An Introduction to Crypto Market Analysis

As with any kind of trading, it is best to go into your chosen market armed with as much information as possible. Go in blind and you might as well be playing a game of Roulette. Being prepared to enter the cryptocurrency markets involves a close examination of the digital assets you wish to trade, their histories and patterns of behavior, as well as the various other factors relating to the intrinsic value of the coin that impact the price.

Types of Cryptocurrency Analysis

The two main types of crypto market analysis we need to consider are known as fundamental analysis and technical analysis:

Technical Analysis

Before we can begin to learn technical analysis for cryptocurrency trading, we need to define the term. Technical analysis is a means of anticipating whether an asset will rise or fall in price, based on patterns that can be identified from its historic performance, which can be seen in asset charts.

A crypto trader will use cryptocurrency analytics tools that provide various types of market information, from price trends to trading volume. Based on the historical crypto market data, the theory of technical analysis assumes that patterns of price movements will hold and will repeat themselves in a cyclical fashion. So, to gain a clear understanding of market sentiment you need to look for these patterns, where the chosen coin exhibits repeated behaviors. It is only when these trends have been identified that you can predict the future direction of the asset.

One of the most important pieces of data for technical cryptocurrency analysis is supply and demand. In a bullish market, supply will be reduced, driving demand and pushing up the coin price, while in a bearish market, the reverse will be true, with low demand and a reduced price. In such a market, participants will see the drop in price as an opportunity to buy the coin cheaply, thereby increasing demand and leading to an increase in price. Then when the market turns bullish, people will sell, continuing the cycle.

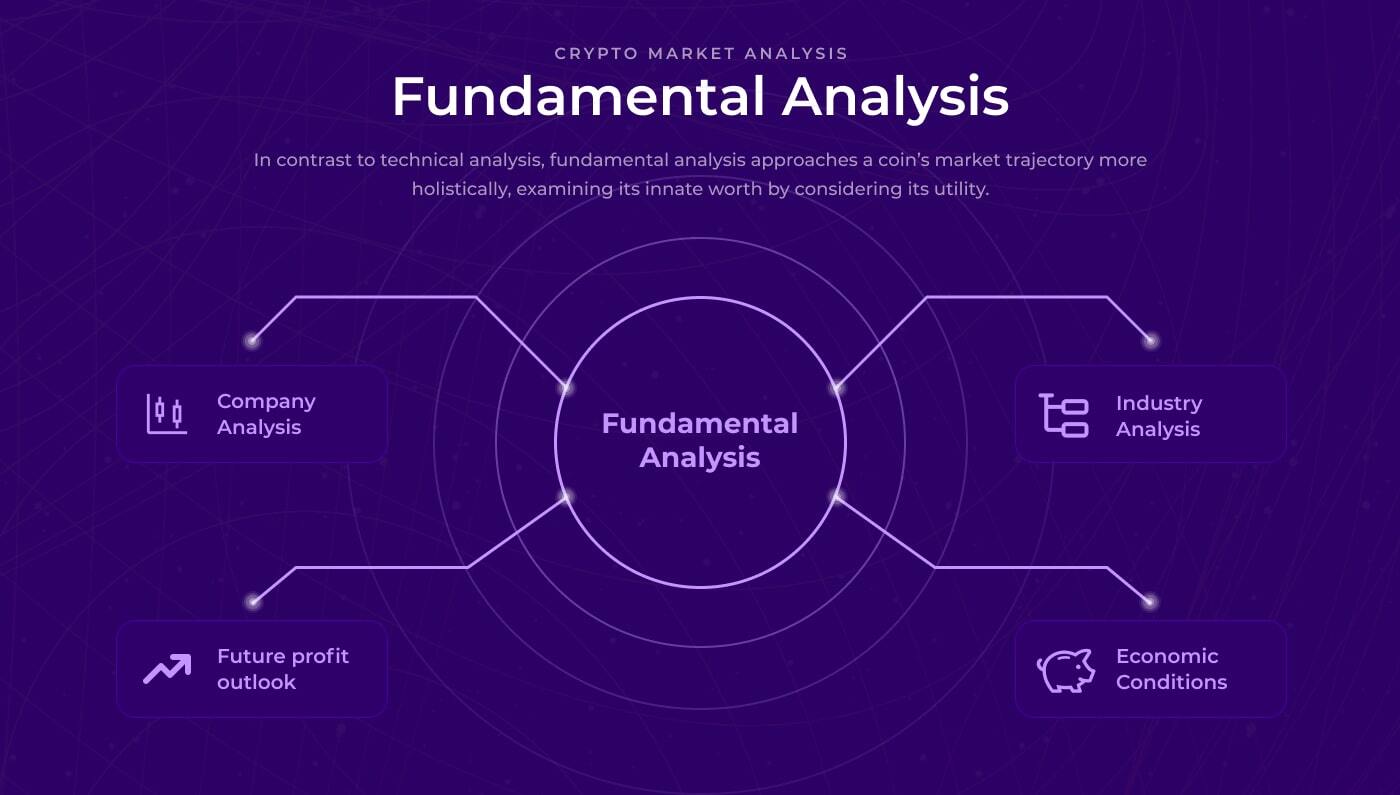

Fundamental Analysis

In contrast to technical analysis, fundamental analysis approaches a coin’s market trajectory more holistically, examining its innate worth by considering its utility. In evaluating the future trajectory of a coin your cryptocurrency analysis will involve the practical applications of the token, the size of its community, the strength of the team behind the project and the market for any product or service for which the token is required. As opposed to looking at what the market is doing, it focuses on why.

Extensive research is needed to effectively identify the projects that have the potential to make it big and differentiate those from the projects that are all hype, with a value that is disproportionate to the price. Based on this cryptocurrency analysis you can determine whether a coin is currently over or undervalued and whether you should go long or short.

When we talk about fundamental analysis in relation to traditional fiat currencies, regularly published economic indicators like the unemployment numbers, consumer price index and GDP are valuable metrics. They will provide an indication of the health of the nation’s economy, which in turn, will impact the price of its currency. However, when it comes to deciding how to analyze a cryptocurrency, the events influencing prices are very different.

Let’s take Bitcoin halving, as an example, a situation where the Bitcoin mining reward is cut in half. Whenever this milestone event occurs it is incredibly influential as the rate at which new Bitcoins enter circulation is halved, as is the Bitcoin inflation rate. In addition, the events can herald new boom and bust cycles which tend to result in a higher coin price than before the event.

Then of course there is legislation for this emerging new asset class. Regulation has been one step behind the fast-paced growth of the crypto market. As governments get to grips with the new financial reality and start to regulate and tax crypto assets, announcements of any new development will be met with a strong market reaction.

Cryptocurrency Analytics Tools

Cryptocurrency analysis often involves the use of software for analyzing cryptocurrency charts. This is because the crypto markets move at such high speeds, they are so incredibly volatile, and there is such a huge wealth of data to process that if you wish to keep track of all the critical developments then you will need the assistance of advanced interactive software that can provide up-to-the-minute insights.

There are a wide variety of tools available and you will want a user-friendly range of live charts and other analytical resources to help you in your technical and fundamental analysis of the market. There are now well over 5,000 coins listed on the exchanges with the number rising all the time, so you want software that lets you track and analyze as many as possible, while giving you trading volumes and data on the hundreds of different exchanges, as well as providing access to base currencies so you can compare them against the performance of your chosen coins. Other useful features include access to a news aggregator that collates information from top news sources, asset watchlists, social trading tools, the ability to add plotting features to charts, such as moving averages for a given time frame, and more.

However, as valuable as the software may be, it is no replacement for your experience and judgement and in the end, you will need to analyze and organize the information you are receiving so it becomes actionable.

The Right Methods of Cryptocurrency Analysis at the Right Time

When deciding how to analyze a cryptocurrency, it is inadvisable to limit yourself to just one method of crypto market analysis. Both fundamental and technical analysis can offer useful insight into the potential future trajectory of a cryptocurrency, although depending on the type of trade you wish to make, one may have greater weight than the other. For example, if you are looking to make short term trades, technical tools are of greater use since they can show patterns over minutes, hours and days, but if you have a view to the long term cryptocurrency analysis that looks at the overall value of the coin will be a better option.

A solid understanding of how to analyze historical asset data, as well as how to evaluate the innate value of a coin are critical skills for any digital currency investor, who wants to increase their revenue potential and mitigate their exposure.

However, there is a simpler way to trade cryptocurrencies, without the risk, or the research. Here at ArbiSmart, our EU licensed, crypto arbitrage platform does all the work for you. Crypto arbitrage is widely acknowledged to be one of the lowest risk forms of investing as it makes a profit from price inefficiencies across crypto exchanges and is not subject to crypto market volatility. Since our system is fully automated, once you have signed up and deposited funds, the AI-based algorithm takes over and you earn a guaranteed passive income, while you get on with your day.

To learn more about crypto trading in general, feel free to check out the ArbiSmart blog. Alternatively, if you wish to learn more about crypto arbitrage specifically, click here.