The Best Crypto Investment Strategy of 2021

One thing for sure is that everyone has a different idea about what makes for a smart crypto strategy and the answer will depend on the type of trader investing and the market climate at the time.

So far this year, the crypto market has been particularly volatile. The rollercoaster ride began with an extended bull run, followed by a crash and now prices are soaring again. Picking the right crypto investment strategy for 2021 will involve choosing an investment approach that is lucrative, providing a reliable return, which enables you to benefit from rising prices while protecting your gains against a sudden reversal.

Crypto Swing Trading

A popular form of crypto investing is swing trading, a short to medium term approach that exploits price shifts over a period of hours, days, or weeks.

Common swing trading strategies include Trend Trading, which uses technical indicators to predict market direction, going long in an uptrend and short in a downtrend. Then there is a Trading Breakout, which involves taking advantage of the volatility that happens when the price breaks out of its normal range.

On the plus side, it’s a great way to make rapid profits while diversifying your portfolio. However, while the highly volatile and unpredictable crypto market offers plenty of lucrative opportunities, it can be a minefield for a weak hands trader, an inexperienced market participant who lacks conviction in their strategies. A great deal of emotional control is required and for even the most experienced trader, the risks of crypto swing trading are exceptionally high.

HODLing

Choosing a crypto investment strategy in 2021, you want to consider which way the market has been moving and where you think it is headed next. When HODLing, this can involve looking years into the future.

If you are new to the digital currency markets, you may wish to opt for a less risky investment strategy in crypto than swing trading. One of the lowest-risk options is HODLing, choosing top “blue chip” coins like Bitcoin and Ethereum and letting them appreciate over the long-term.

Think about it. If you bought BTC in the 2017 bull run at $20 and then exited this April, you would have more than tripled your investment. If the current bull run continues the price could well hit those recent peaks again very soon.

Whatever asset you choose to trade, fiat or crypto, holding a blue hip investment over the long-term will be better for the health of your portfolio than a series of riskier investments, on a highly volatile market, if only because you will pay lower transaction costs and less taxes.

On the downside, you can’t play the market and benefit from crypto market volatility. You would also be missing out on opportunities relating to new emerging up-and-coming altcoins.

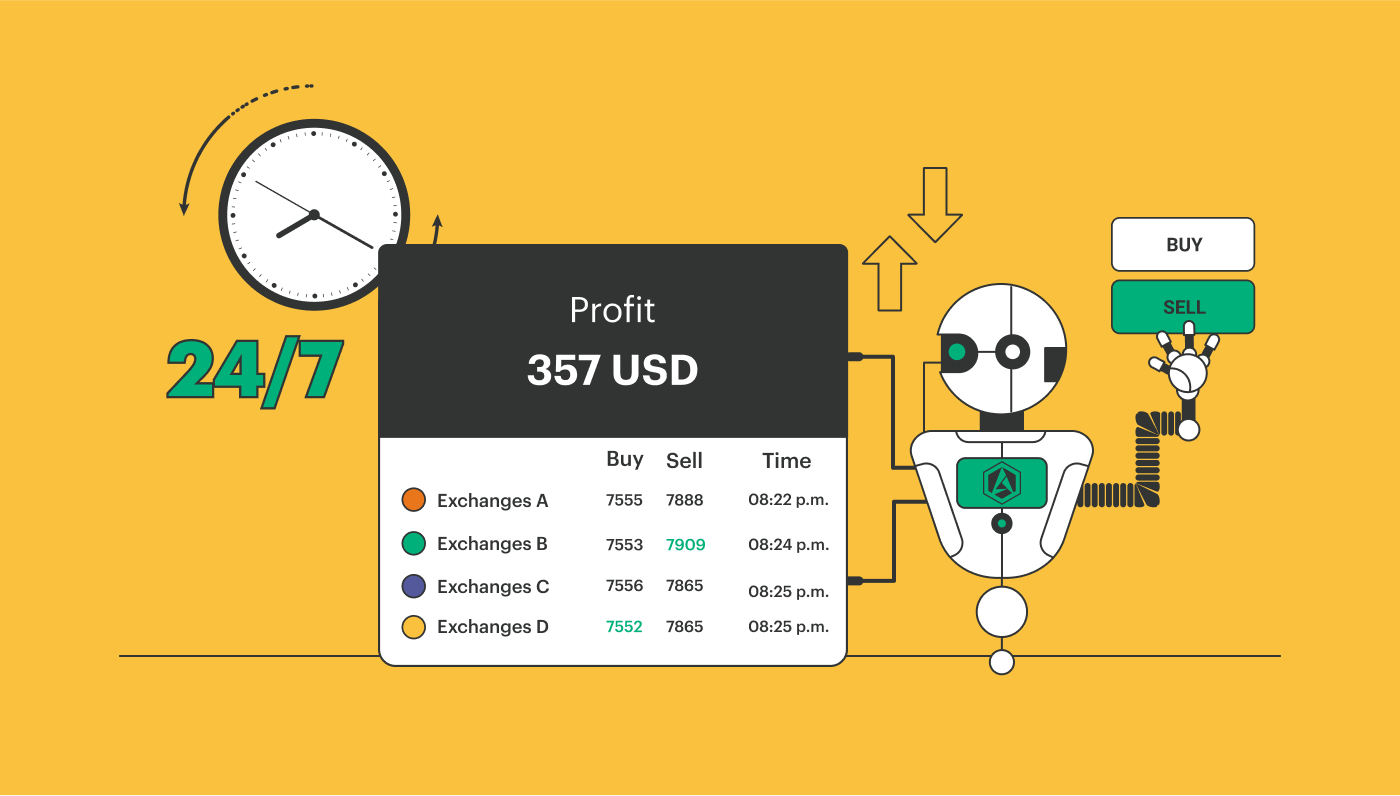

Automated Crypto Arbitrage

Crypto arbitrage offers the best of both worlds. It is low risk, while offering steady returns, as it puts your money to work on your behalf.

Temporarily, a coin can be available on multiple exchanges at different prices simultaneously. So, a crypto arbitrage algorithm will buy the coin wherever the price is lowest and then sell it for a profit on the exchange where the price is highest.

A major advantage of this type of investing in that whether it’s a crypto bull market or bear market, you will earn the same steady returns, as even if the crypto market was to suddenly take a sharp dive, price differences across exchanges would continue to occur with the same regularity as ever. This makes crypto arbitrage an excellent hedge against amarket drop.

Here at ArbiSmart, our EU licensed, automated crypto arbitrage platform is connected to 35 different exchanges, which it monitors 24/7 looking for crypto arbitrage opportunities to exploit on hundreds of coins simultaneously. The algorithm can execute a huge volume of trades at once at lightning speed, generating returns that start at 10.8% and reach as high as 45% year (0.9% to 3.75% a month), depending on the size of your deposit.

The ArbiSmart platform also offers compound interest as well as capital gains on the rising value of RBIS, our native token, which has already gone up by 450%, since it was introduced, just two years ago. Additionally, those who choose to open an ArbiSmart savings account that is locked for a set period can also earn an extra source of passiverevenue that at the top account levels can reach up to 1% a day.

Profit Optimization Strategies

One of the golden rules of investing is to never put all your eggs in one basket and a strong crypto portfolio, particularly in the current, volatile market, will include a diverse range of strategies for a wide array of assets.

To start with there is the popular strategy of Dollar Cost Averaging, where you invest small amounts, at regular intervals and reduce the impact of volatility on large asset purchases.

To boost your bottom line, you can also try putting your money to work while storing it. There is lending, where you loan your crypto to the wallet or platform in return for interest payments, or there is staking, where you allow your funds to be used to help validate network transactions on a Proof of Stake (PoS) blockchain.

For each trader, the best crypto investment strategy of 2021, will depend on their experience level, the time they wish to dedicate to their investments, their risk tolerance and more. However, some common factors make for smart investment approach in all market climates, for all types of investors. The best strategies will mitigate risk if the market takes a sharp turn, and maximize revenue potential, with minimal effort.

Learn more about a broad range of crypto trading strategies, as well as a wide variety of other blockchain, crypto and DeFi related topics, on the ArbiSmart blog.