4 Tips for Success in Bitcoin Trading

Over the past year cryptocurrencies have experienced a huge boost in mainstream adoption, with investment from corporate giants, governments, and major financial institutions, as well as the average investor looking to get a piece of the action. The legitimacy of crypto has grown and Bitcoin trading has become increasingly popular, despite the substantial risks that come with investing in such an incredibly volatile asset class. These days, everyone wants to get a slice of the Bitcoin pie, since BTC has risen from around $8,000 to over $60,000 in a single 12-month period.

In this guide, we’ll be providing some valuable tips on how to make money by trading Bitcoin, without risking all your capital. When it comes to success in Bitcoin trading you need to take the time before jumping in to do some critical research. Learn about various wallets and exchanges and look at the various types of digital assets available. Find out how to trade Bitcoin for other cryptocurrencies or for fiat currencies without paying huge fees or compromising the security of your funds. To be successful, none of these initial steps to trading Bitcoin can be skipped as the right market decisions can only be made from a place of knowledge.

Learn What Moves Bitcoin’s Price

Whenever you decide to open a position with BTC, you need to ask yourself a single, critical question. Can I make money trading Bitcoin, in the current market?

The answer will depend on a number of factors. Firstly, take a look at what the media is saying and what community sentiment seems to be across social channels. If there is fear and uncertainty, due to a large dumping of coins, or a security breach in a major exchange platform, people will sell short, and the price will fall. Conversely, appreciation from HODLing by whales, keeping a share of the already limited supply (capped at 21 million) out of circulation, or alternatively, media hype due to investment by well-known corporate player can raise the price of BTC. Another factor raising the price of Bitcoin over the past year has been the growing distrust in fiat currencies that were weakened as a result of the economic fallout from the global pandemic. People then looked to another store of value- Bitcoin.

Study Basic Fundamental and Technical Analysis Skills

In order to make money trading Bitcoins you need to be able to make informed market decisions. There are a variety of sources of information, and you should exploit them all. The first way in which to predict market activity, is with fundamental analysis. Look into the company behind a cryptocurrency, check into the team and the project, examining the technology and the market demand for the utility being offered.

You also need to stay up to date with the latest industry events on the leading crypto news sites For example, news of a Bitcoin halving will drive up the price, or corporate investment, such as the huge purchase in Bitcoin, by Tesla, earlier in the year. In contrast new crypto regulation or a major coin sell of could send cryptocurrencies on a downward trajectory. In addition, following the conversations taking place within the community across social media will help you strategize effectively and keep up with market sentiment.

So, how do you make money trading bitcoin? By constantly reading, listening and learning.

Technical analysis is another way to get to grips with what is happening with your chosen cryptocurrency at any given time. It involves looking at the price history of an asset, evaluating support and resistance levels, learning to read order books and candlestick charts, as well as understanding technical indicators like Relative Strength Index, Moving Averages, On Balance Volume and Bollinger Bands to identify patterns and trends that can help you predict the future trajectory of the coin.

Implement Profit and Loss Limits

Want to make money trading Bitcoins? Be smart by being safe

Bitcoin trading, particularly over the short term will expose you to an exceptionally high level of risk, which needs to be mitigated at all costs. The best way to achieve this is by setting Stop Loss and Take Profit Limits. This involves setting a pre-set price at which you are automatically exited from a trade.

With a Stop Loss order, this is a price below the current value of the coin, so if the price drops when you are away from your screen, your losses will be halted, and your position is closed, when the pre-determined price is hit.

With a Take Profit order your position is closed if it hits a pre-set price above the current value. This protects you from a scenario in which there is a sudden price reversal, and you suddenly lose all your gains.

Find the Bitcoin Trading Style and Strategy that Suits You

Bitcoin trading can be performed many different ways, some riskier than others. To decide on a trading style, you need to be clear-eyed about the extent of your experience and expertise, you have to know your level of risk tolerance and decide on how much time you can realistically dedicate to your trading.

You may be best suited to HODLing Bitcoin, buying and then holding on for the long term – a relatively safe strategy that involves almost no effort, even though your capital will be sitting idle in a wallet for a long period.

Alternatively, you may be a natural risk-taker, who enjoys the adrenaline rush of swing trading and has the time to spend, in front of a screen, opening and closing trades in rapid succession, across exchanges. With this type of trading, it is always a good idea to mitigate risk. Bitcoin hedging, and diversifying your portfolio with a variety of fiat and cryptocurrencies, will ensure that all your eggs are not in one basket.

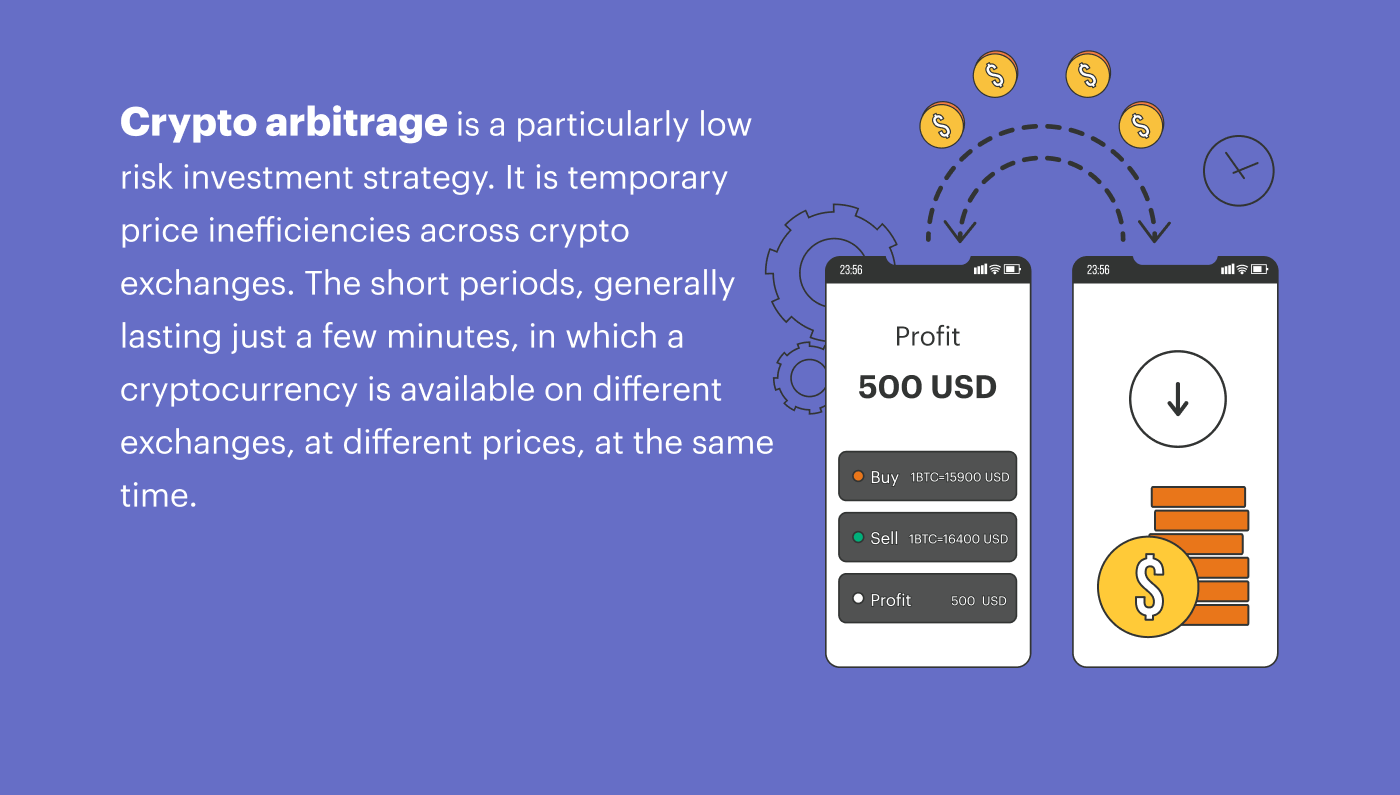

There is one strategy, crypto arbitrage, that is widely acknowledged to be exceptionally low risk, because it does not expose you to the dangers of crypto market volatility. It involves taking advantage of temporary price inefficiencies across exchanges. These are brief windows during which a coin will be available on different exchanges, at different prices, at the same time.

Here at ArbiSmart, our EU regulated, crypto arbitrage platform is integrated with 35 exchanges. ArbiSmart’s AI-based algorithm scans the exchanges, 24/7, tracking thousands of coins, looking for price inefficiencies. It will then, automatically, buy the coin at the lowest available price and then sell it on the exchange with the highest available price to make a profit before the price inefficiency resolves itself.

The advantages are that there is minimal risk, and zero effort required, because you simply sign up, deposit funds and then the platform takes over, earning passive profits on your behalf. Most importantly however, depending on the size of your investment, you can make returns reaching up to 45% a year!

Learn more about crypto arbitrage or explore a variety of different topics relating to the world of crypto trading, on the ArbiSmart blog.