilot programs are well underway across four entire provinces.

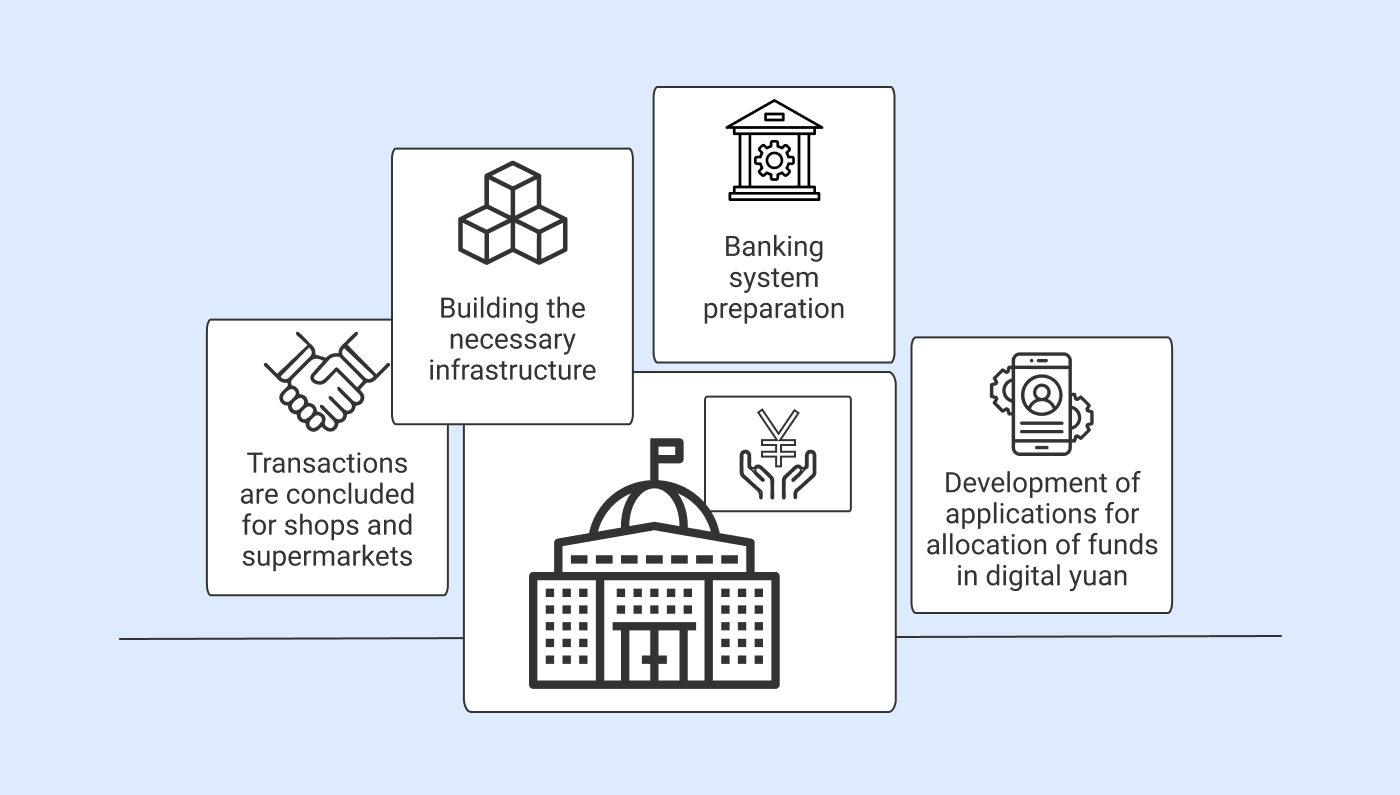

The government and local authorities are encouraging adoption, with deals for convenience stores and supermarket payments in digital yuan, the signing up of merchants, and more. The construction of the necessary infrastructure is well underway, with the preparation of the banking system, and the development of applications to earmark digital yuan funds for various purposes.

So far in 2023 developments include the extension of cross-border payments using e-CNY, with CBDC pilots targeting the Association of Southeast Asian Nations (ASEAN), with a focus on trade. The number of regions involved in digital yuan pilots keeps growing, with the latest being Guangxi, on China’s Western border with Vietnam.

Recently the People’s Bank of China announced that the e-CNY would be included in MO reporting going forward, meaning the reporting of the monetary supply in circulation. The figure at the end of 2022 was 13.61 billion yuan ($2 billion).

What Are the Dangers of e-CNY Adoption?

Ideally, a government sanctioned currency is meant to boost efficiency and drive innovation in the financial arena. However, in reality, it has the capacity to be used as a tool for social control, providing the government with a way to monitor Chinese citizens and evade international financial sanctions.

The Chinese government has social and political motivations as well as a financial agenda.

With the rise in smartphone use, mobile payment systems surged in popularity in China, since a large segment of the population did not own credit cards. The digital yuan enables the government to track these individuals with a payment method they are already familiar with. Over the last decade, cash was mostly replaced by WeChat Pay and AliPay, and these became the primary payment method for 80% of the population in major cities and around 65% percent in rural areas. By working to gain control of how citizens make payments, the government can take this power from the tech companies, who had access to user purchase data and a wealth of financial regulatory influence.

In direct contrast to decentralized currencies like Bitcoin and Ethereum, that use the blockchain, the e-CNY is issued directly by the centralized Chinese central bank. The bank is under government authority and anonymity is no longer a guarantee. However, the Chinese central bank claims that for account holders with balances below a certain amount, only a phone number will be required to confirm their identity.

A worst-case scenario would be for a critic of the government to lose access to their wallet and therefore their freedom and mobility, while the authorities would gain full visibility into their lives.

Is a CBDC a Good Digital Currency Option?

Privacy concerns are a massive issue that needs to be taken into consideration, as governments enter an arena that had previously been the exclusive domain of private banks. In contrast, cyptocurrencies are outside the control of government even though they are capable of serving exactly the same functions.

In the case of China, the concerns are even greater, when their government’s history of controlling the activities of its citizenry are considered.

Here at ArbiSmart, we are committed to true financial freedom, and believe that the only way to guarantee your autonomy is with cryptocurrencies like Bitcoin, Ethereum and of course our own native token RBIS.

RBIS ownership provides a great investment opportunity, since the coin is on track to soar in value over the coming year. In addition, it gives you access to a number of revenue generating services within the ArbiSmart financial ecosystem.

For instance, you can earn up to 147% a year in passive profits just for storing capital in our interest-bearing wallet, and the ArbiSmart exchange enables you to buy and sell FIAT and crypto, at rates, unmatched anywhere in the industry.

For better or worse, as digital finance innovation gains ground, it has become the new technological frontier after space exploration and the internet. We are likely to see more CBCD’s in the coming decade as China’s competitors fear being left behind and losing their status in the global financial arena. However, unless issues of privacy are handled effectively and transparently, decentralized cryptocurrencies offer a far safer alternative.

To learn more about CBDC’s, blockchain technologies, emerging and established digital currencies as well as a range of crypto market investment strategies check out the ArbiSmart blog.