CEX Vs. DEX: A Comparison Between Centralized and Decentralized Crypto Exchanges

There are two types of crypto exchanges, centralized (CEX) and decentralized (DEX). In this post we’ll be examining the differences between the two, including the advantages and disadvantages of each.

What is a centralized exchange (CEX)?

As the name suggests, a centralized exchange or CEX is managed by a centralized entity. The organization controlling order execution acts as the middleman between the traders who are buying a cryptocurrency and those who are selling it. Frequently, though not always, they operate under regulatory oversight. Some of the best known CEXs are Binance, Kraken and Coinbase and they are more popular overall than DEXs, with larger userbases and far greater trading volume.

How does a CEX work?

Transactions are executed using an order book, which records and verifies all buy and sell orders, and lists all open orders. An order is placed by a trader who wishes to buy or sell a cryptocurrency at a given price. The order stays open until another trader accepts the offer from the trader who placed it. Market orders are meant to be executed quickly at the market price, whereas Limit orders have a minimum or maximum price at which the trader is willing to make the transaction, so they may take longer to find someone to accept the offer. A CEX is considered the user-friendly choice for novice investors, as all you need to do is place an order and that’s basically it.

All centralized exchanges have their own crypto wallets, so users can store the crypto they buy, but this means they won’t hold the private keys that secure their personal funds.

A CEX will strictly select the coins that it lists, to avoid failed projects or scams, and will have tough criteria that new cryptocurrencies need to meet.

In addition, centralized exchanges do not guarantee anonymity. In fact, they generally require users to perform Know Your Client (KYC) and anti-money laundering (AML) procedures, regulatory requirements that verify the identity of the user to prevent fraud.

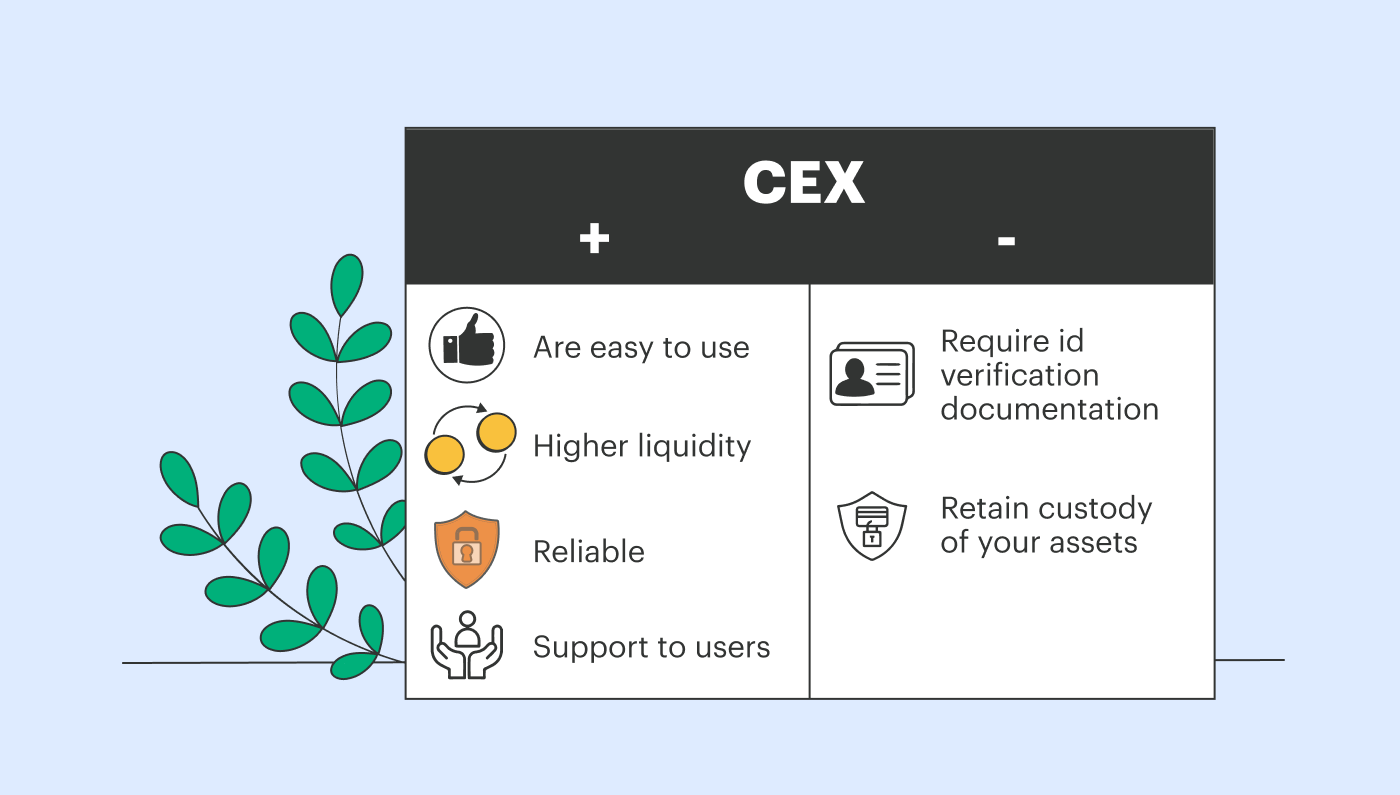

CEX advantages

Centralized exchanges offer a number of benefits as they:

- are easy to use, making crypto trading accessible to the average investor

- offer higher liquidity, as more users make it is faster and easier to find buyers and sellers

- are more reliable, complying with regulations to safeguard against criminal activity

- provide plenty of choices including futures, lending, staking, spot and NFT trading

- offer support to users who may need assistance with performing trading activities

CEX disadvantages

Centralized exchanges also have specific drawbacks as they:

- require ID verification documentation, preventing users from remaining anonymous

- retain custody of your assets, exposing you to the risk of fraud or the exchange failing

What is a decentralized exchange (DEX)?

On a decentralized exchange, or DEX, there is no single entity managing order execution. Rather transactions are fully automated using smart contracts and decentralized applications (dapps). A DEX allows its users to trade with one another directly without any middlemen. Examples of popular DEXs include UniSwap, SushiSwap and PancakeSwap.

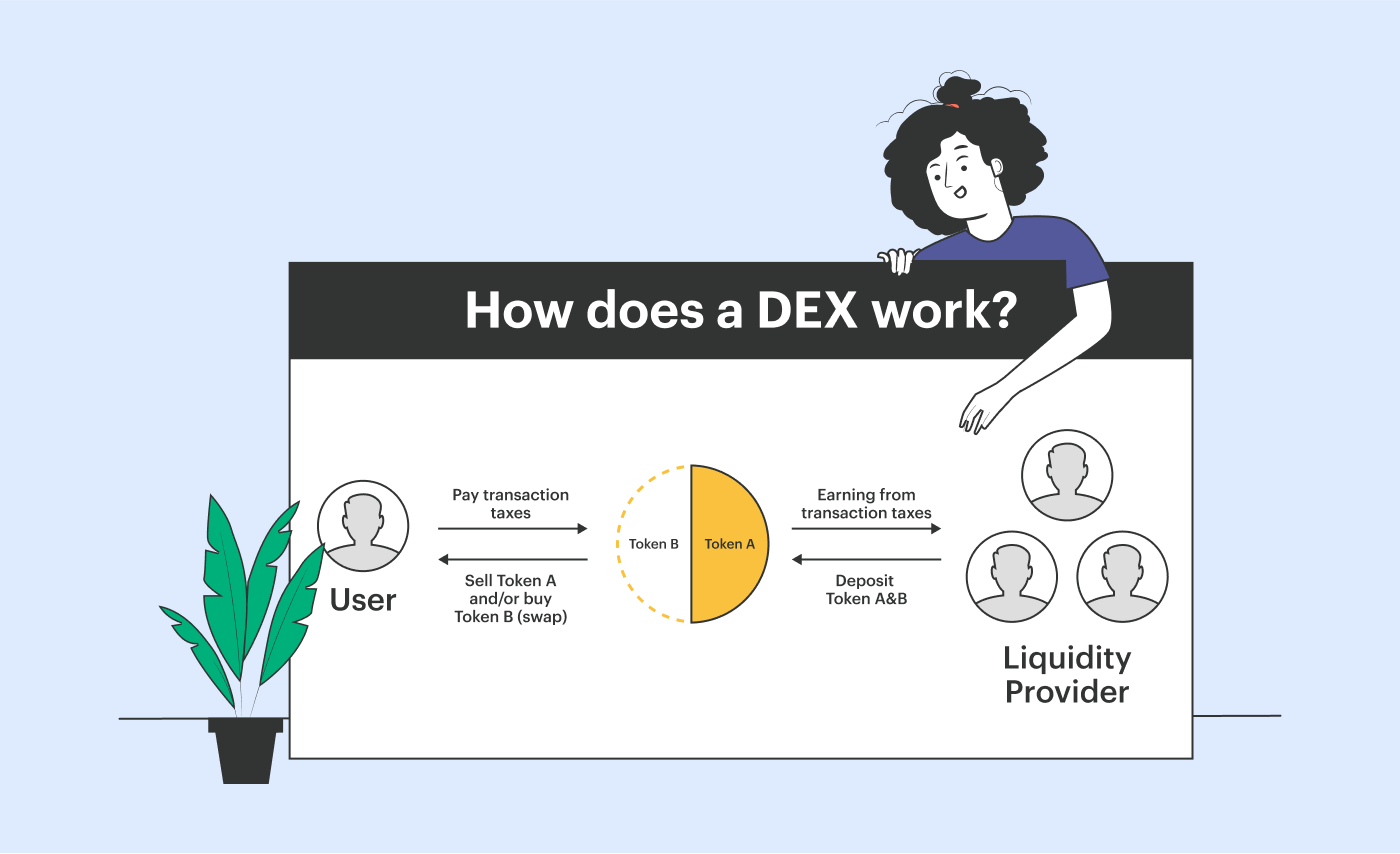

How does a DEX work?

With a DEX, orders are either made via an order book that uses an algorithm, or they are made using an Automated Market Maker (AMM) model.

With the AMM model, a smart contract pools the liquidity from users and prices the assets within the pool using algorithms. The liquidity provider then earns a fee for every time a trader executes a swap in the pool. In cases where liquidity in the pool is low and a trader wants to execute a big swap they run the risk of slippage, meaning the cost for purchasing will exceed the market price. The cost at the time the transaction is submitted will be lower than when it is executed, so they will pay a higher price than they initially expected.

A decentralized exchange offers total anonymity, since no identification is required, which increases the accessibility to financial services. DEXs also don’t discriminate about the coins and tokens they list. This means greater choice and the chance to get in on the ground floor with emerging opportunities but also exposure to potential scam projects. However, it is worth noting that FIAT is not available on decentralized exchanges.

While there is no central authority controlling and monitoring activity, with the power to freeze assets, and no custodian with the keys to your wallet, there is also no support and no recourse or refunds in the case of theft or other criminal behavior.

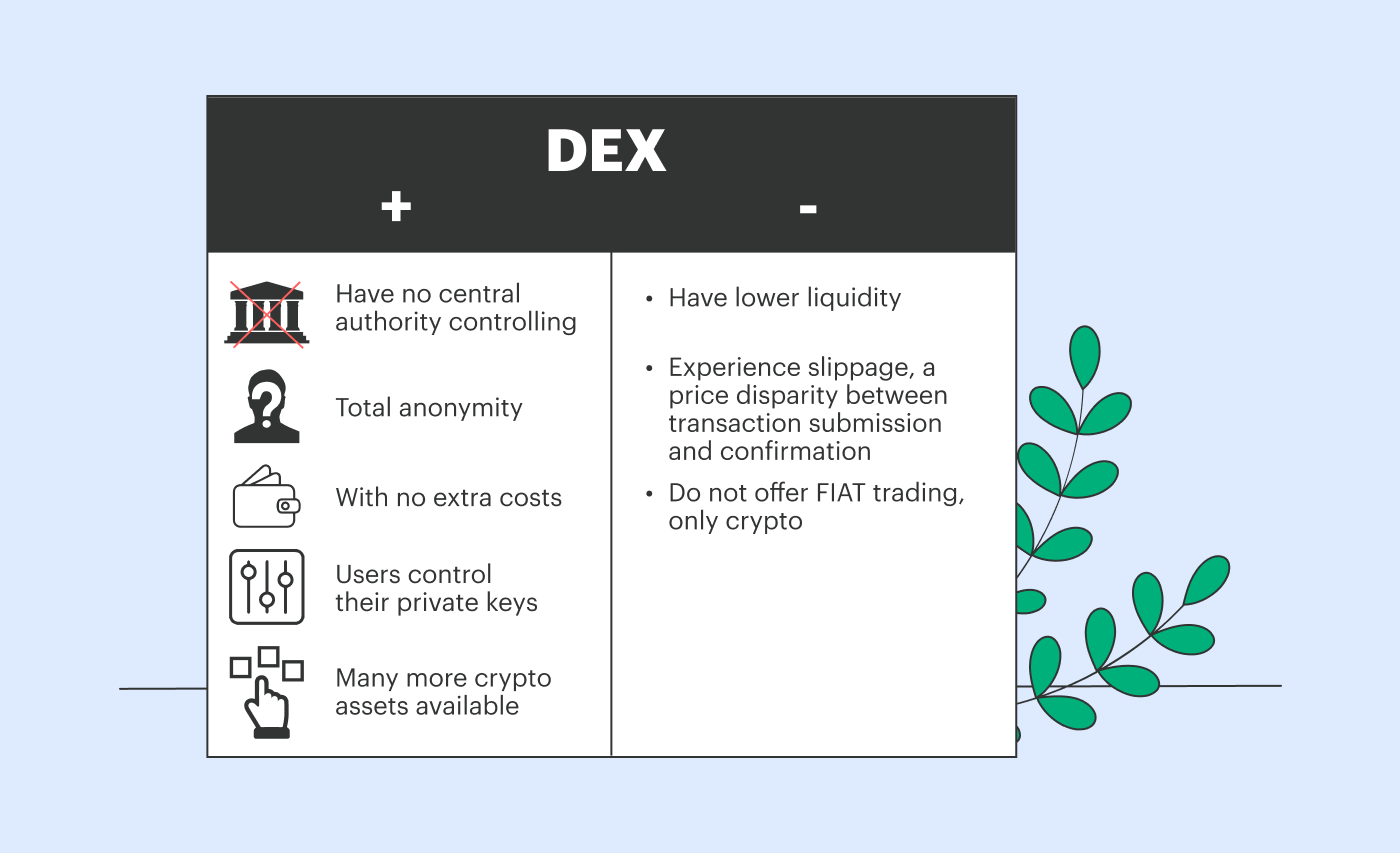

DEX advantages

Decentralized exchanges offer certain benefits as they:

- have no central authority controlling, monitoring, or interfering in user transactions

- enable total anonymity with no ID verification requirements, and access to all

- The only charges are transaction fees, with no extra costs on buying and selling crypto

- Users control their private keys and as custodians always have access to their own funds

- There are many more crypto assets available, great for early adopters of new coins

DEX disadvantages

Decentralized exchanges also have some downsides as they:

- have lower liquidity so finding buyers and sellers is harder and slower

- experience slippage, a price disparity between transaction submission and confirmation

- do not offer FIAT trading, only crypto

A Comparison of Decentralized and Centralized Exchanges

The differences between a CEX and DEX are outlined in the below table:

| CEX | DEX |

| Run by a centralized authority that manages order execution | Run using automated dapps and smart contracts with no middlemen |

| Controls access to all cryptocurrencies | The participants control access to all cryptocurrencies |

| Licensed, complying with requirements from regulatory authorities | Unregulated, with no licenses and no government interference |

| User-friendly without a learning curve for novice crypto traders | More complexity to how it functions, and the risks involved |

| Many CEXs require KYC from users, identity verification documentation | Users can remain anonymous as no KYC is required |

| Liquidity is higher, provided by the CEX and institutional investors | To date, liquidity on DEXs is lower, and provided by exchange users |

| Less currencies but more trading options like spot trading and futures | Many more available currencies but currently, less trading options |

A perfect combination of the best centralized and decentralized features

Here at ArbiSmart, we offer the best of all words. Since our interest-generating wallet is centralized, we are able to offer the highest levels of security. As an EU authorized and registered financial services provider we comply with the strictest regulatory protocols including KYC and AML requirements. The ArbiSmart wallet and financial services ecosystem is exceptionally user-friendly, making it accessible to anyone wishing to store, exchange or buy crypto or FIAT currencies and there is professional support, available 24 hours a day.

Also, as a custodian of client funds, ArbiSmart is able to offer generous passive profits from interest on savings plans, reaching as high as 147% a year, which would not be available on a self-managed wallet. Also, the system enables users to buy crypto through ArbiSmart, with discounts on digital asset purchases of up to 50%!

Moreover, in H1 2023, we will be introducing the ArbiSmart DeFi protocol where we will offer self-managed arbitrage, a yield farming program, with one-of-a-kind gamification features, and a professional exchange. These new utilities will not only strengthen the value of RBIS, our native token and offer their own revenue channels but will provide all the benefits of decentralization, with none of the drawbacks. Like a centralized system, users will benefit from personal 24/7 support but the DeFi protocol will be free from interference from any central authority, users will always have instant access to funds and be able to maintain complete anonymity, fees will be minimal as there are no middlemen, and the choice of coins and tokens will be very broad providing lucrative opportunities to become an early adopter for the next Bitcoin or Shiba Inu.

To learn more about all kinds of topics relating to crypto and blockchain technologies, check out the rest of the ArbiSmart blog, or open a wallet within 72 hours of this post going live, and get a 30% bonus on long-term savings plans.