An Introduction to Wrapped Bitcoin (WBTC)

Wrapped Bitcoin (WBTC) is an ERC-20 – compatible coin. It is backed by Bitcoin (BTC) with 1-1 value and can be used in Ethereum-powered decentralized applications.

WBTC serves the valuable function of allowing for interoperability between Bitcoin and Ethereum (ETH). Being able to use BTC in an ETC ecosystem enables rapid transactions as there is no need to perform them across blockchains. As a tokenized Bitcoin asset, WBTC combines Bitcoin’s high liquidity and price value with Ethereum’s impressive programmability.

It is critical to understand however that Wrapped Bitcoin is not actually Bitcoin, but is just backed by BTC, serving as a bridge to ETH decentralized apps. So, you are not holding Bitcoin and do not benefit from the privacy and security of the BTC network when you hold WBTC. It simply serves as a means of reliably and transparently standardizing Bitcoin to the ERC-20 format.

How Is Wrapped Bitcoin Minted?

To mint Wrapped BTC, a Bitcoin owner will use a merchant, like Airswap or DiversiFi, to tokenize their BTC into WBTC, while using the custodian BitGo, to hold the funds.

The entire process works as follows:

Your first step as a Bitcoin holder is to pick a merchant that will initiate the transaction. The merchant will send your Bitcoin to the custodian, authorizing it to mint the WBTC. On receiving multiple confirmations of the BTC transaction the custodian will mint the new WBTC and send it to the merchant’s Ethereum address. You will then be able to request your WBTC directly from the merchant, and once they have verified your ID, you get your WBTC, and they receive BTC.

It should be noted that you can also swap an Ethereum-based token, like ETH or USDT into Wrapped BTC on a decentralized exchange.

Wrapped Bitcoin Opportunities in DeFi

Wrapped BTC is gaining value by the day, and currently has a market cap of $9.8 billion, due to the meteoric rise of Bitcoin and the consistent growth of DeFi.

There are multiple opportunities offered by WBTC in the DeFi space. For example, it provides a great means of generating yield farming or liquidity mining profits, as well as a way to earn interest in DeFi lending pools. Wrapped Bitcoin can also serve as collateral for a crypto-backed loan or for margin trading on crypto derivative exchanges.

Other Tokenized Versions of Bitcoin

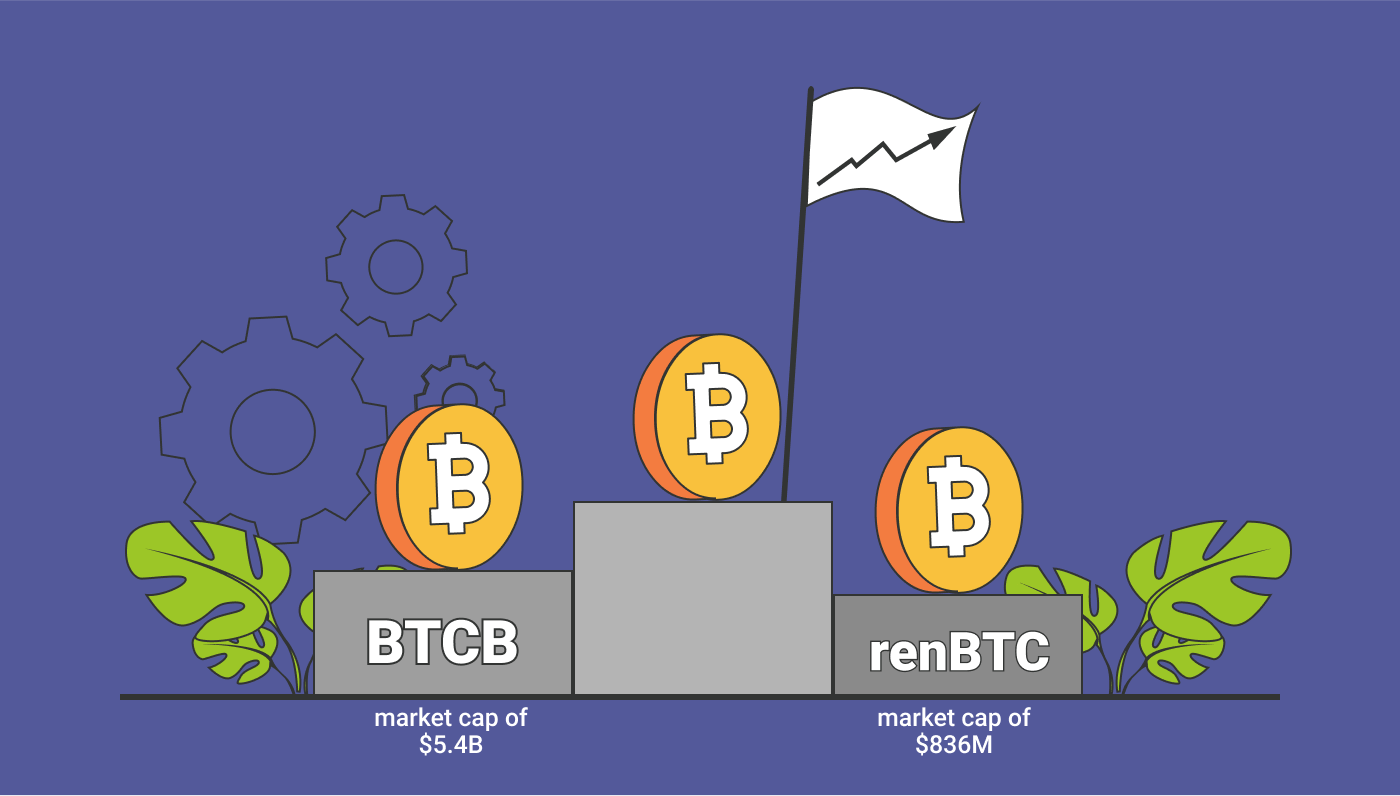

While wrapped BTC is by far the most popular tokenized form of Bitcoin, other leading versions include BTCB and renBTC.

BTCB is gaining traction at an impressive rate, and it has become one of the fastest-growing pegged coins on the Binance Smart Chain, with a market cap of $5.4B. Alternatively, another ERC-20, tokenized version of BTC is renBTC. This pegged coin offers inter-chain liquidity for decentralized applications and has a market cap of $836M.

In spite of their growing popularity, wrapped coins have one primary disadvantage, and it relates to centralization. When it comes to WBTC, and other pegged assets, wrapping cannot be automated via smart contract on the Ethereum blockchain but is performed via a centralized system. These assets are dependent on the issuing platform and as a result all decisions relating to them are made centrally, making them vulnerable to manipulation, and undermining the basic principles of decentralization. They are also completely dependent on the level of security and reliability of the custodian and then the Ethereum based decentralized app.

Another factor to consider is that coins backed by Bitcoin are as equally vulnerable to crypto market volatility as Bitcoin itself. However, here at ArbiSmart, our native token, RBIS, is able to withstand market fluctuations and keeps climbing even during bear markets.

Withstanding Market Volatility

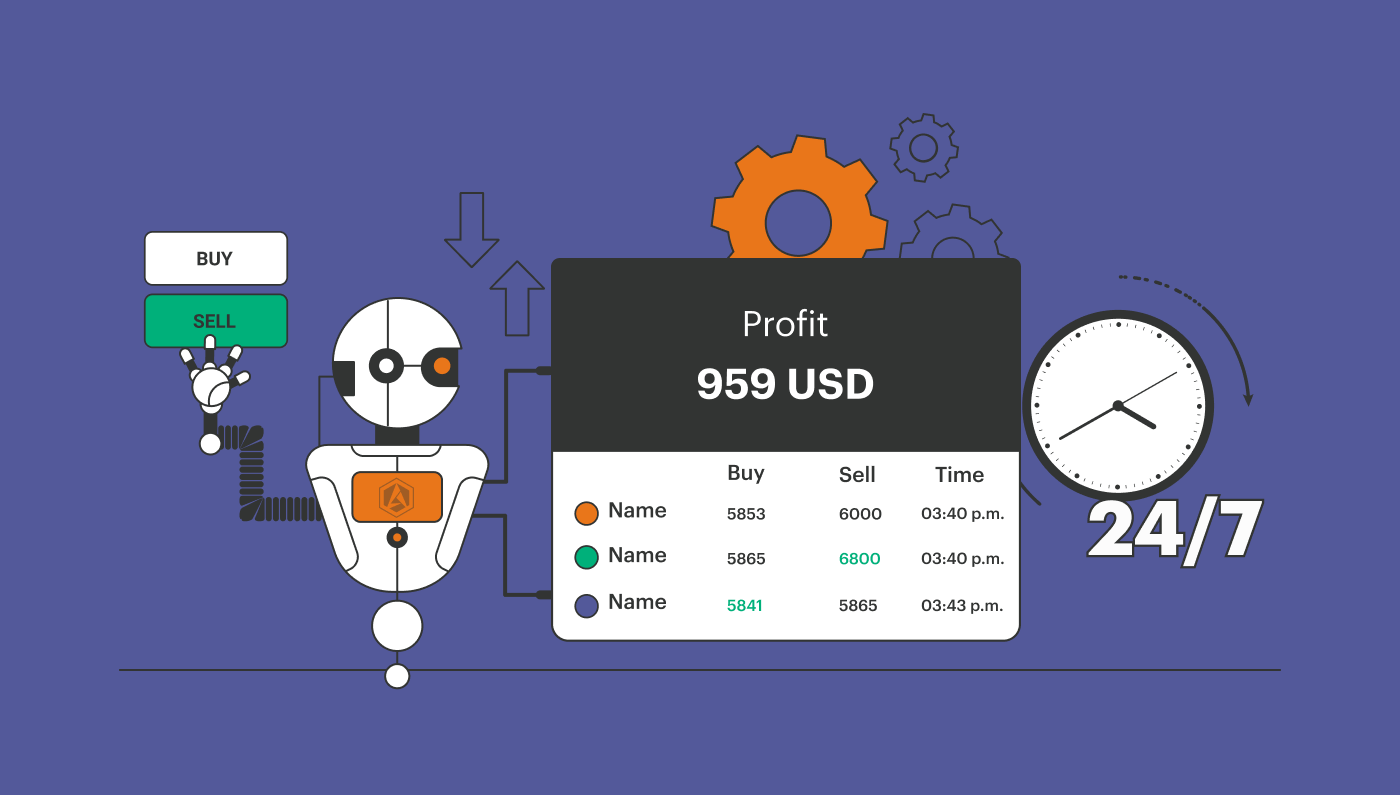

The reason for this is that ArbiSmart performs crypto arbitrage, a form of investing that makes money by exploiting temporary price inefficiencies – short periods in which a coin is available on various exchanges at different prices, at the same time. These inefficiencies occur for all kinds of reasons, such as disparities in trading volume and liquidity levels between larger and smaller exchanges.

ArbiSmart uses an algorithm to scan hundreds of coins across 35 exchanges, simultaneously, looking for inefficiencies. It will then generate a profit by buying on the exchange where the price is lowest and then selling wherever the price is highest.

As a platform user, you just sign up, invest fiat or crypto and that’s it. The algorithm then takes over, converting your funds into RBIS and using them to perform automated crypto arbitrage, generating profits that start at 10.8% and reach as high as 45% a year, depending on the size of your deposit.

Since price inefficiencies will continue to occur in either a bull or bear market ArbiSmart offers a great hedge against a crash. Rather than lose its value, your crypto will maintain its worth and you can earn a steady, ongoing passive revenue. You won’t just make crypto arbitrage profits, (plus compound interest) but also earn as much as 1% extra a day by storing your money in a locked savings account for a pre-set period. Additionally, you will make capital gains on the rising value of the RBIS token, which in the two years since it was introduced has already gone up in value by 630% and is on track to soar this quarter as new utilities are launched, and RBIS becomes listed on exchanges.

Whichever way to choose to enter the digital currency markets, the future looks bright, with increased adoption, by retail investors as well as corporate giants. In addition, regulatory developments are enhancing the legitimacy of the crypto space and creating a more secure investing experience.

To learn more about a wide range of topics relating to blockchain, DeFi and various types of increasingly popular digital assets, check out the ArbiSmart blog.