A Starter Guide to Bitcoin ATM Machines

A Bitcoin ATM, (BATM), is an automated teller machine designed specifically to enable the user to purchase and/or sell Bitcoin and other cryptocurrencies.

There are two main types of Bitcoin ATM. The first and most basic is a one-way ATM machine, that only allows users to buy digital assets, while the other is a two-way bitcoin ATM, which enables the user to both buy and sell crypto. Directly integrated with a crypto exchange the machines differ with regard to whether they just accept cash or also allow for payment via credit or debit card.

How Big Is the Bitcoin ATM Market Globally and Who Are the Operators?

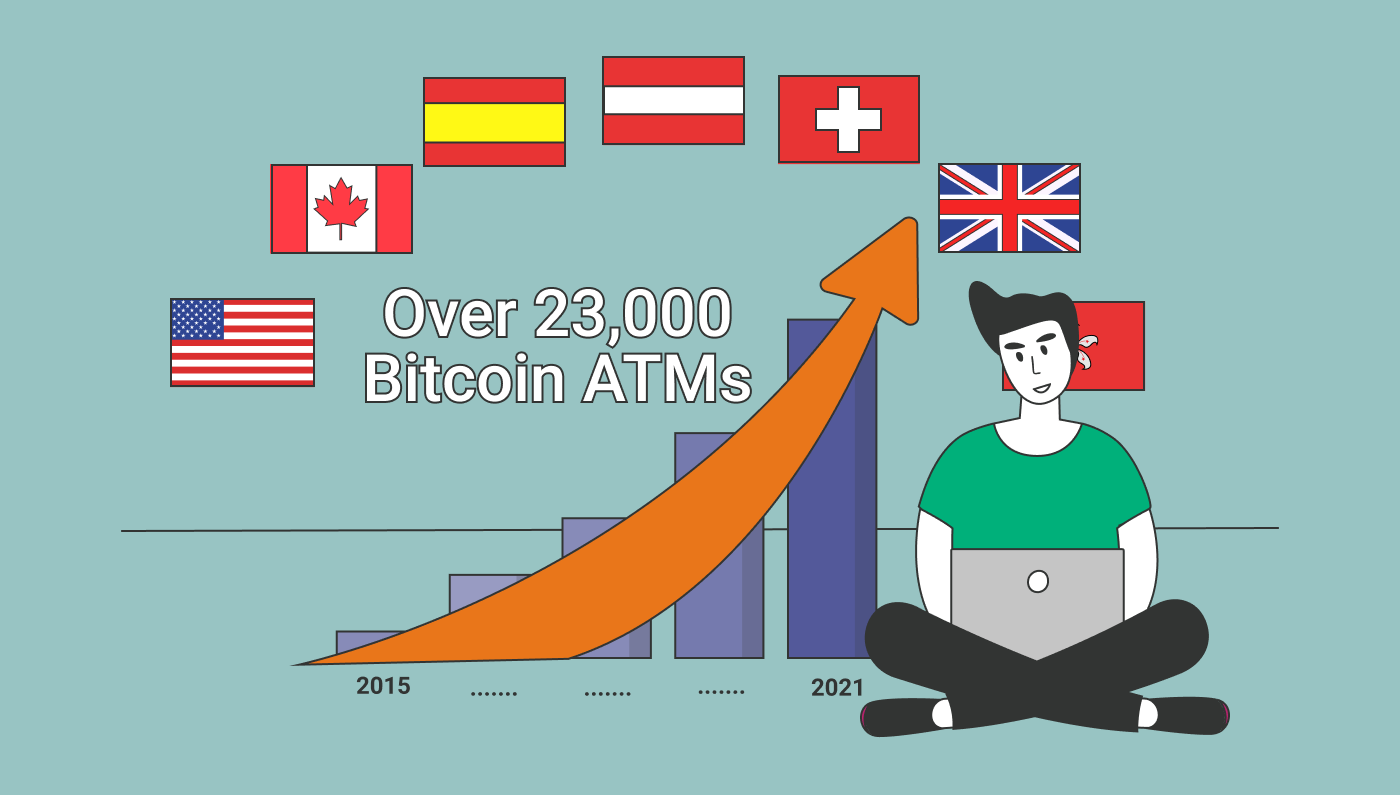

So, how many bitcoin ATMs are available? Since first being introduced in 2015, the number of Bitcoin ATMs has grown rapidly year after year, and now there are over 23,000 in use globally, with the vast majority (over 90%) in the United States and the rest primarily in Canada, Spain, Austria, Switzerland the United Kingdom, and Hong Kong.

Similar to the fiat ATMs operated by banks, BATMs are provided by third party companies that sell the machines to business that have them installed on-site. Top bitcoin ATM machine providers include US based Bitcoin Depot that enables users to buy and sell Bitcoin Ethereum and Litecoin, as well as RockItCoin and CoinSource, which both allow users to buy and sell crypto using cash.

Major operators also include Bitovo, BitVending, General Bytes, Genesis alongside plenty of other companies, which are joining by the day hoping to exploit this growing market. Since traditional fiat ATMs are unlikely to add Bitcoin to their machines any time soon BATM machines are on track to continue gaining popularity world-wide.

How Do You Buy and Sell Crypto with a Bitcoin ATM?

Commonly, in order to use a Bitcoin ATM machine, you will need to create an account with the ATM service provider.

Then, every time you use the BATM you will need to enter a single-use password, sent to your phone or email, as a means of verifying your identity. If given the choice, you then select whether to buy or sell crypto.

If you are purchasing Bitcoin, you will input the amount you wish to buy and choose the fiat currency you will be using for the transaction. Next, you will deposit fiat in the slot and then, depending on the machine, one of the following will occur:

Via the screen, you will be shown a QR code to scan

The machine will request an email to which it will send a QR code

The machine will request and scan the QR code of your existing Bitcoin wallet

You will receive a printout of a QR code for accessing your new Bitcoin wallet

Once you have scanned the QR code, the transaction can be completed and the BItcoin sent to your chosen wallet address.

If you are selling Bitcoin, you will be required to enter the amount to be sold. To sell the funds, you will need to send your BTC to a wallet address provided on the screen. Then, once the transaction is verified, the corresponding fiat sum, minus fees, will be paid. The timeframe for the delivery of the fiat payment will differ between ATMs.

Both the purchase and sale of Bitcoin and other cryptocurrencies will incur a transaction fee. These fees are currently very high, averaging between 8% and 10%, and are likely to remain so, until there is greater adoption of the technology.

How Do Bitcoin ATMs Compare to Crypto Exchanges?

Every Bitcoin ATM is connected to an exchange. It provides a means of buying and selling a cryptocurrency through the exchange but from a real-world physical location. The primary difference between using a BATM and an exchange is the rates, with costs for purchasing on a Bitcoin ATM around 5-10% higher.

In spite of the significant costs the machines offer familiarity and ease-of-use, without requiring lengthy, digitized exchange registration protocols. Also, while a crypto exchange can take hours to verify your account and execute you transaction, buying through a Bitcoin ATM is instantaneous.

How Can You Make Buying and Selling Crypto Even Easier?

The exceptional volatility of the crypto markets means that digital currencies can be a risky investment and their purchase and sale can result in significant losses if your timing is off.

Here at ArbiSmart, our fully automated crypto arbitrage platform, buys and sells crypto on your behalf at close to zero risk, with minimal fees, for profits that start at 10.8% a year and reach as high as 45% a year, (0.9% to 3.75% a month), depending on the size of your deposit.

It works by exploiting price efficiencies across exchanges. These are brief periods in which a coin is available at different prices at the same time. They can occur for all types of reasons, like differences in liquidity or trading volume between exchanges of different sizes.

The user just deposits fiat or crypto and then the platform does everything else, converting the funds into our native token, RBIS, and uses the funds to perform crypto arbitrage. Connected to 35 exchanges, which it monitors 24/7, the algorithm finds an inefficiency and then instantly buys the coin on the exchange where the price is lowest before selling for the best possible profit, on whichever exchange the price is highest.

It provides a great hedge against a market crash, since price inefficiencies continue to occur, with equal regularity in both bear and bull markets. You will also make capital gains on the rising value of the RBIS token, which has already risen by over 830%, in the two years since it was introduced. Additionally, youcan store your fund in a locked ArbiSmart savings account for a contracted period and get up to 1% a day in extra passive profits.

When buying or selling stored cryptocurrencies you need to do your homework, to find the most secure, cost-effective, and convenient technology. To learn more about blockchain-based systems, types of coins, DeFi applications, crypto trading strategies and more, check out the ArbiSmart blog.