A Beginner’s Guide to Bitcoin Exchange Traded Funds (ETFs)

One of the most exciting aspects of crypto’s continuing evolution is the way it can so successfully integrate with more traditional investment channels to create new, more secure, and lucrative opportunities. A great example of this is the way in which crypto investors are now looking to capitalize on the growth of exchange traded funds (ETFs), with a Bitcoin ETF that tracks BTC. However, the road so far has been a bumpy one.

One major obstacle to a Bitcoin ETF has been the fact that Bitcoin and other crypto assets are still largely unregulated, with bodies like the Securities and Exchange Commission (SEC), being reluctant to open the door to ETF trading on such an untested asset-class. However, on October 21st, 2021, trading began on the ProShares Bitcoin Strategy Fund, America’s first ever Bitcoin ETF.

What Is a Bitcoin ETF?

Before we dive into a definition of Bitcoin ETFs, let’s start with an explanation of traditional exchange traded funds. An ETF is a basket of securities that can be bought and sold, like stock, on an exchange. Many popular ETFs track the performance of well-known stock indexes like the S&P 500. They enable the investor to easily diversify their portfolio without having to purchase the actual assets, offering an alternative to trading individual stocks bonds or commodities.

Similarly, a Bitcoin ETF enables investors to trade on the price of the world’s leading cryptocurrency, without having to purchase the asset. This means that they do not have to get to grips with the complexities of buying and trading actual Bitcoin which involves a series of advanced security and storage procedures.

Investing in Bitcoin vs. a Bitcoin ETF

There are additional benefits to purchasing a Bitcoin ETF over just buying Bitcoin, beyond the comparative simplicity of the process. Not only are there none of the security procedures to follow for storing Bitcoin, but there is also no need to deal with the complexities of using crypto exchanges as Bitcoin ETFs can be traded via traditional exchanges.

Moreover, cryptocurrencies are not as well understood across the investment community, as ETFs. As a result, Bitcoin ETFs provide a way for traditionally focused investors to dip a toe into crypto waters, without having to dive into a completely unfamiliar financial world.

Another advantage is the option to short sell bitcoin ETF shares, when you believe that the BTC price is about to drop, which cannot be done when you are trading Bitcoin itself.

Bitcoin ETF Approval

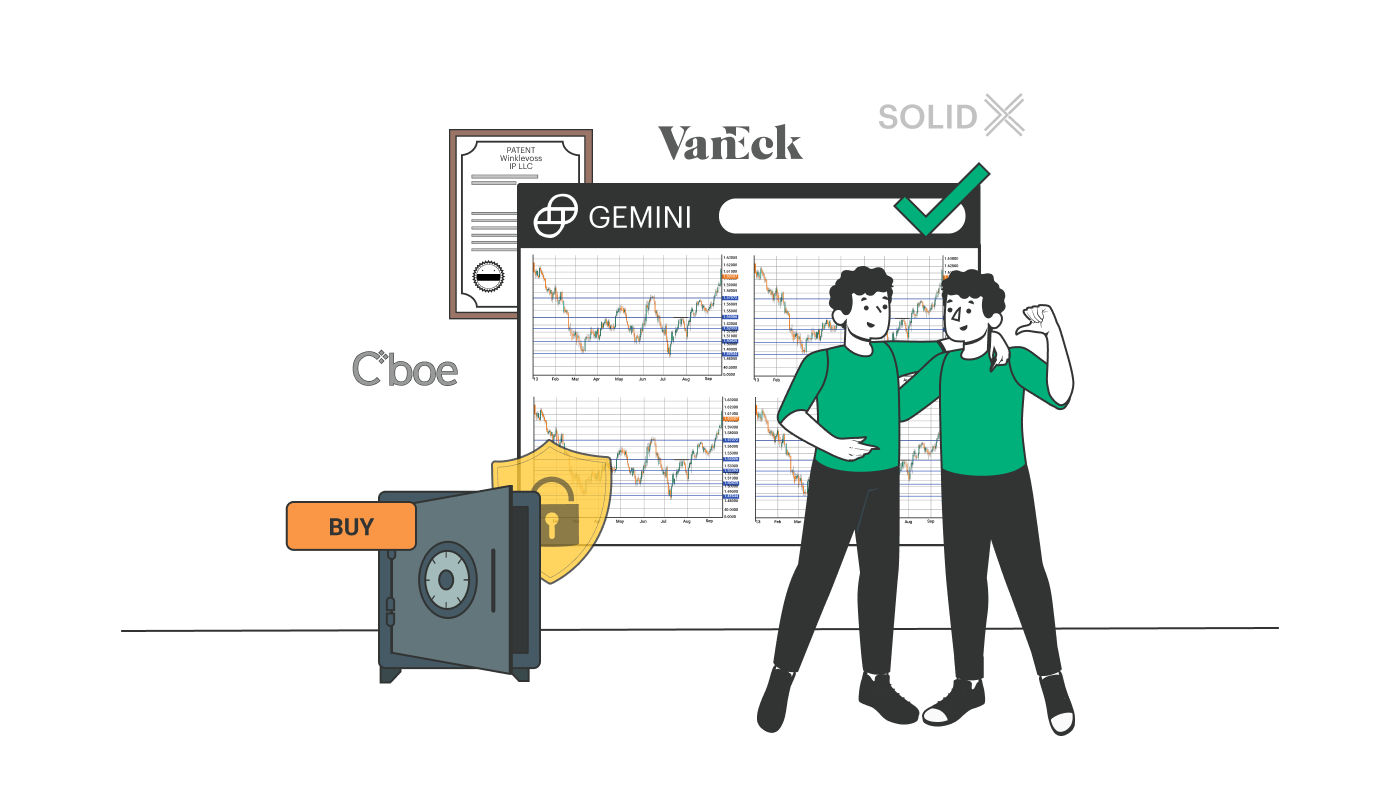

The journey to Bitcoin ETF approval has been slow with regulatory agencies objecting to the fact that Bitcoin is traded on exchanges that are under-regulated, exposing investors to the risk of manipulation and fraud.

The Winklevoss twins, behind the Gemini exchange have been looking to create a Bitcoin ETF since 2017, when their petition to the SEC to launch the Winklevoss Bitcoin Trust was denied. However, their persistence started to pay off a year later, when they were awarded a patent for the Winklevoss IP LLC for exchange traded products.

ETF approval has been sought by others equally eager to be the first to launch a Bitcoin ETF, like Cboe Global Markets, VanEck and SolidX. All hoped to be the first to introduce a physically – backed Bitcoin exchange traded fund that will provide access to Bitcoin price activity while safeguarding against the operational risks of buying and holding cryptocurrency.

ProShares Bitcoin Strategy ETF

In October last year ProShares Bitcoin Strategy ETF, the first bitcoin-related exchange traded fund was launched, with the ticker BITO, and trading began. The ETF tracks the performance of BTC/USD via futures contracts.

On the plus side, the fund makes cryptocurrencies easily accessible and enables Bitcoin short selling. However, on the downside, since it tracks Bitcoin’s future price it won’t be tied directly to the spot price. In other words, the returns from the ETF, based on a future price, could be substantially different than the returns from purchasing Bitcoin directly, as they are not based on the current market price at which Bitcoin is being bought and sold. A Bitcoin ETF is tracking the future price of a highly volatile asset, so this could lead to significant losses if a long-term futures contract has a much higher price than a contract with a short-term expiry.

While You Wait

Without a doubt, the ProShares Bitcoin Strategy ETF is a positive sign that the SEC is moving towards full Bitcoin ETF approval. However, it may be a while before a Bitcoin ETF that is directly tied to BTC becomes a reality.

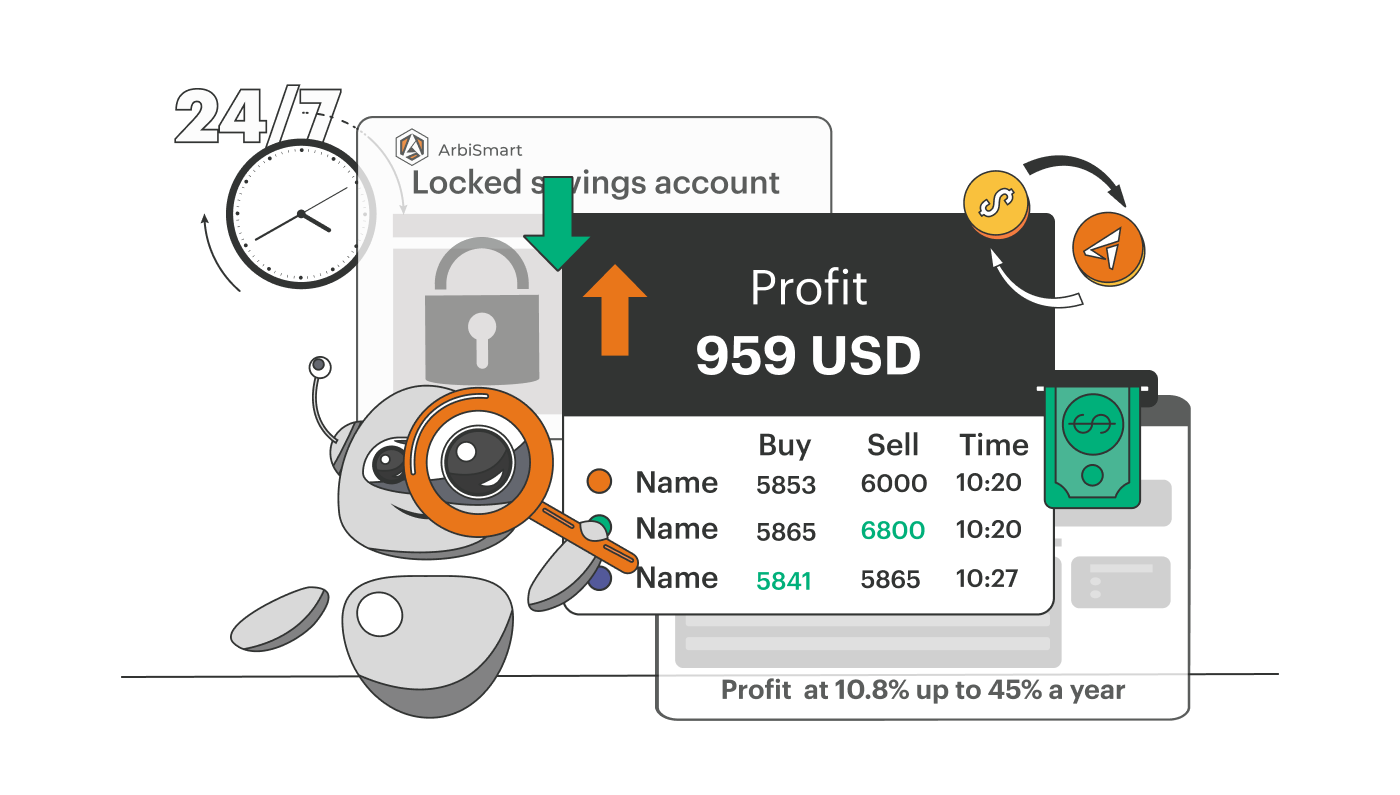

Meanwhile, there are a variety of ways to benefit from cryptocurrency market price fluctuations without having to join an exchange and buy Bitcoin.

Here at ArbiSmart, our fully automated crypto arbitrage platform offers guaranteed annual yields that start at 10.8% and reach up to 45%, depending on the deposit amount.

As a platform user, you just sign up, deposit funds in crypto or FIAT and then the algorithm does the rest. It converts your funds into our native token RBIS and uses them to exploit brief periods in which a coin is available across a few exchanges at different prices at the same time. The ArbiSmart system is connected to 35 exchanges that it monitors round the clock. When it finds a price difference, it profits by buying the coin wherever the price is lowest then selling it wherever it is offered at the highest price.

Price differences occur consistently in both bear and bull markets so even if Bitcoin and other cryptocurrencies crash, you’ll continue to earn a reliable profit.

By storing your funds in a locked, long-term savings account you can also earn additional profits of up to 1% interest a day, depending on the time frame you choose for the lock on your capital.

To drive up demand for the RBIS token even higher, and increase platform users’ capital gains, in the first half of 2022 we are also introducing a series of new utilities, including a yield farming program being introduced later this month, an NFT marketplace and a wallet for both fiat and crypto coming next quarter, with more to on the way in H2.

As crypto gains in global popularity and regulatory bodies catch up with developments on the ground, this rapidly evolving asset class will offer an increasingly wide range of innovative and intuitive investment opportunities. To learn more about a broad range of crypto-related topics, check out the ArbiSmart blog. Alternatively, to get hold of RBIS before the price soars with all the new utilities in the pipeline, buy RBIS now.