Is Bot Trading Good or Bad for the Crypto Market?

The huge impact of bot trading on the crypto market cannot be underestimated. However, before we examine whether the widespread use of an algorithm in cryptocurrency trading is a positive or negative development, let’s first look at what a cryptocurrency trading bot is, how it functions and how this is changing the way we trade.

What is cryptocurrency algorithmic trading?

Crypto algorithmic, trading is the use of a software program to automatically monitor the crypto exchanges around the clock and then execute trades when certain pre-programmed conditions are met. Bot trading has become a common tool in the traditional financial space and accounts for a lot of forex and most stock market activity and is now taking center stage in the crypto arena.

Bot trading. How it works

A cryptocurrency trading bot can perform at exceptionally high speeds, processing a vast amount of data and implementing its programmed strategies based on the information it is receiving lightning-fast, often executing a large volume of trades simultaneously. This high frequency trading capacity opens the door to a range of strategies that were previously beyond the capabilities of any human being and the use of an automated program seems like the perfect match for crypto’s fully digital, 24/7 financial ecosystem.

The way it works is that the trading bot will connect to a wide array of crypto exchanges using an API, then it will trade automatically on your behalf, with pre-configured responses triggered by different market conditions.

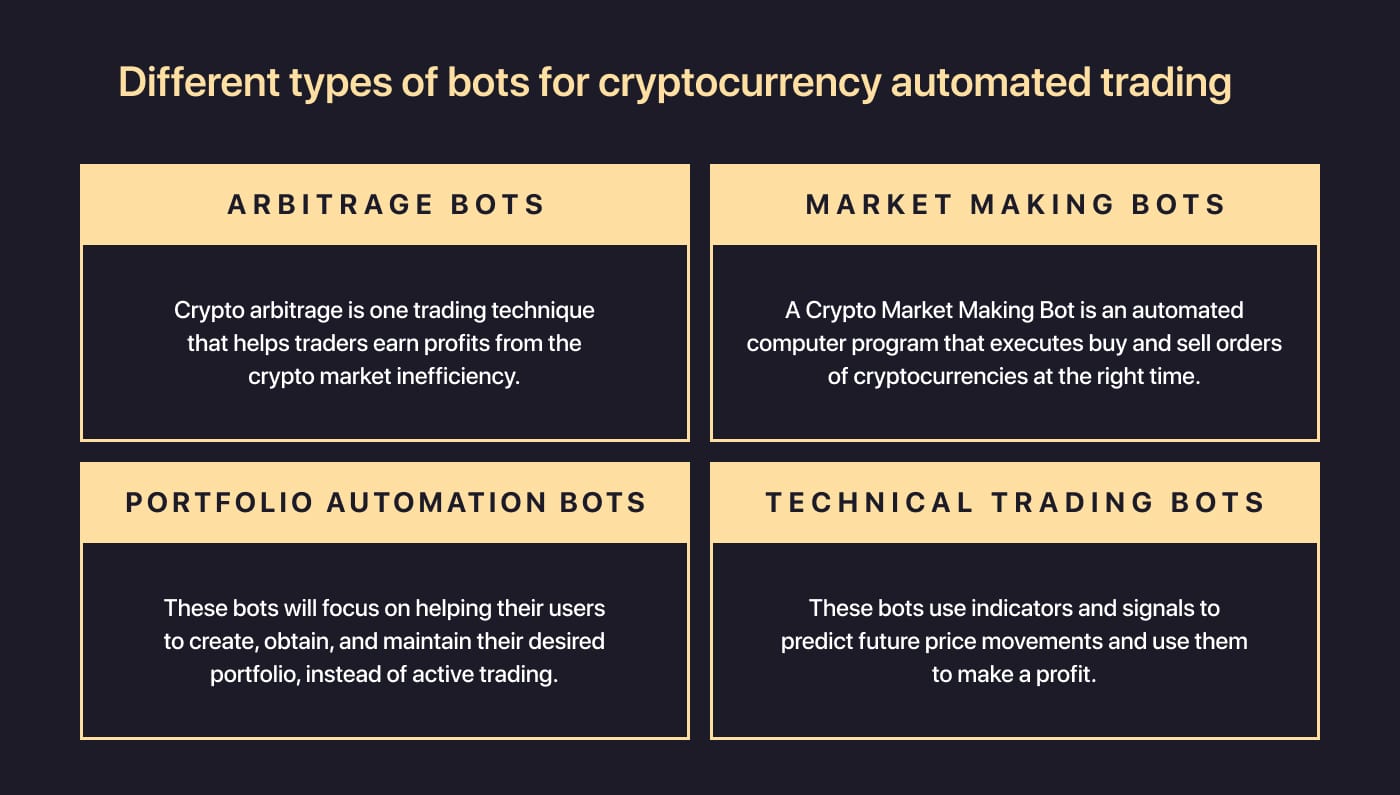

Different types of bots for cryptocurrency automated trading

There is a wide variety of autotrading software from the most basic bot with ready-made, pre-configured logic to highly sophisticated AI-based machine learning systems.

If you simply want to test out a trading strategy risk-free before using it on the market a simpler bot may be all you need, but keep in mind that you can only change the pre-installed logic by altering the actual code. If you do not have the skill set to code, or have no idea how to create a cryptocurrency trading bot strategy and are hoping to trade passively and let the bot do all the work for you, then bot trading on the crypto market with the more basic options could be a problem. This is because if there is a fundamental, long-term market shift that requires a new kind of strategic approach, the pre-coded triggers and their various permutations will not be sufficient to respond to the new market reality successfully.

Another type of bot is a robot advisor, which rather than trade for you, just provides expert recommendations on how to respond to given market conditions.

Finally, there are always the advanced algorithms using artificial intelligence and neural networking technology. These bots can actually learn from their experience and will analyze crypto market activity and then trade with greater precision over time.

The prices of all these bots can differ greatly. You can choose to pay thousands of dollars for the high-end systems at the top of the scale or go for a free, open-source cryptocurrency bot. The wide availability of this type of free technology for the average trader is going a long way to levelling the playing field and democratizing economic access.

Positive and negative effects of cryptocurrency bot trading

The impact of using a bot for cryptocurrency automated trading will be greater than using algo trading software in a more traditional financial arena. This is due to the fact that the smaller size of the digital asset markets means that the actions of a single individual or small group of market participants can have a significant influence on market prices.

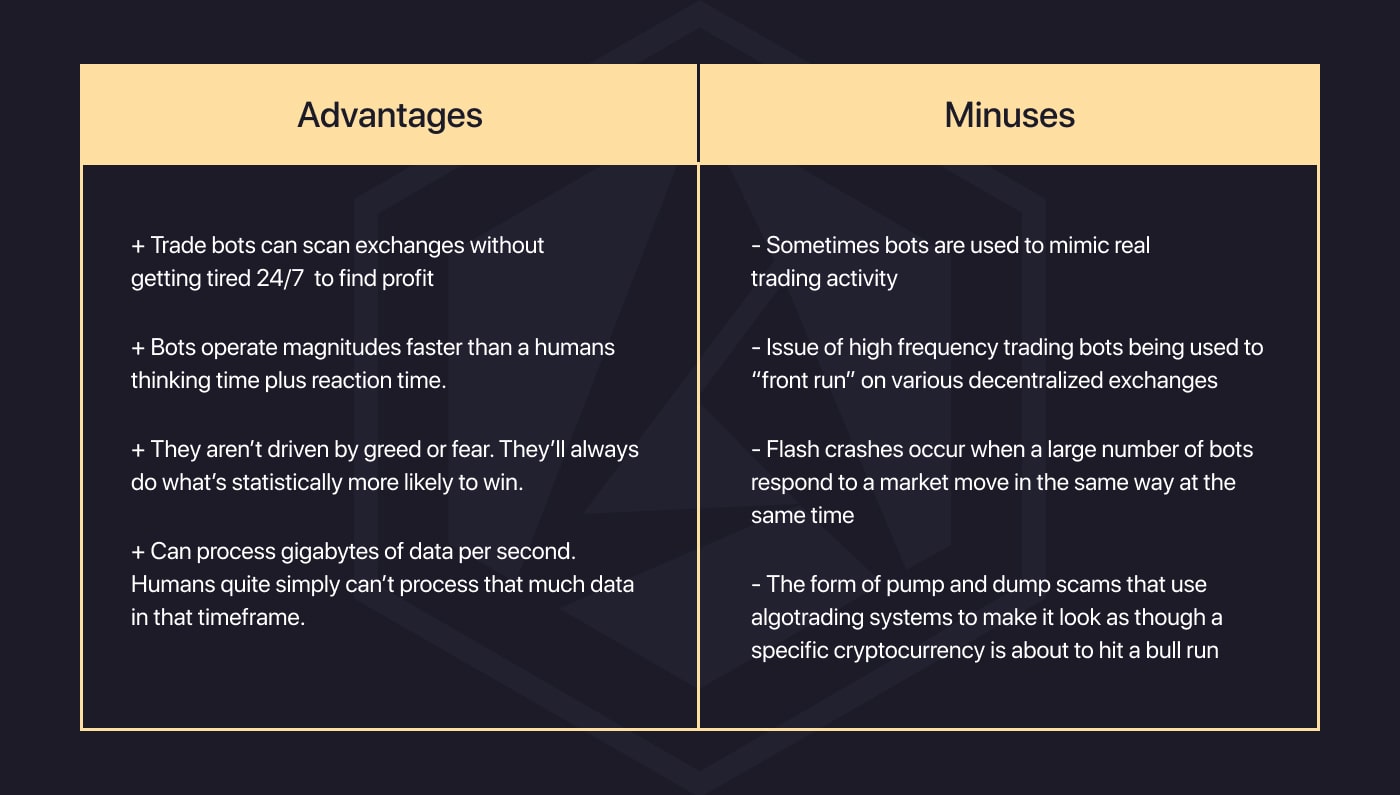

The primary job of any algorithm in cryptocurrency trading is to make money for the user. However, they often have the added advantage of boosting liquidity substantially and also enabling the markets to move more efficiently, since the use of high-frequency trading tools mean price discovery is happening more quickly, so price disparities can be identified faster.

The increased liquidity brought about by large volumes of trades being executed simultaneously by automated systems has had the positive effect of ensuring that there are enough buyers and sellers that you can always make a trade when you need to, without delay.

For example, market makers use high frequency trading bots to place buy and sell orders across the bid ask spread, profiting from the difference. This attracts large investors to the crypto market, creating a better experience for traders with more opportunities for generating revenue, increasing adoption as the popularity and legitimacy of crypto trading is enhanced and boosting liquidity even further.

This enhanced liquidity has a downside though, as it can result in market manipulation. Sometimes bots are used to mimic real trading activity. Known as “slippage”, this practice of simulating real trading to manipulate prices and make an exchange appear more active has been estimated to account for a majority of trading volume on some exchanges. This is illegal in traditional markets, but unfortunately, in the crypto sphere much of the landscape is still under-regulated and this tactic is not unheard of.

Then of course, there is the issue of high frequency trading bots being used to “front run” on various decentralized exchanges, meaning that the bots are ensuring their trades get priority, using their exceptional speed to make sure that no human trader can compete.

Another way in which automated trading bots are impacting the crypto space by providing an unfair advantage is with colocation. This is where a large corporation will enable other companies to rent and host their servers on the same site as the exchange and directly connect to the trading systems. The companies that are able to pay for the privilege can therefore enter faster orders than anyone else leaving smaller players behind.

A final danger that trading bots present to the trading arena is in the form of pump and dump scams that use algotrading systems to make it look as though a specific cryptocurrency is about to hit a bull run, creating hype and artificially pumping the price to encourage traders to get on board and feed the trend, before selling off and letting the price collapse.

It is not always conscious price manipulation that can lead to trouble. Flash crashes occur when a large number of bots respond to a market move in the same way at the same time. This is a problem that is worsened by the relatively small size of the crypto market, where the impact is far greater. For example, if a specific coin drops in value, then this can trigger a landslide, where more and more bots sell off the coin pushing the market down even further.

Strategies of cryptocurrency automated trading

There are countless cryptocurrency bot strategies, enough to suit every type of trader, from scalping to trend following and arbitrage.

Scalping is a short-term strategy whereby the bot buys and sells across the spread to make a profit off small price changes. A bot is ideal for this as it requires a high level of discipline requiring the trader to get in and out quickly, without letting greed keep them in a trade too long.

Trend-following is a strategy that most mimics the approach of a manual trader. It requires the bot to automatically analyze market activity, projecting future movement and buying and selling in line with market trends. The success of the bot is wholly dependent on its programming. If it is smartly coded, to respond to the market data in the right way, then it can have great benefits for the trader.

Finally, we have the arbitrage cryptocurrency bot. Crypto arbitrage trading takes advantage of crypto price inefficiencies across exchanges. This means that it exploits instances where a cryptocurrency is temporarily available at different prices at the same time. This is by far one of the lowest-risk ways to invest, as it is not vulnerable to crypto market volatility, and makes the most of the speed and efficiency offered by automated trading software. Let’s use the ArbiSmart crypto arbitrage platform as an example, to see how it works.

The ArbiSmart platfor It then buys the coin where it is being offered at the lowest price and then sells it instantly on the exchange where the price is highest, all before the window closes, the market adjusts, and the price inefficiency resolves itself. Our AI-based arbitrage cryptocurrency bot is able to execute a huge volume of trades at once and it is fully automated, meaning that you simply deposit funds and the platform takes over from there, generating profits of up to 45% a year.

In order to mitigate many of the dangers we have outlined, such as flash crashes, we have a human risk management team monitoring the markets around the clock to intervene in instances of extreme market upheaval. Moreover, as a fully EU regulated, FIU licensed platform, our clients are powerfully protected against fraud and hacks with external auditing, strict data security protocols and capital insurance to cover account funds in case of emergency.

As we have seen, for better or worse, trading bots have become an integral part of the crypto trading experience and they are almost certainly here to stay. As we enter 2021, the question is not whether a bot is necessary to maximize your revenue potential, but rather, which type of bot will best meet your needs and how you are going to incorporate it into your trading plan.

To learn more about different aspects of crypto investing, feel free to explore the rest of the ArbiSmart blog. To learn more about ArbiSmart, come and check out our website, any time.