A Guide to Strategy Differences When Trading Forex and Stocks

ks and Forex

There are a number of significant differences between the stocks market and the foreign exchange market.

Firstly, the stock market is open for a limited number of hours during the day, while the forex market is open 24 hours a day, five days a week.

In addition, the forex market is much more liquid than the stock market, with higher trading volumes and tighter spreads. Then of course there is the issue of volatility. The forex market is generally more volatile than the stock market, with larger price movements in shorter time frames.

Finally, there is the fact that news events can have a greater impact on the forex market than the stock market, which can lead to sudden price movements.

Given these differences, it is important to use different strategies for trading stocks and forex. For example, stock traders may focus on analyzing a company’s financial reports and news events related to the company, while forex traders may focus more on economic data releases and geopolitical events.

Additionally, different technical analysis tools may be more effective in each market. For example, stock traders may use fundamental analysis and chart patterns to make trading decisions, while forex traders may rely more on technical indicators and price action analysis.

Similarities Between Stocks and Forex Analysis Tools

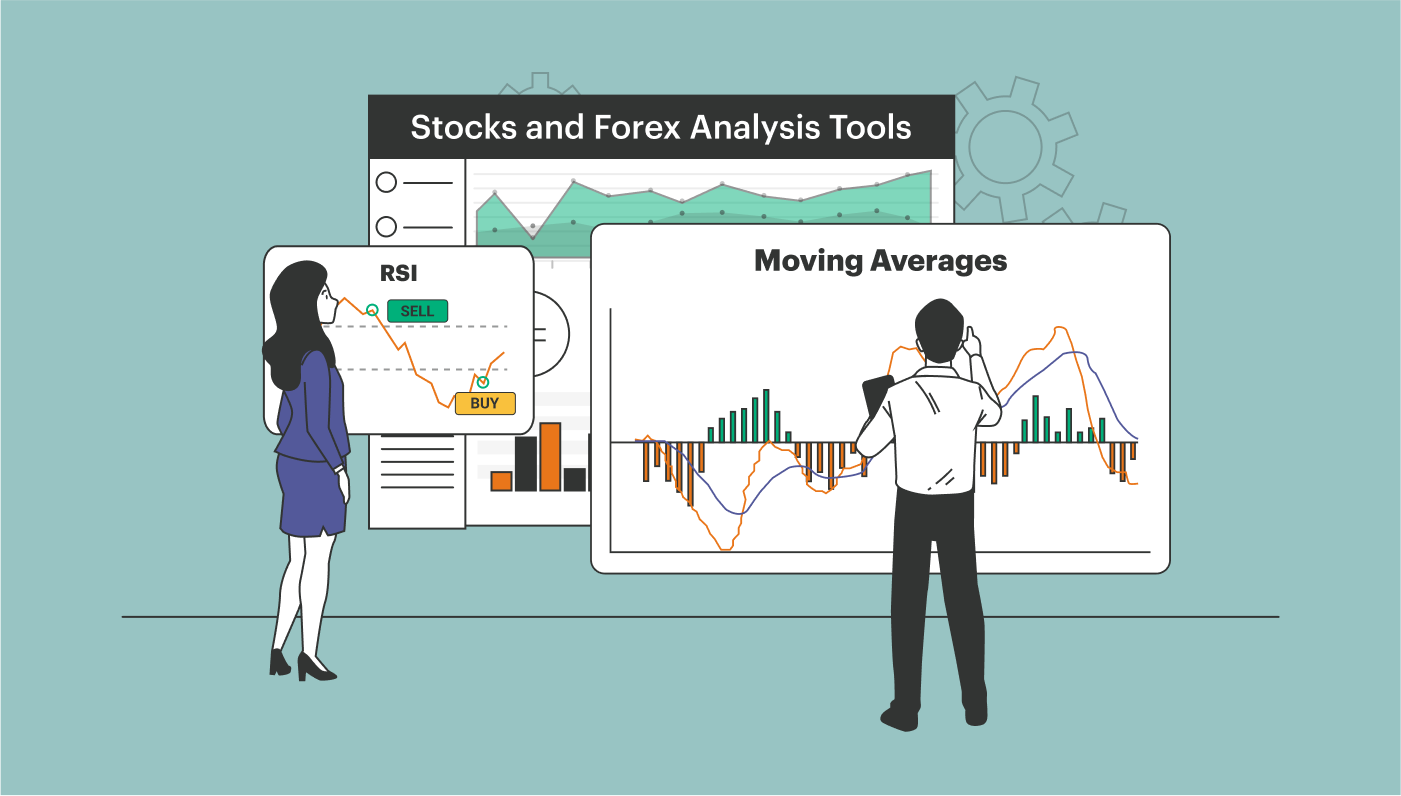

There are several analysis tools that traders use for trading both stocks and forex.

For stocks traders and forex traders alike, technical analysis involves analyzing price and volume data using charts and technical indicators to identify trends and trading opportunities. This can include tools like moving averages, relative strength index (RSI), and Bollinger Bands.

Market sentiment analysis is also useful for trading a wide range of asset types. It involves analyzing market trends and investor sentiment to determine the overall market outlook and how it may impact individual assets. This can include monitoring news and social media feeds for mentions of specific stocks or currencies and analyzing options and futures market data.

No matter the asset being traded, risk management tools are essential. This includes tools like stop-loss orders and position sizing to manage risk and limit potential losses.

The best analysis tools for trading stocks or currencies depend on the trader’s individual style and preferences. It is important to have a well-rounded approach that incorporates a mix of analysis types, along with risk management tools, to make informed trading decisions.

Differences Between Stocks and Forex Analysis Tools

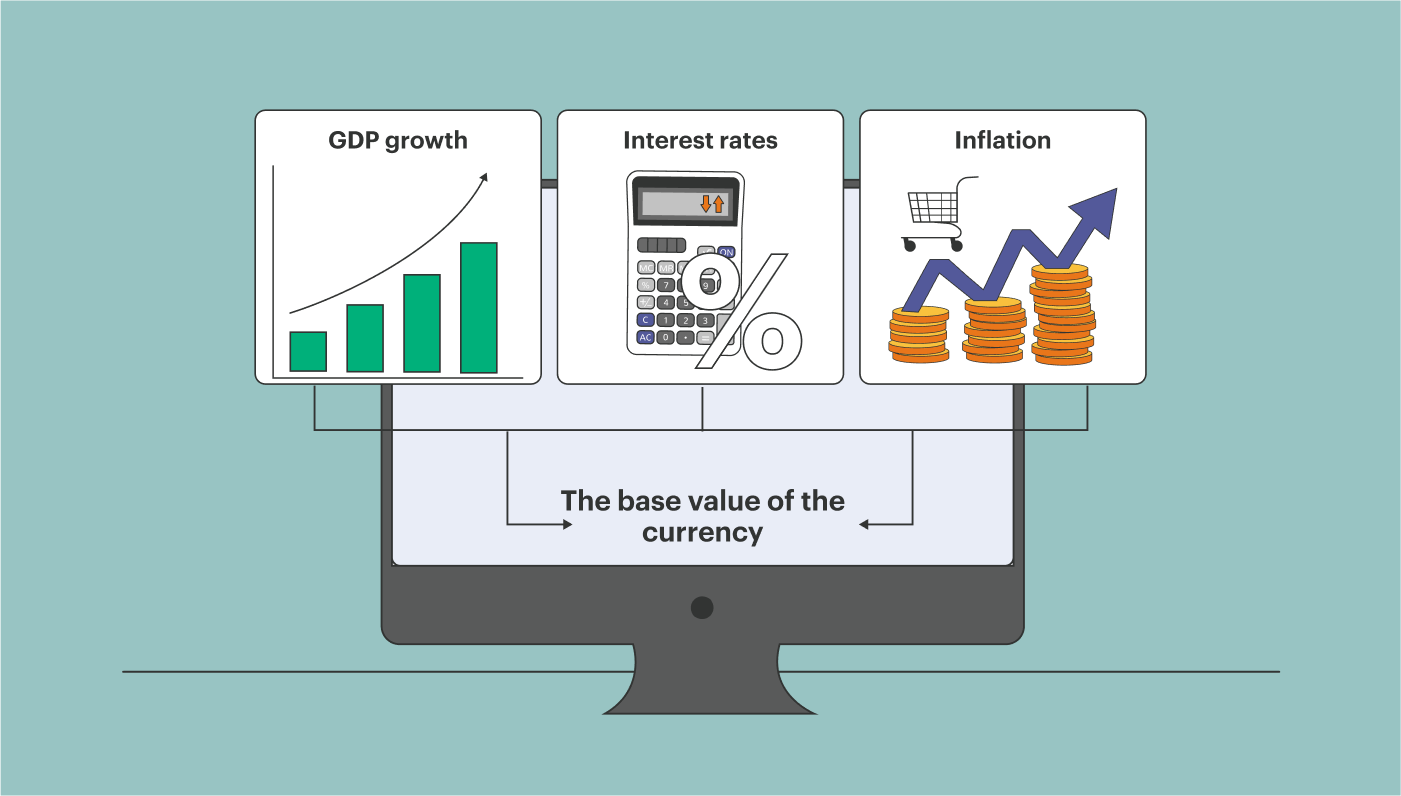

Certain forms of analysis will be used differently, depending on the asset type being traded. This can be clearly seen when we look at fundamental analysis.

For stocks traders, fundamental analysis involves analyzing a company’s financial statements, industry trends, economic conditions, and other relevant factors to determine the underlying value of a stock. This can include metrics like earnings per share, price-to-earnings ratios, and return on equity.

For forex traders, fundamental analysis involves analyzing economic data releases and news events related to the currencies being traded to determine the underlying value of a currency. This can include metrics like interest rates, inflation, and GDP growth.

Then, there are certain forms of analysis that are specifically geared to a specific asset type. For a stocks trader, would clearly need to examine certain industry verticals, using sector analysis.

Sector analysis involves analyzing the performance and trends of specific industries or sectors to identify opportunities for investment or trading. This can include analyzing economic data, regulatory changes, and other factors that may impact specific industries.

Equally, certain forms of analysis are more appropriate for analyzing the currecy markets.

Seasonality analysis involves analyzing historical trends in forex prices and trading volumes to identify seasonal patterns that can be used to inform trading decisions. Then, there is correlation analysis, which involves analyzing the relationships between different currency pairs to identify trading opportunities and manage risk.

Whatever asset you choose to trade, it is important to have a clear understanding of its characteristics and develop strategies tailored to the specific market you are trading.

However, if the complexities of technical and fundament analysis seem too overwhelming, here at ArbiSmart, we offer a fully automated crypto arbitrage platform. Crypto arbitrage is a low-risk trading strategy that makes money from price differences across exchanges, which occur with the same frequency regardless of whether the market is rising or falling. You simply make a deposit in FIAT or crypto and then get on with your day, while the platform trades on your behalf, 24/7, generating a consistent profit of up to 147% a year.

To gain a better understanding of the financial markets and learn more about trading strategies for all types of assets, from stocks and forex to cryptocurrencies, go to the ArbiSmart blog.