Understanding the Crypto Market Rally: How and Why Do Bitcoin Bear and Bull Runs Happen?

We have seen the crypto market rally, more than once in recent years. For example, the bull run of late 2017 saw the price of Bitcoin, Ethereum and a variety of altcoins soar, and more recently we saw an explosion of interest in decentralized finance that led to the crypto market rally beginning in the summer of 2020 and continuing all the way through until the spring of 2021.

When the market is rallying it is essential to identify which potential contributing factors are driving the rise in prices so that you can pinpoint which types of digital asset are most likely to benefit from the bull run.

What Is a Bull Market Rally?

The definition of a bull market rally is a period during which prices sustain an upward trajectory, as the result of specific announcements or events. Bullish investors with a positive outlook for the market, purchase the asset in large numbers, driving up the market value.

The market is rallying not just when assets soar in valuation by huge percentages in a matter of days, but also when there is more gradual growth of 5% to 10% or 15% over an extended period of a year or more. When it comes to Bitcoin and Ethereum, the trading charts we are used to seeing tend to reflect quite dramatic price shifts with a steep climb.

Indicators of a bull market include increased liquidity as well as greater crypto adoption by major corporations and financial institutions.

What Is a Bear Run?

We have a bear market when the reverse is the case. In this scenario, the investors doubt the capacity of the asset-class in question to retain its value, selling en masse, causing a drop in market prices. We saw an example of this in spring 2020, when some coins dropped in value by as much as 50%

There are a number of indicators that serve to warn of a crypto bear run and these include reduced trading volume, as people tend to hold on to their coins in periods of market uncertainty; a “death cross”, a technical indicator where the 50 day moving average for a coin crosses the 200 day moving average, and finally “backwardation”, whereby the current asset price is higher than the price on the futures market.

What Led to the 2020-2021 Bitcoin Rally?

Bitcoin has seen a number of rallies since its introduction over a decade ago, but to understand how a crypto market rally can occur, let’s look at the 2020-2021 Bitcoin bull run. By December 2020 the price of Bitcoin had surged to $30,000 and by the spring of 2021 the price of Bitcoin would soar to a new high exceeding $60,000. Then in July of 2021 a new rally began, which continues today.

So, what led to increased demand by retail and institutional investors for cryptocurrencies like Bitcoin and Ethereum?

The crypto market rally was the result of many factors. The Bitcoin halving in May increased demand. Meanwhile, governments were starting to take crypto seriously with developments in taxation legislation, and then China piloted the CBDC in December. With the hit to fiat currencies brought about by the Coronavirus pandemic a lot of investors were seeking out an alternative home for their capital. The price rise was further fueled by an increasing belief in cryptocurrencies coming closer to mainstream adoption, due to the interest of corporate giants like Paypal. Of course, investors were also looking for a haven, a hedge against increasing inflation.

How Does a Crypto Market Rally Differ from a Stock Market Rally?

Crypto volatility tends to be far wilder than for any other asset class, with gains of hundreds if not thousands of percentage points. Stock market rallies entail less risk, but also more restrained returns. For example, while the last five years saw Apple rise by 117% and Tesla surge by a whopping 800%, this is nothing compared to Ethereum gains of 9,000% and Bitcoin’s 16,000% climb.

The rule of successful trading is to buy low and sell high, so the ability to identify the trigger events leading bear or bull market is essential in order to minimize your risk and maximize your revenue potential. However, what if you could save yourself the effort, with a low risk, high return strategy that offers a hedge against crypto market volatility?

How Can You Sidestep the Dangers of Crypto Market Volatility?

One way in which you can avoid exposure to the extreme fluctuations in crypto market prices is to employ a crypto arbitrage trading strategy.

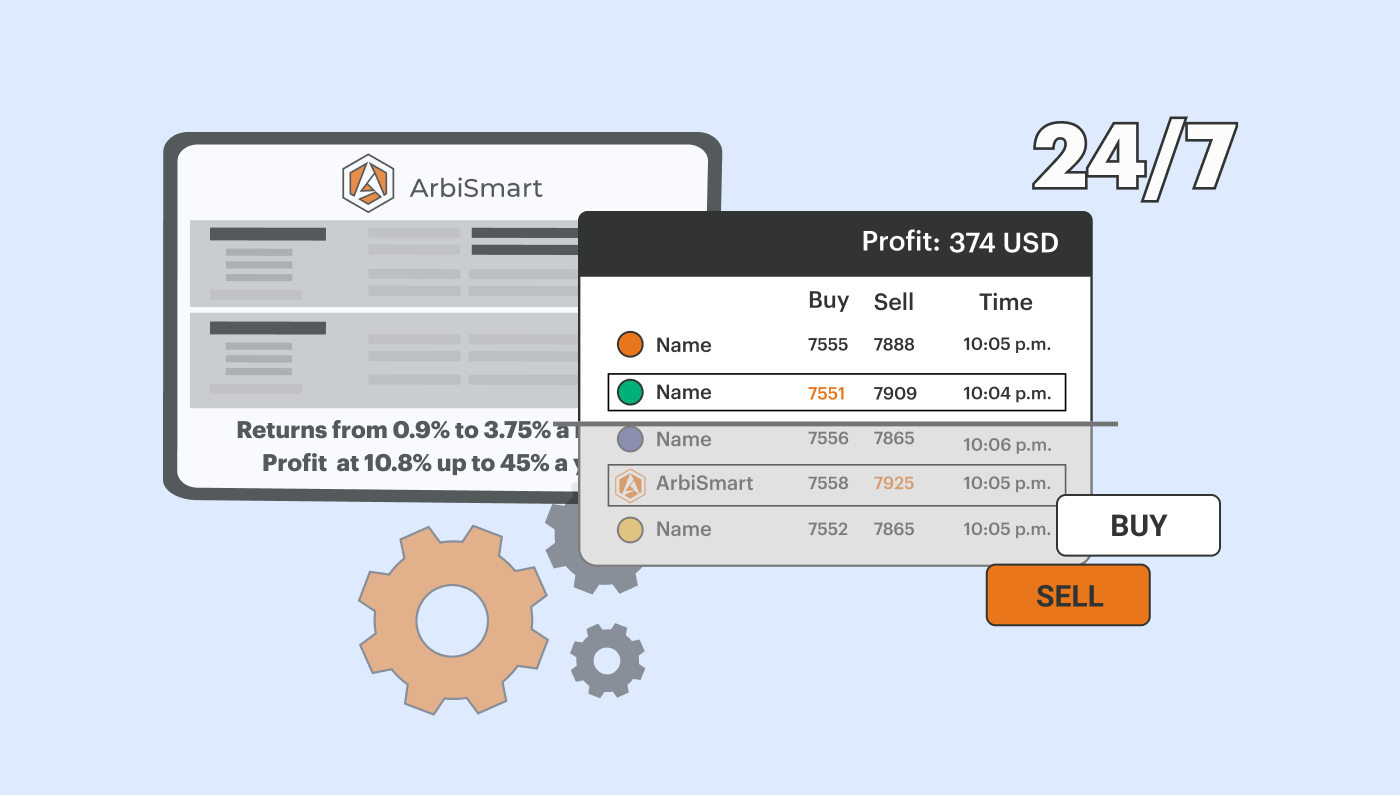

Here at ArbiSmart, our fully automated, EU licensed, crypto arbitrage platform offers profits that start at 10.8% and reach as high as 45% a year, (0.9% to 3.75% a month), depending on the size of your investment.

Crypto arbitrage works by exploiting temporary price inefficiencies that frequently arise across exchanges. In other words, it takes advantage of the fact that for various reasons, a coin can briefly be available at different prices at the same time.

You just register, funds your account and the platform does the rest, converting your fiat or crypto into RBIS, our native token and using it to trade crypto arbitrage for you, 24 hours a day.

ArbiSmart’s algorithm, connected to 35 exchanges, scans hundreds of cryptocurrencies simultaneously. On finding a price difference, it automatically buys the coin on the exchange where the price is lowest and then sells it on the exchange with the highest price to generate a profit.

These price inefficiencies can have all kinds of causes such a difference in trading volume between exchanges of varying sizes, and they will keep occurring with equal regularity in either a bull or bear rally. So, even if the market were to suddenly collapse you would continue to earn a steady crypto arbitrage profit, and your crypto would retain its value, making ArbiSmart a great hedge against a crash.

In addition to passive crypto arbitrage profits of up to 45% you also earn compound interest as well as a yield of up to 1% a day, just for storing your funds in a locked savings account for a pre-determined period.

You will also earn capital gains on the rising value of the RBIS token, which has already risen by 760%!

At the end of the year, RBIS is going to be listed on global exchanges and in the coming months a number of new RBIS utilities are being launched including an interest-bearing wallet and a new yield farming program. These developments should drive demand pushing up the price even higher, since there is only a limited token supply.

These factors all make ArbiSmart a great alternative to trying to anticipate the ups and downs of the hard-to-predict digital currency markets.

To learn more about the crypto markets, various types of digital assets, DeFi applications and blockchain-based technology, check out the ArbiSmart blog.