A Beginner’s Guide to Blockchain Smart Contracts

We use contracts in all the various of areas of our lives, from securing the terms of our employment to purchasing a house or closing a business deal. So how do smart contracts used in blockchain transactions compare to the traditional kind in terms of function, security and ease of use? Let’s take a closer look.

What Are Smart Contracts?

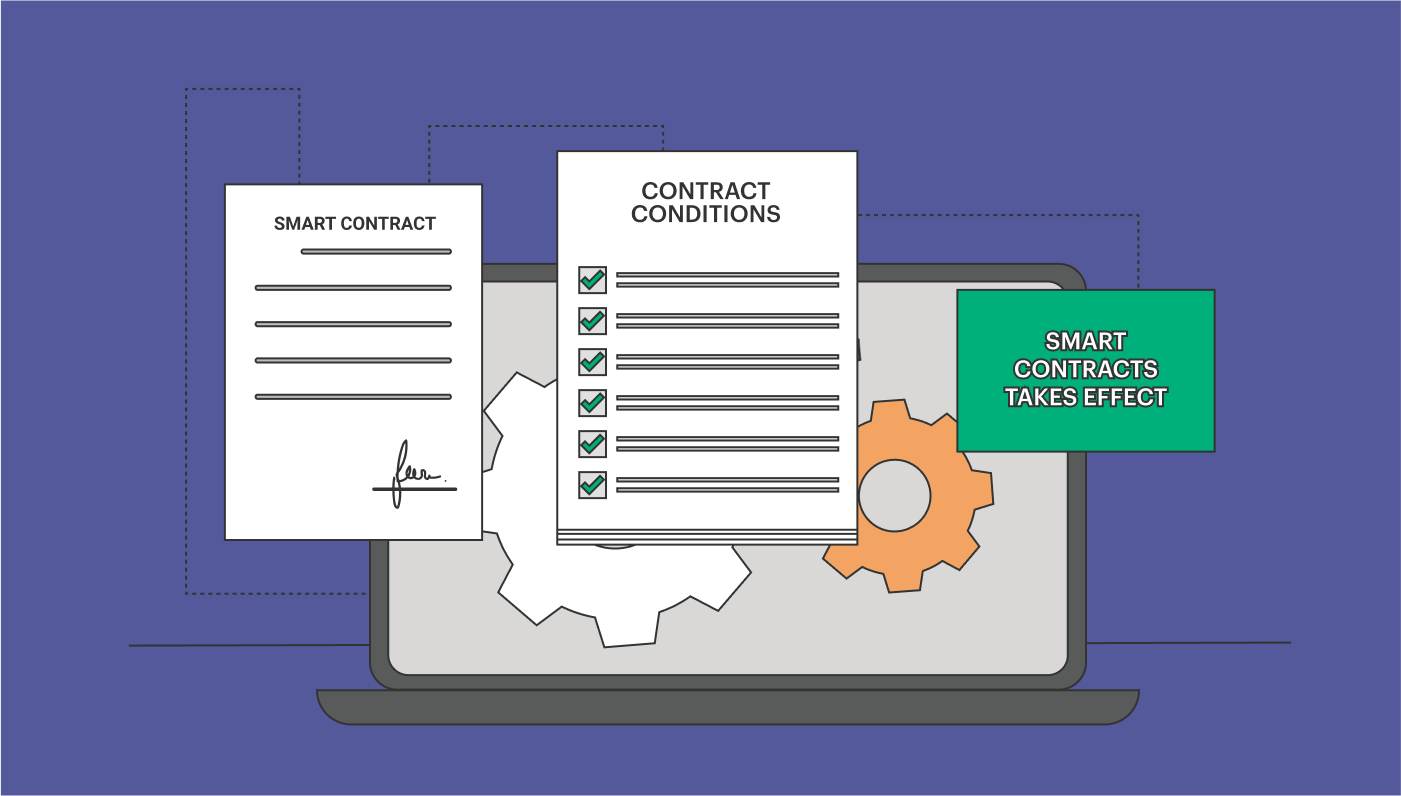

Smart contracts are essentially computer programs for automating blockchain transactions and executing contract conditions. Once specific conditions are met, the self-executing smart contract is instantly triggered and automatically takes effect.

How Do Blockchain Smart Contracts Work?

Smart contracts are programs with encoded pre-set business logic that operate in a dedicated digital environment and are embedded in a distributed ledger.

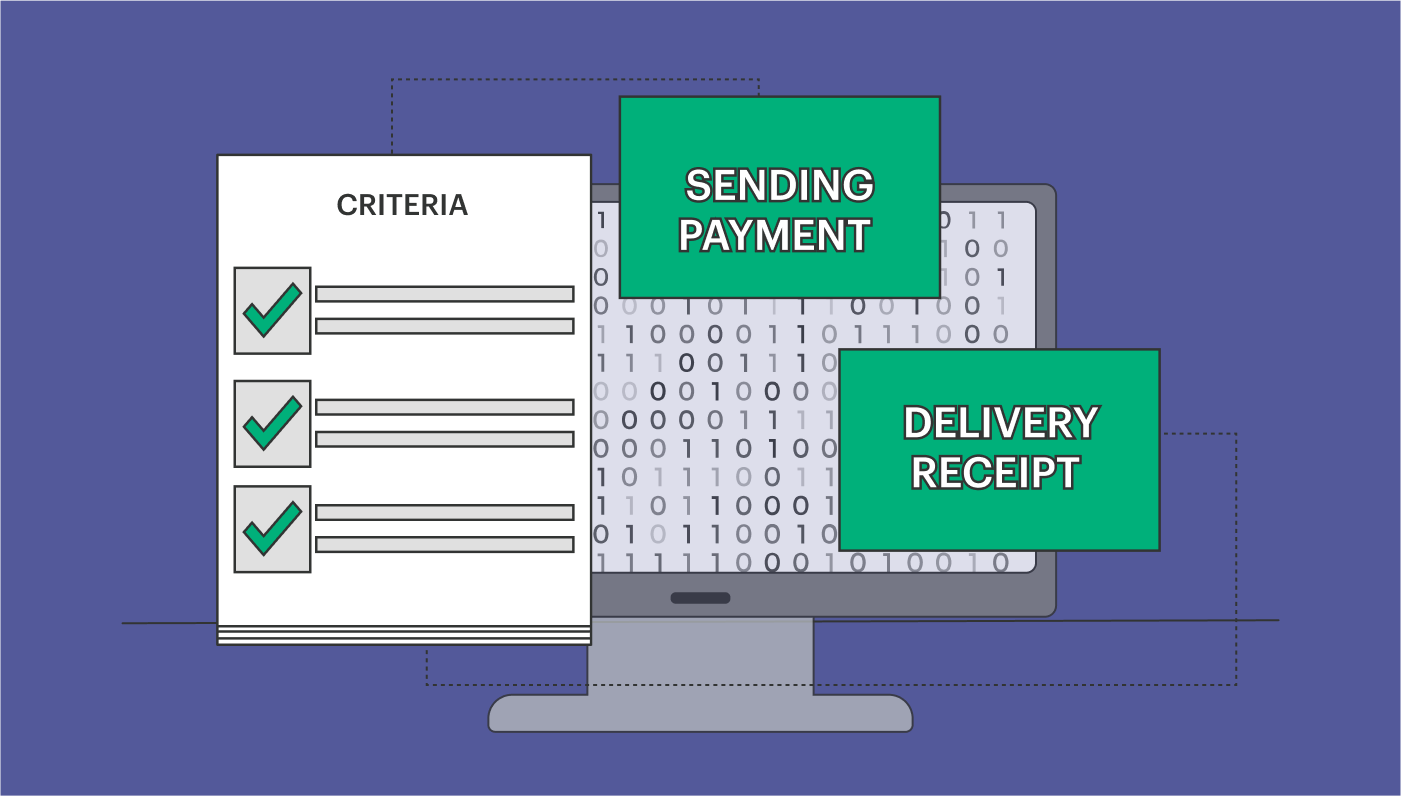

To begin with, automated actions like the release of a payment or the delivery of a receipt are pre-programmed to be triggered when certain criteria are met, such as when a market price is reached, or a payment is authorized.

Once the application is written the smart contract logic will be tested, and the security will be vetted. Prior to deployment on a blockchain, or another distributed ledger, the smart contract will need to be authorized.

The smart contract will receive event updates from one or more “oracles”, which are encrypted streaming data sources. The necessary combination of events will trigger the self-execution of the contract.

What Are the Benefits of Smart Contracts?

Smart contracts make blockchain transactions far faster, more efficient and simpler than traditional contracts. Since they are automated and digital there is zero paperwork, without the danger of human error. Also, all the terms of the contract are written directly into the lines of code and the buyer and seller can verify the execution of the agreement instantly, with no lengthy delays. They are also highly cost-effective, since no third parties means no expensive fees due to the involvement of intermediaries such as brokers, agents and lawyers.

Smart contracts are much safer and more accurate than traditional contracts, as every transaction is irreversible, transparent and can be traced in the public blockchain record. Data is tamper-proof since transaction logs are encrypted and exchanged between the two parties to the contract with no 3rd parties involved.

Blockchain security is incredibly tight and transaction record encryption is exceptionally tough to hack. Moreover, each entry recorded on the distributed public ledger is linked to the preceding and following entries in the chain, so a hacker would need to alter the entire chain to modify a single record.

What Are the Drawbacks of Smart Contracts?

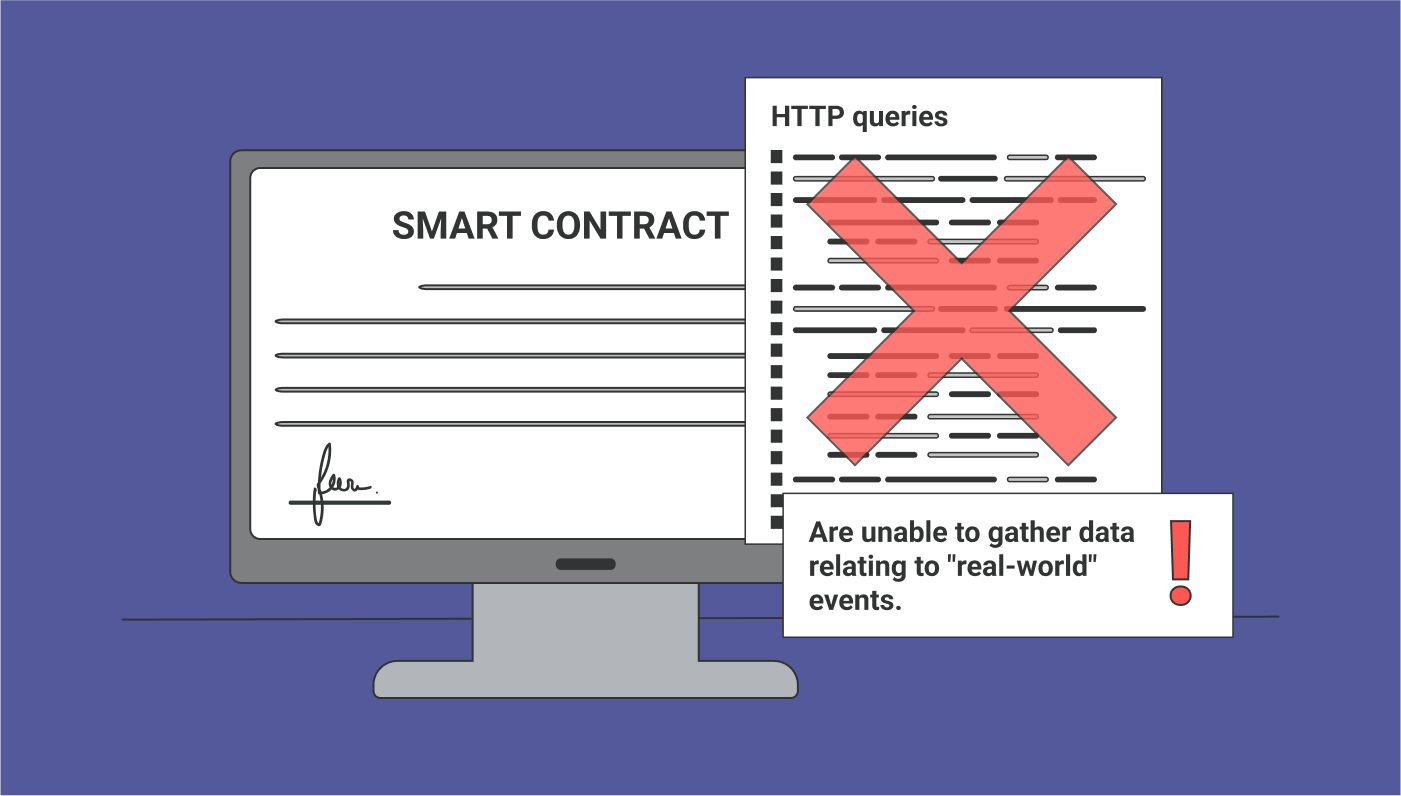

Smart contracts are useful but have some limitations, the most important being that since smart contracts can’t send HTTP queries, they are unable to gather data relating to “real-world” events. However, some consider this to be a feature and not a bug, since the use of external information sources could threaten the security and decentralization of the protocol.

Smart contracts are also impossible to change, so any coding error can be expensive and time-consuming to correct.

There is also a limitation to the capacity of smart contracts to completely remove third parties. For example, even if the parties to the contract don’t need to bring in a lawyer, the developer may have needed one to understand the terms required to create the code for the smart contract. Moreover, if the terms are too vague the smart contract may be impossible to execute as it will be too difficult to determine if the conditions are met.

What Are Some Possible Use Cases?

From crowdfunding and gaming to real-estate, banking, insurance and healthcare there are countless use cases for smart contracts.

Executing legally binding contracts from house purchases to marriage contracts can entail a great deal of expense, but when no intermediaries are required and with e-signatures now widely accepted, the time and costs involved can be significantly reduced. For this reason, smart contracts are making their way into all kinds of new areas.

Some of the most common smart contract applications are financial, for activities like trading, lending and borrowing, due to the trustless, immutable, and transparent nature of blockchain technology as well as the fact that they offer 24/7 functionality

Here at ArbiSmart, our wallet and financial services hub, fueled by the RBIS token, is about to generate huge profits for clients using smart contracts. Later this quarter, ArbiSmart is introducing a decentralized yield farming program.

Yield farming rewards users for liquidity mining, which involves locking their cryptocurrency, using permissionless liquidity pools. These are smart contracts containing the capital of all participating liquidity providers. ArbiSmart yield farmers will receive industry leading rewards of up to 190,000% APY in addition to 0.3% of the fees from each trade.

The yield farming program being introduced at the end of this quarter is just one of a stream of profit-generating new utilities being added in the second half of 2022. So far, ArbiSmart has already introduced its interest-bearing wallet offering an unmatched 147% a year. At the same time as the launch of the yield farming service, the development team will be introducing a mobile application as well as a collection of thousands of one-of-a-kind digital artworks as well as an NFT marketplace where participants will be able to buy and sell non-fungible tokens. Close on its heels, ArbiSmart will be releasing a professional-grade crypto exchange as well as a play-to-earn gaming metaverse.

All these services will generate their own sources of profit, while also contributing to an increase in demand for RBIS, since the native token is required for use of all the service in the ArbiSmart ecosystem. As demand rises, and the limited supply shrinks, the value will rise leading to huge capital gains. In fact, analysts are projecting that RBIS will grow to 48 times the current price by the end of 2022.

The smart contracts used by ArbiSmart and countless other entities are self-verifying, and self-executing, able to map legal obligations through an automated process and record the agreement execution publicly, offering total transparency. They use sophisticated cryptography, making them tamper resistant and able to offer greater contractual security, with lower transaction costs since they don’t require intermediaries such as lawyers or real-estate agents.

To learn more about smart contracts or other technologies and trends dominating the crypto arena, check out the ArbiSmart blog. Alternatively, if you wish to get hold of the RBIS token now before the price takes off, buy RBIS here!