6 Top Cryptocurrency Trends in 2022

2021 was full of ups and downs for the crypto industry, but overall, it was a banner year, with the market cap of the entire crypto market climbing to over $3 trillion. Bitcoin saw 70% gains, a trend that was also evident in the prices of established coins like Ethereum as well as a number of altcoin newcomers, some of which saw gains of hundreds of percent.

Other developments across the crypto world in 2021 included the increasing popularity of non-fungible tokens (NFT’s) as well as the rise of the Metaverse, with Facebook, transforming into Meta, and leading the way in the creation of a virtual universe.

Many crypto trends in 2022 will be a continuation and evolution of the trends that started to emerge last year. These are some of the most likely developments shaping the crypto arena in the year ahead:

A New Regulatory Landscape

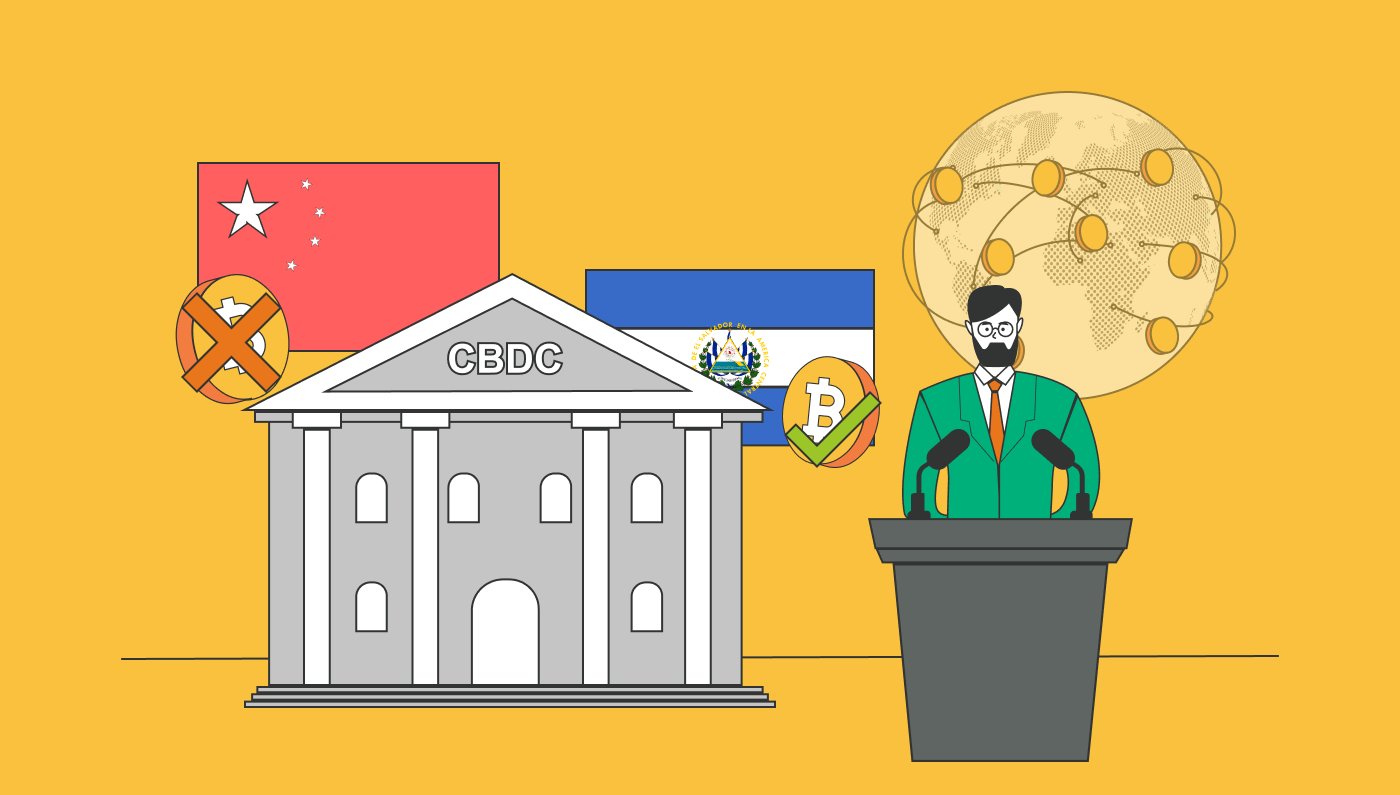

2021 saw many government bodies and financial institutions, exploring the financial impact of cryptocurrencies on global economies and many central banks were weighing the risks to their financial stability from digital assets. Bitcoin was banned in China, and India took initial steps to introduce regulation banning all private crypto assets. However, BTC was adopted as legal tender in El Slavador

Without a doubt, 2022 will see even greater governmental interest and regulatory activity, such as the creation of introduction of central bank digital currencies (CBDCs). According to the CBDC Tracker, currently 79 countries are at various stages of researching and developing their own digital currency.

Broader Web 3.0 Adoption

More intelligent, connected, and open, web 3.0 is one of the biggest evolving cryptocurrency trends of 2022. A blockchain-based version of the internet, it will allow individuals to regain control of their data, remove the possibility of a site crash resulting from a single point of failure and enable website owners to avoid reliance on the companies that own the servers. As Web 3.0 takes off, linked cryptocurrencies will thrive in 2022.

A Bitcoin Resurgence

Having hit a peak of over $67,000 in November 2021, Bitcoin dropped to $35,000 in mid-January, but has already started to bounce back. FSInsight, in a note to investors, said Bitcoin could hit $200,000 in the second half of 2022, a climb of over 460%. While some analysts are projecting a Bitcoin collapse in 2022 to as low as $10,000, based on what is deemed a lack of fundamental value, others hold the belief that Bitcoin will rally, continuing its overall upward trajectory surging back to its previous high and surpassing it to exceed the $100,000 mark at the bare minimum.

Spot Bitcoin Exchange-Traded Funds (ETF’S)

In October 2021, ProShares Bitcoin Strategy ETF (BITO) was launched. Liquid and transparent, it is the first U.S. bitcoin-linked ETF, and it delivers capital appreciation through managed exposure to bitcoin futures contracts. It is important to note though that in buying BITO you are not buying actual Bitcoin. Also, the exceptionally high cost of rolling over contracts making it unpopular with retail investors.

The first spot bitcoin ETF is widely expected to be introduced very shortly, and once crypto curious investors gain direct access to Bitcoin this should lead to a major spike in retail investment in 2022.

Expansion of the NFT Market

Another of the top cryptocurrency trends 2022 will be the continued growth of the NFT market. Non- fungible tokens utilize smart contracts to open the door to decentralized funding for artists and offer a highly secure means of authenticating the ownership of digital assets. As a result, the NFT market is gaining in popularity with increasingly high valuation as more artists seek to gain control over their work.

A Growth in Institutional Crypto Investment

In 2021, the crypto industry saw massive investment from major corporate giants and financial organizations, with venture capitalists investing $30 billion in the crypto sphere. The momentum is likely to increase in 2022. Companies like Meta and Microsoft are diving headfirst into the metaverse and leading global brands like Nike have already come on board with virtual products, with more likely to follow their lead for a slice of the pie.

Growth is also anticipated in the area of decentralized finance (DeFi). Banks too are showing increased interest and are introducing loan products backed by crypto assets.

ArbiSmart is at the forefront of crypto, innovation with a series of developments that reflect the most prominent cryptocurrency trends of 2022. Firstly, this quarter, ArbiSmart is introducing a decentralized yield farming program via the Uniswap dapp. It will offer highly competitive rewards, including annual percentage yields of up to 190,000% APY, as well as 0.3 % of the trading fees on every trade.

Later this quarter, we will also be launching an NFT marketplace, with 10,000 unique digital artworks, verified by NFT’s that can only be bought by sending RBIS, ArbiSmart’s native token, to a specified smart contract.

2022 will also see the introduction of a series of additional RBIS utilities designed to drive demand and push up the price. These include an interest-generating wallet, a crypto exchange, a mobile application, and a launchpad for funding promising new cryptocurrencies.

To learn more about a wide array of emerging trends relating to every aspect of the crypt world, check out the ArbiSmart blog. Or, to take advantage of the fact that the RBIS token is about to explode in 2022 with all the new developments in the pipeline, buy RBIS now!